Trading has remained muted as major markets recuperate from a lengthy weekend. Investors are not reacting dramatically to the agreement regarding US debt ceiling. Instead, they are casting a cautious eye towards Congress, awaiting indications of how the deal will be received. Compounding the apprehension, a slew of significant economic data is slated for release in the latter half of this week. Reports such as Eurozone CPI flash and US non-farm payrolls are bound to generate increasing market volatility as the week progresses.

In the midst of these developments, the currency markets are seeing Yen emerge as one of the stronger performers this week, alongside the Swiss Franc. However, it’s important to note that Yen’s strength seems to be a result of digesting the deep losses incurred earlier in the month. This suggests a resumption of the sell-off could occur at any time, contingent on the broader trends in equity and bond markets.

Meanwhile, commodity currencies are bearing the brunt of the downturn, led by Australian Dollar, which is succumbing to the weight of faltering Chinese equities. Dollar and Euro are straddling a middle ground, showing a mixed performance.

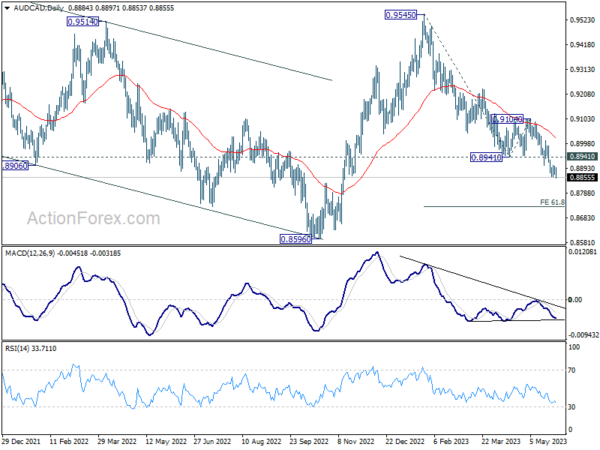

Technically, AUD/CAD is now extending recent down trend from 0.9545, with break of last week’s low. Near term outlook will stay bearish as long as 0.8941 support turned resistance holds. Next target is 61.8% projection of 0.9545 to 0.8941 from 0.9104 at 0.8731. A simultaneous focus is when AUD/USD would break through 0.6489 temporary low to resume the corresponding down trend from 0.7156 too.

In Asia, at the time of writing, Nikkei is up 0.42%. Hong Kong HSI is down -0.75%. China Shanghai SSE is down -0.92%. Singapore Strait Times is up 0.04%. Japan 10-year JGB yield is down -0.001 at 0.435.

In Asia, at the time of writing, Nikkei is up 0.42%. Hong Kong HSI is down -0.75%. China Shanghai SSE is down -0.92%. Singapore Strait Times is up 0.04%. Japan 10-year JGB yield is down -0.001 at 0.435.

ECB De Cos: Closer to end of tightening, prolonged restrictive rates necessary

ECB Governing Council member, Pablo Hernandez de Cos, expressed his thoughts on the direction of ECB’s monetary policy during a speech yesterday.

In his remarks, de Cos stated, “We think that we still have some way to go in tightening monetary policy, although we also think that we are closer to the end.” This suggests a continued commitment to ECB’s policy of monetary tightening, albeit with the recognition that this phase might be nearing its completion.

Furthermore, de Cos underscored the necessity of maintaining restrictive interest rates over a substantial duration. The intention behind this strategy, he explained, is to ensure ECB’s objectives are achieved in a consistent manner over time.

BoJ Ueda: Will patiently continue monetary easing

In today’s parliamentary address, BoJ Kazuo Ueda laid out the central bank’s approach to an evolving inflation scenario in Japan. Governor Ueda announced, “We expect inflation to quite clearly slow below 2%” as we move further into the current fiscal year.

Despite this imminent deceleration, BoJ is forecasting a subsequent rebound, albeit with a degree of caution. Ueda added, “Inflation is likely to rebound thereafter … though there is high uncertainty” about the future direction of inflation rates.

In response to these trends, BoJ plans to remain patient and maintain its current approach to monetary policy. Ueda affirmed the central bank’s commitment to its strategy, stating, “(We) will patiently continue monetary easing as there’s still distance to achievement of sustainable and stable 2% price hikes together with continued rises in wages.”

US NFP and ISM; Eurozone CPI and ECB accounts

As speculation intensifies around the possibility of a Fed rate hike in June, all eyes will be on the forthcoming non-farm payroll data. The report could be a significant determining factor for both traders and Fed officials, as it provides insight into the state of the labor market and potential need for further monetary tightening. Aspects such as headline job growth, unemployment rate, and wage growth will be scrutinized closely. Moreover, the ISM Manufacturing Index, which showcases the ongoing challenges in the sector, is also anticipated with interest.

Turning to the Eurozone, two key events are expected to make headlines – CPI flash estimate and ECB meeting accounts. ECB has been explicit about its intention to continue tightening its monetary policy, with the apex expected to be reached by the summer. However, uncertainty prevails over the specific month and rate of this peak, largely depending on the pace at which core inflation decelerates.

Elsewhere, much attention will also be on Australia CPI and China PMIs.

Here are some highlights for the week:

- Tuesday: New Zealand building permit; Australia building approvals; Japan unemployment rate; Swiss GDP, KOF; Eurozone M3 money supply; Canada current account; US house price index, consumer confidence.

- Wednesday: Japan industrial production, retail sales, consumer confidence, housing starts; New Zealand ANZ business confidence; Australia CPI. China PMIs; Germany import prices, unemployment, CPI flash; Swiss retail sales, Credit Suisse economic expectations; France GDP, consumer spending; Canada GDP; US Chicago PMI, Fed’s Beige Book.

- Thursday: Japan capital spending, PMI manufacturing final; Australia private capital expenditure, retail sales; China Caixin PMI manufacturing; Germany retail sales; Swiss trade balance, PMI manufacturing; Eurozone PMI manufacturing final, CPI flash, unemployment rate, ECB accounts; UK PMI manufacturing final, M4 money supply, mortgage approvals; US ADP employment, jobless claims, ISM manufacturing.

- Friday: New Zealand terms of trade; Japan monetary base; US non-farm payrolls.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6521; (P) 0.6538; (R1) 0.6556; More…

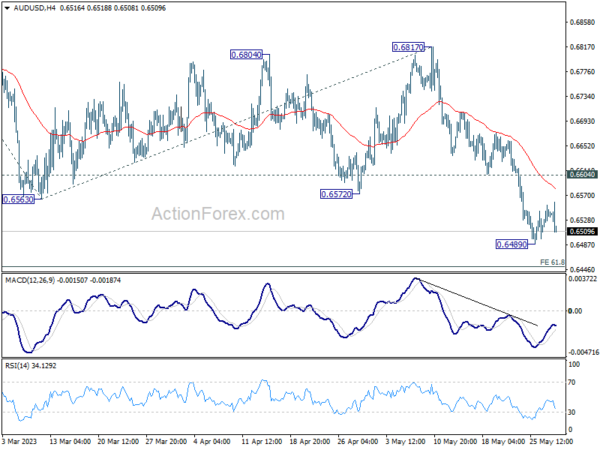

Intraday bias in AUD/USD remains neutral first as consolidation from 0.6489 temporary low is extending. Upside of recovery should be limited by 0.6604 support turned resistance to bring another decline. Break of 0.6489 will resuming larger down trend, and target 61.8% projection of 0.7156 to 0.6563 from 0.6817 at 0.6451. Firm break there will target 100% projection at 0.6224.

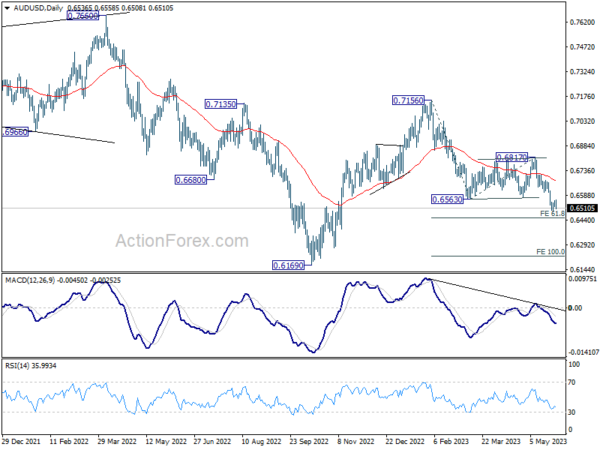

In the bigger picture, rejection by 55 W EMA (now at 0.6822) keeps medium term outlook bearish. Current development suggests that down trend from 0.8006 (2021 high) is possibly still in progress. Retest of 0.6169 (2022 low) should be seen next. Firm break there will confirm down trend resumption. For now, this will remain the favored case as long as 0.6817 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Apr | -2.60% | 7.00% | 6.60% | |

| 23:30 | JPY | Unemployment Rate Apr | 2.60% | 2.70% | 2.80% | |

| 01:30 | AUD | Building Permits M/M Apr | -8.10% | 2.30% | -0.10% | -1.00% |

| 07:00 | CHF | KOF Leading Indicator May | 95.3 | 96.4 | ||

| 07:00 | CHF | GDP Q/Q Q1 | 0.10% | 0.00% | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Apr | 2.10% | 2.50% | ||

| 09:00 | EUR | Eurozone Economic Sentiment May | 99 | 99.3 | ||

| 09:00 | EUR | Eurozone Industrial Confidence May | -4 | -2.6 | ||

| 09:00 | EUR | Eurozone Services Sentiment May | 10 | 10.5 | ||

| 09:00 | EUR | Eurozone Consumer Confidence May F | -17.4 | -17.4 | ||

| 12:30 | CAD | Current Account (CAD) Q1 | -9.9B | -10.6B | ||

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Mar | -1.70% | 0.40% | ||

| 13:00 | USD | Housing Price Index M/M Mar | 0.30% | 0.50% | ||

| 14:00 | USD | Consumer Confidence May | 99.1 | 101.3 |