Dollar relinquished its early gains, entering US session as the day’s softest currency. Even as US benchmark 10-year yields skyrocketed to touch 4.3% mark, they found themselves lagging behind their German and UK counterparts. On the flip side, Australian Dollar is mustering a recovery, buoyed in part by China’s proactive measures to stabilize Yuan’s exchange rate.

However, despite these fluctuations, the greenback has managed to secure its position as the second strongest currency for the week for now. Investors remain on the lookout, with possibility of a return of Dollar buyers should risk sentiments sway once more.

Sterling, marching to its own beat, continues its reign as this week’s top performer, and its momentum against Euro is gaining steam. Meanwhile, Swiss Franc clinches third place. At the opposite end of the spectrum, Aussie struggles to shake off its tag as the week’s laggard, trailed by Yen and Kiwi.

Technically, Bitcoin breaks through 28555 support today to resume the decline from 31815. It’s uncertain whether this move is a correction to the larger up trend, or a reversal. But in either case, firm break of 61.8% projection of 31815 to 28555 from 30219 at 28204 could prompt downside acceleration to 100% projection at 26959. If materializes, this could be in tandem with deeper selloff in risk markets, in particular NASDAQ.

In Europe, at the time of writing, FTSE is down -0.32%. DAX is down -0.26%. CAC is down -0.32%. Germany 10-year yield is up 0.0396 at 2.691. Earlier in Asia, Nikkei dropped -0.44%. Hong Kong HSI dropped -0.01%. China Shanghai SSE rose 0.43%. Singapore Strait Times dropped -0.52%. Japan 10-year JGB yield is up 0.0226 at 0.655.

Chinese Yuan recovers as PBoC pledges to prevent over-adjustment

Chinese Yuan made a notable recovery today after PBoC made its intentions clear, vowing to staunchly prevent an “over-adjustment” in the Yuan’s exchange rate and avert systemic financial pitfalls. Amplifying this verbal intervention, several of China’s major state-owned banks have been observed actively selling US Dollars in favor of Yuan in both onshore and offshore markets this week.

This proactive stance by PBoC and state-owned banks arises at a time when Yuan has been on a downward trajectory, dangerously inching closer to its lowest levels since 2007.

Market observers are now grappling with a pivotal question: Is China’s move aimed at establishing a firm bottom for Yuan or merely an effort to slow down its rapid decline?

Technically, a temporary top should be formed at 7.3491 in USD/CNH and some consolidation is now expected. As long as 55 4H EMA holds (now at 7.2685), further rally is still in favor. Break of 7.3491 will resume the rally from 6.6971 towards 7.3745 high, or possibly further to 61.8% projection of 6.8100 to 7.2853 from 7.1154 at 7.4889.

US initial claims dropped to 239k, slightly above expectation

US initial jobless claims dropped -11k to 239k in the week ending August 12, slightly below expectation of 240k. Four-week moving average of initial claims rose 3k to 234k.

Continuing claims rose 32k to 1716k in the week ending August 5. Four-week moving average of continuing claims dropped -8k to 1692k.

Eurozone exports rose 0.3% yoy in Jun, imports down -17.7% yoy

Eurozone exports of goods rose 0.3% yoy to EUR 252.3B in June. Imports fell -17.7% yoy to EUR 229.3B. Trade balanced recorded a EUR 23B surplus. Intra-Eurozone trade fell -4.1% yoy to EUR 231.6B.

In seasonally adjusted term, exports dropped -0.5% mom to EUR 237.2B. Imports dropped -5.6% mom to EUR 224.6B. Trade surplus widened to EUR 12.5B, larger than expectation of EUR 2.3B. Intra-Eurozone trade fell from EUR 220.8B to 217.6B during the month.

Australian employment down -14.6k, but hours worked continue to rise

Australia witnessed a contraction in employment by -14.6k in July, starkly missing expectations of a 15.2k growth. This decline was majorly attributed to a drop in full-time jobs by -24.2k, even as part-time employment saw an increase of 9.6k.

Unemployment rate rose from 3.5% to 3.7%, surpassing market anticipations which had pinned it at 3.6%. The participation rate also registered a dip, moving from 66.8% to 66.7%.

However, it wasn’t all bleak. Monthly hours worked showed a marginal increase of 0.2% mom. Commenting on this aspect, Bjorn Jarvis, ABS head of labour statistics, observed, “The strength in hours worked shows that it continues to be a tight labour market.”

Jarvis pointed out that hours worked have risen by an impressive 5.2% compared to July 2022, a significant outperformance relative to the 2.8% annual increase in employment.

He further noted, “The strength in hours worked over the past year, relative to employment growth, shows the demand for labour is continuing to be met, to some extent, by people working more hours.”

RBNZ Orr: We don’t feel a rush to be changing rates anytime soon

In a Bloomberg TV interview, RBNZ Governor Adrian Orr indicated that a forthcoming mild recession is the “bare minium” for New Zealand, as “demand has been well outstripping the pace of the supply capacity.”

“We need to see subdued consumer spending, business investment and government constraints on spending, these are a critical part of the inflation process,” he added.

Orr also reiterated that interest rate will need to stay high for a period of time, as “we don’t feel a rush to be changing rates anytime soon.”

“We believe if we stay where we are for long enough, inflation will be back inside the target band mid-next year and, and stay there,” he added.

RBNZ projects OCR to peak at 5.59% in mid-2024, then retract slightly to 5.36% by early 2025. This suggests rate cuts might be off the table for about 18 months. Orr clarified that these figures are projections and “signal or constraint.”

Japans’ export contracts in Jul, shipments to China fell for 8th month

Japan Witnesses First Export Contraction in Over Two Years Amidst Declining Trade with China

Japan’s exports experienced a dip of -0.3% yoy to JPY 8725B in July. This contraction is noteworthy as it breaks a growth streak that has lasted for over two years since February 2021.

Diving deeper into the data, while shipments to US and Europe saw a positive trajectory with respective rises of 13.5% yoy and 12.4% yoy, the trade dynamics with China narrated a different story.

Exports to China, Japan’s primary trading ally, plummeted by -13.4%, marking the steepest decline since January. Notably, this reflects an ongoing trend with shipments to China diminishing for the eighth consecutive month, subsequent to a -10.9% yoy drop in June.

On the import front, Japan registered a decline of -13.5% yoy to JPY 8804B. This marks the fourth consecutive month of declining imports and is the most significant dip since September 2020. The downturn can be partly attributed to the decreasing commodities prices.

With imports exceeding exports, trade balance for the month ended in a deficit of JPY -78.7B.

When observing the figures in seasonally adjusted terms, both exports and imports displayed a 2.0% mom rise, amounting to JPY 8460B and JPY 9018B respectively. Consequently, trade deficit widened slightly, reaching JPY -557B.

GBP/USD Mid-Day Outlook

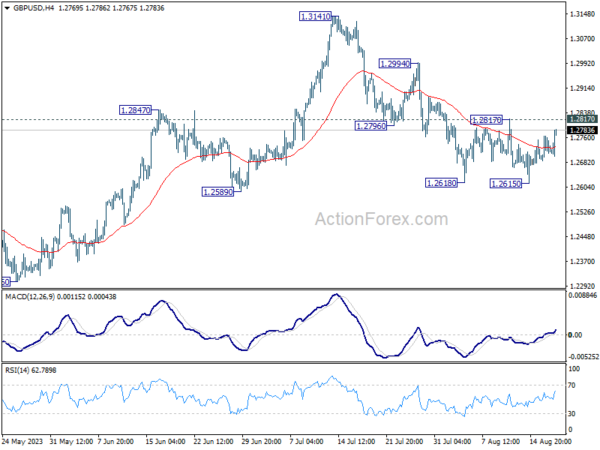

Daily Pivots: (S1) 1.2690; (P) 1.2729; (R1) 1.2770; More…

GBP/USD’s recovery from 1.2615 extends higher today but stays below 1.2817 resistance. Intraday bias remains neutral for the moment. On the downside, firm break of 1.2615, and sustained trading below 1.2678 resistance turned support will argue that it’s already in a larger correction. Deeper decline would then be seen to 1.2306 support next. Nevertheless, break of 1.2817 minor resistance will indicate that the pull back from 1.3141 has completed, and turn bias back to the upside for stronger rebound.

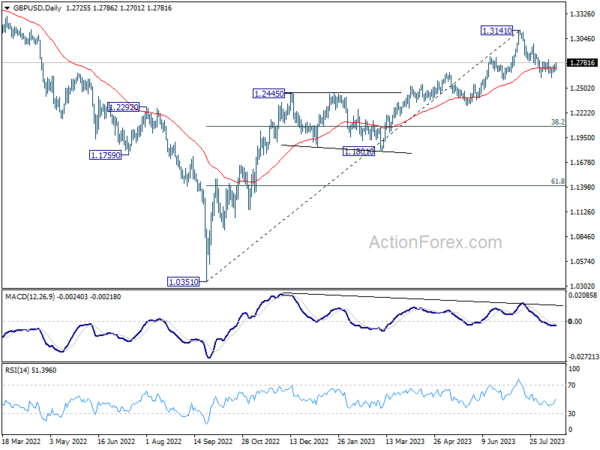

In the bigger picture, a medium term top could be in place at 1.3141 already, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.2723) should confirm this case, and bring deeper fall to 38.2% retracement of 1.0351 to 1.3141 at 1.2075, as a correction to up trend from 1.0351 (2022 low). For now, rise will stay mildly on the downside as long as 1.3141 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q2 | -0.20% | 0.40% | 0.20% | 0.00% |

| 22:45 | NZD | PPI Output Q/Q Q2 | 0.20% | 0.80% | 0.30% | 0.20% |

| 23:50 | JPY | Trade Balance (JPY) Jul | -0.56T | -0.44T | -0.55T | -0.54T |

| 23:50 | JPY | Machinery Orders M/M Jun | 2.70% | 3.60% | -7.60% | |

| 01:30 | AUD | Employment Change Jul | -14.6K | 15.2K | 32.6K | 31.6K |

| 01:30 | AUD | Unemployment Rate Jul | 3.70% | 3.60% | 3.50% | |

| 04:30 | JPY | Tertiary Industry Index M/M Jun | -0.40% | -0.10% | 1.20% | 1.00% |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jun | 12.5B | 2.3B | -0.9B | |

| 12:30 | USD | Initial Jobless Claims (Aug 11) | 239K | 240K | 248K | 250K |

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Aug | 12 | -9.5 | -13.5 | |

| 14:30 | USD | Natural Gas Storage | 35B | 29B |