US equities surged to new record highs again while treasury yields jumped as tax plan and Fed chair position continued to be the theme that drove the markets. The developments also took Dollar generally higher. DOW closed up 167.80 pts or 0.72% at 23441.76, hitting all time high. S&P 500 and NASDAQ gained 0.16% and 0.18% too but lagged DOW in the record runs. 10 year yield jumped 0.030 to close at 2.406, above 2.396 key resistance, which is see as a bullish signal. TNX could now be heading to retest 2.621 high made back in December.

At this point, Dollar index is still limited below 94.14 key near term resistance. But that’s mainly due to Euro’s resilience, which is trading as the second strongest currency for the week, next to Dollar. The common currency is being supported by expectation of ECB tapering, to be announced tomorrow. Elsewhere in the currency markets, Australian Dollar tumbles sharply today after CPI miss. Aussie is even weaker than Kiwi, which is suffering from negative reactions to the policies of the new government.

For the day ahead, UK Q3 GDP will be a key to watch. While a BoE November hike is highly likely, that’s not a done deal yet. Sterling could suffer if GDP growth misses expectations. German Ifo business climate is another focus in European session but that is unlikely to alter ECB’s course. BoC rate decision is the main highlight in US session but that could be a non-event. US will release durable goods orders, house price index and new home sales.

Republicans united on tax plan, despite political rift with Trump

The feud between US President Donald Trump and some Republicans continued, including with Bob Corker and Jeff Flake. But recent developments suggest that while some Republicans would continue to heavily criticize Trump on political front, they are rather united regarding the tax plan. The rifts are not going to derail the push for completing the tax cuts by year end. It’s reported that House Republicans are now prepared to take the Senate version of the tax plan in order to move forward swiftly, dropping some ideological demands. Reconciliation of the Senate and House version will be a big step forward.

Taylor got most "show of hands" in Fed chair race

Treasury yields are also supported by news that Stanford University economist John Taylor got the most "show of hands" in a closed-door lunch, where Trump asked the Republican senators who they prefer to be next Fed Chair. The White House noted that Trump is taking this decision seriously. While Taylor has been viewed as a hawk as the Taylor rule he created points to significant increase in the policy rate from the current level, his own monetary stance might not be so.

In his speech titled Rules Versus Discretion: Assessing the Debate Over the Conduct of Monetary Policy at the Boston Fed conference on October 13, Taylor noted that "one can easily adjust the equilibrium interest rate in the rule". He added that the most important suggested change in policy rules in recent years is probably to "adjust the intercept to accommodate the lower estimate of the equilibrium real interest rate (R*)". He appears content with the situation that the FOMC members have recently adjusted the average estimate of the neutral by "at least one percentage point lower" than the original 2%.

Aussie CPI miss suggests no RBA hike soon

Consumer inflation data from Australia surprised to the downside. Headline CPI rose 0.6% qoq in Q3, below expectation of 0.8% qoq. Annual rate slowed to 1.8% yoy, down from 1.9% yoy and missed expectation of 2.0% yoy. RBA trimmed mean CPI was unchanged at 1.8% yoy, missed expectation of 2.0% yoy. RBA weighted median CPI was unchanged at 1.9% yoy, below expectation of 2.0% yoy. The data suggested that it will be hard for RBA to considering raising interest rate any time soon.

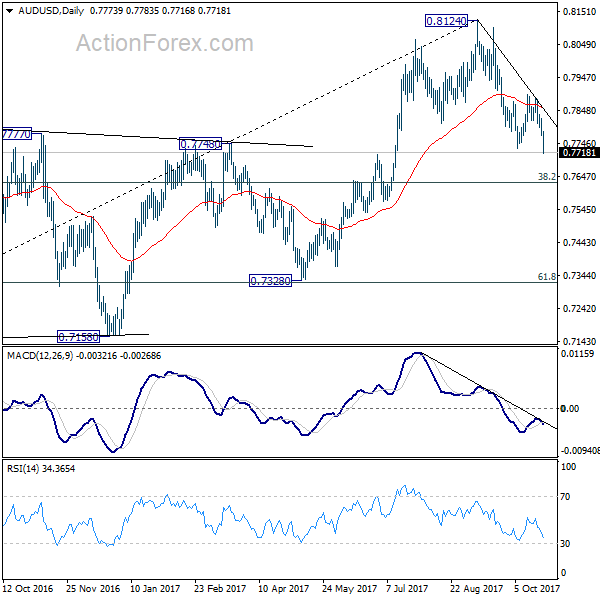

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7755; (P) 0.7790; (R1) 0.7809; More…

AUD/USD drops to as low as 0.7783 so far today. Break of 0.7732 support confirms resumption of decline from 0.8124. Intraday bias is back on the downside for medium term fibonacci level at 0.7628 first. Current development affirms the case of medium term reversal. Firm break of 0.7628 will pave the way to 0.7328 key support next. On the upside, above 0.7769 minor resistance will turn intraday bias neutral first. But outlook will remain cautiously bearish as long as 0.7896 resistance holds.

In the bigger picture, rise from 0.6826 medium term bottom is seen as corrective pattern. Current development suggests that it might be completed with three waves up to 0.8124 already. Break of 38.2% retracement of 0.6826 to 0.8124 at 0.7628 will affirm this bearish case. And, decisive break of 0.7328 key cluster support (61.8% retracement at 0.7322) will confirm and bring retest of 0.6826 low. In case rise from 0.6826 resumes and extends, strong resistance should be seen at 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | CPI Q/Q Q3 | 0.60% | 0.80% | 0.20% | |

| 0:30 | AUD | CPI Y/Y Q3 | 1.80% | 2.00% | 1.90% | |

| 0:30 | AUD | CPI RBA Trimmed Mean Q/Q Q3 | 0.40% | 0.50% | 0.50% | |

| 0:30 | AUD | CPI RBA Trimmed Mean Y/Y Q3 | 1.80% | 2.00% | 1.80% | |

| 0:30 | AUD | CPI RBA Weighted Median Q/Q Q3 | 0.30% | 0.50% | 0.50% | |

| 0:30 | AUD | CPI RBA Weighted Median Y/Y Q3 | 1.90% | 2.00% | 1.80% | 1.90% |

| 6:00 | CHF | UBS Consumption Indicator Sep | 1.53 | |||

| 8:00 | EUR | German IFO – Business Climate Oct | 115.1 | 115.2 | ||

| 8:00 | EUR | German IFO – Expectations Oct | 107.3 | 107.4 | ||

| 8:00 | EUR | German IFO – Current Assessment Oct | 123.5 | 123.6 | ||

| 8:30 | GBP | GDP Q/Q Q3 A | 0.30% | 0.30% | ||

| 8:30 | GBP | GDP Y/Y Q3 A | 1.50% | 1.50% | ||

| 8:30 | GBP | Index of Services 3M/3M Aug | 0.40% | 0.50% | ||

| 12:30 | USD | Durable Goods Orders Sep P | 1.00% | 2.00% | ||

| 12:30 | USD | Durables Ex Transportation Sep P | 0.50% | 0.50% | ||

| 13:00 | USD | House Price Index M/M Aug | 0.40% | 0.20% | ||

| 14:00 | CAD | BoC Rate Decision | 1.00% | 1.00% | ||

| 14:00 | USD | New Home Sales Sep | 556K | 560K | ||

| 14:30 | USD | Crude Oil Inventories | -5.7M |