Yen continued to face significant pressure in early US session, remaining as the day’s weakest performer. Hopes of substantial changes from BoJ were dashed earlier as it made only a minor adjustment to the definition of yield cap. The selling sentiment intensified following revelation that Ministry of Finance refrained from spending on interventions between September 28 and October 27. This has propelled USD/JPY towards 151 mark, while the EUR/JPY surged to its highest in over ten years.

Contrastingly, Euro emerges as the strongest currency of the day, a surprising turn of events given the lower than expected Eurozone GDP and CPI data. However, Euro’s lead is being closely challenged by Dollar, and it remains uncertain which currency will prevail as the day’s strongest. Nonetheless, Dollar still faces significant challenges ahead, including the upcoming FOMC and ISM manufacturing data tomorrow, and crucial economic indicators later in the week such as non-farm payrolls and ISM services.

In other currency market movements, Australian Dollar experienced a dip, making it the day’s second weakest currency, closely followed by Swiss Franc and New Zealand Dollar. Sterling and Canadian Dollar showed mixed responses.

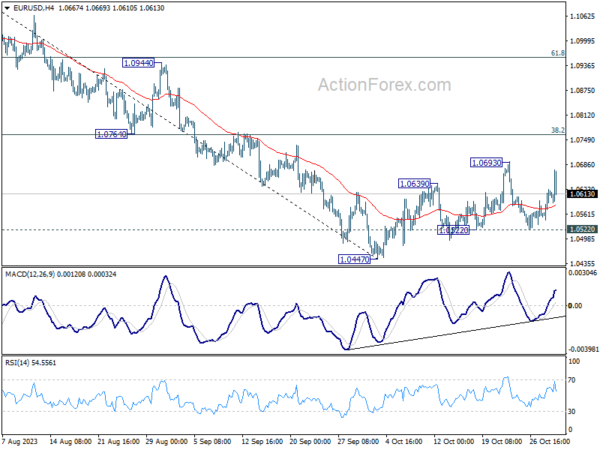

Technically, despite today’s strong rebound, EUR/USD is still capped below 1.0693 resistance. Larger decline is in favor to continue and break of 1.0522 support would push EUR/USD through 1.0447 low. However, break of 1.0693 will risk stronger rebound through 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763).With significant economic events on the horizon, clarity on the currency’s direction is likely to emerge in the coming days.

In Europe, at the time of writing, FTSE is up 0.25%. DAX is up 0.59%. CAC is up 0.98%. Germany 10-year yield is down -0.0358 at 2.789. Earlier in Asia, Nikkei rose 0.53%. Hong Kong HSI dropped -1.69%. China Shanghai SSE dropped -0.09%. Singapore Strait Times rose 0.11%. Japan 10-year JGB yield rose 0.0521 to 0.949.

Canada’s GDP essentially unchanged in Aug, missed expectations

Canada’s GDP was flat at 0.0% mom in August, essentially unchanged for a second month, below expectation of 0.1% mom growth. Services producing industries edged up by 0.1% mom in the month while goods-producing industries contracted -0.2% mom. Overall, 8 of 20 industrial sectors increased.

Statistics Canada noted, “factors such as higher interest rates, inflation, forest fires and drought conditions continued to weigh on the economy”.

Advance information suggests that real GDP was essentially unchanged again in September, as well as in Q3. Decreases in mining, quarrying, and oil and gas extraction and utilities were partially offset by increases in the construction and public sectors.

Eurozone CPI slows to 2.9% yoy, lowest since Jul 2021

Eurozone CPI cooled off further in October, decelerating from 4.3% yoy to 2.9% yoy. This slowdown in inflation was more pronounced than market predictions, which had forecasted a rate of 3.1% yoy. Notably, this is the most muted inflation pace the region has experienced since July 2021.

Excluding volatile components in energy, food, alcohol, and tobacco, core CPI experienced a deceleration from 4.5% yoy to 4.2% yoy, hitting its lowest mark since July 2022, and meeting the predictions set by market experts.

Breaking down the main components of inflation, food, alcohol, and tobacco observed the most significant annual inflation rate for October, registering 7.5% compared to 8.8% in September. Services prices recorded a marginal decline, moving from 4.7% in September to 4.6% in October. Non-energy industrial goods also experienced a slowdown, with prices rising 3.5% in October compared to 4.1% in the preceding month.

However, the most dramatic shift was observed in the energy component. Prices in this segment plummeted to -11.1% in October from -4.6% in September, reflecting the volatile nature of global energy markets.

Eurozone GDP contracts -0.1% qoq in Q3, EU grows 0.1% qoq

Eurozone’s GDP shrank unexpectedly in Q3, contracting by -0.1% qoq, defying expectations of a stagnant 0.0% growth. When compared with the same quarter of the previous year, Eurozone’s growth was barely positive at 0.1% yoy. Meanwhile, the broader EU reported a similar pattern, with a 0.1% growth both qoq and yoy.

The performance across member states varied significantly. Latvia emerged as the top performer with 0.6% growth over the previous quarter, followed by Belgium and Spain, recording 0.5% and 0.3% growth respectively. Conversely, Ireland faced the steepest decline with a -1.8% contraction, followed by Austria at -0.6% and Czechia at -0.3%.

Year-on-year growth rates revealed a similar disparity among the member states. Portugal, Spain, and Belgium led the way with 1.9%, 1.8%, and 1.5% growth respectively. However, Ireland experienced a sharp -4.7% decline, with Estonia (-2.5%), Austria and Sweden (-1.2% both) also facing significant contractions.

BoJ’s yield cap redefinition underwhelms

Under the Yield Curve Control framework, BoJ has maintained the short-term policy interest rate at -0.10%, while 10-year JGB yield target remains at around 0%. These decisions were reached unanimously. However, the central bank subtly altered its wording regarding the 10-year JGB yield cap, now referring to the 1.0% level as a “reference in its market operations.” This move is perceived as transforming the cap into a flexible upper boundary rather than a strict limit.

Adding to this, BoJ stated, “Given extremely high uncertainties over the economy and markets, it’s appropriate to increase flexibility in the conduct of yield curve control.” This sentiment was not universally shared, as Nakamura Toyoaki expressed dissent, suggesting that increasing flexibility should be contingent upon confirming a rise to firms’ earning power.

In a significant update, BoJ’s new economic projections reveal upgraded core inflation forecasts across the board, with a noteworthy jump from 1.9% to 2.8% for fiscal 2024.

Here’s a summary of the updated forecasts:

Core CPI Forecasts (July):

- Fiscal 2023: 2.8% (up from 2.5%)

- Fiscal 2024: 2.8% (up from 1.9%)

- Fiscal 2025: 1.7% (up slightly from 1.6%)

Core-Core CPI Forecasts:

- Fiscal 2023: 3.8% (up from 3.2%)

- Fiscal 2024: 1.9% (up from 1.7%)

- Fiscal 2025: 1.9% (up from 1.8%)

GDP Forecasts:

- Fiscal 2023: 2.0% (up from 1.3%)

- Fiscal 2024: 1.0% (down from 1.2%)

- Fiscal 2025: 1.0% (unchanged)

Japan’s industrial output lags behind expectations; retail sales see mixed results

Japan’s industrial production in September posted subdued growth, clocking in at only 0.2% mom, significantly below the anticipated rise of 2.5% mom. When compared year-on-year , the figures revealed a drop of -4.6% yoy. Furthermore, the output for the third quarter (July-September) saw a decline, registering at -1.3% compared to the preceding quarter. In terms of a seasonally adjusted index, the production at factories and mines was at 103.3, benchmarked against 2020 base of 100.

Feedback from manufacturers, as sourced by the Ministry of Economy, Trade and Industry, paints a mixed picture for the upcoming months. They project an increase in the seasonally adjusted output by 3.9% for October, followed by a decline of -2.8% in November.

Retail statistics for September also indicated a mix of growth and contraction. On a yearly basis, retail sales rose by 5.8% yoy, narrowly missing forecasted 5.9% yoy. However, assessing the data month-on-month reveals a slight decline of -0.1% mom in retail sales.

On the job front, there’s a glimmer of positive news. Unemployment rate experienced a marginal dip, moving from 2.7% to 2.6%, aligning with market expectations. The jobs-to-applicant ratio for September remained steady at 1.29, signifying that there were 129 job opportunities available for every 100 job seekers.

China’s official PMI indicates manufacturing back in contraction and non-Manufacturing slows

China’s economic pulse seems to have lost its rhythm, as indicated by the latest PMI figures for October. The official PMI Manufacturing dropped from 50.2 to 49.5, falling below the anticipated 50.4 mark. This downturn is not an isolated occurrence; the manufacturing sector has experienced contraction in six out of the ten months of 2023 so far.

In a similar vein, PMI Non-Manufacturing sector witnessed a decrease, moving from 51.7 to 50.6, which is also below the projected 51.8. Compounding these concerns is PMI Composite, which aggregates both manufacturing and non-manufacturing sectors. It fell from 52.0 to 50.7, registering its lowest reading since December 2022.

National Bureau of Statistics senior statistician Zhao Qinghe acknowledged these challenges in a statement. He noted, “China’s economic activity fell to an extent, and the foundation for a continued recovery still needs to be further solidified.”

NZ ANZ business confidence jumped to 23.4, inflation pressures remain

New Zealand’s ANZ Business Confidence for October showcased a significant rise, moving from 1.5 to a robust 23.4. This upbeat sentiment was mirrored in the Own Activity outlook, which climbed from 10.9 to 23.1.

A broader analysis of the report’s details reveals positive shifts across multiple components: Export intentions rose from -0.4 to 6.1, Investment intentions moved from a negative -4.1 to a positive 3.8, and Employment intentions took a jump from 1.2 to 5.6.

However, while these figures indicate growing optimism in business activities and prospects, inflation front remains a concern. Cost expectations reduced slightly from 78.6 to 76.0. Similarly, Pricing intentions saw a minor drop, moving from 47.1 to 46.3. Inflation expectations also experienced a negligible downtick, adjusting from 4.95% to 4.94%.

Reacting to these numbers, ANZ remarked, “Just as we thought that the rebound in activity indicators in the ANZ Business Outlook survey might be running out of steam, we’ve seen a marked jump across most.”

The bank also cautioned against hasty conclusions based on the current data, especially considering the potential disruptions from the election, suggesting a wait-and-watch approach: “we’ll see whether the newfound (relative) optimism persists over the next few months.”

On the inflation front, ANZ noted that, “inflation pressures are gradually waning in the big picture.” Despite this, the bank emphasized that significant progress in curbing inflation has been missing over recent months. The journey back to the inflation target remains substantial. “We continue to expect it’ll take at least one more OCR hike to get us there.”

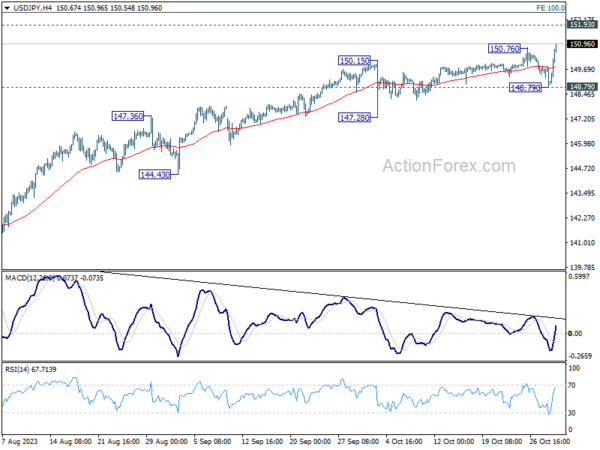

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.63; (P) 149.24; (R1) 149.67; More…

USD/JPY’s recent rally resumed by breaking through 150.76 and intraday bias is back on the upside. Next target is 151.93 high. Break there will target 100% projection of 129.62 to 145.06 from 137.22 at 152.66. For now, break of 148.79 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, immediate focus is now on 151.93 resistance (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will argue that rise from 127.20 has completed, and turn outlook bearish for 137.22 support and below. However, sustained break of 151.93 will confirm resumption of long term up trend. Next target will be 61.8% projection of 102.58 to 151.93 from 127.20 at 157.69.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Sep | -4.70% | -6.70% | -7.00% | |

| 23:30 | JPY | Unemployment Rate Sep | 2.60% | 2.60% | 2.70% | |

| 23:50 | JPY | Industrial Production M/M Sep P | 0.20% | 2.50% | -0.70% | |

| 23:50 | JPY | Retail Trade Y/Y Sep | 5.80% | 5.90% | 7.00% | |

| 00:00 | NZD | ANZ Business Confidence Oct | 23.4 | 1.5 | ||

| 00:30 | AUD | Private Sector Credit M/M Sep | 0.50% | 0.40% | ||

| 01:00 | CNY | NBS Manufacturing PMI Oct | 49.5 | 50.4 | 50.2 | |

| 01:00 | CNY | NBS Non-Manufacturing PMI Oct | 50.6 | 51.8 | 51.7 | |

| 03:28 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 05:00 | JPY | Housing Starts Y/Y Sep | -6.80% | -6.20% | -9.40% | |

| 05:00 | JPY | Consumer Confidence Index Oct | 35.7 | 35.1 | 35.2 | |

| 06:30 | EUR | France Consumer Spending M/M Sep | 0.20% | 0.60% | -0.50% | -0.60% |

| 06:30 | EUR | France GDP Q/Q Q3 P | 0.10% | 0.10% | 0.50% | 0.60% |

| 07:00 | EUR | Germany Import Price Index M/M Sep | 1.60% | 0.40% | 0.40% | |

| 07:00 | EUR | Germany Retail Sales M/M Sep | -0.80% | 0.50% | -1.20% | -1.10% |

| 07:30 | CHF | Real Retail Sales Y/Y Sep | -0.60% | -1.20% | -1.80% | -2.20% |

| 09:00 | EUR | Italy GDP Q/Q Q3 P | 0.00% | 0.10% | -0.40% | |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | -0.10% | 0.00% | 0.10% | |

| 10:00 | EUR | Eurozone CPI Y/Y Oct P | 2.90% | 3.10% | 4.30% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct P | 4.20% | 4.20% | 4.50% | |

| 12:30 | CAD | GDP M/M Aug | 0.00% | 0.10% | 0.00% | |

| 12:30 | USD | Employment Cost Index Q3 | 1.10% | 1.00% | 1.00% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Aug | 0.30% | 0.10% | ||

| 13:00 | USD | Housing Price Index M/M Aug | 0.50% | 0.80% | ||

| 13:45 | USD | Chicago PMI Oct | 44.7 | 44.1 | ||

| 14:00 | USD | Consumer Confidence Oct | 100.4 | 103 |