In the currency trading arena, there’s been a notable lack of movement today. Gold has caught the market’s attention, sliding past the 1900 psychological level. Yet Dollar remains relatively undisturbed, also showing no significant response to the latest jobless claim data and Q1 GDP final figures. Likewise, the release of higher-than-anticipated German CPI data sparked only a fleeting and mild rally in Euro, lacking subsequent follow-through. Despite today’s tranquil conditions, market participants are bracing for potential turbulence tomorrow, as data releases including China’s PMIs, Eurozone’s CPI flash, and US PCE inflation data are slated.

So far this week, US Dollar and Euro are neck-and-neck in the contest for the strongest currency, with Swiss Franc hot on their heels. Australian and New Zealand Dollars are battling it out to avoid the week’s weakest currency title, though Canadian Dollar may still swoop in and claim that unenviable status. Japanese Yen finds itself in the middle of the pack, trading within a consolidation range, under threat potential government intervention. British Pound is showing signs of weakness, but any significant depreciation is yet to materialize.

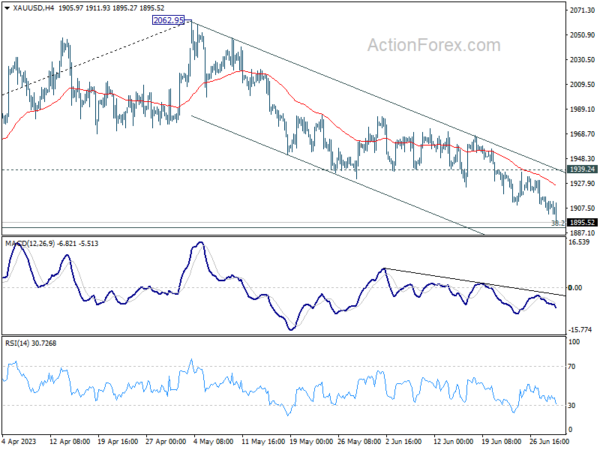

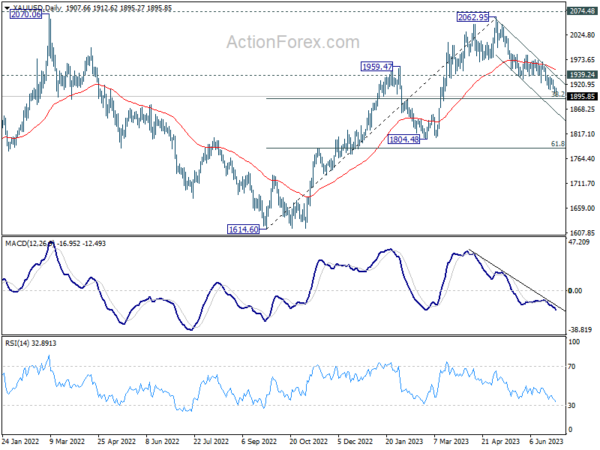

Technically, Gold is now quickly approaching fibonacci support at 38.2% retracement of 1614.60 to 2062.95 at 1891.68. Strong rebound from that level, followed by break of 1939.24 resistance, will be the first sign of bottoming, and keep the decline from 2062.95 as a near term correction only. However, sustained break of 1891.68 would raise the chance of trend reversal. Or, at least that would open up deeper fall to 1804.48, and possibly to 61.8% retracement at 1785.86.

In Europe, at the time of writing, FTSE is down -0.48%. DAX is down -0.03%. CAC is up 0.44%. Germany 10-year yield is up 0.072 at 2.391. Earlier in Asia, Nikkei rose 0.12%. Hong Kong HSI dropped -1.24%. China Shanghai SSE dropped -0.22%. Singapore Strait Times rose 0.06%. Japan 10-year JGB yield dropped -0.0041 to 0.384.

Fed Powell: A long way to go to bring inflation down to 2%

In a speech today, Fed Chair Jerome Powell underscored the ongoing battle with inflation, asserting, “Inflation pressures continue to run high, and the process of getting inflation back down to 2 percent has a long way to go.”

He added that “a strong majority of Committee participants expect that it will be appropriate to raise interest rates two or more times by the end of the year,” referring to the latest dot plot.

Powell painted a mixed picture of the U.S. economy. He noted that “recent indicators suggest that economic activity has continued to expand at a modest pace.” He also pointed to the effects of higher interest rates and slower output growth on business fixed investment.

His comments also highlight the persistent tightness in the labor market. “Over the past three months, payroll job gains have been robust,” Powell said, adding that “labor demand still substantially exceeds the supply of available workers.” Nevertheless, he also observed “some easing in nominal wage growth, and declining vacancies.”

Fed Bostic not seeing urgency to hike again as by others including Powell

Atlanta Fed President Raphael Bostic signaled a more cautious stance on interest rate hikes, contrary to some of his peers’ sentiments. he said, “I don’t see as much urgency to move as stated by others, including my Chair,” expressing his willingness to assess further signs of economic slowdown before advocating for more aggressive action.

Bostic highlighted the fact that Fed has “only been in restrictive territory for 8-10 months”. He is waiting for “more signs that a slowdown is happening in the next several months”.

Nevertheless, Bostic left room for adaptability based on incoming data. He remarked, “If inflation moves away from target or seems to significantly stall out, then we’ll probably have to do more.” However, he also noted that, “We’re not seeing either of those right now.”

US initial jobless claims dropped to 239k, vs exp. 265k

US initial jobless claims dropped -26k to 239k in the week ending June 24, below expectation of 265k. Four-week moving average of initial claims rose 1.5k to 257.5k, highest since November 13, 2021 when it was 260k.

Continuing claims dropped -19k to 1742k in the week ending June 17. Four-week moving average of continuing claims dropped -13k to 1758k.

Eurozone economic sentiment fell to 95.3, EU down to 94.0

Eurozone Economic Sentiment Indicator dropped from 96.4 to 95.3 in June, slightly below expectation of 96.0. Employment Expectations Indicator rose from 104.6 to 105.0. Economic Uncertainty Indicator dropped from 21.6 to 20.4. Industry confidence fell from -5.3 to -7.2. Services confidence fell from 7.1 to 5.7. Retail trade confidence fell from -5.3 to -6.0. Construction confidence fell from -0.3 to -2.0. Consumer confidence improved from -17.4 to -16.1.

EU Economic Sentiment Indicator fell from 95.1 to 94.0. Employment Expectation Indicator rose from 103.9 to 104.3. Economic Uncertainty Indicator dropped from 21.2 to 20.1. Amongst the largest EU economies, the ESI deteriorated in Germany (-1.9), Italy (-1.1), the Netherlands (-1.0) and Spain (-0.9), while it remained virtually unchanged in Poland (-0.1) and improved in France (+0.8).

Japan retail sales rose 1.3% mom, 5.7% yoy, beat expectations

In the latest release from Japan, retail sales rose 1.3% mom, surpassing the anticipated increase of 0.8% mom. This growth also reflects a robust 5.7% yoy rise, again beating expectations of 5.2% year-on-year.

While inflation remaining above 3% mark could have been a contributing factor in boosting retail sales, there is evidence to suggest that return of overseas tourists is also playing a substantial role in stimulating economic activity.

Earlier reports from Japan National Tourism Organization highlighted that number of overseas visitors is nearing 70% of pre-pandemic levels as of May, indicating a resilient recovery of the tourism sector, and with it, potential for further economic growth.

In separate release, Consumer Confidence index nudged up from 36.0 to 36.2. This is the highest reading observed since January 2022, suggesting that households are more optimistic about the economy’s trajectory. This could potentially translate into a higher propensity to spend, further bolstering retail sales and overall economic performance in the coming months.

NZ ANZ business confidence rose to -18, subtle signs of easing inflation pressures

New Zealand ANZ Business Confidence Index improved notably from -31.1 to -18.0 in June, marking the highest level since November 2021. Furthermore, the outlook for their own activity rose from -4.5 to 2.7, turning positive for the first time in 14 months.

Digging into the details reveals a more nuanced picture. Despite the improved overall business sentiment, export intentions dipped from 2.0 to -1.8. However, there were more encouraging signs in other areas: investment intentions rose from -6.8 to -2.7, and employment intentions followed suit, moving from -5.7 to -3.5. Meanwhile, pricing intentions have shown a modest decline from 52.4 to 49.3.

On the inflation front, there are tentative signs that pressures might be easing slightly. Cost expectations dropped from 84.1 to 76.0, and inflation expectations decreased from 5.47% to 5.29%. There was also a slight improvement in profit expectations, which rose from -27.4 to -24.1.

Commenting on the results, ANZ noted, “for now, cautious optimism appears to be emerging that the worst could be past – but it’s conditional on those inflation indicators continuing to fall.”

Australia retail sales rose 0.7% mom, boosted by sales events

Australia retail sales turnover rose 0.7% mom to AUD 35.52B in May, well above expectation of 0.1% mom. Through the year, sales turnover was up 4.2% yoy.

Ben Dorber, ABS head of retail statistics, said: “Retail turnover was supported by a rise in spending on food and eating out, combined with a boost in spending on discretionary goods.

“This latest rise reflected some resilience in spending with consumers taking advantage of larger than usual promotional activity and sales events for May.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0883; (P) 1.0928; (R1) 1.0957; More…

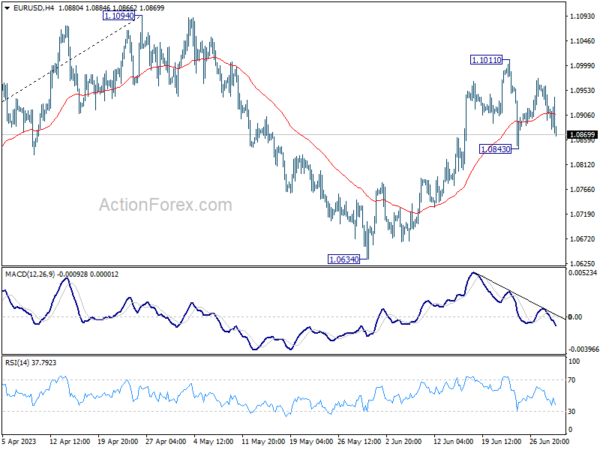

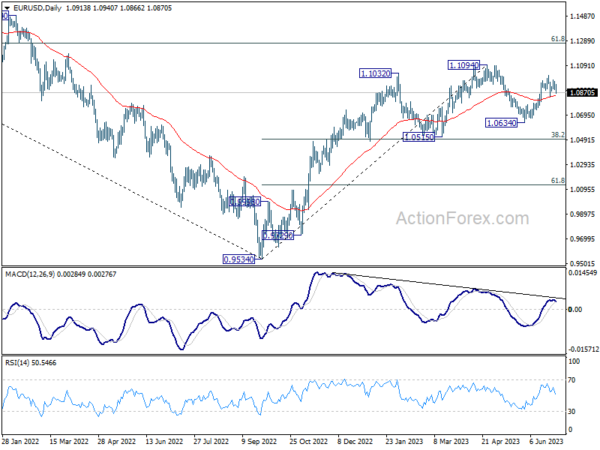

EUR/USD is extending the sideway pattern from 1.1011 and intraday bias stays neutral. For now, further rally is still mildly in favor. Break of 1.1011 will resume the rise from 1.0634 and target 1.1094 resistance. Decisive break there will resume larger up trend from 0.9534. However, break of 1.0843 will turn bias to the downside for 1.0634 support instead.

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | 5.70% | 5.20% | 5.00% | 5.10% |

| 01:00 | NZD | ANZ Business Confidence Jun | -18 | -31.1 | ||

| 01:30 | AUD | Retail Sales M/M May | 0.70% | 0.10% | 0.00% | |

| 05:00 | JPY | Consumer Confidence Jun | 36.2 | 36.2 | 36 | |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:30 | GBP | Mortgage Approvals May | 51K | 50K | 49K | |

| 08:30 | GBP | M4 Money Supply M/M May | 0.20% | -0.10% | 0.00% | |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Jun | 95.3 | 96 | 96.5 | |

| 09:00 | EUR | Eurozone Industrial Confidence Jun | -7.2 | -5.5 | -5.2 | |

| 09:00 | EUR | Eurozone Services Sentiment Jun | 5.7 | 5.5 | 7 | |

| 09:00 | EUR | Eurozone Consumer Confidence Jun F | -16.1 | -16.1 | -16.1 | |

| 12:00 | EUR | Germany CPI M/M Jun P | 0.30% | 0.20% | -0.10% | |

| 12:00 | EUR | Germany CPI Y/Y Jun P | 6.40% | 6.30% | 6.10% | |

| 12:30 | USD | Initial Jobless Claims (Jun 23) | 239K | 265K | 264K | 265K |

| 12:30 | USD | GDP Annualized Q1 F | 2.00% | 1.30% | 1.30% | |

| 12:30 | USD | GDP Price Index Q1 F | 4.10% | 4.20% | 4.20% | |

| 14:00 | USD | Pending Home Sales M/M May | -0.30% | 0.00% | ||

| 14:30 | USD | Natural Gas Storage | 83B | 95B |