Asian markets are trading in positive mood today, even though US stocks were unmoved by FOMC’s rate hike overnight. Fed Chair Jerome Powell was predictably non-committal regarding next policy decision. But investors appear content to go along with the prevailing trend. Meanwhile, this upbeat sentiment is giving a notable boost to commodity currencies, with Australian Dollar emerging as the frontrunner. Dollar, however, is facing broad-based pressure, closely followed by European majors, while Yen is holding steady as it awaits its next catalyst.

ECB rate decision is definitely a major focus today. However, it’s essential to keep in mind that the US is set to release key economic data today as well, including Q1 GDP advance estimate, durable goods orders, and weekly jobless claims figures. Both ECB decision and US GDP data have the potential to significantly stir the markets. Meanwhile, any unusual fluctuations in Yen should also be closely monitored, particularly ahead of tomorrow’s policy decision by BoJ.

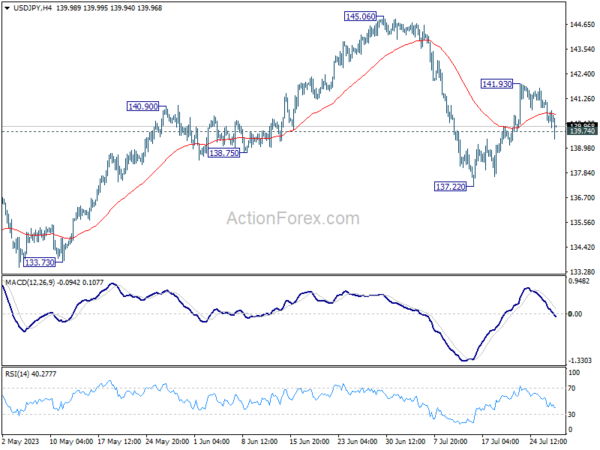

Talking about Yen, the breach of 139.74 minor support in USD/JPY argues that recovery from 137.22 might have completed at 141.93 already. More importantly, fall from 145.06 is probably not over yet. Risk will now stay mildly on the downside as long as 141.93 resistance holds, for retesting 137.22 support next.

In Asia, at the time of writing, Nikkei up 0.64%. Hong Kong HSI is up 1.36%. China Shanghai SSE is up 0.44%. Singapore Strait Times is up 0.66%. Japan 10-year JGB yield is up 0.0040 at 0.452. Overnight, DOW rose 0.23%. S&P 500 dropped -0.02%. NASDAQ dropped -0.12%. 10-year yield dropped -0.0061 to 3.851.

Fed Powell keeps Sep hike open, S&P 500 continues to lose upside momentum

US equities ended mixed in Wednesday’s session, following Fed’s expected rate increase by 25 bps to 5.25-5.50%. Despite the major policy decision, market volatility was surprisingly restrained throughout the trading session. Fed Chair Jerome Powell indicated that another rate hike could be on the table for September, while steering clear of predicting when a rate cut might transpire, pointing to the prevailing high economic uncertainty.

Current market expectations for additional rate hikes this year stand at 22% for September, 33% for November, and 30% for December. The likelihood of a rate cut commencing as early as March next year is considered to be 55.8%.

Powell, in the post-meeting press conference, stated, “It is certainly possible we would raise the funds rate at the September meeting if the data warranted, and I would also say it’s possible that we would choose to hold steady at that meeting”. He emphasized that Fed’s monetary policy decisions will continue to be formulated on a meeting-by-meeting basis, largely dependent on economic data and indicators.

When discussing potential rate cuts, Powell asserted, “We’d be comfortable cutting rates when we’re comfortable cutting rates,” suggesting that a cut could take place next year if inflation hovers consistently near the Fed’s target. However, he stressed that this scenario remains a considerable ‘if,’ given the considerable uncertainty surrounding future economic developments and subsequent policy meetings.

More on FOMC

- FOMC to Assess Policy One Meeting at a Time

- Fed Review: Balancing Act With Focus on Data

- FOMC Goes for a Summer Hike

- FOMC Hikes Again, Signals More May Be Needed

S&P 500 closed down slightly by -0.02% overnight. The index continued to lose upside momentum as seen in D MACD. While further rise cannot be ruled out, upside would likely be limited by 138.2% projection of 3491.58 to 4100.51 from 3808.86 at 4650.40. Meanwhile, break of 4458.48 resistance turned support will confirm that a correction is at least underway, and target 55 D EMA (now at 4362.79) and below.

Australia export price down -8.5% qoq in Q2, largest fall since 2009

Australia’s Q2 Export Price Index registered -8.5% qoq drop, the most substantial quarterly decline since Q3 2009. Concurrently, the index declined -11.2% yoy compared to the same quarter last year. On the flip side, Import Price Index dipped slightly by -0.8% qoq, – 0.3% yoy.

Michelle Marquardt, Head of Price Statistics at Australian Bureau of Statistics (ABS), attributed this steep fall in the Export Price Index to a substantial contraction in global energy demand. “Global economic slowdown and eased supply pressures are contributing to a retreat in energy prices from their 2022 peak,” said Marquardt.

The dampening effect of weaker energy prices extended to the Import Price Index, which saw a decline of -0.8% in Q2 2023. More specifically, the prices of petroleum and petroleum products decreased by -7.0% in this quarter. Nevertheless, this decline in energy prices was somewhat counterbalanced by inflationary pressures on various imported consumption and capital goods.

ECB to hike another 25bps, EUR/CHF accelerating downwards

ECB is widely expected to raise interest rates for the ninth time in a row today. The main refinancing rate will be lifted by 25bps to 4.25%. Deposit rate, once negative will be raised by 25bps to 3.50%. The question remains on what the central bank would do next, and whether there would be further tightening in September. But it’s unlikely for President Christine Lagarde to provide any concrete answer, other likely pointing to incoming data and the new economic projections to be prepared before next decision.

EUR/CHF’s decline from 1.0095 is showing sign of downside acceleration this week, by breaking through near term falling channel support, and as displayed in D MACD too. Next target is 100% projection of 0.9995 to 0.9670 from 0.9840 at 0.9515. Sustained break there will put 0.9407 (2022 low) in focus. Regardless of any recovery, outlook will remain bearish as long as 0.9670 support turned resistance holds.

Meanwhile, it should also be noted that prior rejection by 55 W EMA keeps medium term outlook in EUR/CHF bearish. That is, the down trend from 1.2004 (2018 high) is in favor to continue. Firm break of 0.9407 would set the stage for 61.8% projection of 1.1149 to 0.9407 from 1.0095 at 0.9018 in the medium term. The unfolding of this bearish scenario would depend significantly on the evolution of increasing recession risks in the latter half of the year and the impact on timing of the first ECB rate cut.

Looking ahead

Germany Gfk consumer sentiment will also be released in European session, in addition to ECB rate decision. Later in the day, US will release Q12 GDP, durable goods orders, jobless claims, and pending home sales.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6729; (P) 0.6761; (R1) 0.6792; More…

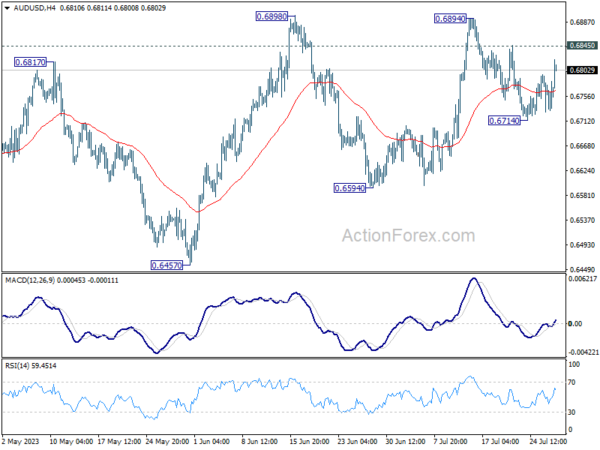

AUD/USD’s rebound from 0.6714 extends higher today but stays below 0.6845 minor resistance. Intraday bias remains neutral at this point. On the upside, above 0.6845 will bring retest of 0.6898 resistance. Decisive break there will resume rise from 0.6457. On the downside below 0.6714 will resume the fall from 0.6894, as the third leg of the corrective pattern from 0.6898. But downside should be contained above 0.6594 support to bring rebound.

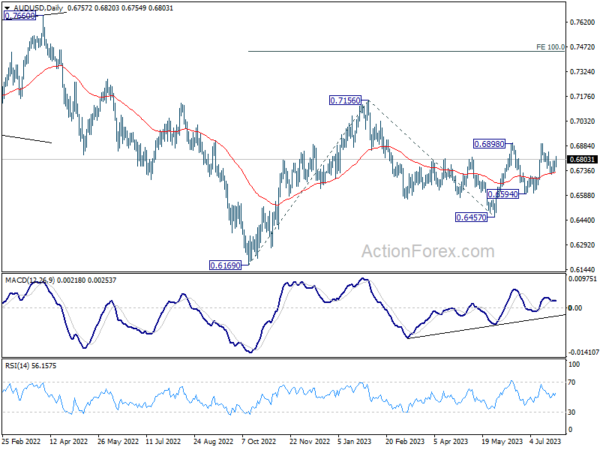

In the bigger picture, price actions from 0.7156 are seen as a correction to the rebound from 0.6169 (2022 low). Break of 0.6898 resistance will argue that rise from 0.6169 is ready to resume through 0.7156. Next target will be 100% projection of 0.6169 to 0.7156 from 0.6457 at 0.7444. For now, this will be the favored case as long as 55 D EMA (now at 0.6715) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Import Price Index Q/Q Q2 | -0.80% | -0.80% | -4.20% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Aug | -24.7 | -25.4 | ||

| 12:15 | EUR | ECB Main Refinancing Rate | 4.25% | 4.00% | ||

| 12:15 | EUR | ECB Rate On Deposit Facility | 3.75% | 3.50% | ||

| 12:30 | USD | Initial Jobless Claims (Jul 21) | 233K | 228K | ||

| 12:30 | USD | GDP Annualized Q2 P | 1.60% | 2.00% | ||

| 12:30 | USD | GDP Price Index Q2 P | 3.10% | 4.10% | ||

| 12:30 | USD | Goods Trade Balance (SUD) Jun P | -91.8B | -91.1B | ||

| 12:30 | USD | Wholesale Inventories Jun P | -0.10% | 0% | ||

| 12:30 | USD | Durable Goods Orders Jun | 1.00% | 1.80% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Jun | 0.10% | 0.70% | ||

| 12:45 | EUR | ECB Press Conference | ||||

| 14:00 | USD | Pending Home Sales M/M Jun | -0.50% | -2.70% | ||

| 14:30 | USD | Natural Gas Storage | 12B | 41B |