Dollar’s strength remains unabated, particularly against its European counterparts and Yen. The greenback rose alongside 10-year yield, which soared past the 4.6% mark overnight, a level unseen in over 15 years. The surging global treasury yields are a clear indicator of the market’s expectation for a prolonged period of restrictive monetary policies by central banks across the globe. This comes as the market grapples with the looming shadow of a potential U.S. government shutdown, adding another layer of complexity to the fiscal equation.

However, this bullish momentum for Dollar is somewhat stymied against commodity currencies. Canadian Dollar emerging as the second strongest for the week so far, spurred by soaring oil prices. New Zealand Dollar is not far behind, buoyed by speculation of another interest rate hike by RBNZ in the fourth quarter. Conversely, the Australian Dollar trails the pack among its commodity-based peers.

Swiss Franc continues its underperformance against Euro and Sterling. Yen paints a mixed picture, as Japanese authorities seem to be adeptly employing verbal interventions, effectively slowing the currency’s decline by putting potential Yen sellers on alert.

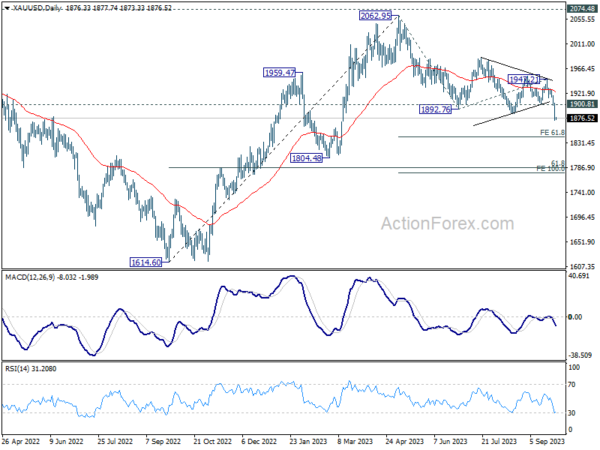

Technically, Gold’s accelerated decline confirms resumption of whole down trend from 2062.95. Near term outlook will now stay bearish as long as 1900.81 support turned resistance holds. Next target is 61.8% projection of 2062.95 to 1892.76 from 1947.21 at 1842.03. This decline from 2062.95 is viewed as a medium term move inside the long term pattern from 2074.84 (2020 high). Break of 1842.03 will target 100% projection at 1777.02 and below.

In Asia, Nikkei closed down -1.55%. Hong Kong HSI is down -1.20%. China Shanghai SSE is up 0.17%. Singapore Strait Times is up 0.13%. Japan 10-year JGB yield is up 0.0124 at 0.752. Overnight, DOW dropped -0.20%. S&P 500 rose 0.02%. NASDAQ rose 0.22%. 10-year yield rose 0.068 to 4.626.

Mixed signals in New Zealand business confidence, ANZ anticipates another RBNZ hike

September has seen a noteworthy rebound in New Zealand’s ANZ Business Confidence, rising from -3.7 to 1.5. However, a closer examination of the details offers a more nuanced picture.

Metrics such as own activity output experienced a slight decline, dropping from 11.2 to 10.9. More alarmingly, export intentions plummeted from a positive 7.5 to a -0.4. There were also declines in investment intentions (from -1.3 to -4.1) and employment intentions (from 4.6 to 1.2).

On the inflation front, cost expectations edged upwards from 75.3 to 78.6, while profit expectations showed an improvement, moving from -17.6 to -13.2. Pricing intentions rose from 44.0 to 47.1, but inflation expectations took a downward turn, shifting from 5.06 to 4.95.

ANZ provided their insights on this mixed bag of indicators, stating, “The New Zealand economy is certainly patchy, and the rebound in activity indicators – that’s been evident since the start of the year – may be running out of steam.”

They further highlighted the complexities in the inflation scenario: “Inflation pressures are gradually waning in the big picture, but not rapidly nor in a straight line, and the jury remains out on whether it’s occurring fast enough to bring core inflation pressures down in a timely fashion.”

Looking ahead, ANZ anticipates further action from RBNZ to ensure inflation is reined in effectively, with a 25 bps hike expected in November.

Australian retail sales see modest 0.2% mom rise amid cost-of-living pressures

The latest retail statistics out of Australia show a muted picture of consumer spending, with retail sales turnover in August rising only 0.2% mom (in seasonally adjusted terms) to AUD 35.4B, falling short of the anticipated 0.3% increase. Through the year, sales turnover was up 1.5% yoy.

According to Ben Dorber, the head of retail statistics at the Australian Bureau of Statistics (ABS), this modest rise indicates a notable restraint in consumer spending. Dorber noted, “The modest rise in August shows consumers continued to restrain their retail spending.”

The trend growth in retail sales paints an even starker image. “In trend terms, retail turnover rose 0.1 per cent, and was up only 1.3 per cent compared to August 2022 – the smallest trend growth over 12 months in the history of the series,” Dorber added.

Dorber highlighted, “Considering how high inflation and strong population growth have added to retail turnover in the past year, the historically low trend growth highlights just how much consumers have pulled back in response to cost-of-living pressures.”

Oil prices hit yearly high on shrinking inventories, WTI in march to 100

Oil prices saw a sharp ascent overnight, extending their gains into Asian trading session today and marking their highest point in over a year. With technical indicators pointing to a potential acceleration, WTI oil is on the march towards 100 psychological level.

A factor propelling this surge is the pronounced drop in US crude stocks, amplifying concerns about tightening global supply in light of OPEC+ production cuts, spearheaded by Saudi Arabia. Yesterday’s data revealed that oil inventories dipped by -2.2m barrels last week, settling at 416.3m barrels.

Furthermore, the stockpiles at Cushing, Oklahoma, a crucial storage hub and the delivery point for US crude futures, saw a reduction of -943k barrels over the week, dropping to just under 22m barrels, lowest since July 2022. Significantly, these reserves at Cushing have been on decline for seven consecutive weeks. Many market participants view these current levels as bordering on the minimum required for operational functionality of the storage tanks.

Technically, WTI crude oil’s recent up trend resumed after brief consolidations and surged through 95 handle. There is sign of upside acceleration with break of the rising channel resistance. Near term outlook will stay bullish as long as 88.67 support holds. Next target is 50% retracement of 131.82 to 63.67 at 97.74. Decisive break there could pave the way through 100 psychological to 61.8% retracement at 105.78.

Looking ahead

ECB monthly bulletin and Eurozone economic sentiment indicator will be released in European session. Germany will publish CPI flash. Later in the day, US jobless claims and pending home sales will be featured along with Q2 GDP final.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9162; (P) 0.9193; (R1) 0.9245; More….

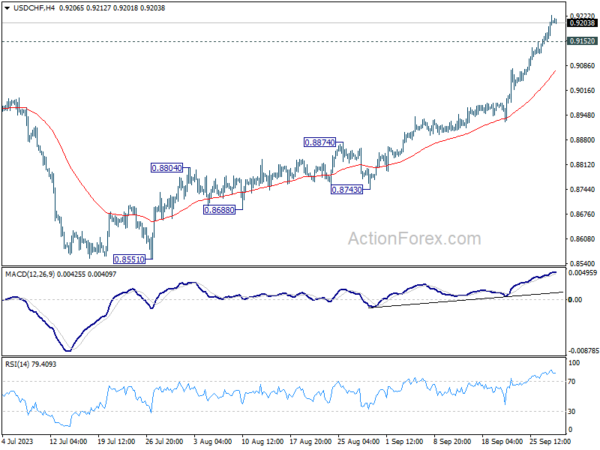

USD/CHF’s rally continues and hit as high as 0.9224. Intraday bias stays on the upside for 0.9439 resistance next. On the downside, below 0.9152 minor support will turn intraday bias neutral and bring consolidations, before staging another rally.

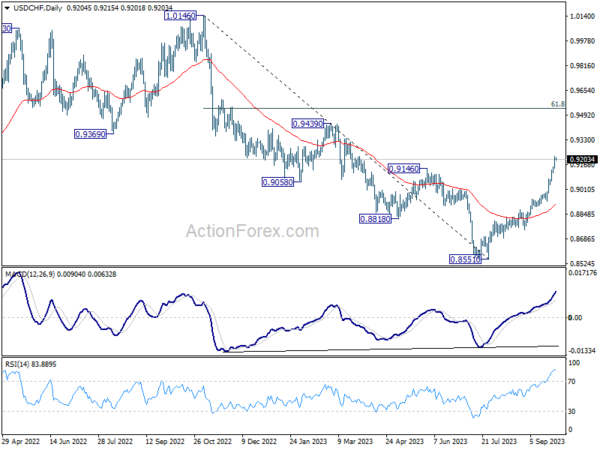

In the bigger picture, current development indicates that rise from 0.8551 is reversing whole down trend from 1.0146. Further rally would then be seen to 61.8% retracement at 0.9537 and above. For now, this will be the favored case as long as 55 D EMA (now at 0.8917) holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | NZD | ANZ Business Confidence Sep | 1.5 | -3.7 | ||

| 01:30 | AUD | Retail Sales M/M Aug | 0.20% | 0.30% | 0.50% | |

| 08:00 | EUR | ECB conomic Bulletin | ||||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Sep | 92.5 | 93.3 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Sep | -10.5 | -10.3 | ||

| 09:00 | EUR | Eurozone Services Sentiment Sep | 3.5 | 3.9 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Sep F | -17.8 | -17.8 | ||

| 12:00 | EUR | Germany CPI M/M Sep P | 0.30% | 0.30% | ||

| 12:00 | EUR | Germany CPI Y/Y Sep P | 4.60% | 6.10% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 22) | 200K | 201K | ||

| 12:30 | USD | GDP Annualized Q2 F | 2.30% | 2.10% | ||

| 12:30 | USD | GDP Price Index Q2 F | 2.00% | 2.00% | ||

| 14:00 | USD | Pending Home Sales M/M Aug | 0.20% | 0.90% | ||

| 14:30 | USD | Natural Gas Storage | 90B | 64B |