As a typical Monday Asian session commences, activity in the financial markets is somewhat muted. Nikkei is displaying a notable rise, although this primarily reflects continuation of its recent flip-flopping pattern within an established range, indicative of ongoing consolidation. A similar pattern is observed across other major Asian markets as well.

On the currency front, major currency pairs and crosses are bounded within Friday’s range for now, with the market awaiting the next move. Releases of PMI data from Eurozone and UK might trigger some volatility today. However, traders’ primary focus will undeniably be the upcoming high-profile events – FOMC and ECB interest rate decisions – set to unfold later this week, along with several key economic data releases.

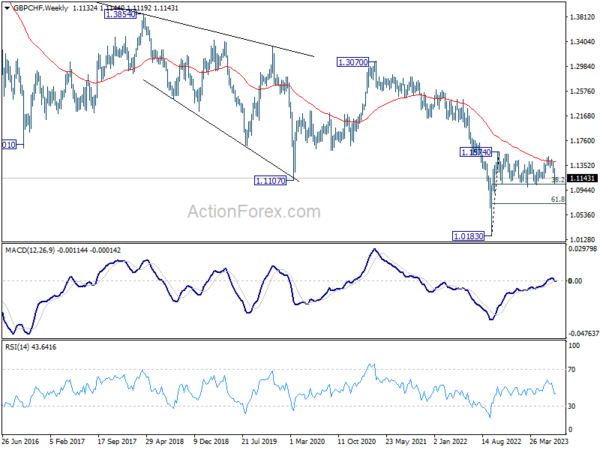

Technically, GBP/CHF will be an interesting one to watch as it’s now trying to draw support from the bottom of the medium term range pattern. Strong support is still in favor at around 38.2% retracement of 1.0183 to 1.1574 at 1.1043 to bring rebound. However, sustained break of 1.1043, coupled with prior rejection by 55 W EMA (now at 1.1398) could be a rather bearish signal, which could trigger downside acceleration through 61.8% retracement at 1.0714.

In Asia, at the time of writing, Nikkei is up 1.26%. Hong Kong HSI is down -1.40%. China Shanghai SSE is up 0.08%. Singapore Strait Times is down -0.53%. Japan 10-year JGB yield is down -0.0039 at 0.462.

Japan PMI manufacturing slipped to 49.4, resurgence in price pressures

Japan’s PMI Manufacturing dropped slightly from 49.8 in June to 49.4 in July, falling short of the forecasted 50.1. Despite this, PMI Manufacturing Output showed a minor uptick, climbing from 48.1 to 48.4. PMI Services saw a small decline, edging down from 54.0 to 53.9. Composite PMI, indicative of the overall health of the economy, was unchanged at 52.1.

Usamah Bhatti, an Economist at S&P Global Market Intelligence, highlighted that activity among private sector firms in Japan extended its growth streak for the seventh consecutive month. The persistence of this trend is largely attributable to steady and considerable improvement in service providers, while manufacturers reported a softer downturn at the dawn of Q3.

However, Bhatti underscored a less robust demand situation among private sector firms compared to the previous survey period. The latest data points to only a marginal increase in new orders, signaling a possible slowdown in demand.

Notably, the second half of 2023 has seen “renewed strengthening in price pressures” within the private sector. Pace of input price inflation has quickened for the first time since January. This trend is reflected across both manufacturing and service sectors, with both reporting steeper rates of output price inflation.

Australia PMI composite fell to 48, but still on narrow path for soft landing

Australia’s PMI Manufacturing recorded a mild uptick in July, rising from 48.2 to 49.6, marking a 5-month high, but still falling short of the expansionary threshold of 50. Concurrently, PMI Services took a downward turn from 50.3 to 48.0, hitting a 7-month low. Consequently, Composite PMI, a measure of combined sectors, dipped from 50.1 to 48.3, which is also a 7-month low.

Warren Hogan, Chief Economic Advisor at Judo Bank, attributed the soft July figures predominantly to a dip in business activity in the services sector, which had previously been on a recovery path in 2023. But the “Australian economy remains on the ‘narrow path’ for a soft landing.”

The July Flash report raised some concerns regarding inflation. Despite the slowdown in activity, price indicators trended higher, particularly within the services sector. These inflationary signals remain elevated, pointing to a potential inflation rate of around 4-5%, substantially exceeding RBA’s target of 2% to 3%.

Hogan noted that the disinflationary trend evident throughout 2022 “appears to have ceased”. As such, July figures will provide critical insights into whether Australia’s inflation aligns with the declining trends seen in other countries recently, or if the nation is “set to experience a more sticky inflation trend in 2023/24.”

NZ goods exports up 1.3% yoy in Jun, imports down -14% yoy

In June 2023, New Zealand’s goods exports observed a modest rise of 1.3% yoy, an equivalent of NZD 84m, taking the total to NZD 6.3B. Conversely, the nation witnessed a significant drop in goods imports by -14.0% yoy, or NZD -1.1B, reducing the total to NZD 6.3B. This left the monthly trade balance at a surplus of NZD 9m, notably below market expectations of NZD 235m.

A deeper look into the country’s top trading partners unveiled mixed outcomes in exports. June 2023 saw a decline in total exports to China by NZD -124m (-7.2% yoy), and to EU by NZD -98m (-20%). Moreover, exports to Japan also slipped by NZD -56m (-13%). On a positive note, exports to Australia and US increased by NZD 190m (30%) and NZD 91m (13%) respectively.

In terms of imports, there were notable reductions across the board. China, one of New Zealand’s principal import partners, witnessed a drop by NZD -232m (-16% yoy), while EU observed a decrease of NZD -100m (-9.2%). Furthermore, imports from Australia and US fell by NZD -93m (-12%) and NZD -96m (-14%) respectively. South Korea recorded the most substantial decline in exports to New Zealand, with a drop of NZD -136m (-26%).

Fed and ECB hikes could be non-eventual, lots of data to digest

The upcoming week will see high anticipation as both Fed and ECB are widely expected to raise interest rates by 25bps, pushing the rates to 5.25-5.50% and 4.25% respectively. However, both monetary institutions have reached a stage where their subsequent decisions will heavily hinge on data trends. With their next monetary policy meetings scheduled for mid-September, this week’s messages are anticipated to be largely non-committal. Although the pledge to combat inflation will be reiterated, neither institution is likely to provide a clear indication of their next move, which will depend on incoming data and new economic projections in September. Thus, these meetings might eventually play out as non-events.

In other central bank activities, BoJ is expected to hold its monetary policy steady this week, including maintaining the current yield cap at 0.50%. BoC will also release summary of deliberations from its last meeting.

The upcoming week will also be bustling with economic data releases. Investors will be closely watching Monday’s PMIs from Australia, Japan, Eurozone, UK, and US. Other key data to watch for during the week include US GDP, consumer confidence and PCE inflation, Germany’s Ifo business climate and Gfk consumer sentiment, Canadian GDP, as well as Australia’s CPI and retail sales.

Here are some highlights for the week:

- Monday: New Zealand trade balance; Australia PMIs; Japan PMIs; Eurozone PMIs; UK PMIs; US PMIs.

- Tuesday: Germany Ifo business climate; US house price index, consumer confidence.

- Wednesday: Japan corporate services price index; Australia CPI; Swiss Credit Suisse economic expectations; Eurozone M3 money supply; US new home sales; BoC minutes; FOMC rate decision.

- Thursday: Australia import prices; Germany Gfk consumer sentiment; ECB rate decision; US GDP, jobless claims, durable goods orders, trade balance, pending home sales.

- Friday: Japan Tokyo CPI, BoJ rate decision; Australia PPI, retail sales; France GDP; Germany CPI flash; Swiss KOF economic barometer; Canada GDP; US personal income and spending and PCE inflation, employment cost index.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6707; (P) 0.6747; (R1) 0.6772; More…

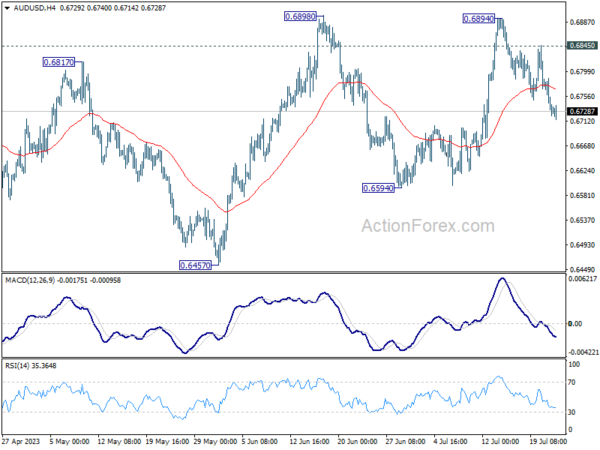

Intraday bias in AUD/USD remains mildly on the downside at this point. Deeper decline should be seen but downside should be contained above 0.6594 support to bring rebound. On the upside, above 0.6845 will bring retest of 0.6898 resistance. Decisive break there will resume rise from 0.6457.

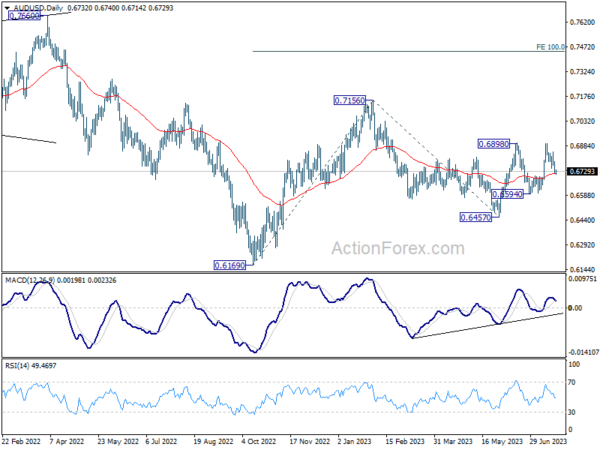

In the bigger picture, price actions from 0.7156 are seen as a correction to the rebound from 0.6169 (2022 low). Break of 0.6898 resistance will argue that rise from 0.6169 is ready to resume through 0.7156. Next target will be 100% projection of 0.6169 to 0.7156 from 0.6457 at 0.7444. For now, this will be the favored case as long as 55 D EMA (now at 0.6715) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance NZD Jun | 9M | 235M | 46M | 52M |

| 23:00 | AUD | Manufacturing PMI Jul P | 49.6 | 48.2 | ||

| 23:00 | AUD | Services PMI Jul P | 48 | 50.3 | ||

| 00:30 | JPY | Manufacturing PMI Jul P | 49.4 | 50.1 | 49.8 | |

| 07:15 | EUR | France Manufacturing PMI Jul P | 46.1 | 46 | ||

| 07:15 | EUR | France Services PMI Jul P | 48.4 | 48 | ||

| 07:30 | EUR | Germany Manufacturing PMI Jul P | 41.2 | 40.6 | ||

| 07:30 | EUR | Germany Services PMI Jul P | 53.1 | 54.1 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Jul P | 43.5 | 43.4 | ||

| 08:00 | EUR | Eurozone Services PMI Jul P | 51.5 | 52 | ||

| 08:30 | GBP | Manufacturing PMI Jul P | 46.1 | 46.5 | ||

| 08:30 | GBP | Services PMI Jul P | 53.1 | 53.7 | ||

| 13:45 | USD | Manufacturing PMI Jul P | 46.3 | |||

| 13:45 | USD | Services PMI Jul P | 54.4 |