Market sentiment in Asia today leans heavily toward risk aversion, following the unexpected move by Fitch Ratings to downgrade US sovereign rating. Consequently, commodity currencies are grappling with strong sell-offs. New Zealand Dollar is leading the downward spiral, despite strong wage growth reflected Q2’s employment data. Australian Dollar, still reeling from the aftereffects of yesterday’s RBA decision, is also on a downward trajectory, breaking through key short-term support levels against both Dollar and Euro. Canadian Dollar is faring slightly better, although it’s also notably weak.

Amid this atmosphere of risk aversion, Yen is attempting a recovery, albeit with limited momentum so far. Dollar remains robust but is battling to break free from its current range against Euro. Market attention now turns to today’s ADP employment report, with traders likely holding off on significant bets until Friday’s non-farm payroll figures. Meanwhile, Euro leads the pack among European majors, but they’re actually just range bound against each other.

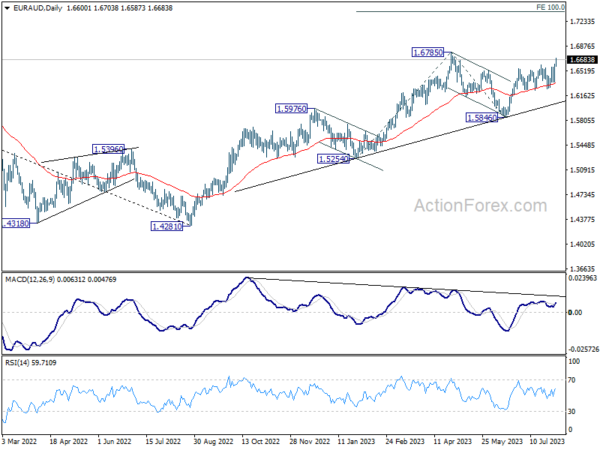

Technically, EUR/AUD finally looks ready to resume medium term up trend with today’s strong rally. Immediate focus for the next few days is 1.6785 high. Decisive break there will set the stage for 100% projection of 1.5254 to 1.6785 from 1.5846 at 1.7377. Judging from current sluggishness in EUR/USD, extended rally in EUR/AUD would more likely be accompanied by deeper fall in AUD/USD, probably through 0.6457 support if EUR/AUD breaks 0.6785 decisively.

At the time of writing, Nikkei is down -2.31%. Hong Kong HSI is down -2.17%. China Shanghai is down -0.99%. Singapore Strait Times is down -1.32%. Japan 10-year JGB yield is up 0.034 at 0.628. Overnight, DOW rose 0.20%. S&P 500 dropped -0.27%. NASDAQ dropped -0.43%. 10-year yield rose 0.092 to 4.051.

Fitch cuts US sovereign rating on steady deterioration in standards of governance

Asian stock markets took a significant plunge following Fitch Ratings’ surprise decision to downgrade US sovereign rating from AAA to AA+. This move mirrors S&P Global Ratings’ decision made over a decade ago, causing considerable unrest among investors.

Fitch’s statement highlighted, “In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025.”

US Treasury Secretary Janet Yellen fiercely contested the downgrade, calling it “arbitrary and based on outdated data.” The White House has also voiced opposition to Fitch’s assessment, with press secretary Karine Jean-Pierre declaring, “It defies reality to downgrade the United States at a moment when President Biden has delivered the strongest recovery of any major economy in the world.”

Fed Goolsbee: Every meeting is live around transition point

Chicago Fed President Austan Goolsbee has refrained from pre-committing to Fed’s actions in September, insisting that every meeting is crucial when navigating the transition point. “When you’re around the transition point, every meeting is a live meeting and you’re trying to figure out trends, not just reflect one month’s data,” Goolsbee said yesterday.

Goolsbee is “guardedly optimistic” about Fed’s ability to stick to what he terms the “golden path,” bringing down prices without inducing a recession. He emphasized the importance of watching how core goods and housing inflation evolve in the coming months to remain on this path.

“Those are the two components that over the next three to six months, let’s call it, if we are to succeed to stay on the golden path, we’ve got to see progress on those two parts of inflation,” he said. He added that progress on services inflation isn’t currently necessary.

He also shared his perspective on the link between wages and inflation, suggesting that wages are more of a lagging indicator rather than a predictor of inflation. According to Goolsbee, if Fed officials focus too much on wages when shaping their policy, they could risk overshooting interest rates.

Fed Bostic warns of overtightening risks, advocates for cautious approach

Yesterday, Atlanta Fed President Raphael Bostic expressed guarded optimism and highlighted the “significant progress” in controlling inflation. He observed, “Inflation is well off its highs that we saw in the last year. And recent numbers have come in promising in ways that suggest that we might be seeing continued declines.”

Bostic pointed to the ongoing economic evolution as in line with an “orderly slowdown,” which he views as “quite promising”. As such, he advocated to be cautious, patient and resolute” in policy-making.

He also voiced concerns about the risk of overtightening monetary policy. “I think we are in a phase now where there is some risk of us overtightening. And so we’ve just got to have that in mind,” he said. By exercising appropriate caution, Bostic believes that the damage to employment can be minimized.

Looking forward, Bostic said, “My baseline outlook doesn’t contemplate any cuts until the second half of next year at the earliest.” He insists on being “resolute to make sure that we don’t move our policy posture in a different direction until we’re absolutely, absolutely certain that inflation is going to get to our target.”

BoJ Uchida: Monetary easing to continue to nurture firms’ changing pricing strategies

BoJ Deputy Governor Shinichi Uchida highlighted in a speech today an emerging trend in firms’ pricing strategies, noting that “firms are developing more forward-looking strategies for setting prices.” According to Uchida, these changes “might be the chance to finally change Japan’s economy.” Hence, he emphasized BoJ will “patiently continue with monetary easing to carefully nurture these signs.”

Uchida was explicit in outlining the Bank’s monetary policy stances. Firstly, he ruled out near-term adjustments to short-term interest rate, currently at -0.10%, stating “there is still a long way to go before such decisions are made.”

Secondly, BoJ will “maintain the current framework” until sustainable and stable achievement of 2% inflation target “come in sight”.

Thirdly, Uchida affirmed the ongoing yield curve control under the present policy framework, aiming to balance its benefits and drawbacks, especially in relation to financial intermediation and the market.

Despite the high economic and price outlook uncertainty, Uchida stated the recent yield curve control modification, allowing the 10-year JGB yield to rise to up to 1%, is aimed at sustaining the ultra-loose policy. “Needless to say, we do not have an exit from monetary easing in mind,” he emphasized.

New Zealand employment up 1% in Q2, wage inflation unchanged at 4.3% yoy

New Zealand reported a better-than-expected employment growth of 1.0% in the second quarter of 2023, surpassing market expectations of a 0.6% rise. On the other hand, unemployment rate slightly increased from 3.4% to 3.6%, marginally above the anticipated 3.5%.

The data released showed that employment rate rose from 69.6% to 69.8%, and the participation rate increased from 72.0% to 72.4%. These are the highest rates recorded since the series began in 1986.

In terms of wage growth, all sector wage inflation climbed by 1.1% on a quarterly basis, resulting in an annual increase of 4.3%. “Annual wage costs continued to increase at historically high rates this quarter, equal to the 4.3 percent annual increase last quarter,” said Bryan Downes, business prices delivery manager.

Downes noted that the most significant contribution to the Labour Cost Index for the June 2023 quarter came from retail trade and accommodation industry. This sector witnessed 1.5% increase in wages on a quarterly basis, following 0.7% rise in the previous quarter. The wage growth in this industry was primarily driven by rise in minimum wage, thereby pushing up overall wage growth during the quarter.

Looking ahead

Swiss SECO consumer climate and PMI manufacturing are the main features in European session. US will release ADP private employment later in the day.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6569; (P) 0.6647; (R1) 0.6692; More…

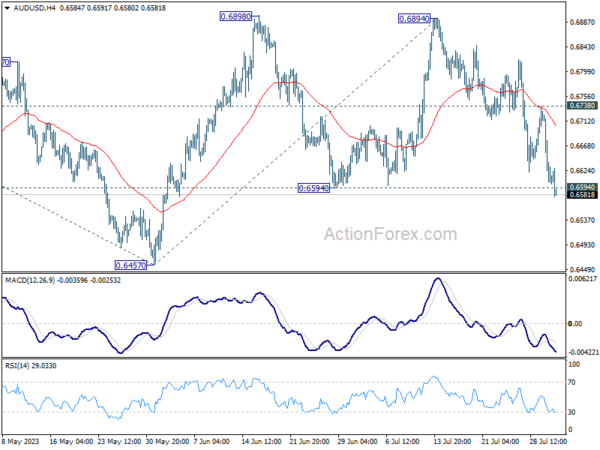

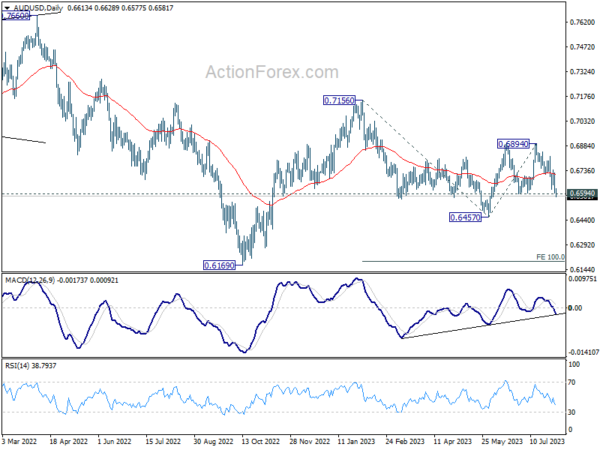

AUD/USD’s break of 0.6594 support argues that rebound from 0.6457 has completed at 0.6894 already. Intraday bias is back on the downside for 0.6457. Break there will resume the fall from 0.7156 to 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195. For now, risk will stay mildly on the downside as long as 0.6738 resistance holds, in case of recovery.

In the bigger picture, outlook is mixed for now as AUD/USD failed to sustain above both 55 D EMA (now at 0.6713) and 55 W EMA (now at 0.6784). On the upside, break of 0.65898 resistance will solidify the case that down trend from 0.8006 (2021 high) has already completed, and target 0.7156 resistance for confirmation. However, break of 0.6457 will likely resume the down trend through 0.6169 (2022 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Employment Change Q2 | 1.00% | 0.60% | 0.80% | 1.10% |

| 22:45 | NZD | Unemployment Rate Q2 | 3.60% | 3.50% | 3.40% | |

| 23:50 | JPY | Monetary Base Y/Y Jul | -1.30% | -0.70% | -1.00% | |

| 23:50 | JPY | BoJ Minutes | ||||

| 07:00 | CHF | SECO Consumer Climate Q3 | -25 | -30 | ||

| 07:30 | CHF | Manufacturing PMI Jul | 44.2 | 44.9 | ||

| 12:15 | USD | ADP Employment Change Jul | 195K | 497K | ||

| 14:30 | USD | Crude Oil Inventories | -0.9M | -0.6M |