Dollar making efforts to continue this week’s rebound, but momentum appears to be lacking, except against Yen. Additionally, its ascent is being challenged by Swiss Franc, which currently stands as the day’s strongest performer, propelled by substantial buying against Euro and Sterling. Commodity currencies are capitalizing on the stabilizing risk sentiment, slowly clawing back against Dollar’s advances.

Investors are now turning their attention to the forthcoming comments from Fed officials, including Chair Jerome Powell and New York Fed President John Williams. Although Fed funds futures suggest only a modest 10% probability of a rate increase in December, the door remains open, and traders are eager for any hints about the leanings of each Fed member.

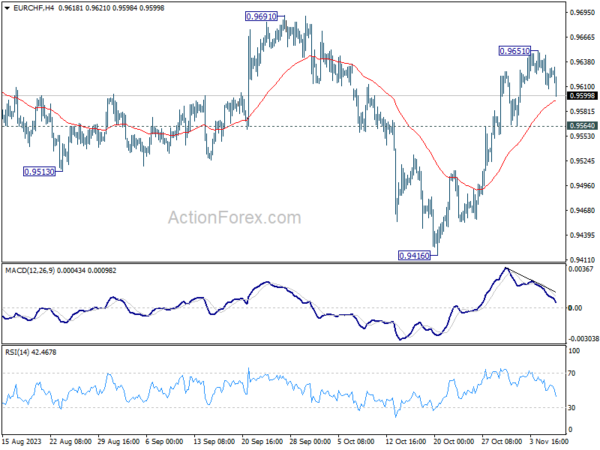

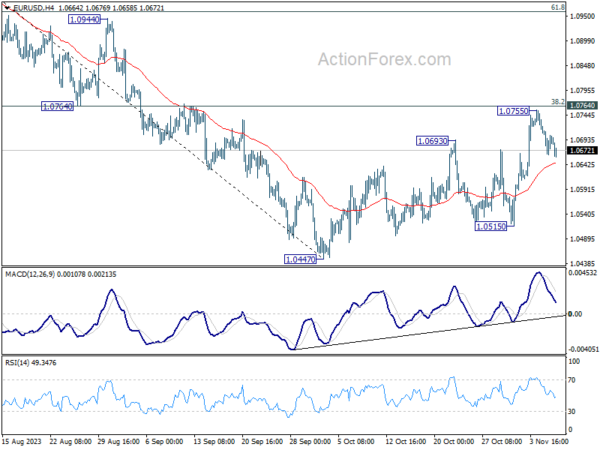

Technically, EUR/CHF’s retreat from 0.9651 is extending today. The first line of defense is on 55 4H EMA (now at 0.9593). Ideally, selling should slow below the EMA, and gradually, a base is build at around 0.9564 support for resuming the rally from 0.9416. However, firm break of 0.9564 will argue that the rally is indeed over, and risk deeper fall. In the bearish case, extended selloff in EUR/CHF could drag EUR/USD down through 55 4H EMA too.

In Europe, at the time of writing, FTSE is up 0.05%. DAX is up 0.15%. CAC is up 0.30%. Germany 10-year yield is down -0.022 at 2.643. Earlier in Asia, Nikkei dropped -0.33%. Hong Kong HSI dropped -0.58%. China Shanghai SSE dropped -0.16%. Singapore Strait Times dropped -1.39%. Japan 10-year JGB yield fell -0.0276 to 0.849.

ECB’s Lane: Some progress on underlying inflation, but not enough

ECB Chief Economist Philip Lane indicated that although there is “some progress” in mitigating underlying inflationary, he is not fully convinced of the sufficiency of these efforts to date.

“This is why we are in this period now of holding interest rates at a significantly high level until this process makes further progress,” Lane explained,

Lane also conveyed his reservations about the steep decline in headline inflation numbers, attributing the fall primarily to the base effect from last year’s energy price surges.

Looking ahead, Lane projected that the descent in inflation rates might pause, with inflation likely hovering in the “high twos or low threes” range in 2024.

He anticipates that a reversion to the ECB’s desired 2% inflation target would not materialize until 2025, suggesting a prolonged journey ahead for the central bank in its fight against persistent inflation.

Bundesbank’s Nagel stresses final push to inflation target as toughest hurdle

Bundesbank President Joachim Nagel likened the journey toward ECB’s inflation target to an arduous “last mile,” which “may well be the hardest”.

Nagel pointed out that a key strategy for businesses would involve absorbing recent wage hikes—a move that will necessitate accepting slimmer profit margins.

On the other side, he emphasized the necessity of a more restrained fiscal approach from governments.

While wage increases are anticipated to exert some pressure on pricing, Nagel reassured that currently, there’s no sign of a “self-reinforcing spiral” in wage-price dynamics. This suggests a cautious optimism that, while the path forward is steep, runaway inflation is not an imminent threat.

ECB Kazaks advocates for certainty over inflation before rate cut

ECB Governing Council member Martins Kazaks has expressed a steadfast stance on interest rates, emphasizing the need for absolute certainty that inflation is under control before considering any reductions.

Kazaks highlighted, “This decision right now to keep rates at current levels is to be really convinced inflation won’t rise again.”

“We have to be convinced that inflation has been beaten — then we can step by step lower rates,” he articulated, pointing out the distinction between short-term suppression of inflation rates and the long-term confidence required to ensure they do not resurge.

Kazaks further clarified, “One thing is to push inflation lower; another is to be convinced inflation won’t rise again.”

Thus, “that’s why there’s this cautiousness.”

ECB survey reveals heightened short-term inflation expectations and economic pessimism

ECB’s latest Consumer Expectations Survey has provided a snapshot of the current economic mood, characterized a heightened anticipation of inflation pressures in the near term juxtaposed with a more pessimistic outlook on economic growth.

The survey results for September show a discernible uptick in median consumer inflation expectations for the coming year, escalating from 3.5% to 4.0%. However, that consumers’ median inflation expectations over a three-year horizon held steady at 2.5%.

Contrastingly, the survey indicates no change in the mean expectations for nominal income growth, which remains anchored at 1.2%. This static view on income growth, coupled with the slight increase in anticipated nominal spending growth from 3.3% to 3.4%, hints at a potential squeeze on real consumer spending power.

The more negative tilt in expectations for economic growth, which have slipped from -0.8% to -1.2%, reflects an escalating concern over the economic direction. Furthermore, the anticipated unemployment rate has edged up from 11.1% to 11.4% for the coming year.

Eurozone retail sales down -0.3% mom in Sep, EU fell -0.2% mom

Eurozone retail sales volume fell -0.3% mom in September, worst than expectation of -0.2% mom. Volume of retail trade decreased by -1.9% for non-food products and by -0.9% for automotive fuels, while it increased by 1.4% for food, drinks and tobacco.

EU retail sales volume was down -0.2% mom, Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were registered in Slovakia (-2.0%), Sweden (-1.1%), Germany and the Netherlands (both -0.8%). The highest increases were observed in Slovenia (+1.1%), Poland (+1.0%) and Denmark (+0.9%).

BoJ Ueda suggests easy policy exit could precede real wage gecovery

In an address to the parliament today, BoJ Governor Kazuo Ueda indicated a forward-looking approach to monetary policy, wherein the anticipation of rising real wages could be a determinant for policy normalization, rather than their current state.

Ueda posited, “Real wages would likely have turned positive when a positive wage-inflation cycle kicks off.”

Delving into the timing of potential policy shifts, Ueda mentioned, “But in terms of how long we maintain our massive monetary easing… real wages don’t necessarily have to turn positive before that decision is made.”

Clarifying this point, he further elaborated that “The decision could be made if we can foresee with some certainty that real wages will turn positive ahead.”

Ueda also addressed the persistent gap between current inflation rates and the bank’s longstanding target, stating, “When looking at trend inflation, there’s still some distance towards our 2% target. That is why we are continuing with massive easing.”

Short-term inflation fears abate according to RBNZ survey

In the latest RBNZ quarterly Business Survey of Expectations, near-term outlook for inflation has cooled, with one-year-ahead expectations retreating from 4.17% to 3.60%, a significant decline of 57 basis points. On a two-year horizon, the expectation for inflation has seen a marginal dip of 7 basis points to 2.76%.

Conversely, expectations for inflation over a five and ten-year span have inched upwards. The survey revealed a mean five-year-ahead annual inflation expectation of 2.43%, marking an 18 basis points increase from the previous quarter’s estimate. Ten-year expectations also saw a modest rise of 6 basis points to 2.28%.

With regard to the Official Cash Rate (OCR), the consensus is that it would hover at 5.50% by the end of December 2023. Looking one year ahead, the mean OCR expectation has fallen to 4.99%, indicating that businesses anticipate a loosening of monetary policy in the future once the immediate inflationary pressures have been mitigated.

On the growth front, respondents to the survey are more bullish. The mean one-year-ahead GDP growth expectation increased to 1.26%, up from 1.02%. The forecast for two-year-ahead GDP growth also saw an uptick, rising to 2.15% from the prior 1.95%.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0668; (P) 1.0696; (R1) 1.0727; More…

No change in EUR/USD’s outlook and intraday bias remains neutral. Further rally is in favor as long as 55 4H EMA (now at 1.0646) holds. Decisive break of 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763) will extend the rise from 1.0447 to 61.8% retracement at 1.0958 next. However, sustained break of 55 4H EMA will argue that the rebound has completed, and target 1.0515 support, and then 1.0447 low.

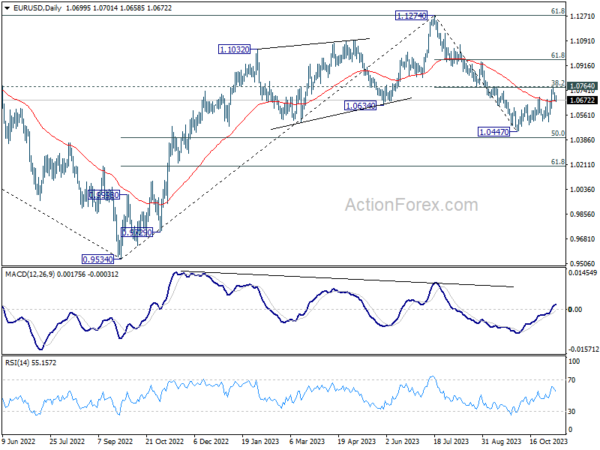

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | NZD | RBNZ Inflation Expectations Q4 | 2.76% | 2.83% | ||

| 05:00 | JPY | Leading Economic Index Sep P | 108.7 | 108.8 | 109.2 | |

| 07:00 | EUR | Germany CPI M/M Oct | 0.00% | 0.00% | 0.00% | |

| 07:00 | EUR | Germany CPI Y/Y Oct | 3.80% | 3.80% | 3.80% | |

| 07:45 | EUR | France Trade Balance (EUR) Sep | -8.9B | -8.1B | -8.2B | -8.3B |

| 09:00 | EUR | Italy Retail Sales M/M Sep | -0.30% | -0.20% | -0.40% | -0.70% |

| 10:00 | EUR | Eurozone Retail Sales M/M Sep | -0.30% | -0.20% | -1.20% | |

| 13:30 | CAD | Building Permits M/M Sep | 1.20% | 3.40% | ||

| 15:00 | USD | Wholesale Inventories Sep F | 0.00% | 0.00% |