In Asian trading session today, the forex markets remained steady with no significant movements outside of yesterday’s range among major pairs and crosses. Sterling stood slightly firmer, holding much anticipation for the forthcoming UK employment data, notably the insights on wage growth which can potentially delineate its next significant move.

In contrast, Euro presented a softer tone as markets awaited Germany ZEW Economic Sentiment indicator, an important data set which may reflect further degradation given the mounting worries of recession. EUR/GBP’s reactions to the releases could be noteworthy.

As we look beyond, Yen has reverted back to its previous week’s range vis-à-vis other major rivals, as yesterday’s sharp rise was fleeting. However, it maintains its position as the second strongest currency at present. Australian Dollar emerges as the frontrunner, a situation catalyzed by rejuvenated Chinese Yuan.

Dollar, on the other hand, has been exhibiting mild weakness this week, closely followed by Swiss Franc. Euro and Canadian dollar are maneuvering with mixed performance. But the picture could be shaken up drastically with the unveiling of US CPI data on Wednesday and the much-awaited ECB rate decision alongside the economic projections slated for release on Thursday.

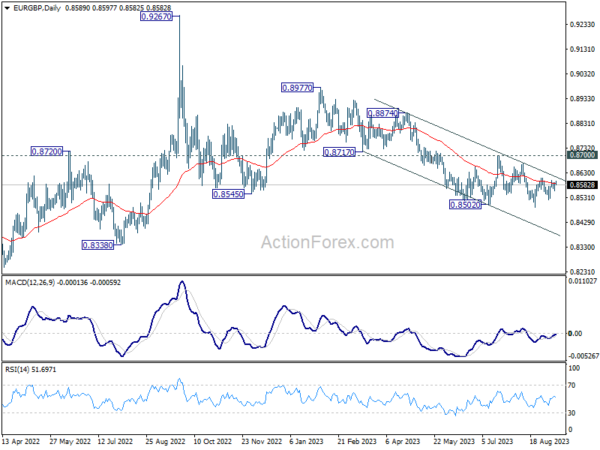

Technically, being capped by falling 55 D EMA, immediate risks for EUR/GBP is staying on the downside. That is, down trend from 0.8977 is in favor to resume sooner rather than later through last week’s low of 0.8491. Sustained break of the 55 D EMA would provide some near term relieve for the cross. Yet, until 0.8700 resistance is decisively broken, bullish reversal remains unconfirmed, keeping the door wide open for sellers to regain control post a recovery.

In Asia, at the time of writing, Nikkei is up 0.81%. Hong Kong HSI is up 0.01%. China Shanghai SSE is up 0.04%. Singapore Strait Times is down -0.20%. Japan 10-year JGB yield is up further by 0.0054 at 0.711. Overnight, DOW rose 0.25%. S&P 500 rose 0.67%. NASDAQ rose 1.14%. 10-year yield rose 0.030 to 4.288.

Japan’s FM Suzuki expects BoJ to liaise with government closely

In the wake of the spike in Yen, prompted by BoJ Governor Kazuo Ueda’s remarks, Finance Minister Shunichi Suzuki made clarifying comments today. Yen’s climb was chiefly attributed to Ueda’s interview with Yomiuri Shimbun, where he hinted at the possibility of exiting negative rates policy in the coming year.

At a regular press conference, Suzuki underlined the autonomy of BOJ, stating that the “specific monetary policy conduct is up to the BOJ to decide.”

However, the minister did not hold back from expressing the government’s expectations . Suzuki conveyed his aspirations for BOJ, emphasizing its collaboration with the government. He said, “I expect the BOJ to continue to liaise with the government closely and conduct monetary policy appropriately.”

The guiding principle for this collaboration, as Suzuki suggests, should be a comprehensive evaluation of the economy, considering factors like pricing and prevailing financial conditions. The ultimate aim is to “achieve its price stability target in a stable and sustainable way.”

The remarks by the Finance Minister, while emphasizing BoJ’s autonomy, also subtly convey the weight of responsibility the central bank carries in managing the nation’s economic health, especially in unpredictable financial climates.

Australia consumer sentiment fell to 79.7, languishes at deeply pessimistic levels

Australia’s consumer sentiment, as depicted by Westpac Consumer Sentiment Index, witnessed a dip of -1.5% mom, settling at 79.7 in September. The sentiment has been gloomily “languished at deeply pessimistic levels”.

Westpac draws attention to the historical context, pointing out that since the initiation of the survey back in 1974, such enduring periods of pessimism have been rare. The most notable instance was during early 1990s’ recession when sentiments dipped even lower and remained so for a duration exceeding two years.

On the brighter side, households showcased reduced apprehension about potential rate hikes, with noticeable surge in confidence, up 7.8%, particularly among mortgagors. However, looming worries about cost of living and inflation continue to weigh down on consumer spirits. Although job confidence has steadied itself, it has drastically plummeted, down -33% from its peak levels. One silver lining is the buoyed expectations around house prices.

Westpac expects RBA to maintain their status quo until August 2024. By this timeframe, Westpac envisions inflation receding to 3.4%, a jump in unemployment rate to 4.5%, and a noticeable slowdown in the annual growth rate of consumer spending, tapering to a mere 0.8%.

Also released, NAB Business Conditions rose from 11 to 13 in August. Business Confidence rose from 1 to 2.

Looking ahead

UK employment data and Germany ZEW Economic Sentiment are the only notably economic data release today.

USD/CAD Daily Outlook

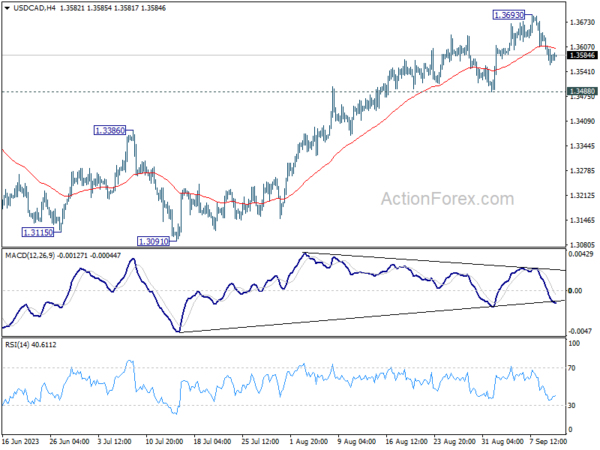

Daily Pivots: (S1) 1.3545; (P) 1.3592; (R1) 1.3623; More….

Outlook in USD/CAD remains unchanged and intraday bias stays neutral. Consolidation from 1.3693 would extend and deeper pull back might be seen. But further rally is expected as long as 1.3488 support holds. Above 1.3693 will resume the rally from 1.3091 to 1.3860 resistance, and then 1.3976 high.

In the bigger picture, price actions from 1.3976 are viewed as a corrective pattern only. Upon completion, rise from 1.2005 (2021 low) would resume through 1.3976. Next target is 61.8% projection of 1.2005 to 1.3976 from 1.3091 at 1.4309. For now, this will remain the favored case as long as 55 D EMA (now at 1.3456) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Consumer Confidence Sep | -1.50% | -0.40% | ||

| 01:30 | AUD | NAB Business Conditions Aug | 13 | 10 | 11 | |

| 01:30 | AUD | NAB Business Confidence Aug | 2 | 2 | 1 | |

| 06:00 | GBP | Claimant Count Change Aug | 29K | |||

| 06:00 | GBP | ILO Unemployment Rate (3M) Jul | 4.30% | 4.20% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Jul | 7.60% | 7.80% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Jul | 8.20% | 8.20% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Sep | -15 | -12.3 | ||

| 09:00 | EUR | Germany ZEW Current Situation Sep | -75 | -71.3 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Sep | -6.2 | -5.5 | ||

| 10:00 | USD | NFIB Business Optimism Index Aug | 91.6 | 91.9 |