The forex markets displayed a calm demeanor during Asian session today, with traders eagerly anticipating FOMC rate decision. After experiencing a tumultuous selloff, Yen found some semblance of stability, courtesy of verbal intervention by Japan. Nonetheless, it remains the week’s laggard, pausing momentarily with the possibility of further decline on the horizon. This weakening Yen has inadvertently boosted Nikkei, contributing to its impressive rally these two days. In the same vein, Swiss Franc trails Yen as the second weakest, with Aussie and Canadian Dollar displaying softness too.

Dollar, on the other hand, holds its ground, maintaining its strength alongside Euro and Sterling. The widely anticipated Fed hold and Chair Jerome Powell’s expected non-committal tone suggest that FOMC policy decision might not stir major waves. On the other hand, Treasury’s quarterly refunding announcement has the potential to be a game-changer, impacting bond markets and subsequently influencing stocks and currencies. Additionally, US ISM manufacturing data presents another variable that could introduce unexpected dynamics. Without significant developments, Dollar might remain in a holding pattern the European majors until Friday’s non-farm payroll provides more direction.

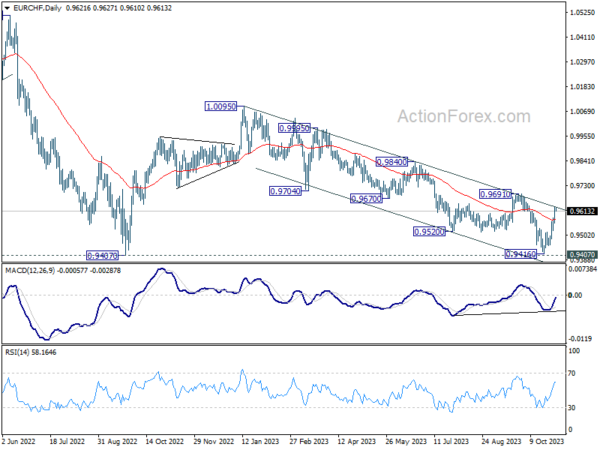

On the technical front, other than Dollar pairs, EUR/CHF is also an interesting one to watch. The strong rebound from 0.9416 continues this week, strengthening the case of medium term bottoming just ahead of 0.9407 key support. Focus for the next few days will be on 0.9691 resistance. Decisive break there argue that whole choppy decline from 1.0095 has completed, and turn outlook bullish. But of course, rejection by 0.9691 will maintain bearishness for at least another take on 0.9407 low.

In Asia, Nikkei closed up 2.41%. Hong Kong HSI is down -0.06%. China Shanghai SSE is up 0.29%. Singapore Strait Times is up 0.20%. Japan 10-year JGB yield rose 0.0121 to 0.961. Overnight, DOW rose 0.38%. S&P 500 rose 0.65%. NASDAQ rose 0.48%. 10-year yield was flat at 4.875.

Kanda announces Japan is on “standby” as Yen plunges past 151 to Dollar

Amid the resumed selloff of Yen, which broke 151 level against Dollar overnight, Japan’s top currency official, Masato Kanda, has issued a stern verbal warning. The Vice Finance Minister for International Affairs emphasized that Japan remains vigilant and “on standby” to mitigate the excessive volatility observed in the currency markets.

However, Kanda refrained from divulging specific details on potential interventions. “But I can’t say what we’ll do, and when — we’ll make judgments overall, and we’re making judgments in a state of urgency,” he added.

Kanda voiced significant concern over the rapid and one-sided shifts in currency values, stressing the importance of calibrated responses against overblown foreign exchange movements. He emphasized that fundamental economic indicators don’t justify such abrupt currency shifts, hinting at other factors at play. “Speculative trading seems to be the biggest factor behind recent currency moves,” Kanda observed.

“The yen has weakened close to 25 yen against the dollar from the start of the year, and it’s also moved a few yen in a short amount of time,” he noted, highlighting the dramatic shift in the currency’s value.

Japan PMI manufacturing: Slump continues, yet optimism shines for 2024

Japan’s PMI Manufacturing for October was finalized at 48.7, a slight uptick from 48.5 in September. Despite the improvement, the index languished below the critical 50 threshold for the fifth consecutive month.

S&P Global’s analysis revealed that a significant decline in output occurred due to persisting sales reductions. This challenging environment also led to the first drop in employment figures since the beginning of 2021. On the brighter side, confidence remains robust regarding a potential return to growth in 2024.

IMF to RBA: More tightening needed to curb inflation

In a report on Australia’s economy, IMF highlighted concerns about persistent inflation levels in the country. Even though inflation is “gradually declining”, it continues to hover “significantly above” RBA’s target, with the country’s output “remains above potential.”

The IMF staff “recommend further monetary policy tightening”. They believe this approach will realign inflation with RBA’s target range by 2025 and “minimize the risk of de-anchoring inflation expectations.”

In terms of economic momentum, the IMF predicts a further slowdown in the near future, coinciding with a steady decrease in inflation. While risks to growth appears “broadly balanced”, the potential for inflation to surpass expectations remains a cause for concern.

NZ employment down -0.2% in Q3, unemployment rate jumps to 3.9%

New Zealand’s employment figures for Q3 came in weaker than anticipated. Employment contracted by -0.2%, sharply diverging from the forecasted growth of 0.40%.

Unemployment rate made a noticeable leap, rising from 3.6% to 3.9%, a figure that met market expectations. Additionally, both employment rate and labor force participation rate registered declines, moving from 69.8% to 69.1% and from 72.5% to 72.0% respectively.

Wage data presented a mixed picture. The all-sector wage inflation stood firm at 4.3% yoy.

The public sector experienced a particularly sharp uptick in salaries and wages, registering a 5.4% yoy increase. This significant rise is notable for being the steepest since the data series commenced in 1992, surpassing 4.2% yoy growth observed in Q2.

In contrast, the private sector saw wage cost inflation moderating to 4.1% yoy in Q3, slightly down from the 4.3% recorded in the previous quarter.

China’s Caixin PMI manufacturing slips to 49.5, business optimism continues to wane

China’s Caixin PMI Manufacturing index slipped from 50.6 in September to 49.5 in October, falling below market expectations set at 50.8. This marks a renewed contraction in the nation’s manufacturing sector.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted several challenges facing the manufacturing industry. “Overall, manufacturers were not in high spirits in October,” he said. The decline in the sector was multifaceted – supply, employment, and external demand all experienced reductions, while domestic demand saw a slower pace of expansion.

The manufacturing environment was further complicated by rising costs and output prices. This was coupled with decrease in purchases and accumulation of inventories of finished goods. Reflecting the various pressures, “business optimism continued to wane”.

Market eyes treasury refunding ahead of FOMC hold

Fed is widely expected to interest rates unchanged at 5.25-5.50% today, a second consecutive pause. The accompany and Fed Chair Jerome Powell’s press conference will likely leave the door open to further hikes. The question is how firm Powell could maintain his hawkish stance, which could reflect the chance of another hike in December.

Fed policymakers have in recent weeks cited the rise in longer-term borrowing costs and the consequent tightening of financial conditions as reasons for lowering the need for more tightening. Powell’s comments on this will be closely watched too.

However, Powell will likely hold off any substantial comments for now, given that the next set of economy projections will be prepared and released in December. That’s what Fed policymakers would decide what to do next. Hence, today’s FOMC could turn out to be a non event.

A more market moving event could be the quarterly treasury refunding announcement before the FOMC decision. Investors got a preview of the Treasury’s direction Monday, when the department said it will be auctioning off USD 776B of debt in the final quarter of 2023. The key variables markets will be watching are the actual sizes of the auction as well as the maturities mix. There is a supply-demand mismatch in the treasury market, and that is what has led to the sharp rise bond yields this year.

Looking ahead

Swiss PMI and UK PMI manufacturing final are the highlights of European session. Later in the day, US will also release ISM manufacturing before FOMC rate decision.

USD/JPY Daily Outlook

Daily Pivots: (S1) 149.87; (P) 150.80; (R1) 152.56; More…

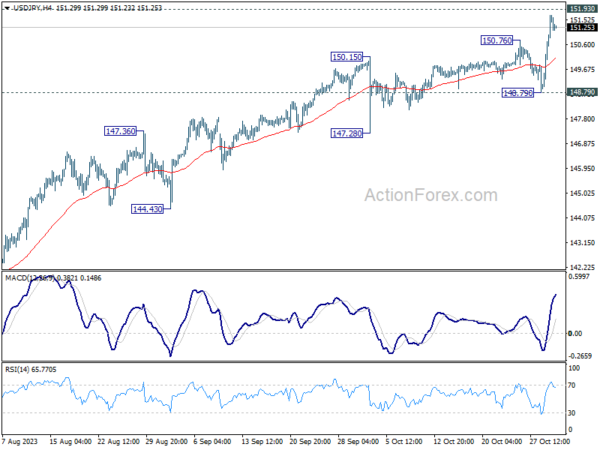

Intraday bias in USD/JPY remains on the upside for 151.93 key resistance. Firm break there will target 100% projection of 129.62 to 145.06 from 137.22 at 152.66. For now, break of 148.79 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

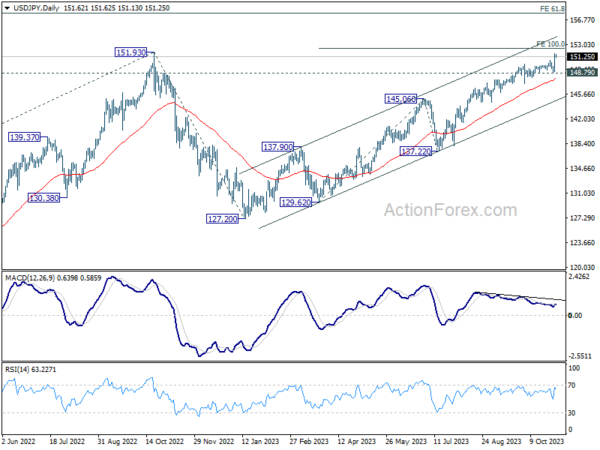

In the bigger picture, immediate focus is now on 151.93 resistance (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will argue that rise from 127.20 has completed, and turn outlook bearish for 137.22 support and below. However, sustained break of 151.93 will confirm resumption of long term up trend. Next target will be 61.8% projection of 102.58 to 151.93 from 127.20 at 157.69.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q3 | -0.20% | 0.40% | 1.00% | |

| 21:45 | NZD | Unemployment Rate Q3 | 3.90% | 3.90% | 3.60% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q3 | 0.80% | 1.00% | 1.10% | |

| 00:30 | AUD | Building Permits M/M Sep | -4.60% | 2.60% | 7.00% | 8.10% |

| 00:30 | JPY | Manufacturing PMI Oct F | 48.7 | 49 | 48.5 | |

| 01:45 | CNY | Caixin Manufacturing PMI Oct | 49.5 | 50.8 | 50.6 | |

| 08:30 | CHF | Manufacturing PMI Oct | 45 | 44.9 | ||

| 09:30 | GBP | Manufacturing PMI Oct F | 45.2 | 45.2 | ||

| 12:15 | USD | ADP Employment Change Oct | 135K | 89K | ||

| 13:30 | CAD | Manufacturing PMI Oct | 47.5 | |||

| 13:45 | USD | Manufacturing PMI Oct F | 50 | 50 | ||

| 14:00 | USD | ISM Manufacturing PMI Oct | 49 | 49 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Oct | 44.5 | 43.8 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Oct | 51.2 | |||

| 14:00 | USD | Construction Spending M/M Sep | 0.40% | 0.50% | ||

| 14:30 | USD | Crude Oil Inventories | 1.5M | 1.4M | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |