Commodity currencies are trading generally higher today on mildly positive market sentiment. Australian Dollar is the stronger one among them, ahead of RBA’s rate decision tomorrow. Opinions on whether RBA would hike by 25bps next month (i.e. August 1 tomorrow) are divided . Major local banks exhibit this split sentiment, with Commonwealth Bank and Westpac predicting a 25bps hike, while ANZ and NAB foresee a pause. Still, it’s actually more of a question of timing on whether the final hike will be delivered tomorrow or later in September. The rally in Copper prices is more likely the primary driver behind Aussie’s rebound.

Elsewhere in the currency markets, European majors are mixed for now. But Euro does ride on slightly stronger than expected core inflation reading to rally against Swiss Franc. Yen is the worst performer, followed by Franc and then Dollar. The selloff in Yen is so far steady, and thus, it’s likely to continue for a while. Dollar will need some strong ISM and NFP readings to revive its near term rebound, except versus the weak Yen.

Technically, Copper’s solid rally today should confirm resumption of rise from 3.5387. It also affirms the case that corrective decline from 4.3556 has completed at 3.5387. Further rise is now expected, as long as 3.8986 minor support holds, to 61.8% projection of 3.5387 to 3.9501 from 3.7725 at 4.0267. Firm break there will solidify this bullish case and target 100% projection at 4.1839. Also, strong break of 4.0267 in Copper will give Aussie a solid boost this week, regardless of tomorrow’s RBA decision.

In Europe, at the time of writing, FTSE is up 0.07%. DAX is up 0.19%. CAC is up 0.47%. Germany 10-year yield is up 0.0146 at 2.505. Earlier in Asia, Nikkei rose 1.26%. Hong Kong HSI rose 0.82%. China Shanghai SSE rose 0.46%. Singapore Strait Times rose 0.08%. Japan 10-year JGB yield rose 0.0531 to 0.603.

Eurozone GDP grew 0.3% qoq in Q2, EU flat

Eurozone GDP grew 0.3% qoq in Q2, above expectation of 0.2% qoq. EU GDP was flat at 0.0% qoq.

Among the Member States for which data are available, Ireland (+3.3%) recorded the highest increase compared to the previous quarter, followed by Lithuania (+2.8%). Declines were recorded in Sweden (-1.5%), in Latvia (-0.6%), in Austria (-0.4%) and in Italy (-0.3%).

The growth rates compared to the same quarter of the previous year were positive for seven countries, with the highest values observed for Ireland (+2.8%), Portugal (+2.3%) and Spain (+1.8%). The highest declines were recorded for Sweden (-2.4%), Czechia (-0.6%) and Latvia (-0.5%).

Eurozone CPI slowed to 5.3.% in Jul, core unchanged at 5.5%

Eurozone CPI slowed from 5.5% yoy to 5.3% yoy in July, matched expectations. CPI core (excluding energy, food, alcohol & tobacco) was unchanged at 5.5% yoy, above expectation of 5.4% yoy.

Looking at the main components, food, alcohol & tobacco is expected to have the highest annual rate in July (10.8%, compared with 11.6% in June), followed by services (5.6%, compared with 5.4% in June), non-energy industrial goods (5.0%, compared with 5.5% in June) and energy (-6.1%, compared with -5.6% in June).

Japan’s industrial production rose 2.0% mom in Jun, moderately picking up

Japan’s Ministry of Economy, Trade and Industry reported 2.0% mom increase in industrial production in June, below expected 2.4%. This places the seasonally adjusted index of production at factories and mines at 105.3, with 2020 as the base of 100.

Motor vehicles led industrial production growth, surging 6.1% thanks to robust demand in both domestic and overseas markets. Out of 15 industrial sectors covered , 10 sectors saw increased output, while production in five dropped.

Despite the production growth coming in lower than expected, the Ministry maintained its basic assessment, noting that industrial production was “showing signs of moderately picking up.”

Looking ahead, the Ministry’s forecast based on a poll of manufacturers anticipates slight output decline of -0.2% in July, followed by climb of 1.1% in August.

Also released, retail sales rose 5.9% yoy in June, above expectation of 5.4% yoy, picked up from prior month’s 5.7% yoy.

China’s PMI manufacturing ticked up to 49.3, but marked 4th month of contraction

China’s official Manufacturing PMI rose from 49.0 in June to 49.3 in July, slightly above anticipated 49.2. However, it marked the fourth consecutive month that this indicator remained below the 50-point mark separating expansion from contraction on a monthly basis.

Zhao Qinghe, a senior NBS official, indicated that while there was a slight rebound, many enterprises reported experiencing a “complicated and severe” external environment. In his statement, Zhao stated, “overseas orders have decreased, and insufficient demand is still the main difficulty faced by enterprises.”

Meanwhile, Non-Manufacturing PMI, which measures activity in both services and construction sectors, dropped from 53.32 to 51.5, missing the expected 53.1, marking its fourth straight monthly decline. The services subindex fell from 52.8 to 51.5, while the construction subindex saw a significant drop from 55.7 to 51.2.

Composite PMI, which provides a broader picture of the economy, also declined from 52.3 in June to 51.1 in July, reflecting the challenges faced by both the manufacturing and non-manufacturing sectors.

NZ ANZ business confidence rose to -13.1, highest since Sep 2021

New Zealand’s business confidence has reached its highest point since September 2021, with ANZ Business Confidence Index improved from -18.0 to -13.1. Although this remains in the negative territory, it shows a relative boost in optimism.

Looking at the details, Own Activity Outlook, a measure of businesses’ expectations of their own activity, experienced a slight drop from 2.7 to 0.8. However, various components of the index witnessed improvements. Export intentions increased from -1.8 to 1.5, indicating a renewed confidence in overseas markets. Both investment and employment intentions showed minor improvements.

Inflation indicators were mixed, with cost expectations climbing from 76.0 to 80.6, while inflation expectations saw a slight ease from 5.29% to 5.14%. At the same time, profit expectations and pricing intentions edged slightly lower.

Despite expecting a recession and rising unemployment, ANZ’s view on the current economic environment is that it’s “patchy rather than capitulating,” suggesting that although there are definite challenges ahead, New Zealand’s economy might show more resilience than expected.

USD/JPY Mid-Day Outlook

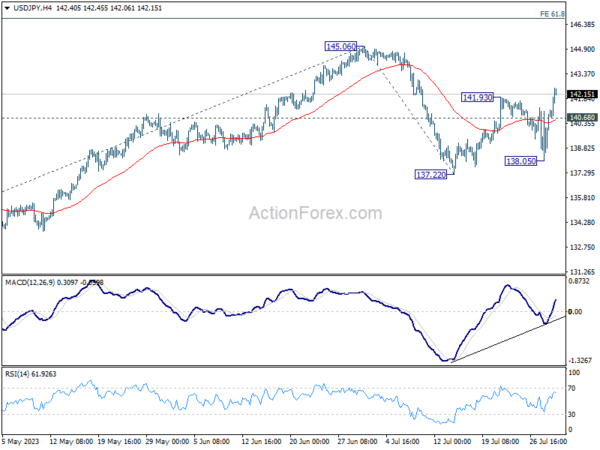

Daily Pivots: (S1) 139.10; (P) 140.14; (R1) 142.21; More…

Intraday bias in USD/JPY remains on the upside for retesting 145.60. Firm break there will resume whole rally from 172.20. Next target is 61.8% projection of 129.62 to 145.06 from 137.22 at 146.76. On the downside, below 140.68 minor support will mix up the outlook and turn intraday bias neutral first.

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Rise from 127.20 is seen as the second leg of the pattern and could still be in progress. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Jun P | 2.00% | 2.40% | -2.20% | |

| 23:50 | JPY | Retail Trade Y/Y Jun | 5.90% | 5.40% | 5.70% | |

| 01:00 | CNY | NBS Manufacturing PMI Jul | 49.3 | 49.2 | 49 | |

| 01:00 | CNY | Non-Manufacturing PMI Jul | 51.5 | 53.1 | 53.2 | |

| 01:00 | NZD | ANZ Business Confidence Jul | -13.1 | -18 | ||

| 01:00 | AUD | TD Securities Inflation M/M Jul | 0.80% | 0.10% | ||

| 01:30 | AUD | Private Sector Credit M/M Jun | 0.20% | 0.40% | 0.40% | |

| 05:00 | JPY | Housing Starts Y/Y Jun | -4.80% | -0.20% | 3.50% | |

| 05:00 | JPY | Consumer Confidence Index Jul | 37.1 | 37 | 36.2 | |

| 06:00 | EUR | Germany Import Price Index M/M Jun | -1.60% | -0.80% | -1.40% | |

| 06:00 | EUR | Germany Retail Sales M/M Jun | -0.80% | -0.20% | 0.40% | 1.90% |

| 08:00 | EUR | Italy GDP Q/Q Q2 P | -0.30% | 0.00% | 0.60% | |

| 08:30 | GBP | Mortgage Approvals Jun | 55K | 49K | 51K | |

| 08:30 | GBP | M4 Money Supply M/M Jun | -0.10% | 0.50% | 0.20% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.30% | 0.20% | -0.10% | |

| 09:00 | EUR | Eurozone CPI Y/Y Jul P | 5.30% | 5.30% | 5.50% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul P | 5.50% | 5.40% | 5.50% | |

| 13:45 | USD | Chicago PMI Jul | 43.5 | 41.5 |