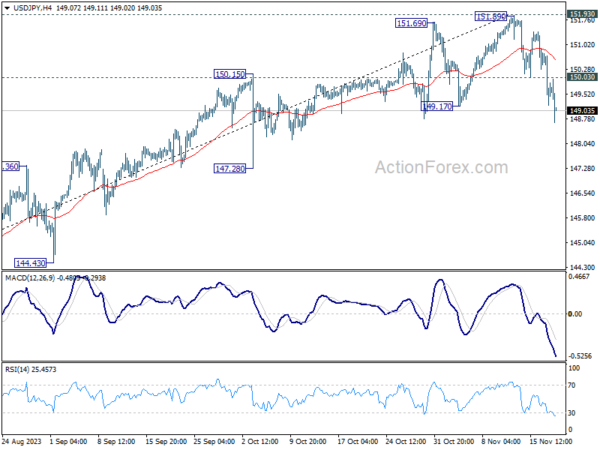

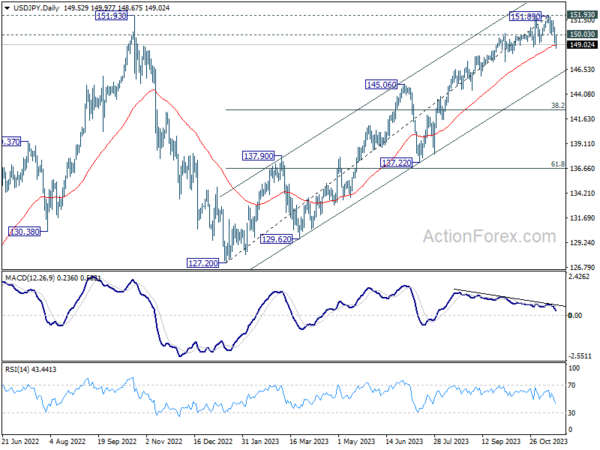

Dollar’s selloff intensified in today’s Asian session, underpinned by strong risk-on sentiment prevalent in the market. This move was particularly evident in USD/JPY, which saw broke through an important near-term support level around the 149 mark, signaling the prospect for further decline. Yen’s strength was mirrored by Chinese Yuan, while the Australian and New Zealand Dollars emerged as the strongest performers in the current environment so far. In contrast, Euro and Canadian Dollar, despite making noticeable gains against Dollar, ranked as the second and third weakest major currencies. Sterling and Swiss Franc, meanwhile, showed mixed performance.

Another notable development is in the Japanese stock market, as Nikkei index briefly reached a new high, not seen in over three decades. This spike in the index represented an attempt to break out from a consolidation phase that has persisted for five months. Despite this bullish signal, the response from cautious investors was somewhat restrained, indicating a level of uncertainty still present in the market.

The rally in Japanese stocks was seen primarily led by financial shares, likely driven by investor expectations of a shift in BoJ longstanding negative rates policy. This sentiment could be further amplified by this week’s upcoming CPI data from Japan. If the CPI data reinforces expectations of a policy shift by BoJ, it might trigger another round of buying in Japanese equities and could lend additional strength to Yen too.

This week, the spotlight in financial markets shifts to the minutes from major central banks including Fed, ECB, and RBA, along with BoE’s monetary policy report hearing. Additionally, a plethora of economic data releases will be in focus, including CPI figures from Canada and Japan, Germany’s Ifo business climate index, and US durable goods orders. PMI data from Australia, Eurozone, UK, Japan will also provide key insights into global economic conditions.

Technically, NZD/USD is ready for a second attempt on breaking 0.6054 resistance, after bouncing from 55 D EMA last week. Decisive break of this resistance will bolster the case that medium term corrective fall from 0.6537 has completed with three waves down to 0.5771. Further rally should then be see towards trendline resistance at around 0.6316 next.

In Asia, Nikkei closed down -0.63% after hitting as high as 33853. Hong Kong HSI is up 1.63%. China Shanghai SSE is up 0.40%. Singapore Strait Times is down -0.73%. Japan 10-year JGB yield is down -0.001 at 0.747.

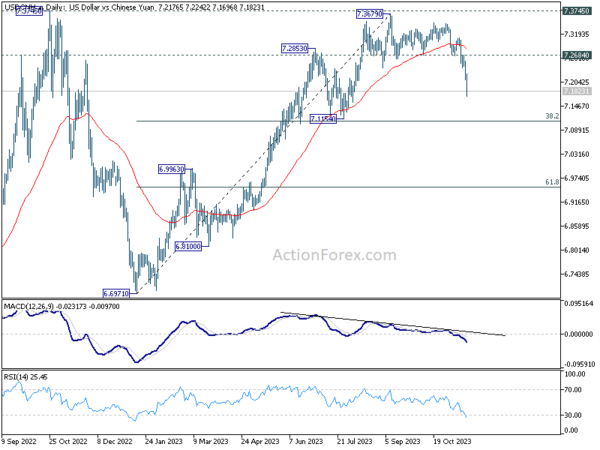

Yuan extends rebound after China maintains 1-yr and 5-yr LPR

As reported by the National Interbank Funding Center today, China’s one-year loan prime rate retains is unchanged 3.45%. Similarly, the over-five-year LPR, a critical determinant of mortgage rates, is also steady at 4.2%.

The LPR, derived from the quotations by various banks with adjustments based on the open-market operation rates, serves as a pivotal indicator for loan pricing. This stability comes in the wake of PBoC’s substantial liquidity injection of CNY 1.45 into the market through the medium-term lending facility last week, maintaining an interest rate of 2.5%.

USD/CNH extends the decline from 7.3679 to as low as 7.1696 so far. Technically, near term outlook will now stay bearish as long as 7.2684 resistance holds, next target is 7.1154 cluster support (38.2% retracement of 6.6971 to 7.3679 at 7.1117). Reaction from there will reveal whether USD/CNH is already reversing whole up trend form 6.6971 to 7.3679.

Fed, ECB, and RBA minutes, alongside global PMIs, to define the week’s economic agenda

This week in the financial markets, the focus is keenly set on the activities of various major central banks, including minutes of Fed, ECB and RBA. Additionally, BoE’s monetary policy report hearing might provide some valuable perspectives.

Fed’s minutes from the October 31-November 1 meeting, slated for an unusual Tuesday release, are expected to offer a peek into the internal debate over future rate hikes. Despite a diverse range of opinions likely to be presented, the minutes might not provide significant guidance on Fed’s next steps. A critical takeaway, however, is Fed’s commitment to maintaining a “sufficiently restrictive” interest rate policy for long enough to tame inflation. The ambiguity surrounding what constitutes “sufficient” and the duration of this stance leaves room for speculation, underscoring the need for December economic projections to shape further decisions.

Turning to ECB, the accounts from its October meeting are not expected to diverge significantly from the current market understanding. ECB officials have consistently communicated that maintaining the current interest rate level should, over time, return inflation to its target. However, like Fed, ECB considers discussions on rate cuts to be premature.

In Australia, RBA’s recent 25 basis point rate hike aligns with expectations following robust Q3 and September CPI data. The forthcoming release of the minutes will likely provide deeper insight into RBA’s decision-making process. The central bank has expressed a low tolerance for inflation surprises, indicating readiness for further action if necessary. However, any additional rate hikes are not anticipated until after Q4 data is reviewed, which is expected to be available by their February meeting.

For BoE, the upcoming parliamentary hearing will likely focus on Governor Andrew Bailey’s interpretation of the recent CPI data, which came in below expectations. Bailey will likely reiterate that the UK is now in a stage of fast disinflation, but it’s still soon to declare victory.

Beyond central bank activities, the week is also rich in global economic data releases. CPI figures from Canada and Japan, Germany’s Ifo business climate, and US durable goods orders will be closely monitored. However, PMI data from Australia, Eurozone, UK, Japan, and to a lesser extent US, will be particularly telling. These data points are crucial in assessing the slowdown in various global economies and the looming risks of recession.

Here are some highlights for the week:

- Monday: Germany PPI.

- Tuesday: New Zealand trade balance; RBA minutes; Swiss trade balance; Canada CPI; US existing home sales, FOMC minutes.

- Wednesday: US jobless claims, durable goods orders.

- Thursday: Australia PMIs; Eurozone PMIs, ECB meeting accounts; UK PMIs.

- Friday: New Zealand retail sales; Japan CPI, PMI manufacturing; Germany Ifo, GDP final; Canada retail sales; US PMIs.

USD/JPY Daily Outlook

Daily Pivots: (S1) 148.91; (P) 149.85; (R1) 150.49; More…

USD/JPY’s break of 149.17 support should confirm rejection by 151.93 resistance. Intraday bias is back on the downside for channel support medium term channel support at 145.80. On the downside, though, above 150.03 minor resistance will turn intraday bias neutral first.

In the bigger picture, focus stays on 151.93 resistance (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will argue that rise from 127.20 has completed, and turn outlook bearish for 137.22 support and below, as the third leg of the long term range pattern from 151.93. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | Germany PPI M/M Oct | -0.10% | -0.20% | ||

| 07:00 | EUR | Germany PPI Y/Y Oct | -11.00% | -14.70% | ||

| 11:00 | EUR | German Buba Monthly Report |