Euro is showing signs of fortitude in relatively subdued market conditions today. The overnight rebounds in EUR/USD and EUR/CHF indicate that bearish traders are hesitating to drive the market, while EUR/JPY continues its upward stride. On the other hand, Dollar is engaged in a tight contest with Euro, mostly reversing its losses from the previous week. Investors were left wanting more after Federal Reserve Chair Jerome Powell’s recent speech, which skirted around pivotal topics such as interest rate changes and the economic forecast, focusing instead on forecasting.

For the current week so far, Dollar, Euro, and Swiss Franc are shaping up to be the frontrunners, while Australian Dollar, New Zealand Dollar, and Canadian Dollar lag behind. British Pound finds itself in a state of limbo, neither excelling nor trailing significantly.

In the equity domain, major US stock indices are encountering resistance, stalling at crucial levels—34147 for DOW, 4393 for S&P 500, and 13714 for NASDAQ. However, the crypto market, spearheaded by Bitcoin breakthrough above 36k mark, might provide a supportive breeze for the tech-heavy NASDAQ if the cryptocurrency continues to gather pace.

Technically, EUR/CAD’s rally from 1.4155 resumed overnight and hit as high as 1.4787 so far. Outlook is unchanged that corrective fall from 1.5111 might have completed with three waves down to 1.4155 already. Further rally is expected as long as 1.4583 support holds. Decisive break of 1.4822 resistance will argue that larger up trend is ready to resume through 1.5111 high.

In Asia, Nikkei closed up 1.57%. Hong Kong HSI is down -0.33%. China Shanghai SSE is down -0.03%. Singapore Strait Times is up 0.25%. Japan 10-year JGB yield is down -0.0067 at 0.843. Overnight, DOW dropped -0.12%. S&P 500 rose 0.10%. NASDAQ rose 0.08%. 10-year yield dropped -0.048 to 4.523.

BoC minutes reflect division on path forward for interest rate

The latest deliberations within BoC have revealed a divide among officials over the course of monetary policy, as they confront the challenge of reigning in inflation without further rate hikes. At the heart of the debate is whether the current 5.00% policy rate will suffice in guiding inflation back to the targeted 2%.

The minutes from the October 25 meeting, where BoC maintained the interest rate, reflect this uncertainty. A faction within the bank is leaning towards additional tightening measures. “Some members felt that it was more likely than not that the policy rate would need to increase further to return inflation to target,” the minutes read, highlighting concerns that the current policy stance may not be enough to temper rising prices.

On the flip side, there is a sense of cautious optimism among other members, who believe that maintaining the current rate might achieve the desired effect over time. “Others viewed the most likely scenario as one where a five per cent policy rate would be sufficient to get inflation back to the two per cent target, provided it was maintained at that level for long enough,” the minutes elaborated.

This divergence in views has culminated in a consensus to adopt a “patient” approach, reflecting a strategy of watchful waiting while assessing incoming data. “They agreed to revisit the need for a higher policy rate at future decisions with the benefit of more information,” according to the documented discussions.

BoJ Ueda awaits wage trends before altering policy

In today’s parliamentary session, BoJ Governor Kazuo Ueda emphasized a cautious stance on Japan’s monetary policy, acknowledging the need for more evidence before making any adjustments.

“We expect trend inflation to gradually approach 2 percent. But we’d like to wait until we have more conviction that sustained achievement of our price target comes into sight,” Ueda said.

Highlighting the significance of wage trends, Governor Ueda noted, “Whether wage hikes will broaden and become embedded in society, firms begin to hike prices on prospects of rising wages, will be key to judging whether inflation target will be met sustainably.”

He reaffirmed the Bank’s current strategy: “Until then, we will maintain negative interest rates and the yield curve control framework.”

The Summary of Opinions from the BoJ’s October meeting, released separately, showed a notable stance from one member suggested optimism about wage growth, “It’s highly possible that wage growth to be agreed in next year’s base pay negotiations will exceed that agreed this year,” and added that “achievement of the BoJ’s price target is coming into sight.”

One member went further to suggest that the chances of meeting the inflation target have increased, proposing that “It’s therefore necessary for the BOJ to gradually adjust the degree of monetary easing down from its maximum level.”

Another member’s opinion highlighted that adjustments in yield controls are not just a mitigation of side-effects but also pave the way for future policy normalization.

Bitcoin breaks key fibonacci resistance amid ETF speculation

In a notable surge, Bitcoin has pierced through a key Fibonacci resistance level, stirring the market as whispers of a wave of Bitcoin ETF approvals by US SEC enhance investor optimism. The digital currency’s leap forward comes amid speculations that the SEC could, within an eight-day window that started today, green-light up to 12 spot Bitcoin ETF filings. Despite the buzz, the market consensus still eyes January 10 as the likely date for concrete decisions.

Technically, near term outlook will now stay bullish as long as 33373 support holds. Next target is 100% projection of 15452 to 31815 from 24896 at 41259.

For the medium term, the break of 38.2% retracement of 68986 to 15452 at 35902 now opens the door to further rally to 61.8% retracement at 48536. The structure and momentum of the current rise will be monitor to assess whether rise form 15452 is a medium term corrective move, or the start of a long term up trend.

Looking ahead

ECB monthly economic bulletin is a highlight of the empty European calendar. US will release jobless claims later in the day.

EUR/JPY Daily Outlook

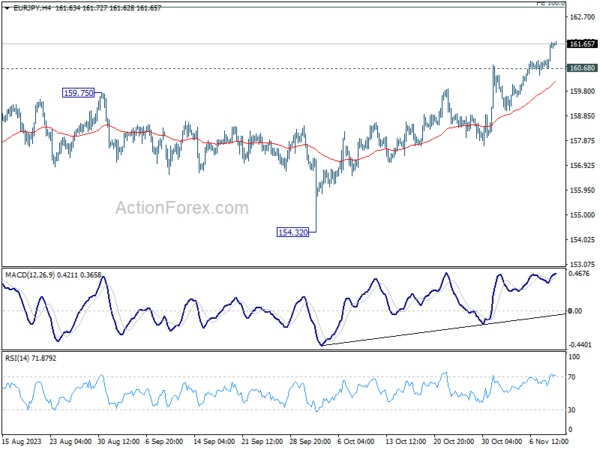

Daily Pivots: (S1) 161.01; (P) 161.37; (R1) 162.04; More….

EUR/JPY’s rally is still in progress and hits as high as 161.71 so far. Intraday bias stays on the upside for 163.06 projection level next. On the downside, below 160.68 minor support will turn intraday bias neutral and bring consolidations first, before staging another rise.

In the bigger picture, rise from 114.42 (2020 low) is in progress. Next target is 100% projection of 124.37 to 148.38 from 139.05 at 163.06. On the downside, break of 154.32 support is needed to be the first sign of medium term topping. Otherwise, outlook will remain bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Current Account (JPY) Sep | 2.01T | 2.27T | 1.63T | 1.50T |

| 00:01 | GBP | RICS Housing Price Balance Oct | -63% | -65% | -69% | |

| 01:30 | CNY | CPI Y/Y Oct | -0.20% | -0.20% | 0.00% | |

| 01:30 | CNY | PPI Y/Y Oct | -2.60% | -2.70% | -2.50% | |

| 05:00 | JPY | Eco Watchers Survey: Current Oct | 49.5 | 50.2 | 49.9 | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Initial Jobless Claims (Nov 3) | 210K | 217K |