British Pound is making broad recoveries following stronger than anticipated retail sales, although signs of a durable rebound remain elusive. Concurrently, Japanese Yen displayed general weakness. Despite solid inflation data from Japan, the figures were not robust enough to force a policy shift from BoJ. Australian and New Zealand Dollars trailed as the next weakest, while Dollar pared some of its gains following yesterday’s rally. Canadian Dollar remained mixed, as investors anticipate retail sales data from Canada.

Looking at the week as a whole, Sterling remained one of the worst performers as traders scaled back their bets on aggressive rate hike from BoE following the latest CPI data. New Zealand Dollar fared slightly worse, with Yen and Aussie not far behind. Contrarily, Canadian Dollar emerged as the strongest performer, followed by Dollar, and then Swiss Franc.

Technically, the breaks of 1.1173 minor support in EUR/USD and 0.8629 minor resistance in USD/CHF argue that Dollar is turned into a consolidation phase. There is no clear sign of reversal for the greenback yet, and thus upside of current recovery could be limited. Gold is also in a retreat after hitting 1987.22. But as long as 1945.57 support holds, further rise is in favor to 2000 handle and above after the consolidation completes.

In Asia, Nikkei closed down -0.57%. Hong Kong HSI is up 0.53%. China Shanghai SSE is down -0.05%. Singapore Strait Times is down -0.05%. Japan 10-year JGB yield is up 0.0198 at 0.479. Overnight, DOW rose 0.47%. S&P 500 dropped -0.68%. NASDAQ dropped -2.05%. 10-year yield rose 0.112 to 3.854.

UK retail sales volume rose 0.7% mom in Jun, sales value up 0.7% mom

UK retail sales volume rose 0.7% mom in June, well above expectation of 0.2% mom. Retail sales value also rose 0.7% mom. During the month, sales volumes increased across all the main sectors (food, non-food and non-store retailing) except automotive fuel.

Quarterly comparing with the three months to March, sales volume rose 0.4 in the three months to June. Sales value rose 1.7

Comparing with the same month a year ago, sales volume dropped -1.0% yoy. Sales value rose 4.3% yoy.

Japan CPI core ticked up to 3.3% yoy, CPI core-core edged down to 4.2% yoy

Japan’s Core CPI, which excludes food, matched expectations, also ticked up from 3.2% yoy to 3.3% yoy. This marks the 15th month that the inflation reading has remained above BoJ’s 2% target.

Meanwhile, CPI core-core, which excludes both food and energy, dropped marginally from 4.3% yoy to 4.2% yoy, aligning with expectations. This slight decrease represents the index’s first slowdown since January 2022. Headline CPI edged higher from 3.2% yoy to 3.3% yoy in June, surpassing 3.2% yoy expectation.

Looking at some details, service prices slightly decelerated from 1.7% yoy to 1.6% yoy. Nevertheless, food prices remained robust, rising by 9.2% yoy. A significant increase was also observed in durable household goods, which rose by 6.7% yoy. Conversely, energy prices fell by -6.6% yoy.

These figures raises the probability of BoJ making an upward revision to its inflation outlook for the current fiscal year, with its two-day policy-setting meeting slated for next week. However, BOJ might still perceive the economy as being far from a virtuous cycle of higher wages, robust consumption, and further price hikes. As Governor Kazuo Ueda indicated earlier this week, if this assumption holds true, “our overall narrative on monetary policy remains unchanged.”

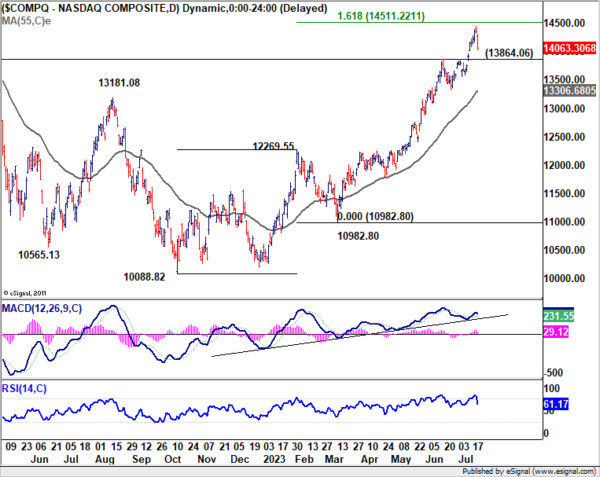

NASDAQ poised for deeper correction

US stocks ended mixed overnight, driven primarily by disparate earnings results. DOW registered its first 9-day rally since 2017, gaining 0.47%, largely boosted by better-than-expected earnings results from pharmaceutical giant Johnson & Johnson. On the other hand, the tech-heavy NASDAQ slipped -2.05% due to disappointing results from streaming giant Netflix and electric carmaker Tesla.

The notable pullback in NASDAQ suggests that US stock markets could be broadly transitioning into a consolidation phase. This shift happens in anticipation of the FOMC rate decision scheduled for next week, followed by crucial employment data in the subsequent week.

From a technical perspective, NASDAQ could be bracing for a deeper correction, given that it was already close to 161.8% projection of 10088.82 to 12269.55 from 10982.80 at 14511.22. Break of 13864.06 resistance turned support would likely trigger deeper fall to 55 D EMA (now at 13306.68).

Should this scenario transpire, it should confirm a near term shift in risk sentiment, potentially providing a boost to Dollar and extending its current rebound.

Looking ahead

Canada retail sales is the main feature for the rest of the day, while new housing price index will also be released.

EUR/GBP Daily Outlook

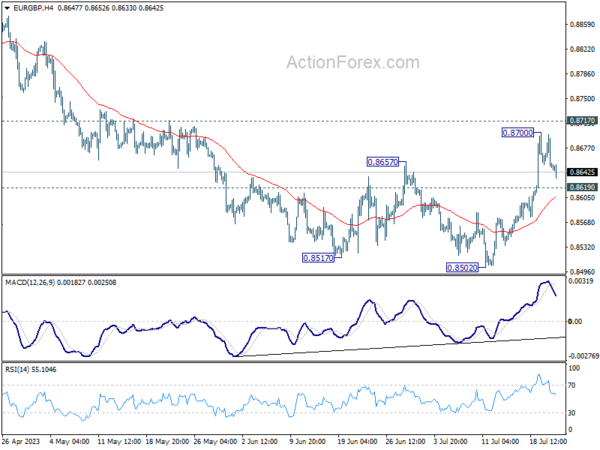

Daily Pivots: (S1) 0.8633; (P) 0.8666; (R1) 0.8682; More…

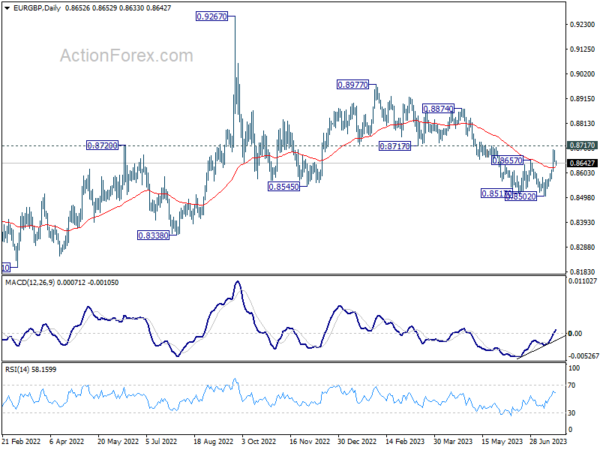

Intraday bias in EUR/GBP is turned neutral with current retreat. Outlook is unchanged that fall from 0.8977 might have completed its five-wave sequence. Firm break of 0.8717 support resistance will solidify this bullish case and target 0.8977 resistance next. On the downside, though, below 0.8619 minor support will mix up the outlook and turn bias back to the downside for retesting 0.8502 low.

In the bigger picture, the down trend from 0.9267 (2022 high) is seen as part of the long term range pattern from 0.9499 (2020 high). Firm break of 0.8717 support turned resistance will argue that it has completed with three waves down to 0.8502. Further break of 0.8977 will bring retest o f0.9267 high. Nevertheless, break of 0.8502 will resume the decline towards 0.8201 (2022 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Jul | -30 | -26 | -24 | |

| 23:30 | JPY | National CPI Y/Y Jun | 3.30% | 3.20% | 3.20% | |

| 23:30 | JPY | National CPI Core Y/Y Jun | 3.30% | 3.30% | 3.20% | |

| 23:30 | JPY | National CPI Core-Core Y/Y Jun | 4.20% | 4.20% | 4.30% | |

| 06:00 | GBP | Retail Sales M/M Jun | 0.70% | 0.20% | 0.30% | 0.10% |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Jun | 17.7B | 20.7B | 19.2B | 15.8B |

| 12:30 | CAD | Retail Sales M/M May | 0.50% | 1.10% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M May | 0.20% | 1.30% | ||

| 12:30 | CAD | New Housing Price Index M/M Jun | 0.00% | 0.10% |