Dollar trades generally lower in quiet markets today. Economic data released this week so far are generally shrugged off by traders. The more important events are BoC and ECB meeting, as well as UK and US GDP. Waiting for the key events, traders seem to be spending their time on speculating who will US President Donald Trump nominate for the post of Fed chair. Current Fed chair Janet Yellen is still in the race and would provide status quo stability. But it’s clear that Yellen is never a favorite of Trump. Fed Governor Jerome Powell is seen as the favorite by bookies, as he has knowledge of Fed and monetary policy. Stanford University economists John Taylor is so far the dark horse. Former Fed governor Kevin Warsh and White House economic advisor Gary Cohn are out of the race already.

Speculations of Nov BoE hike cooled mildly

In UK, speculations of a November rate hike cooled mildly since a string of weaker than expected data, and some dovish comments from MPC members. Markets are now pricing in 78% chance of a 25bps hike in November, down from near 90% at the beginning of this month. The dilemma for BoE is that inflation has surged to 3% due to depreciation of Pound’s exchange wage. But that hasn’t really transferred into wage growth. And recent data shows that retail sales are faltering. And in the background, the deadlock of Brexit negotiation is still unresolved, and that would tie businesses’ hands in investing. But still, we’d like to point out that a 25bps hike will just bring the Bank Rate back to pre-Brexit referendum level. Thereafter, BoE will wait till there’s some significant progress in Brexit talks before acting again. Hike or not, Sterling could face some pressure against Dollar afterwards.

Talking about Brexit, UK Prime Minister Theresa May said that "important progress" was made at last week’s EU summit. And, she had a "degree of confidence" of achieving sufficient progress to move to to trade talks by December. It’s reported by some German newspaper, and then UK press, that May was tired, exhausted, and begged for help in last week’s summit. But European Commission Jean-Claude Juncker rubbished those reports. He said that "I had an excellent working dinner with Theresa May. She was in good shape, she was noted tired, she was fighting, as is her duty, so everything for me was OK."

Japan PMI manufacturing dropped

In Japan, Nikkei continues to push higher today, riding on Prime Minister Shinzo Abe’s landslide victory in Sunday’s snap election. At the time of writing, Nikkei is trading up 57pts, or 0.25%. Japan PMI manufacturing dropped to 52.5 in October, down from 52.9, and missed expectation of 53.1. Nonetheless, that’s still the 14th straight months of expansionary reading. Markit noted that "although still improving solidly, the Japanese manufacturing sector appeared to lose some momentum in October, as growth eased from September’s four-month high." And, "softer expansions were seen for both output and new orders." The output component dropped to 52.6, down from 53.2. New orders dropped to 52.4, down from 53.4. Expectation on output also dropped to 57.5, down from 61.2.

Looking ahead

PMI data will be the main focuses today with Eurozone PMIs featured in European session. US will also release PMIs later today.

USD/CAD Daily Outlook

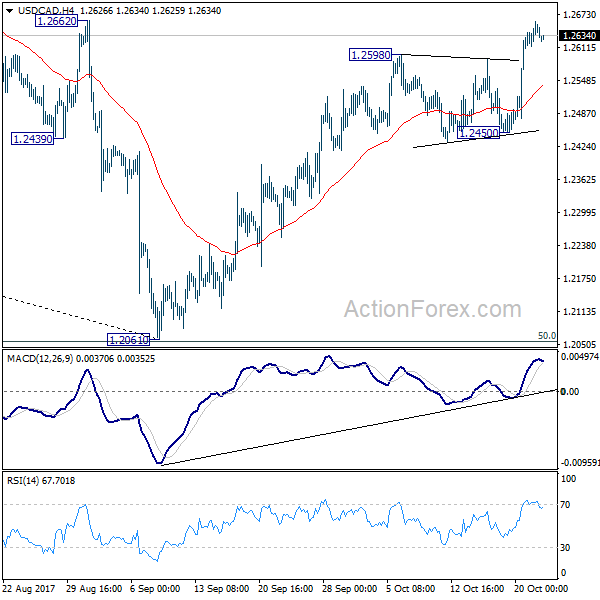

Daily Pivots: (S1) 1.2619; (P) 1.2639; (R1) 1.2665; More….

At this point, intraday bias remains on the upside for further rally. Current rebound from 1.2061 should extend to 1.2777 resistance first. Decisive break there will confirm medium term reversal and target 38.2% retracement of 1.4689 to 1.2061 at 1.3065 next. On the downside, break of 1.2450 support is needed to indicate completion of the rebound. Otherwise, outlook will remain mildly bullish in case of retreat.

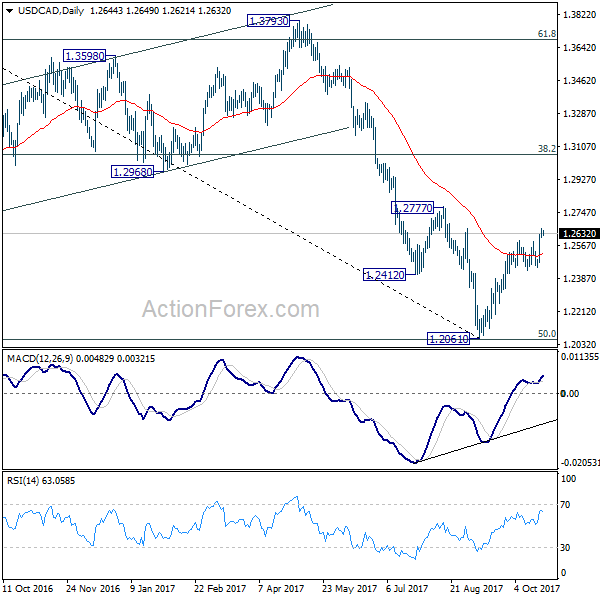

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4869 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Break of 1.2777 will further affirm this bullish case. That is, larger up trend from 0.9406 is not completed. And in that case, USD/CAD should target 1.3793 key resistance next. However, on the other hand, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | PMI Manufacturing Oct P | 52.5 | 53.1 | 52.9 | |

| 07:00 | EUR | France Manufacturing PMI Oct P | 56 | 56.1 | ||

| 07:00 | EUR | France Services PMI Oct P | 56.9 | 57 | ||

| 07:30 | EUR | Germany Manufacturing PMI Oct P | 60 | 60.6 | ||

| 07:30 | EUR | Germany Services PMI Oct P | 55.5 | 55.6 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Oct P | 57.8 | 58.1 | ||

| 08:00 | EUR | Eurozone Services PMI Oct P | 55.6 | 55.8 | ||

| 13:45 | USD | US Manufacturing PMI Oct P | 53.2 | 53.1 | ||

| 13:45 | USD | US Services PMI Oct P | 55.1 | 55.3 |