In the wake of BoE’s decision to maintain interest rates unchanged, Sterling exhibited a mixed performance, gaining against Dollar yet faltering when paired with the Euro and commodity-linked currencies. The voting pattern at the BoE leaned slightly more hawkish than anticipated, but the newly projected rate path suggests the peak in interest rates was reached already. The Dollar, on the other hand, is losing ground, exacerbated by a further dip in 10-year yield, now below 4.7% mark. This development is mirrored in US stock futures, which are signaling positive opening.

Currently, Dollar is the third weakest performer of the week, managing only marginal gains over Yen and the Swiss Franc. However, its position remains precarious. In contrast, Australian Dollar leads the pack as the week’s strongest, followed by New Zealand Dollar and Euro. Canadian Dollar shows a mixed performance, while Sterling struggles to keep pace with its peers.

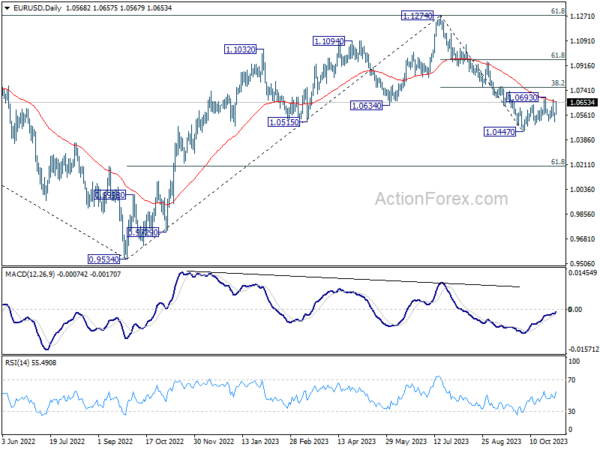

Technically, EUR/USD is back pressing 55 D EMA with today’s strong bounce. Strong break of this EMA and 1.0693 resistance will carry bullish implication. Further rise should at least be seen to 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763). However, rejection by 55 D EMA will keep near term outlook bearish for another fall through 1.0447, soon.

In Europe, at the time of writing, FTSE is up 1.24%. DAX is up 1.60%. CAC is up 1.94%. Germany 10-year yield is down -0.085 at 2.680. Earlier in Asia, Nikkei rose 1.10%. Hong Kong HSI rose 0.75%. China Shanghai SSE dropped -0.45%. Singapore Strait Times rose 0.19%. Japan 10-year JGB yield dropped -0.0433 to 0.916.

US initial jobless claims rose to 217k, above exp 210k

US initial jobless claims rose 5k to 217k in the week ending October 28, above expectation of 210k. Four-week moving average of initial claims rose 2k to 210k.

Continuing claims rose 35k to 1818k in the week ending October 21. Four-week moving average of continuing claims rose 37k to 1758k.

BoE stands pat, adopts lower rate path for economic forecasts

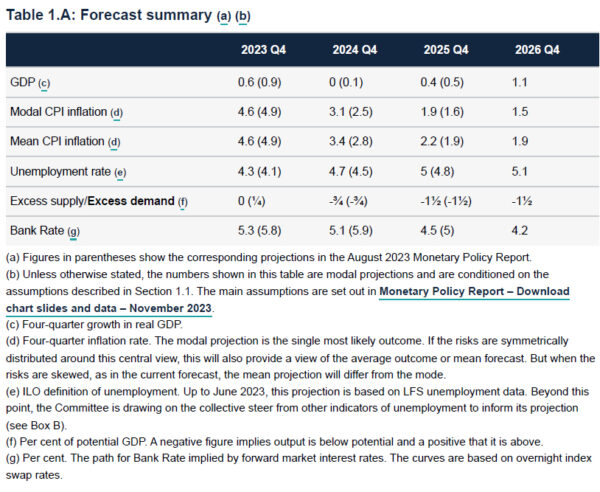

BoE held its Bank Rate steady at 5.25%, aligning with broad market anticipations. The decision came with a 6-3 split, with Megan Greene, Jonathan Haskel, and Catherine Mann opting for a 25 basis points increase. The bank emphasized the necessity of maintaining a restrictive monetary stance for an extended period to steer inflation back to its target. They also signaled that should more enduring inflation signs surface, the option for further rate hikes is still on the table.

Four-quarter GDP growth:

- Lowered from 0.9% to 0.6% in Q4 2023.

- Lowered from 0.1% to 0.0% in Q4 2024.

- Lowered from 0.5% to 0.4% in Q4 2025.

- At 1.1% in Q4 2026 (new).

Modal CPI inflation:

- Lowered from 4.9% to 4.6% in Q4 2023.

- Raised from 2.5% to 3.1% in Q4 2024.

- Raised from 1.6% to 1.9% in Q4 2025.

- Slow to 1.5% in Q4 2026. (new).

These projections are based on a market-implied path for the Bank Rate that hovers around 5.25% until Q3 2024, and then gradually decreases to 4.25% by the end of 2026.

This represents a lower trajectory compared to the projections in August, which anticipated a Bank Rate of 5.8% by the end of 2023, 5.9% by the end of 2024, and 5% by the end of 2025.

Eurozone PMI manufacturing finalized at 43.1, woes deepen

Eurozone’s PMI Manufacturing reading for October was finalized at 43.1, a slight decline from September’s 43.4.

A closer look at individual countries, notably, Germany, Europe’s largest economy, posted a five-month high, though it still lurks in the downturn territory with a reading of 40.8. France hits a 41-month low at 42.8.

Amidst the broader decline, Greece displayed resilience with a two-month high of 50.8. In contrast, countries such as Ireland, Spain, and Italy presented figures pointing towards continued economic pressure with readings of 48.2, 45.1, and 44.9, respectively.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, likened the ongoing trend in Eurozone manufacturing to a “bumpy sleigh ride.” While the slight stability in recent PMI figures might hint at approaching the low point of this downturn, the critical indicators like the new orders index remain in the red.

The stagnation of these vital indices, as history suggests, could potentially set the stage for a recovery. However, de la Rubia anticipates this turnaround to materialize in the first half of the upcoming year.

Furthermore, he pointed out the synchronized decline among the eurozone nations. With key players like France, Italy, Spain, and Germany showcasing dipping PMIs, it’s evident that a sectoral contraction might be imminent for these nations in the current quarter.

Swiss CPI unchanged at 1.7% yoy in Oct, core CPI rises to 1.5% yoy

Swiss CPI rose 0.1% mom in October, matched expectations. Core CPI (excluding fresh and seasonal products, energy and fuel) rose 0.1% mom. Domestic products prices was flat at 0.0% mom. Imported products prices rose 0.3% mom.

Annually CPI was unchanged at 1.7% yoy, matched expectations. Core CPI accelerated from 1.3% yoy to 1.5% yoy. Domestic products price growth quickened from 2.1% yoy to 2.2% yoy. Imported products price growth slowed from 0.5% yoy to 0.4% yoy.

Australia’s trade surplus narrows sharply to AUD 6.79B in Sep

Australia’s economic outlook has taken a concerning turn as the trade surplus for September contracted significantly, recording its lowest monthly surplus since March 2021. The data released indicates a shrinkage from prior month’s AUD 10.16B to AUD 6.79B, falling short of the anticipated AUD 9.58B surplus. This sharp decline in trade surplus is fueling concerns that the Australian economy may have slipped into recession in the third quarter.

The primary factor contributing to the reduced surplus is a noticeable -1.4% yoy drop in goods exports, which totaled AUD 45.62B. This decline was primarily driven by a substantial -39.2% reduction in the shipment of metals and non-monetary gold, a critical export commodity for the Australian economy.

On the import side, there was a 7.5% yoy increase to AUD 38.84B. This surge in imports is attributed to a 23.3% jump in import of capital goods. Additionally, there was a noticeable spike in the demand for recreational items.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2110; (P) 1.2137; (R1) 1.2179; More

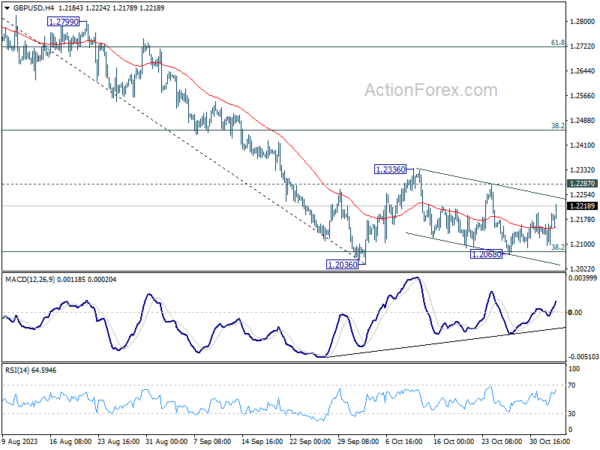

GBP/USD is still bounded in established range despite today’s rebound, and intraday bias stays neutral. On the upside, firm break of 1.2287 resistance will argue that rise from 1.2036 is resuming. Intraday bias will be turned back to the upside for 38.2% retracement of 1.3141 to 1.2036 at 1.2458. On the downside, decisive break of 1.2036 will resume whole decline from 1.3141 for 1.1801 support next.

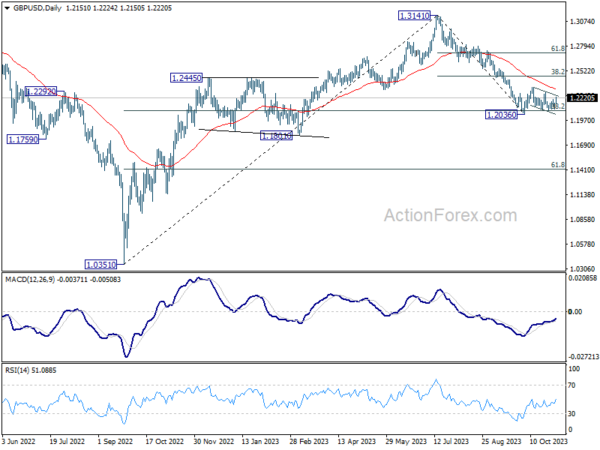

In the bigger picture, fall from 1.3141 medium term top could still be a correction to up trend from 1.0351 (2022 low) only. But risk of complete trend reversal is rising. Sustained break of 38.2% retracement of 1.0351 to 1.3141 at 1.2075 will pave the way to 61.8% retracement at 1.1417. For now, risk will stay on the downside as long as 55 D EMA (now at 1.2315) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Oct | 9.00% | 5.90% | 5.60% | |

| 00:30 | AUD | Goods Trade Balance (AUD) Sep | 6.79B | 9.58B | 9.64B | 10.16B |

| 07:30 | CHF | CPI M/M Oct | 0.10% | 0.10% | -0.10% | |

| 07:30 | CHF | CPI Y/Y Oct | 1.70% | 1.70% | 1.70% | |

| 08:45 | EUR | Italy Manufacturing PMI Oct | 44.9 | 46.5 | 46.8 | |

| 08:50 | EUR | France Manufacturing PMI Oct F | 42.8 | 42.6 | 42.6 | |

| 08:55 | EUR | Germany Manufacturing PMI Oct F | 40.8 | 40.7 | 40.7 | |

| 08:55 | EUR | Germany Unemployment Change Oct | 30K | 15K | 10K | |

| 08:55 | EUR | Germany Unemployment Rate Oct | 5.80% | 5.80% | 5.70% | |

| 09:00 | EUR | Eurozone Manufacturing PMI Oct F | 43.1 | 43 | 43 | |

| 11:30 | USD | Challenger Job Cuts Y/Y Oct | 8.80% | 58.20% | ||

| 12:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | 5.25% | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 3–0–6 | 2–0–7 | 4–0–5 | |

| 12:30 | USD | Initial Jobless Claims (Oct 27) | 217K | 210K | 210K | 212K |

| 12:30 | USD | Nonfarm Productivity Q3 P | 4.70% | 4.00% | 3.50% | |

| 12:30 | USD | Unit Labor Costs Q3 P | -0.80% | 1.10% | 2.20% | |

| 14:30 | USD | Natural Gas Storage | 81B | 74B |