Today’s Asian financial markets have shown signs of calmness, partly due to holiday in Japan that has likely tempered trading activities. Dollar and Euro were mildly softer, while Aussie, Kiwi, and Yen exhibited slight strength. However, the fluctuations were confined within the ranges observed last Friday, pointing to the low-volatility environment in currency markets. The quietude is expected to continue throughout the day owing to a light economic calendar

Yet more vibrant trading environment should emerge later in the week. Market participants are directing their attention towards the upcoming central bank meetings including Fed, BoJ, and SNB, alongside releases of crucial economic data such as CPI, retail sales, and PMIs from various countries and regions. These events hold the potential to infuse volatility into the markets as the week progresses.

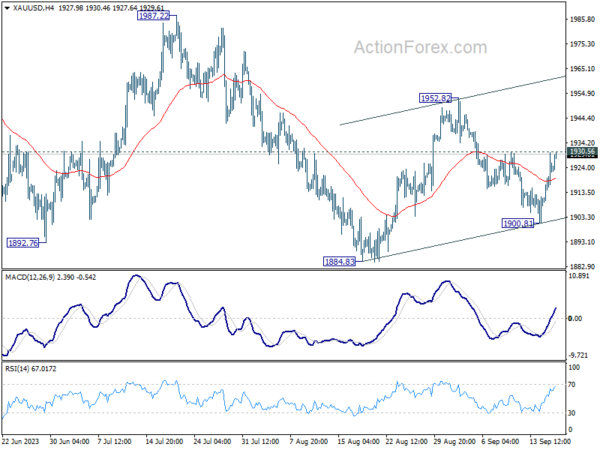

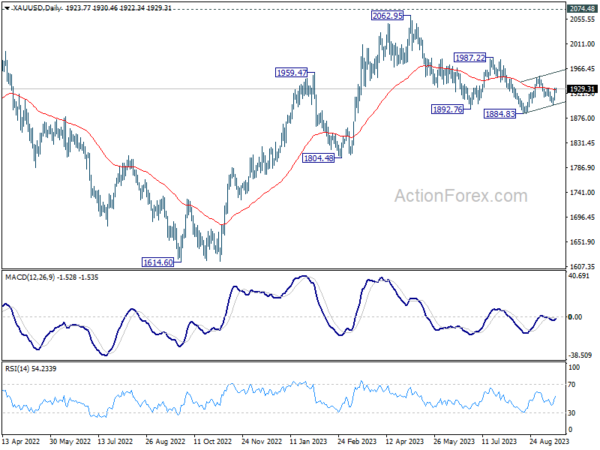

Shifting the focus to the commodities market, Gold is capturing attention as it nudges close to a near-term resistance at 1930.56, following successful defense of 1900 level last week. Decisive breakthrough at this juncture could signal completion of the pullback from 1952.82, further suggesting resumption of its upward march started from 1884.83.

Such a development would strongly hint that the correction phase starting from 2062.95 has already reached its end at 1884.83. Breaking 1952.82 barrier would then steer momentum towards 1987.22 resistance for confirmation.

If these dynamics take shape, extended Gold rally might serve as an early sign of Dollar weakening against currencies like Euro. Investors will be keeping a close watch on these potential shifts, especially with so much scheduled for the week ahead.

ECB’s Kazaks dismisses early rate cut speculations

In an interview over the weekend, ECB Governing Council member Martins Kazaks, chief of Latvia’s central bank, sought to temper market expectations regarding rate cuts. He emphasized that any anticipations of rate cuts in the spring or early summer are “not really consistent with the macro scenario” that is currently envisioned.

Kazaks underscored his contentment with the present rate levels, expressing that they stand aptly. He clarified, “While I’m comfortable with where rates are at the moment, if necessary we will take the right decisions.” However, he declined to affirm the notion that the rates have reached their peak, thus leaving room for more tightening based on future economic developments.

Stressing the urgency to effectively address the inflation issues in a decisive manner, he said, “I would like to see that we solve inflation in one attempt, that we are not forced to come back,” to avoid a scenario necessitating “larger interventions” down the line.

Separately, another Governing Council member Yannis Stournaras, Greek central bank head, said, “I would have preferred to hold rates last week. But there were arguments in favor of both outcomes — hiking and holding — so I’m fine with the decision we took.”

Last Thursday saw ECB raising the interest rates by 25bps, marking the tenth consecutive hike, thereby elevating deposit rate to a record 4%. Additionally, ECB signaled interest rates have probably peaked in the currency cycle.

New Zealand’s services sector continues its descent, a deeper dive

New Zealand’s BusinessNZ Performance of Services Index reported another slump in August, marking the third consecutive month of declining in the services sector. This downturn saw PSI slip from 48.0 in July to 47.1 in August, notably falling short of long-term average of 53.5.

Looking into the components, while there were marginal improvements in activity/sales, which climbed from 39.7 to 43.4, and employment, which rose from 49.1 to 50.9, other areas did not fare as well. New orders/business made a meager ascent from 44.5 to 47.3. Conversely, stocks/inventories dipped from 54.0 to 52.5, and supplier deliveries took a hit, declining from 52.0 to 49.2.

BusinessNZ’s Chief Executive, Kirk Hope, offered a bleak perspective, highlighting that August’s data provided little hope for a swift recovery.

This sentiment was further cemented by the proportion of negative comments received in the survey. In August, 63.9% of the comments were negative, a slight improvement from July’s 67% but a significant jump from June’s 55.6%. The cloud of uncertainty hanging over the upcoming General Election, combined with persisting challenging economic conditions, were predominant themes among these comments.

BNZ’s Senior Economist Doug Steel noted that the PSI and PMI results resonate with RBNZ’s projections of an impending recession rather than Treasury’s more optimistic forecast of sustained, albeit moderate, growth in the near future.

NZ economic growth to remain subdued according to NZIER forecasts

Latest forecasts from New Zealand Institute of Economic Research anticipate a period of subdued economic growth over the next few years. The annual average GDP growth is expected to decline to 0.4% in the fiscal year ending March 2024, followed by modest growth of 1.1% in 2025.

This sluggish pace is partly attributable to the ripple effect of consecutive hikes in RBNZ’s OCR, currently standing at 5.50%, which have started to curb demand in the broader economy. Moreover, diminishing demand for exports, spurred mainly by China’s weaker growth outlook, poses downside risk to the nation’s economic vitality.

Shifting focus to inflation sphere, there has been a notable upward revision for the projections as of March 2024, with annual CPI inflation predicted to retreat to 4.3% in 2024, and further dip to 2.4% in the subsequent year.

As for currency outlook, NZD Trade Weighted Index forecasts have undergone revisions, showing a downturn for the approaching year but portraying an uplift in 2025.

NZD has not encountered significant fluctuations against other currencies in recent times in terms of yield attractiveness. This steadiness, however, is anticipated to meet challenges due to reduced export demand from China.

The forecast encapsulates expectation of NZD TWI oscillating between 70.8 and 71.6 in the period spanning 2024 to 2027.

Central bank bonanza with Fed, BoE, SNB, BoJ, and more data

In a week filled with central bank meetings and releases of pivotal economic data, market participants remain on high alert, eager to grasp any cues that might illuminate the path central banks are inclined to tread in the near future.

Fed takes center stage with broad consensus aligning towards a decision to hold interest rates steady in the 5.25-5.50% bracket come Wednesday. Markets have all but confirmed, with a 98% probability priced in. While the prospect of a further rate hike this year remains a topic of conjecture, analysts and investors alike are leaning more towards discerning the potential timing of a rate cut. Insights into this might be gleaned from the fresh set of economic projections and dot plots Fed is slated to release, offering a gauge on the sentiments swirling amongst policymakers.

Crossing the Atlantic, BoE gears up for its Thursday meeting with anticipations steering towards a 25bps rate lift, setting the figures at 5.50%. UK economy manages has staved off a widely anticipated recession for now. At the same time, inflation in July was still more than triple BoE’s 2% target. These mandate another almost compulsory response from the central bank. The discourse, however, splits when it comes to predicting the summit of this cycle, albeit a slight majority are banking on this hike being the peak. The voting pattern in the BoE council stands as a critical element warranting scrutiny in this context.

Simultaneously, SNB preps for a similar 25bps increase to attain 2.00% rate, operating under the central bank’s anticipation of rising inflation post the current lull. Yet, it remains under wraps whether SNB will emulate ECB in signaling a sustained pause in rate hikes.

BoJ’s decision on Friday will be closely watched also be interesting, especially given its penchant for springing surprises on the market. While speculations are rife about BoJ’s potential shift away from negative rates next year, it’s likely that the central bank will lay the groundwork for such a move in Q4, maintaining its dovish position for the time being. RBA is also in the fray, set to release the minutes from its September meeting.

However, the central banks are not sole actors in this week’s economic theatre as a torrent of significant economic data is set to flood the market avenues. Spotlighting this release spree are the CPI figures from the UK, Canada, and Japan, coupled with retail sales data emanating from the UK and Canada. New Zealand joins the parade disclosing its GDP figures. A comprehensive view of economic health of major global economies will be portrayed through PMI flashes set to be unveiled.

Here are some highlights for the week:

- Monday: New Zealand BusinessNZ Services; Canada housing starts, IPPI and RMPI; US NAHB housing market index.

- Tuesday: RBA minutes; Swiss trade balance; Eurozone CPI core; Canada CPI; US building permits and housing starts.

- Wednesday: New Zealand current account; Japan trade balance; Germany PPI; UK CPI, PPI; Swiss SECO economic forecasts; BoC summary of deliberations; Fed rate decision.

- Thursday; New Zealand GDP; SNB rate decision; BoE rate decision; Canada new housing price index; US jobless claims, Philly Fed survey, current account, existing home sales.

- Friday: New Zealand trade balance; Australia PMIs; Japan PMIs, CPI; BoJ rate decision; UK Gfk consumer sentiment, retail sales, PMIs; Eurozone PMIs; Canada retail sales; US PMIs.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6413; (P) 0.6443; (R1) 0.6462; More…

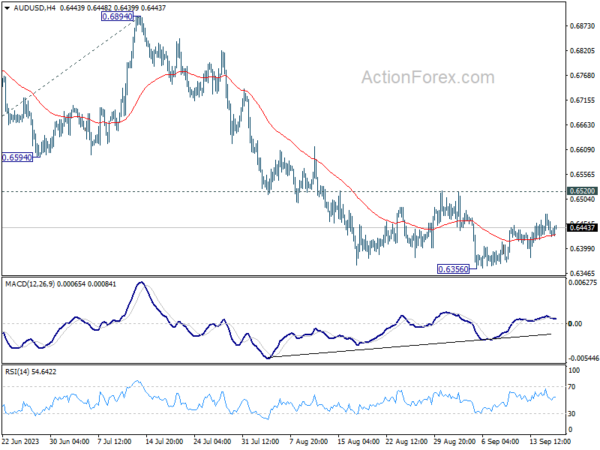

Outlook in AUD/USD is unchanged as corrective rise from 0.6356 might extend higher. Intraday bias stays neutral for the moment. Further decline is expected as long as 0.6520 resistance holds. Break of 0.6356 will resume larger down trend to 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195.

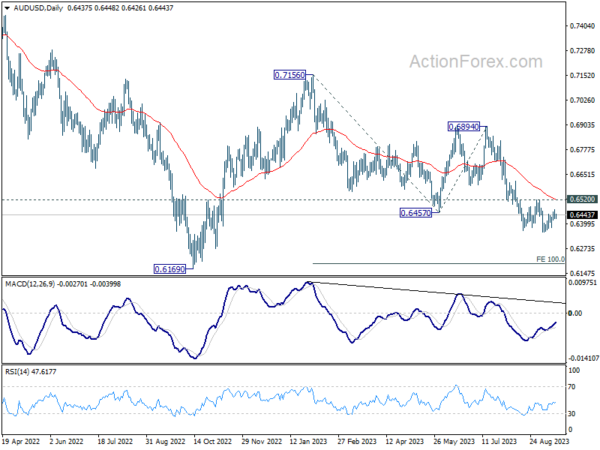

In the bigger picture, down trend from 0.8006 (2021 high) is possibly still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Aug | 47.1 | 47.8 | 48 | |

| 23:01 | GBP | Rightmove House Price Index M/M Sep | 0.40% | -1.90% | ||

| 12:15 | CAD | Housing Starts Aug | 257K | 255K | ||

| 12:30 | CAD | Industrial Product Price M/M Aug | 0.50% | 0.40% | ||

| 12:30 | CAD | Raw Material Price Index Aug | 3.80% | 3.50% | ||

| 14:00 | USD | NAHB Housing Market Index Sep | 50 | 50 |