Dollar found itself hovering within a narrow range during Asian session, as market participants paused to reflect on recent comments from hawkish Fed members hinting at more tightening. Despite these hawkish tones, the overall risk mood found its footing after the US markets displayed resilience, with only a slight dip in Asian equities following suit.

Market focus is now shifting towards a lineup of speeches from various Fed officials scheduled for today. Fed Chair Jerome Powell. It is anticipated that Fed Chair Jerome Powell will adopt a balanced tone, potentially leaving the task of shaping market expectations to his colleagues. Of special interest is the perspective of New York Fed President John Williams, whose insights often carry significant weight.

In the currency arena, Dollar is leading the pack, with Swiss Franc and Euro trailing behind. Commodity-linked currencies, however, are languishing at the bottom, with Australian Dollar leading. Yen is an outlier, displaying mixed performance despite the supportive rhetoric from BoJ Governor, as traders show little enthusiasm for advancing Yen’s position.

Technically, NASDAQ is in proximity to 13714.13 resistance, which is also close to falling channel resistance. Decisive break there would confirm that whole correction from 14446.55 has completed at 12543.85. Further rally should be seen to retest this high. If materializes, that would solidify near term risk-on sentiment in the overall markets. However, rejection by 13714.13 could open up another fall to extend the correction from 14446.55.

In Asia, at the time of writing, Nikkei is down -0.21%. Hong Kong HSI is down -0.50%. China Shanghai SSE is down -0.35%. Singapore Strait Times is down -1.46%. Japan 10-year JGB yield is down -0.0246 at 0.852. Overnight, DOW rose 0.17%. S&P 500 rose 0.28%. NASDAQ rose 0.90%. 10-year yield dropped -0.091 to 4.571.

Fed’s Logan: Tight financial conditions crucial to steer inflation back to target

At a Fed conference overnight, Dallas Fed President Lorie Logan said that inflation appears to be “trending toward 3%”, a figure still above the 2% target.

Despite a cooling labor market, Logan highlighted that it remains “too tight,” implying that the job market’s strength could continue to put upward pressure on wages and, consequently, inflation.

Logan emphasized the need “see tight financial conditions in order to bring inflation to 2% in a timely and sustainable way”. She will be looking at “data” and “financial conditions” as the next meeting in December approaches.

With a particular focus on recent retracement in 10-year Treasury yield and broader financial conditions, Logan suggests these elements will play a pivotal role in shaping Fed’s forthcoming monetary policy decisions.

Fed’s Bowman expects to raise interest rates further

In a speech overnight, Fed Governor Michelle Bowman asserted, “I continue to expect that we will need to increase the federal funds rate further to bring inflation down to our 2% target in a timely way.”

She acknowledged that interest rates “appears to be restrictive” while financial conditions “have tightened since September”. However, “We don’t yet know the effects of tightened financial conditions on economic activity and inflation, she cautioned.

“There is an unusually high level of uncertainty regarding the economy and my own economic outlook, especially considering recent surprises in the data, data revisions, and ongoing geopolitical risks,” she noted.

BoJ Ueda suggests easy policy exit could precede real wage recovery

In an address to the parliament today, BoJ Governor Kazuo Ueda indicated a forward-looking approach to monetary policy, wherein the anticipation of rising real wages could be a determinant for policy normalization, rather than their current state.

Ueda posited, “Real wages would likely have turned positive when a positive wage-inflation cycle kicks off.”

Delving into the timing of potential policy shifts, Ueda mentioned, “But in terms of how long we maintain our massive monetary easing… real wages don’t necessarily have to turn positive before that decision is made.”

Clarifying this point, he further elaborated that “The decision could be made if we can foresee with some certainty that real wages will turn positive ahead.”

Ueda also addressed the persistent gap between current inflation rates and the bank’s longstanding target, stating, “When looking at trend inflation, there’s still some distance towards our 2% target. That is why we are continuing with massive easing.”

Short-term inflation fears abate according to RBNZ survey

In the latest RBNZ quarterly Business Survey of Expectations, near-term outlook for inflation has cooled, with one-year-ahead expectations retreating from 4.17% to 3.60%, a significant decline of 57 basis points. On a two-year horizon, the expectation for inflation has seen a marginal dip of 7 basis points to 2.76%.

Conversely, expectations for inflation over a five and ten-year span have inched upwards. The survey revealed a mean five-year-ahead annual inflation expectation of 2.43%, marking an 18 basis points increase from the previous quarter’s estimate. Ten-year expectations also saw a modest rise of 6 basis points to 2.28%.

With regard to the Official Cash Rate (OCR), the consensus is that it would hover at 5.50% by the end of December 2023. Looking one year ahead, the mean OCR expectation has fallen to 4.99%, indicating that businesses anticipate a loosening of monetary policy in the future once the immediate inflationary pressures have been mitigated.

On the growth front, respondents to the survey are more bullish. The mean one-year-ahead GDP growth expectation increased to 1.26%, up from 1.02%. The forecast for two-year-ahead GDP growth also saw an uptick, rising to 2.15% from the prior 1.95%.

Looking ahead

Germany CPI final, France trade balance, Italy retail sales, and Eurozone retail sales will be release in European session. Later in the day, US wholesale inventories final will be featured. Canada building permits and BoC summary of deliberations will be released too.

AUD/USD Daily Report

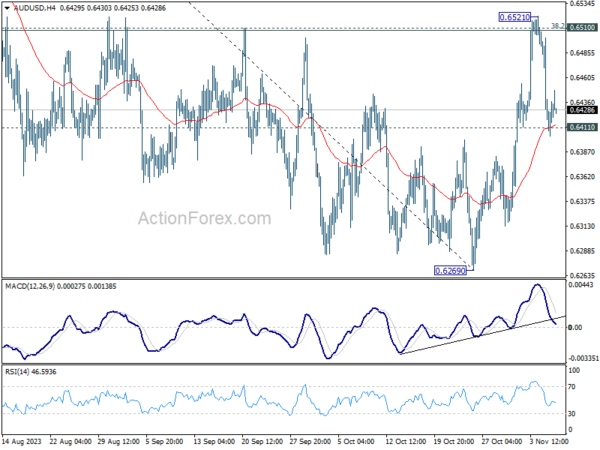

Daily Pivots: (S1) 0.6393; (P) 0.6448; (R1) 0.6492; More…

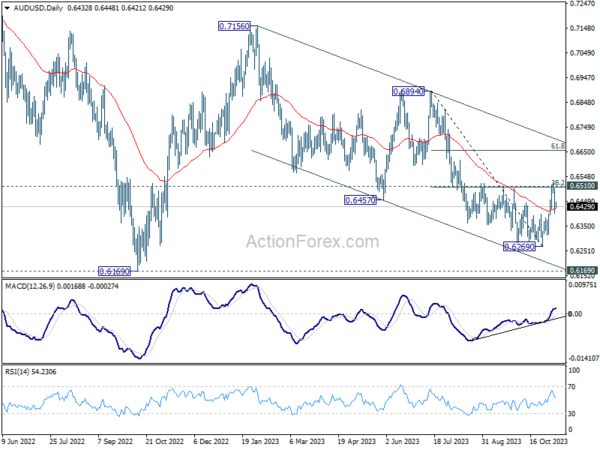

AUD/USD recovered after hitting 0.6411 minor support as well as 55 4H EMA. Intraday bias stays neutral first. On the downside, firm break of 0.6411 will indicate rejection by 0.6510 cluster resistance (38.2% retracement of 0.6894 to 0.6269 at 0.6508) , and turn bias back to the downside for retesting 0.6269 low. Nevertheless, decisive break of 0.6508/10 will argue that whole decline from 0.7156 might be completed with three waves down to 0.6269. Stronger rally should then be seen to medium term trend line resistance (now at 0.6700).

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. While current rebound from 0.6269 might extend higher, it could be the third leg of a corrective pattern from 0.6169 (2022 low) only. For now, medium term bearishness will remain as long as 0.6894 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | NZD | RBNZ Inflation Expectations Q4 | 2.76% | 2.83% | ||

| 05:00 | JPY | Leading Economic Index Sep P | 108.7 | 108.8 | 109.2 | |

| 07:00 | EUR | Germany CPI M/M Oct | 0.00% | 0.00% | ||

| 07:00 | EUR | Germany CPI Y/Y Oct | 3.80% | 3.80% | ||

| 07:45 | EUR | France Trade Balance (EUR) Sep | -8.1B | -8.2B | ||

| 09:00 | EUR | Italy Retail Sales M/M Sep | -0.20% | -0.40% | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Sep | -0.20% | -1.20% | ||

| 12:30 | CAD | Building Permits M/M Sep | 1.20% | 3.40% | ||

| 15:00 | USD | Wholesale Inventories Sep F | 0.00% | 0.00% |