European majors are maintaining their upward momentum against the Dollar, leveraging last week’s rally and finding additional support in the unexpectedly positive Eurozone investor confidence data. Yet, while the data provided a glimmer of positivity, the market remains guarded, unwilling to fully commit to the narrative of an economic rebound.

Meanwhile, Australian and New Zealand Dollars are surrendering some of their recent gains as traders pivot their attention to the upcoming RBA interest rate decision. With the central bank expected to hike rates, traders are holding their bets in anticipation of volatility. Yen, on the other hand, finds itself on softer footing following dovish remarks from BoJ Governor.

Across other markets, European stocks have shown signs of hesitancy, and US futures are hovering without a clear course, as investors seem to be on standby for a stronger signal. On the commodities front, Gold struggles to find direction as it lingers around the pivotal 2000 psychological resistance. Bitcoin consolidates, maintaining its position near 35k mark. Crude oil has seen a slight uplift as OPEC heavyweights Saudi Arabia and Russia reaffirm supply cuts, possibly hinting at a tighter oil market ahead.

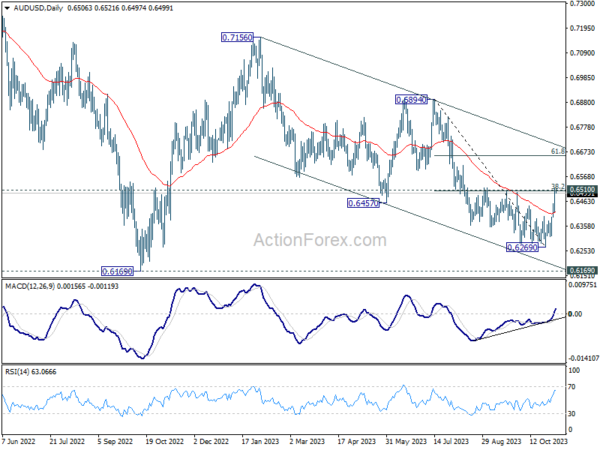

From a technical standpoint, pressing an important cluster resistance at 0.6510 (38.2% retracement of 0.6894 to 0.6269 at 0.6508). Decisive break there will raise the chance that whole down trend from 0.7156 has completed with three waves down to 0.6269. That would open up further near term rise to trend line resistance at around 6.7. However, rejection by 0.6510 will retain near term bearishness for another fall through 0.6269 at a later stage. With the RBA’s rate decision on the near horizon, the currency pair’s response will be telling, possibly setting the tone for its near-term direction.

In Europe, at the time of writing, FTSE is down -0.05%. DAX is down -0.19%. CAC is down -0.37%. Germany 10-year yield is up 0.0660 at 2.714. Earlier in Asia, Nikkei rose 2.37%. Hong Kong HSI rose 1.71%. China Shanghai SSE rose 0.91%. Singapore Strait Times rose 1.17%. Japan 10-year JGB yield is down -0.0419 at 0.874.

Eurozone Sentix rose to -18.6 as inflation worries ease

Eurozone’s Sentix Investor Confidence Index rose from -21.90 to -18.6 in November, marking the highest level since June and surpassing analysts’ expectations of -22.5.

The details of the report are also encouraging, with Current Situation Index marginally improving from -27.0 to -26.8. Expectations Index leaped towards optimism, reaching the highest point since February at -10.0, up from -16.8.

However, it is critical to acknowledge that expectations remain in negative terrain. “The decrease in negative momentum is an initial sign of improvement,” according to the Sentix report, “but the all-clear can only be given if expectations turn positive.”O

ne notable development is the rise in the Sentix “Inflation” theme index, which has crossed into positive territory for the first time since early 2020, suggesting that inflation may be diminishing as a key concern. The index now stands at +6.5 points, a development that could potentially reduce ECB’s urgency to act.

Eurozone PMI services finalized at 47.8, stagflation concerns mount

Eurozone PMI Services slumped to 47.8 (final reading) from September’s 48.7. PMI Composite index, which tracks both manufacturing and services, descended to a 35-month low of 46.5 from 47.2. The rate at which new business is falling has reached levels not seen since 2012, with the exception of the pandemic period.

This downturn is evident across key Eurozone economies, with member states reporting troubling metrics. Spain hit a 2-month low at the brink of stagnation with PMI Composite of 50.0, while Ireland descended to an 11-month low at 49.7. Italy and Germany both reported figures suggesting continuing contraction in service sector activity, with PMIs at 47.0 and 45.9 respectively. France, although at a 2-month high, still sits in a contractionary phase at 44.6.

Cyrus de la Rubia of HCOB offers a stark analysis: “The Eurozone service sector appears to be struggling at the onset of Q4, continuing a three-month trend of decline. A steep decrease in new business intake is a worrying harbinger for future activity. Although there is a slight uptick in future expectations, they still linger well below the historical average.”

The economic situation seems paradoxical, with prices rising without the typical accompanying demand, pointing to a condition of “stagflation”. De la Rubia questions how long this “odd stagflation zone” will persist, a query that also plagues ECB. With PMI data suggesting no quick exit from these conditions, it appears ECB is not in a position to lower interest rates just yet, as it balances the dual threats of sluggish growth and persistent inflation.

BoJ Governor Ueda affirms commitment to easing amid uncertain inflation-wage dynamics

BoJ Governor Kazuo Ueda reaffirmed today the central bank’s commitment to its accommodative stance.

“We’re seeing more positive signs than before in corporate wage and price-setting behavior,” Ueda stated, acknowledging the nascent signs of a healthier inflation-wage cycle. However, he also underscored the prevailing uncertainties, admitting, “there’s still uncertainty on whether the positive cycle will strengthen, as we predict.”

With an eye on supporting economic activity, Ueda emphasized the central bank’s resolve, “We will patiently maintain monetary easing,” indicating no immediate shift from BoJ’s long-standing dovish position.

Last week’s decision to relax the 1% cap on 10-year JGB yield, allowing greater movement in long-term borrowing costs, was a nod to flexibility in BoJ’s approach. Today, Ueda elaborated, “We will conduct nimble market operations when interest rates rise, depending on the level and speed of moves of long-term rates.”

Ueda also sought to temper market expectations regarding the potential for sharp rises in long-term yields. “Even if long-term rates come under upward pressure, don’t expect the 10-year JGB yield to sharply exceed 1%,” he stated.

The Governor’s comments reflect a deep consideration of the “real” interest rate, which factors in inflation expectations. He explained, “Long-term rates may rise somewhat but what’s important is to look at the real interest rate that takes into account inflation expectations.”

He reassured markets, “Even if long-term rates rise, real interest rates will move in negative territory so monetary conditions will be sufficiently accommodative.”

Japan’s PMI services finalized at 51.6, growth is on the wane

Japan’s PMI Services was finalized at 51.6 in October, down from previous month’s 53.8. PMI Composite figure similarly declined to 50.5 from September’s 52.1.

Andrew Harker of S&P Global Market Intelligence highlighted the subdued performance: “While the PMI data continue to make positive reading for the Japanese service sector, the recent trends suggest that growth is on the wane.”

He elaborates that the slowdown is notably marked by the softest increases in activity and new orders witnessed since the year’s inception, which could herald a persistent deceleration as we edge closer to the year’s end.

This softening expansion has raised concerns regarding the service sector’s capacity to buoy the broader economy, particularly as manufacturing continues to lag. Harker notes the stagnation of new orders in October, halting an eight-month stretch of growth and presenting a cautionary backdrop for the upcoming months.

EUR/USD Mid-Day Outlook

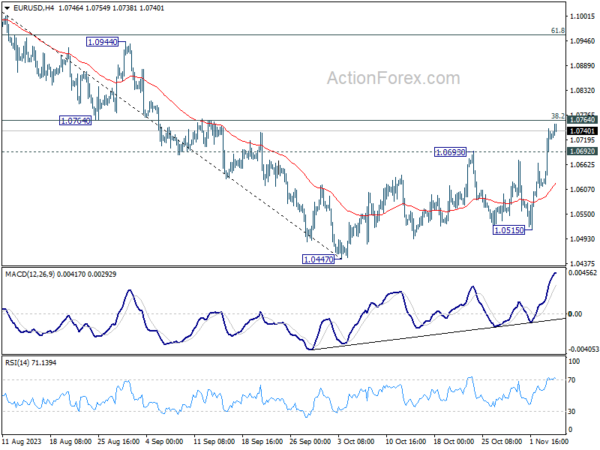

Daily Pivots: (S1) 1.0648; (P) 1.0698; (R1) 1.0780; More…

No change in EUR/USD’s outlook and intraday bias remains on the upside. Decisive break of 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763) will extend the rise from 1.0447 to 61.8% retracement at 1.0958 next. On the downside, below 1.0666 minor support will turn intraday bias neutral first.

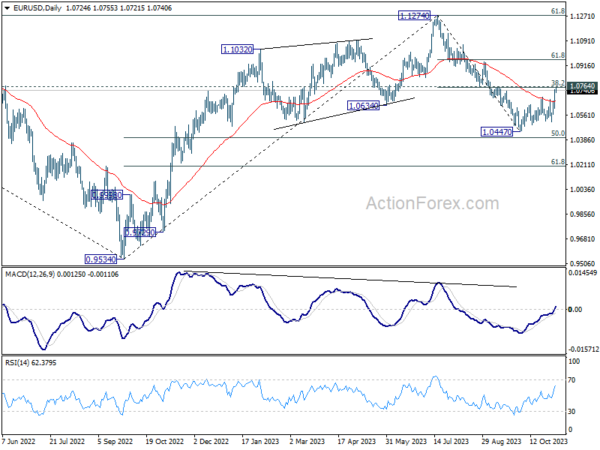

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 00:00 | AUD | TD Securities Inflation M/M Oct | -0.10% | 0.00% | ||

| 07:00 | EUR | Germany Factory Orders M/M Sep | 0.20% | -1.40% | 3.90% | 1.90% |

| 08:45 | EUR | Italy Services PMI Oct | 47.7 | 48.5 | 49.9 | |

| 08:50 | EUR | France Services PMI Oct | 45.2 | 46.1 | 46.1 | |

| 08:55 | EUR | Germany Services PMI Oct | 48.2 | 48 | 48 | |

| 09:00 | EUR | Eurozone Services PMI Oct | 47.8 | 47.8 | 47.8 | |

| 09:30 | EUR | Eurozone Sentix Investor Confidence Nov | -18.6 | -22.5 | -21.9 | |

| 09:30 | GBP | Construction PMI Oct | 45.6 | 46.2 | 45 | |

| 15:00 | CAD | Ivey PMI Oct | 54 | 53.1 |