Today’s release of US ADP jobs data, showing stellar job growth yet continuing slowdown in wage growth, has left Dollar traders seemingly indecisive. Treasury yields have surged post-release, with 2-year year yield hitting its highest level since 2007 and benchmark 10-year yield breaking 4% threshold. US futures have also seen a tumble, driven by expectations of extended Fed tightening. However, Dollar’s rebound against Yen has been mild at best, and the greenback is facing an uphill struggle against Euro and Sterling. This indicates a complex interplay of risk aversion and rising yields on Dollar.

The more consistent development is that Canadian Dollar’s extended selloff, and Australian Dollar is also trading lower. On the other hand, Sterling has emerged as the front-runner for the day, supported by continued buying against Euro during European trading session. Euro and Swiss Franc are also on the firmer side. Yen suffers some selloff in early US session and looks vulnerable to further decline ahead.

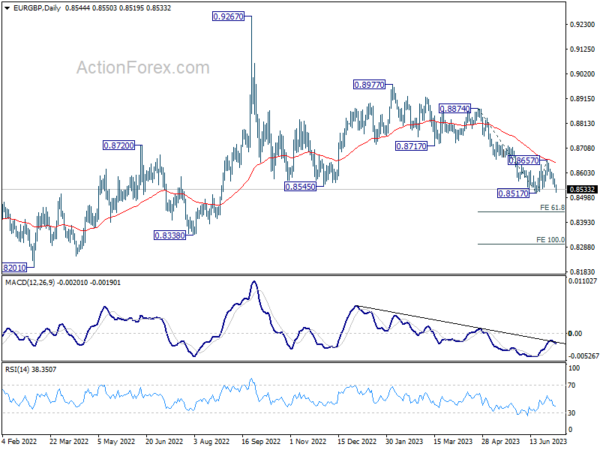

Technically, EUR/GBP looks ready to break through 0.8517 support to resume the decline from 0.8977. In this case, next target will be 61.8% projection of 0.8874 to 0.8517 from 0.8650 at 0.8436. GBP/JPY might take the lead on breaking through 183.99 temporary top. GBP/USD could follow later and breaks through 1.2847 resistance.

In Europe, at the time of writing, FTSE is down -1.69%. DAX is down -1.64%. CAC is down -2.31%. Germany 10-year yield is up 0.1261 at 2.607. Earlier in Asia, Nikkei dropped -1.70%. Hong Kong HSI dropped -3.02%. China Shanghai SSE dropped -0.54%. Singapore Strait Times dropped -1.10%. Japan 10-year JGB yield rose 0.0246 to 0.412.

US ADP surged 497k, but wages growth continues to ebb

US ADP private employment grew 497k in June, well above expectation of 250k. By industry, goods-producing jobs increased 124k while service-providing jobs rose 373k. By establishment size, small companies added 299k jobs, medium companies added 183k, large companies cut -8k.

Annual pay growth of job-stayers slowed from 6.6% yoy to 6.4% yoy. For job-changers, pay gains slowed for the 12th straight month to 11.2% yoy, slowest pace since October 2021.

“Consumer-facing service industries had a strong June, aligning to push job creation higher than expected,” said Nela Richardson, chief economist, ADP. “But wage growth continues to ebb in these same industries, and hiring likely is cresting after a late-cycle surge.”

US initial jobless claims rose to 248k, slightly below expectation

US initial jobless claims rose 12k to 248k in the week ending July 1, slightly below expectation of 249k. Four-week moving average of initial claims dropped -3.5k to 253k.

Continuing claims dropped -13k to 1720k in the week ending June 24. Four-week moving average of continuing claims dropped -9k to 1747k.

Eurozone retail sales flat in May, EU down -0.1% mom

Eurozone retail sales volume was unchanged in May, compared with the prior month. Volume of retail trade decreased by -0.5% mom for food, drinks and tobacco and by -0.3% mom for automotive fuels, while it increased by 0.1% mom for non-food products.

EU retail sales fell -0.1% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were registered in Slovenia (-5.3%), Luxembourg (-4.5%) and Poland (-3.7%). The highest increases were observed in Romania (+3.3%), Portugal (+3.2%) and Sweden (+1.6%).

BoE Bailey can’t tell when interest rates start to come down

In an interview with BBC’s Newsround, BoE Governor Andrew Bailey retrained from providing a definite timeline for potential decreases in interest rates. Instead, he emphasized the necessity of bringing inflation under control.

“I can’t give you a date as to when interest rates start to come down because that really depends upon what happens over the period of time ahead, but getting inflation down is the most important thing that we have to do,” Bailey stated.

Offering a glimmer of optimism, Bailey noted a discernible reduction in inflation. He predicted a noticeable fall in inflation rates and affirmed the bank’s dedication to lowering it to their target level of 2%.

Inflation “has already started to come down and I expect … quite a marked fall in inflation, we’ll notice it. What we have to do is set the interest rate to get it all the way down to 2%,” he expounded.

UK PMI construction fell to 48.9, contracts on rising borrowing costs and weaker housing market

UK’s construction sector faced a downturn in June as PMI fell from 51.6 in May to 48.9, falling short of 50.9 expectation. This marks the first contraction in construction activity in five months, driven primarily by the fastest decline in residential work witnessed in over three years.

Tim Moore, Economics Director at S&P Global Market Intelligence, explained the contraction, stating, “Weaker housing market conditions in the wake of higher borrowing costs acted as a major constraint on UK construction output in June.” According to him, the steep downturn in residential work since May 2020—excluding the slump during lockdown—has been the most rapid in over 14 years.

On a positive note, input prices decreased for the first time since January 2010, a potential silver lining for the construction sector. Additionally, supplier performance improved at its fastest pace in 14 years, signalling some resilience despite the prevailing industry headwinds. However, recent contraction raises concerns about the health of construction sector amidst rising borrowing costs and a cooling housing market.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 144.26; (P) 144.49; (R1) 144.91; More…

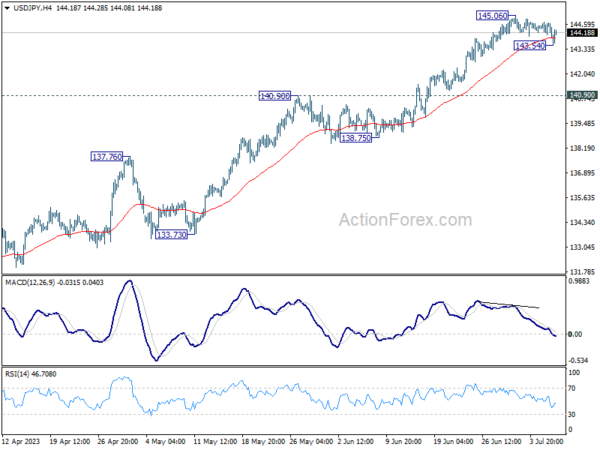

Intraday bias in USD/JPY is turned neutral again as it recovered quickly after dipping to 143.54. Overall outlook remains bullish with 140.90 resistance turned support intact. Break of 145.06 will resume larger rise to 161.8% projection of 127.20 to 137.90 from 129.62 at 146.93. On the downside, break of 143.54 will turn bias to the downside for deeper correction.

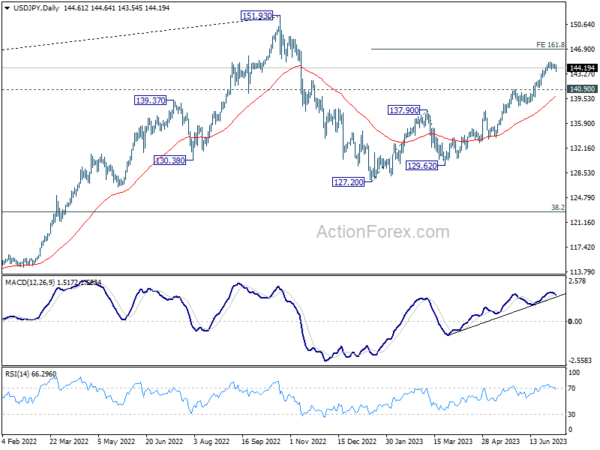

In the bigger picture, rise from 127.20 is currently seen as the second leg of the corrective pattern from 151.93 high. Further rally is expected as long as 138.75 support holds, to retest 151.93. But strong resistance could be seen there to limit upside. Break of 138.75 will indicate the the third leg has started back towards 127.20.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) May | 11.79B | 10.70B | 11.16B | |

| 06:00 | EUR | Germany Factory Orders M/M May | 6.40% | 1.50% | -0.40% | 0.20% |

| 08:30 | GBP | Construction PMI Jun | 48.9 | 50.9 | 51.6 | |

| 09:00 | EUR | Eurozone Retail Sales M/M May | 0.00% | 0.20% | 0.00% | |

| 11:30 | USD | Challenger Job Cuts Jun | 25.20% | 286.70% | ||

| 12:15 | USD | ADP Employment Change Jun | 497K | 250K | 278K | 267K |

| 12:30 | USD | Initial Jobless Claims (Jun 30) | 248K | 249K | 239K | 236K |

| 12:30 | USD | Trade Balance (USD) May | -69.0B | -68.2B | -74.6B | |

| 12:30 | CAD | Trade Balance (CAD) May | -3.4B | 1.5B | 1.9B | 0.9B |

| 13:45 | USD | Services PMI Jun F | 54.1 | 54.1 | ||

| 14:00 | USD | ISM Services PMI Jun | 51.3 | 50.3 | ||

| 14:30 | USD | Crude Oil Inventories | -2.0M | -9.6M |