Asian market trading is subdued today, with Dollar retreating as its recent rally began to lose steam. Notably, overnight remarks from Fed officials didn’t provide any fresh cues, reinforcing expectations of a pause in rate hike this month. However, the door remains open for a subsequent rate hike, contingent on incoming data. All eyes now turn to the forthcoming CPI release next week, which could steer the greenback towards its next significant move.

Japanese Yen, fresh off the heels of more verbal interventions by Japanese officials, sought to claw back some losses, albeit with limited success. Momentum waned swiftly, curtailing the currency’s rebound. Wile Copper and Chinese Yuan evidenced marked weakness, the Australian dollar held steady within a constricted range, but staying the week’s laggard. Canadian Dollar hovered in mixed territory, with investors casting their gaze towards upcoming Canadian employment data. Meanwhile, European currencies floated without a clear directional bias, although British Pound displayed a slightly softer undertone.

Offshore Chinese Yuan emerged as a notable mover in the session, plunging to its lowest level this year. PBoC facilitated this decline by setting its reference rate at a two-month low, showcasing its receptiveness to a lower exchange rate, a stance that contrasts a viewpoint expressed in the state-backed Securities Times. The publication tried to talk up Yuan with an the optimistic view on economic recovery

From a pure technical perspectively, USD/CNH is now on track to 7.3756 (2022 high) and possibly above. But strong resistance could emerge at 61.8% projection of 6.8100 to 7.2853 from 7.1154 at 7.4091 to limit upside. A critical juncture to observe would be the authorities’ response as USD/CNH approaches 7.4 mark.

In Asia, at the time of writing, Nikkei is down -1.40%. China SSE is down -0.24%. Singapore Strait Times is down -0.53%. Japan 10-year JGB yield is down -0.0099 at 0.648.Overnight, DOW rose 0.17%. S&P 500 dropped -0.32%. NASDAQ dropped -0.89%. 10-year yield dropped -0.0030 to 4.260.

BoC Macklem concerned that inflation progress has slowed

BoC Governor Tiff Macklem said in a speech overnight that 2% inflation target is now in sight”. However, he cautioned, “we are not there yet and we are concerned progress has slowed”. Also, “monetary policy still has work to do”.

In a bid to harmonize the potentially conflicting risks of “under- and over-tightening,” BoC opted to hold policy rate at 5% this week. Macklem didn’t rule out the possibility of further rate hike, mentioning that such a step might become necessary “if inflationary pressures persist.”

As Canada navigates a period riddled with economic uncertainties, the central bank adopts a vigilant stance, closely monitoring an array of indicators to assess the trajectory of inflation. Macklem highlighted the multifaceted nature of the factors affecting inflation data month on month, distinguishing between temporary influences and those with a potential for a lasting impact.

Fed Williams: Still an open question as we go forward

New York Fed President John Williams, engaged in a discussion moderated by Bloomberg yesterday, where he noted that while is “pretty clear we’re restrictive” on monetary policy, there remains “still an open question as we go forward.”

Williams expressed optimism that “things are moving in the right direction and we’ve got policy in a good place.” However, he insisted on the continuous need to be “data-dependent” and closely watch economic developments to make informed decisions regarding monetary policy trajectory.

He urged for sustained focus on comprehensive data analysis, stating, “We’ll have to keep watching the data carefully analyzing all of that and really asking ourselves the question: is this sufficiently restrictive.”

Fed Goolsbee foresees change in rate debate focus

Chicago Fed President Austan Goolsbee expressed a cautious optimism in an interview with Marketplace Radio yesterday, noting that the focal point of discussions surrounding interest rates might soon shift.

Goolsbee acknowledged “overall level of inflation is still above where we want to be.” Despite the circumstances, he demonstrated a semblance of confidence that “There’s a growing confidence that we can pull it off.”

However, he asserted that the achievement wasn’t set in stone, adding a note of caution: “that’s not a guarantee.”

Goolsbee foresees a change in narrative in the coming times. Instead of deliberating on the scale of rate hikes, he envisaged that the discourse would gravitate towards the duration for which rates should be maintained at the established levels to steer the economy back on the desired path.

Putting it succinctly, he remarked, “We are very rapidly approaching the time when our argument is not going to be about how high should the rates go.”

Elaborating on this, he stated, “it’s going to be an argument of how long do we need to keep the rates at this position before we’re sure that we’re on the path back to the target.”

Fed Logan: Skipping in Sep does not imply stopping

Dallas Fed President Lorie Logan remains unconvinced that the central bank has fully “extinguished excess inflation”, and “there is work left to do.”

With the upcoming FOMC meeting slated for September 19-20, Logan noted “another skip could be appropriate.” However, she was quick to add that “skipping does not imply stopping,” suggesting that further policy actions might still be on the table.

Logan expressed a consciousness of the dual risks presented at this junction: the peril of sustained high inflation and the danger of dampening the economy too much.

With this in mind, she emphasized, “In coming months, further evaluation of the data and outlook could confirm that we need to do more to extinguish inflation.”

Japan cash earnings growth slows to 1.3% yoy, real wages down for 16th month

In July, Japan experienced slowdown in growth of labor cash earnings, recording increase of 1.3% yoy, a figure notably below expectation of 2.4% yoy. This decline comes in the wake of a 2.3% yoy surge in June and a 2.9% yoy hike in May.

Drilling down into the details, while the base annual salary grew 1.6% yoy, outpacing June’s 1.3% yoy rise, overtime pay experienced a reduced uplift of 0.5% yoy, a significant deceleration from the 1.9% yoy in June.

One of the more concerning revelations is the continued drop in real wages, which adjusted for inflation, decreased by -2.5% yoy, a deepening from June’s -1.6% yoy decline. This marks the 16th consecutive month of falling real wages, spotlighting inability of salaries to keep pace with escalating prices, thereby exacerbating the financial strain on households.

Corroborating this trend is separate data published earlier this week which highlighted a pronounced drop in household spending in July, plummeting -5.0% yoy, marking its most substantial decline in close to two and a half years.

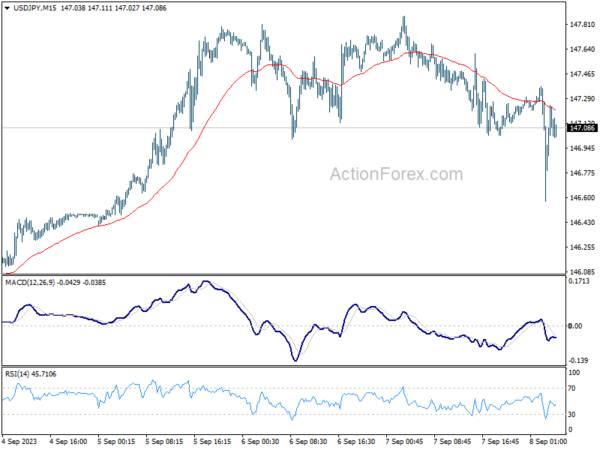

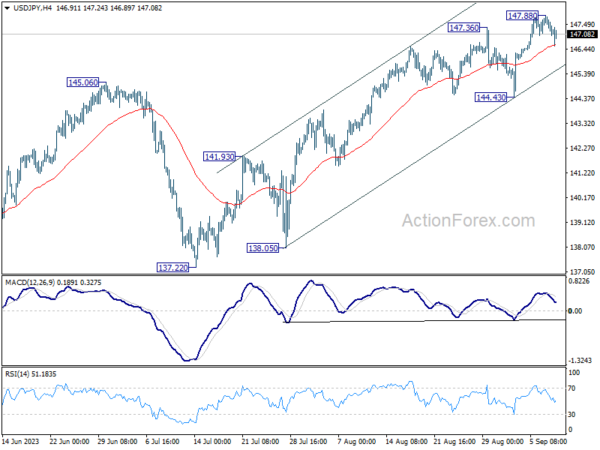

USD/JPY dips briefly after Japan Suzuki’s verbal intervention

Japan’s Finance Minister Shunichi Suzuki said today that the government is closely watching the currency market’s developments with a “heightened sense of urgency.” His comments reverberate a growing concern amidst Japanese policymakers about the recent depreciation of Yen.

Suzuki emphasized that “appropriate action” would be taken to counter any excessive volatility, without ruling out any options. The finance minister stressed the government’s position that currency movements should remain stable and echo the economic fundamentals Additionally, he rejected the notion that the government has set specific intervention levels in mind.

This vigilance is echoed by Vice Minister of Finance for International Affairs, Masato Kanda, who warned on Wednesday that “all options are on the table” if such fluctuating trends persist, signaling a high readiness to intervene to maintain market stability.

Following the minister’s comments, USD/JPY spiked lower to 146.57, but it rapidly recuperated, reclaiming 147 handle shortly after. The current downturn from 147.88 is perceived as a short-term correction as of now. 55 4H EMA is furnishing support at present, with no overt signs pointing towards a trend reversal in the USD/JPY just yet.

Looking ahead

Germany CPI final and France industrial production will be released in European session. Later in the day, major focus will be on Canada employment.

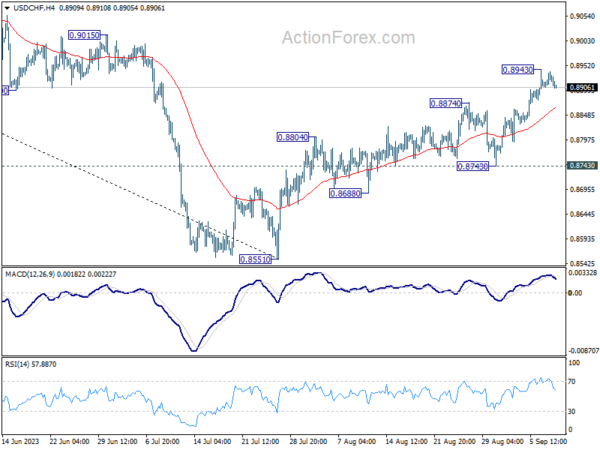

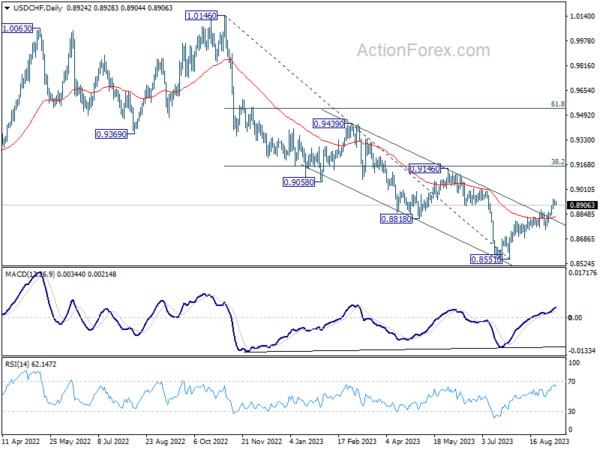

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.8911; (P) 0.8926; (R1) 0.8942; More….

Intraday bias in USD/CHF is turned neutral first with current retreat. Some consolidations could be seen. But further rally is expected as long as 0.8743 support holds. On the upside, above 0.8943 will resume the rally from 0.8551 to 0.9146 cluster resistance next.

In the bigger picture, rebound from 0.8551 medium term bottom is currently seen as a correction to the downtrend from 1.0146 (2022 high). Further rally would be seen to 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160). Strong resistance could be seen there to limit upside, at least on first attempt.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Jul | 1.30% | 2.40% | 2.30% | |

| 23:50 | JPY | Bank Lending Y/Y Aug | 3.10% | 2.80% | 2.90% | |

| 23:50 | JPY | GDP Q/Q Q2 F | 1.20% | 1.40% | 1.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 F | 3.50% | 3.40% | 3.40% | |

| 06:00 | EUR | Germany CPI M/M Aug F | 0.30% | 0.30% | ||

| 06:00 | EUR | Germany CPI Y/Y Aug F | 6.10% | 6.10% | ||

| 06:45 | EUR | France Industrial Output M/M Jul | 0.20% | -0.90% | ||

| 12:30 | CAD | Net Change in Employment Aug | 20.0K | -6.4K | ||

| 12:30 | CAD | Unemployment Rate Aug | 5.60% | 5.50% | ||

| 12:30 | CAD | Capacity Utilization Q2 | 82.50% | 81.90% | ||

| 14:00 | USD | Wholesale Inventories Jul F | -0.10% | -0.10% |