As Thanksgiving long weekend approaches, a noticeable tranquility has enveloped the financial markets. The aftermath of FOMC minutes, which revealed a slightly toned-down hawkish stance, has resulted in rather subdued market reactions. Major stock indices have slightly retreated from their recent advances, reflecting a cautious sentiment among investors. Correspondingly, 10-year Treasury yield also concluded yesterday’s session almost unchanged. At the same time, Dollar is showing signs of steadying after a period of selloffs. This stabilization suggests the possibility Dollar entering a phase of near-term recovery, although the extent and sustainability of this trend remain to be seen.

Japanese Yen, on the other hand, is pulling back from its recent strong bounce. This retracement comes on the heels of Japan’s government downgrading its economic assessment for the first time in a 10 months. While the market still anticipates BoJ to exit its negative interest rate policy in the upcoming year, investors may be looking for additional positive signals or confidence boosters to reignite momentum in Yen.

In terms of weekly performance among major currencies at this point, Euro is currently lagging, positioned as the weakest, closely followed by Dollar and Canadian. New Zealand Dollar stands out as the strongest, with Yen and Sterling also showing robustness. Australian Dollar and Swiss Franc, meanwhile, are mixed.

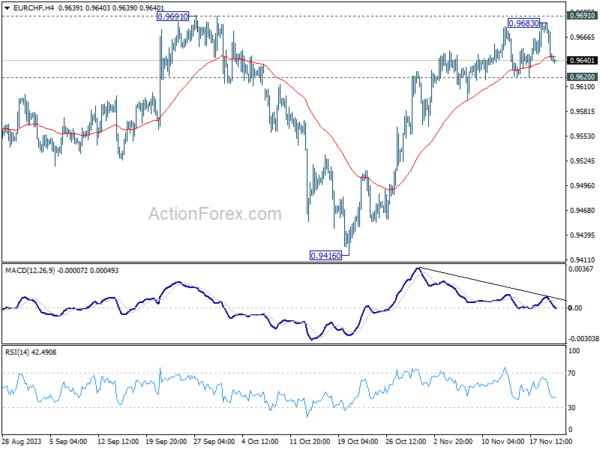

From a technical analysis perspective, as Euro is losing momentum, EUR/CHF is a pair that’s worth some attention. Another rise is in favor as long as 0.9620 support holds. Decisive break of 0.9691 resistance will indicate larger bullish trend reversal. However, break of 0.9620 support will indicate short term topping, on bearish divergence condition in 4H MACD, after rejection by 0.9691 structural resistance. In this case, the bullish reversal scenario would be delayed at least, suggesting a near-term pullback in underway first.

In Asia, at the time of writing, Nikkei is up 0.20%. Hong Kong HSI is down -0.10%. China Shanghai SSE is down -0.37%. Singapore Strait Times is up 0.53%. Japan 10-year JGB yield is up 0.0305 at 0.730. Overnight, DOW dropped -0.18%. S&P 500 dropped -0.20%. NASDAQ dropped -0.59%. 10-year yield dropped -0.004 to 4.418.

FOMC minutes indicate cautious approach and possible softening in hawkish stance

A key takeaway from FOMC minutes from October 31-November 1 meeting is the consensus on proceeding with caution, as indicated by the unanimous agreement that “the Committee was in a position to proceed carefully.”

The minutes also emphasized Fed’s readiness to implement further tightening measures if the progress toward its inflation target is deemed insufficient. This stance is aligned with Fed’s ongoing commitment to combatting inflation, as reflected in the sentiment that “further tightening of monetary policy would be appropriate if incoming information indicated that progress toward the Committee’s inflation objective was insufficient.”

The committee members were also unanimous in their view that restrictive policy stance should be maintained until inflation shows a sustainable decline towards Fed’s target. This highlights Fed’s focus on ensuring that inflationary pressures are adequately managed before considering any policy easing.

However, a notable shift in the committee’s outlook was observed in the latest minutes. The previous stance, which suggested that “one more increase in the target federal funds rate at a future meeting would likely be appropriate,” was conspicuously absent in the latest document. This omission may signal a slight softening in the FOMC’s hawkish stance, indicating a potential pivot in future policy decisions.

ECB’s Lagarde emphasizes vigilance in inflation battle, outlines wage dynamics and policy outlook

ECB President Christine Lagarde, in her speech overnight, cautioned against premature optimism on the ongoing fight against inflation in Eurozone, stating emphatically, “this is not the time to start declaring victory”.

Lagarde highlighted the complex nature of inflation in the Eurozone, stressing the need for ongoing attentiveness to the risks of “persistent inflation”. The dynamics of “wage-setting” in the region, which are often “multi-annual and staggered”, play a significant role in this context.

She pointed out that “the high inflation rates that are now behind us are still having a significant influence on wage agreements today,” indicating the lag effect of past inflation on current wage negotiations.

Addressing the current wage growth scenario, Lagarde opined that it primarily represents “catch-up” effects from past inflation, rather than being driven by expectations of future inflation. However, she noted the importance of monitoring wage developments to assess any potential risks to price stability. This involves closely observing how firms manage rising wages, whether there is an easing of labor market tightness, and ensuring that inflation expectations remain anchored.

Lagarde also reiterated ECB’s commitment to maintaining policy rates at sufficiently restrictive levels for as long as necessary to achieve its inflation targets. She emphasized that future decisions will be data-dependent, allowing ECB the flexibility to act again if the risk of missing inflation target increases.

Japan’s economic outlook downgraded amid domestic demand weakness

The Japanese government has revised its assessment of the nation’s economy, marking the first downgrade in ten months. This change in outlook indicates pausing in part” in Japan’s moderate recovery, primarily attributed to weakening domestic demand. This shift represents a departure from the previously consistent description of the economy as “recovering at a moderate pace” over the past six months.

A critical aspect of this revised assessment is the downgraded view on business investment, which has been adjusted for the first time in nearly two years. The government’s monthly report cites the slowing of global growth, particularly in China, as a significant factor contributing to the “pausing” in pick-up in business investment.

Despite this downgrade, the Cabinet Office maintained its assessment of other economic components. Private consumption is described as “picking up,” driven by a continued recovery in service demand. The report also highlights a positive trend in both industrial production and exports, which are showing signs of “picking up”.

The government’s report, however, underscores several downside risks to the Japanese economy. These include the impacts of aggressive interest rate hikes in other countries and the economic slowdown in China. Additionally, the government emphasizes the need for full attention to price increases, developments in the Middle East, and fluctuations in financial and capital markets.

Australia’s Westpac leading index fell to -0.40%, indicates prolonged low growth

Westpac Leading Index in Australia has shown a marginal decline from -0.38% to -0.40% in October, underscoring the ongoing trend of subdued economic growth. This marks the fifteenth consecutive month where the index’s growth rate has been below zero, signaling that the Australian economy is likely to continue experiencing limited growth into 2024.

Despite this, the overall growth rate can still be considered moderately positive, especially when viewed against current annual population growth rate of approximately 2.4%. Both Westpac and RBA project the economy’s actual growth to be within the range of 1-2% for both this and the coming year, a rate that lags behind potential trend growth.

A key concern for RBA is the adequacy of this sluggish growth in achieving inflation target of 2-3% within a reasonable timeframe. As highlighted in RBA’s recent November meeting minutes, Board maintains a strict stance of “low tolerance” against any further unexpected rises in inflation or delays in returning to the target range. This stance indicates that RBA’s policy meetings in the upcoming year will be crucial and “live”.

Looking ahead

Main focuses of the day will be US durable goods orders and the weekly jobless claims.

USD/JPY Daily Outlook

Daily Pivots: (S1) 147.51; (P) 148.05; (R1) 148.94; More…

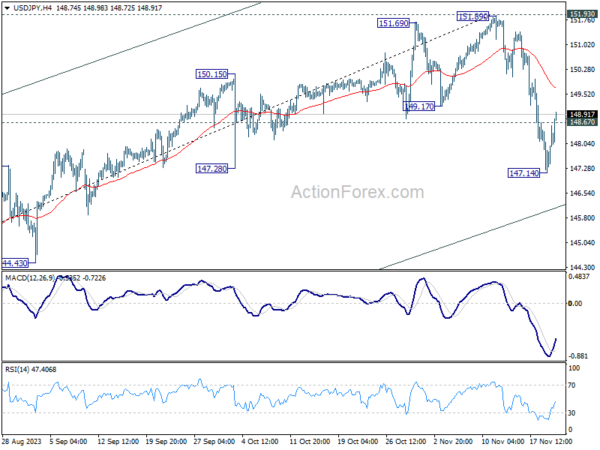

Intraday bias in USD/JPY is turned neutral first with current recovery. Some consolidations would be seen above 147.14 temporary low first. But risk will stay on the downside as long as 55 4H EMA (now at 149.73) holds. Below 147.14 will target medium term channel support at 146.00 next. Nevertheless, sustained break of 55 4H EMA will revive near term bullishness, and target a retest on 151.89/93 resistance zone.

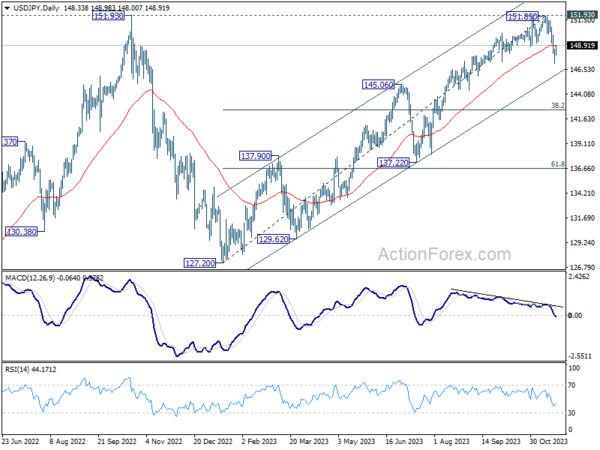

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 resistance (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Westpac Leading Index M/M Oct | 0.00% | 0.10% | ||

| 13:30 | USD | Initial Jobless Claims (Nov 17) | 225K | 231K | ||

| 13:30 | USD | Durable Goods Orders Oct | -3.20% | 4.60% | ||

| 13:30 | USD | Durable Goods Orders ex-Transport Oct | 0.20% | 0.40% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Nov F | 61.1 | 60.4 | ||

| 15:00 | EUR | Eurozone Consumer Confidence Nov P | -18 | -18 | ||

| 15:30 | USD | Crude Oil Inventories | 0.9M | 3.6M | ||

| 17:00 | USD | Natural Gas Storage | 1B | 60B |