Dollar is making an effort to extend its near term rebound in early US session, bolstered by significantly stronger-than-expected ADP private job report. Concurrently, the greenback is finding support from the risk-off mood triggered by Fitch’s unexpected downgrade of US sovereign rating, which sent global equities lower. However, Dollar’s upside momentum seems far from being decisive, possibly an outcome of the typical summer trading slowdown. Yen, on the other hand, is having a slight recovery today, primarily due to exhaustion in its recent sell-off, though signs of a meaningful resurgence are yet to materialize.

On the European front, major currencies are showing mixed performance, with Euro holding up slightly better. Sterling seems to be in a dormant state, possibly in anticipation of tomorrow’s BoE rate decision, while Swiss Franc clearly trails behind. Commodity currencies, however, continue to underperform, with the Canadian Dollar fairing slightly better than its peers. Aussie is facing headwinds from both the risk-off environment and reversal in Copper prices.

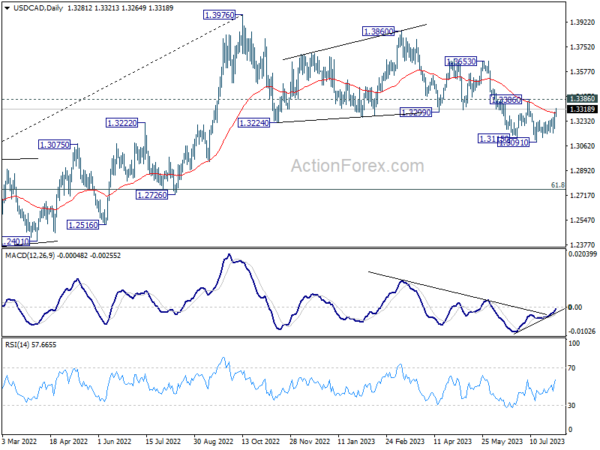

USD/CAD would be an interesting one to watch, even though it’s a bit early for a mention now, considering that both US and Canada will publish job data on Friday. Technically speaking, today’s break above 55 D EMA (now at 1.3292) is a near term bullish sign. Extended rally through 1.3386 resistance could mark the completion of whole corrective fall from 1.3976 (2022 high), with three waves down to 1.3091. That would set up a short-to-medium term rally back towards this high. Let’s see if the data could trigger this scenario.

In Europe, at the time of writing, FTSE is down -0.95%. DAX is down -0.94%. CAC is down -0.56%. Germany 10-year yield is down -0.0434 at 2.515. Earlier in Asia, Nikkei fell -2.30%. Hong Kong HSI fell -2.47%. China Shanghai SSE fell -0.89%. Singapore Strait Times fell -1.45%. Japan 10-year JGB yield jumped 0.0338 to 0.628.

US ADP jobs rose 324k, slowdown in pay growth without broad-based job loss

US ADP private employment grew 324k in July, well above expectation of 195k. By sector, goods-producing jobs rose 21k while service-providing jobs rose 303k. By establishment size, small companies added 237k jobs, medium added 138k, large lost -67k. Job-stayers annual pay growth fell to 6.2% yoy, slowest pace since November. Job-changers annual pay growth also fell to 10.2% yoy.

Nela Richardson Chief Economist, ADP, said: “The economy is doing better than expected and a healthy labor market continues to support household spending. We continue to see a slowdown in pay growth without broad-based job loss.”

BoJ Uchida: Monetary easing to continue to nurture firms’ changing pricing strategies

BoJ Deputy Governor Shinichi Uchida highlighted in a speech today an emerging trend in firms’ pricing strategies, noting that “firms are developing more forward-looking strategies for setting prices.” According to Uchida, these changes “might be the chance to finally change Japan’s economy.” Hence, he emphasized BoJ will “patiently continue with monetary easing to carefully nurture these signs.”

Uchida was explicit in outlining the Bank’s monetary policy stances. Firstly, he ruled out near-term adjustments to short-term interest rate, currently at -0.10%, stating “there is still a long way to go before such decisions are made.”

Secondly, BoJ will “maintain the current framework” until sustainable and stable achievement of 2% inflation target “come in sight”.

Thirdly, Uchida affirmed the ongoing yield curve control under the present policy framework, aiming to balance its benefits and drawbacks, especially in relation to financial intermediation and the market.

Despite the high economic and price outlook uncertainty, Uchida stated the recent yield curve control modification, allowing the 10-year JGB yield to rise to up to 1%, is aimed at sustaining the ultra-loose policy. “Needless to say, we do not have an exit from monetary easing in mind,” he emphasized.

New Zealand employment up 1% in Q2, wage inflation unchanged at 4.3% yoy

New Zealand reported a better-than-expected employment growth of 1.0% in the second quarter of 2023, surpassing market expectations of a 0.6% rise. On the other hand, unemployment rate slightly increased from 3.4% to 3.6%, marginally above the anticipated 3.5%.

The data released showed that employment rate rose from 69.6% to 69.8%, and the participation rate increased from 72.0% to 72.4%. These are the highest rates recorded since the series began in 1986.

In terms of wage growth, all sector wage inflation climbed by 1.1% on a quarterly basis, resulting in an annual increase of 4.3%. “Annual wage costs continued to increase at historically high rates this quarter, equal to the 4.3 percent annual increase last quarter,” said Bryan Downes, business prices delivery manager.

Downes noted that the most significant contribution to the Labour Cost Index for the June 2023 quarter came from retail trade and accommodation industry. This sector witnessed 1.5% increase in wages on a quarterly basis, following 0.7% rise in the previous quarter. The wage growth in this industry was primarily driven by rise in minimum wage, thereby pushing up overall wage growth during the quarter.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8711; (P) 0.8745; (R1) 0.8784; More….

USD/CHF’s rebound from 0.8551 is extending higher today and intraday bias stays on the upside. Rejection by 0.8818 support turned resistance will maintain near term bearishness. Further break of 0.8863 minor support will turn bias back to the downside for retesting 0.8551. Nevertheless, decisive break of 0.8818 will carry larger bullish implication, and target 0.9146 cluster resistance.

In the bigger picture, down trend from 1.0146 is seen as in progress as long as 0.8188 support turned resistance holds. Next target is 61.8% retracement of 0.7065 (2011 low) to 1.0342 (2016 high) at 0.8317. However, sustained break of 0.8818 should indicate medium term bottoming, and bring stronger rise back to 0.9146 cluster resistance (38.2% retracement of 1.0146 to 0.8551 at 0.9160), even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Employment Change Q2 | 1.00% | 0.60% | 0.80% | 1.10% |

| 22:45 | NZD | Unemployment Rate Q2 | 3.60% | 3.50% | 3.40% | |

| 23:50 | JPY | Monetary Base Y/Y Jul | -1.30% | -0.70% | -1.00% | |

| 23:50 | JPY | BoJ Minutes | ||||

| 07:00 | CHF | SECO Consumer Climate Q3 | -27 | -25 | -30 | |

| 07:30 | CHF | Manufacturing PMI Jul | 38.5 | 44.2 | 44.9 | |

| 12:15 | USD | ADP Employment Change Jul | 324K | 195K | 497K | |

| 14:30 | USD | Crude Oil Inventories | -0.9M | -0.6M |