Dollar is experiencing a broad rise today, buoyed by an uptick in treasury yields and risk aversion sentiments. The US Congress averted potential economic turbulence by passing a stopgap funding bill over the weekend, ensuring the federal government doesn’t enter its fourth partial shutdown within a decade. However, this positive momentum in US futures was fleeting. This strengthening of Dollar is mirrored by decline in Gold and Silver, both plunging to their lowest levels since March.

In the realm of currencies, Canadian Dollar is emerging as one of the stronger performers, with Swiss Franc not far behind – the latter finding support from purchases against European majors. Conversely, Australian and New Zealand dollars are today’s underperformers. Both antipodean currencies are in the spotlight as anticipating respective central bank meetings this week, with RBA kicking off the sequence in the coming Asian session.

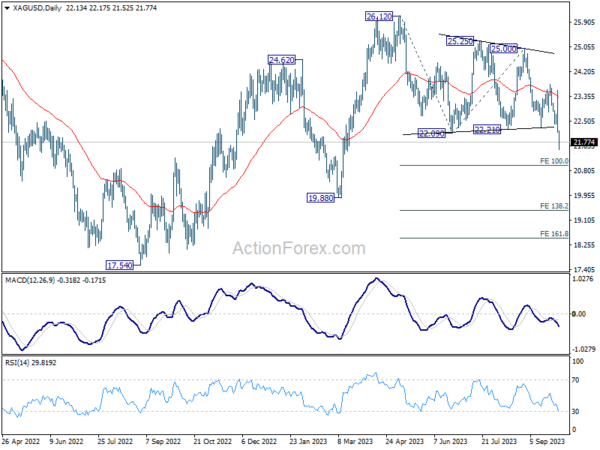

Technically, Silver resumed the decline from 26.12 and hits a low as 21.52 so far. It’s unsure whether this fall is an impulsive or a corrective move for now. But risk will stay on the downside as long as 55 D EMA (now at 23.35) holds. Next target is 100% projection of 26.12 to 22.09 from 25.00 at 20.97. Decisive break there could prompt downside acceleration, and will act as a strong signal of underlying bearishness.

In Europe, at the time of writing, FTSE is down -0.49%. DAX is down -0.32%. CAC is down -0.37%. Germany 10-year yield is up 0.0253 at 2.870. Earlier in Asia, Nikkei closed down -0.31% on late selloff. Japan 10-year JGB yield rose 0.0054 to 0.776. Singapore Strait Times fell -0.27%.

Eurozone unemployment rate ticks down to 6.4%, EU down to 5.9%

Unemployment rate in Eurozone has seen a drop from 6.5% to 6.4% in August, aligning with market expectations. Similarly, the broader EU reported a decrease in its unemployment rate, ticking down from 6.0% to 5.9%.

Eurostat, provided further details on this development. As of August 2023, an estimated 12.837m individuals in EU were unemployed. Out of these, Eurozone accounted for 10.856m jobless persons. When juxtaposed with the data from July, there’s a marked decrease of -112k unemployed persons in EU, with Eurozone contributing a decline of -107k to this number.

An even more pronounced positive trend emerges when the data is analyzed year-on-year. From August 2022 to August 2023, EU saw a reduction in unemployment by -335k individuals, while Eurozone alone experienced a decline of -407k unemployed persons.

Eurozone PMI manufacturing finalized at 43.4, sub-50 reading persists for 15 months

September Eurozone PMI Manufacturing shows a persistent trend of contraction, finalizing at 43.4, a marginal decline from August’s 43.5. This marks a continuous 15-month spell where the headline index has been below the 50.0 threshold, indicating contraction.

Excluding Greece, which barely recorded expansion with Manufacturing PMI of 50.3, every other country monitored in the survey showed downturns. A country-wise breakdown ranks Greece at the top, followed by Ireland (49.6), Spain (47.7), Italy (46.8), France (44.2), Netherlands (43.6), Austria (39.6), and Germany (39.6).

Cyrus de la Rubia, the Chief Economist at Hamburg Commercial Bank, painted a clear picture of the current manufacturing scenario. He stated, “We are feeling pretty certain that the recession in manufacturing continued during this period.” He also added that a significant pickup might only materialize with the advent of the new year. However, he expressed optimism by highlighting the possibility of reaching the lowest point in the current economic cycle.

Drawing parallels with past recessions, de la Rubia remarked, “With the exception of the great recession in 2008/2009, output prices have never decreased at a pace faster than the current three-month average.” He emphasized the rarity of such sharp falls and indicated the likelihood of a rebound.

France and Germany led the downturn, while Spain and Italy showed relative resilience. However, when viewed through the lens of ongoing slowdown duration, Italy emerged as the poorest performer. Its manufacturing sector has been in recession since the latter half of 2022, with Germany joining the downturn in the second quarter of the current year.

“Given our forecast that the global manufacturing sector is bottoming out, these countries may be spared from a downturn lasting longer than two quarters,” de la Rubia added, hinting at a silver lining in the looming clouds of economic contraction.

UK PMI manufacturing finalized at 44.3, still mired in contraction

UK PMI Manufacturing experienced a slight uptick, finalized 44.3 in September from the previous month’s 39-month low of 43.0. However, despite this marginal improvement, an in-depth examination of the five sub-indices of the PMI – new orders, output, employment, stocks of purchases, and supplier delivery times – revealed a consistent downturn in the sector’s performance.

Rob Dobson, Director at S&P Global Market Intelligence, portrayed a challenging scene for the UK’s manufacturing industry. “September saw the manufacturing sector still mired in contraction territory,” he noted. This is attributed to weakened conditions both domestically and internationally that have negatively impacted new order intakes, leading to reduced production volumes.

One of the significant factors exacerbating the situation is the ongoing cost-of-living crisis in the UK. A rapid increase in interest rates is further pressuring the manufacturing sector. Producers have explicitly linked these developments to the troubles they are encountering.

BoJ opinions: A blend of caution and optimism

Summary of Opinions of BoJ’s September 21-22 meeting reiterated the general stance that ultra-loose monetary policy remains necessary for now. Yet, there was an undercurrent of optimism, with some members seeing achieve of price target “in sight”.

The collective view reinforced that the “sustainable and stable achievement of the price stability target, accompanied by wage increases, has not yet come in sight.” Given this scenario, the summary stressed the necessity to “patiently continue with monetary easing under yield curve control.”

Underpinning the continued focus on wages, one member stated it is “necessary” to uphold the “momentum for wage hikes through continuation of monetary easing.” Also, in order to achieve inflation target of 2 percent in a sustainable manner, it is necessary that “wage increases take root.”

However, amid the cautious tones, rays of optimism emerged. One member opined that “Japan’s economy is getting closer to achieving the price stability target, although there is somewhat of a distance to go.” Providing a potential timeline for evaluating the price stability objective, focus is now on “the second half of fiscal 2023” especially considering the wage growth prospects for 2024.

Furthering this optimism, another viewpoint conveyed confidence, indicating that “Achievement of 2 percent inflation in a sustainable and stable manner seems to have clearly come in sight.” This perspective also hinted at a clearer outcome by “January to March of next year.”

Japan’s Tankan survey reveals strong business sentiment

The latest Tankan survey results in Q3 showcased strengthening corporate sentiment in Japan. Key indices and outlooks, along with projections for capital expenditure, underscore a robust business environment, as inflation expectations maintain steadiness.

Large Manufacturing Index showed notable gains from 5 to 9, marking its second consecutive quarter of growth. Concurrently, Large Non-Manufacturing Index advanced from 23 to 27, recording its best level since 1991 and marking its sixth straight quarter of improvement.

Further reflecting this positive trend, Large Manufacturing Outlook Index increased from 9 to 10, while its Large Non-Manufacturing Outlook saw an ascent from 20 to 21.

In terms of capital commitments, prominent firms revealed ambitious plans, with an anticipation to bolster capital expenditure by 13.6% for the fiscal year ending March 2024.

Regarding inflation, the corporate sector’s expectations remain consistent. Firms anticipate a price increase of 2.5% in the upcoming year, 2.2% over a three-year horizon, and 2.1% looking five years ahead. These figures mirror projections made in the prior quarter.

A crucial insight from a BOJ official noted that many large businesses have successfully offset higher costs by adjusting consumer prices, subsequently enhancing the overall business sentiment.

Further elevating the positive mood have been factors such as a resurgence in auto production and declining costs for raw materials. However, the official also acknowledged the challenges faced by some smaller enterprises, which have found it difficult to raise their prices.

Japan PMI manufacturing finalized at 48.5 in Sep, headwinds at home and abroad

Japanese manufacturing sector is facing challenges as evidenced by the drop in PMI Manufacturing to 48.5 in September, down from August’s 49.6, the lowest level since February. Additionally, the average reading for Q3 stands at 49.3, a reduction from 50.0 in Q2.

According to key findings by S&P Global, the sector experienced faster falls in production and incoming new work. Alarmingly, backlogs declined at the strongest rate since April. A specific area of concern is the accelerated rate of input price inflation, reaching a four-month high, fueled by increasing costs of raw materials, oil, freight, and energy.

Usamah Bhatti at S&P Global Market Intelligence, conveyed a sombre view of the situation. He noted, “Depressed economic conditions domestically and globally weighed heavily on the sector, as both output and new orders were scaled back further. The decline in the latter was notably sharp, and the strongest seen for seven months.” The future outlook is also tinged with apprehension, as manufacturers signaled the most significant depletion in outstanding business in five months.

The inflationary aspect further complicates the picture. Bhatti highlighted, “The rate of input price inflation accelerated for the second month running to a four-month high.” Reports indicated that the sustained weakness of the yen is exacerbating the situation, elevating prices for inputs from abroad and placing an additional strain on firms.

EUR/USD Mid-Day Outlook

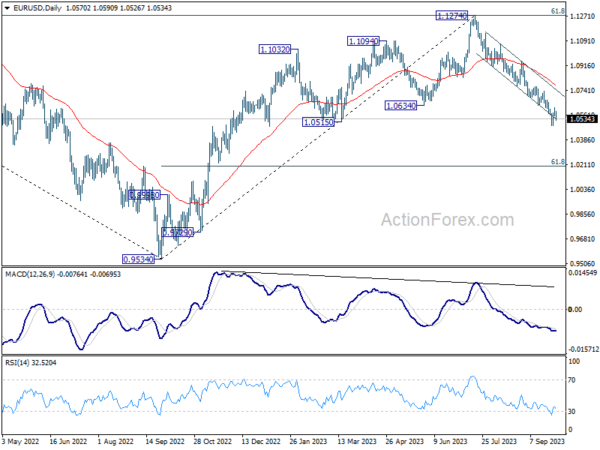

Daily Pivots: (S1) 1.0548; (P) 1.0583; (R1) 1.0607; More…

EUR/USD dips notably after rejection by 55 4H EMA, but stays above 1.0487 support. Intraday bias remains neutral for the moment. Stronger recovery cannot be ruled out. But near term outlook will stay bearish as long as 1.0764 support turned resistance holds. Break of 1.0487 will resume the fall from 1.1274 to 1.0199 fibonacci level.

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, current fall should target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0786) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Tankan Large Manufacturing Index Q3 | 9 | 6 | 5 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q3 | 10 | 5 | 9 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q3 | 27 | 24 | 23 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q3 | 21 | 22 | 20 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q3 | 13.60% | 13.40% | ||

| 00:00 | AUD | TD Securities Inflation M/M Sep | 0.00% | 0.20% | ||

| 00:30 | JPY | Manufacturing PMI Sep F | 48.5 | 48.6 | 48.6 | |

| 06:30 | CHF | Real Retail Sales Y/Y Aug | -1.80% | -1.80% | -2.20% | -2.50% |

| 07:30 | CHF | Manufacturing PMI Sep | 44.9 | 40.5 | 39.9 | |

| 07:45 | EUR | Italy Manufacturing PMI Sep | 46.8 | 45.6 | 45.4 | |

| 07:50 | EUR | France Manufacturing PMI Sep F | 44.2 | 43.6 | 43.6 | |

| 07:55 | EUR | Germany Manufacturing PMI Sep F | 39.6 | 39.8 | 39.8 | |

| 08:00 | EUR | Italy Unemployment Aug | 7.30% | 7.70% | 7.60% | |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep F | 43.4 | 43.4 | 43.4 | |

| 08:30 | GBP | Manufacturing PMI Sep F | 44.3 | 44.2 | 44.2 | |

| 09:00 | EUR | Eurozone Unemployment Rate Aug | 6.40% | 6.40% | 6.40% | 6.50% |

| 13:30 | CAD | Manufacturing PMI Sep | 48 | |||

| 13:45 | USD | Manufacturing PMI Sep F | 48.9 | 48.9 | ||

| 14:00 | USD | ISM Manufacturing PMI Sep | 47.9 | 47.6 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Sep | 48.9 | 48.4 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Sep | 48.5 | |||

| 14:00 | USD | Construction Spending M/M Aug | 0.60% | 0.70% |