Dollar is trading as the strongest one for the week. The greenback was lifted by talks that John Taylor is considered a hawk and has impressed US President Donald Trump in Fed chair interview. But momentum in the greenback is rather weak as it struggled to extend gains in late US session. Dollar was also weighed down mildly by falling yields, with 10 year yield closed down -0.09 at 2.298. Sterling is extending this week’s decline as markets are reassessing the dovish possibilities of November BoE meeting. Meanwhile, Canadian Dollar rebounded as NAFTA negotiation is extended. UK job data will be the main focus today. Markets will also keep an eye on Chinese Communist Party Congress in Beijing.

Trump likes Taylor for his hawkishness? Or flexibility?

Dollar’s rally since yesterday was built on top of speculations that Standford University economist John Taylor is catching up in the race as the next Fed chair. Analysts point to the fact that Taylor is known for the so called Taylor rule, which implies higher interest rate. He has also criticized Fed’s ultra-loose monetary policy before and is seen by some as the most hawkish candidate. However, we’d like to point out again that firstly, US President Donald Trump would likely prefer someone who he can work well with, rather than someone who’s most suitable for the job. Or maybe in better words, Trump would see someone he can work well with as the most suitable one, not from Fed’s operation nor market stability angle. Secondly, Taylor has demonstrated his flexibility in recent speeches, as he said that rules shouldn’t be used as a "way to tie central bankers’ hands." Instead, "there are reasons to run policy with a strategy." It could be his "flexibility" that impressed Trump, not his "hawkishness."

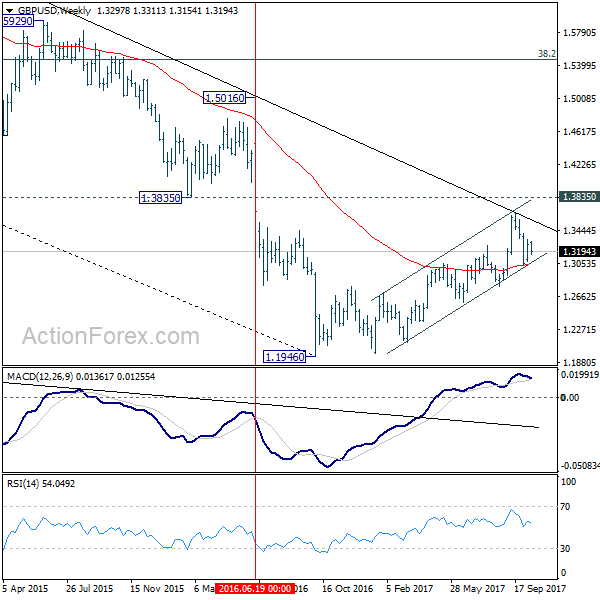

Markets reassessing dovish possibilities for BoE November meeting

Sterling was sold off yesterday even though CPI hit 3% level in September. BoE Governor Mark Carney also reiterated that "the judgment of the majority of the committee is some raise in interest rates over the coming months may be appropriate". The developments affirmed the central case of a November BoE hike. However, markets are starting to look at some dovish scenarios. Firstly, a November hike is still not a done deal, even though it’s the most likely scenario. Secondly, the vote split could be dovish if hawks just win by a margin. Thirdly and most importantly, it could just be a one-off. As we pointed out before, a 25bps hike just brings the Bank Rate back to pre-Brexit referendum level. Back then, GBP/USD was above 1.3835 key support level. And since then federal funds rate was raised from 0.50% to 1.25%, and another hike is coming in December. Based on this, a break above 1.3835 handle in GBP/USD is not justifiable. And upside potential is rather limited.

EU to start preparing trade talks with UK

Ahead of the EU summit later this week, officials are already starting to prepare for trade negotiation with UK after Brexit. It’s reported that EU is targeting to have a road map ready by December. And the after the December summit, it’s hopeful that sufficient progress is being made on the negotiations to move on to trade talks. But for the moment, preparation work will only be carried out within EU. EU’s chief Brexit negotiator said that "this week’s European Council will be a stepping stone toward the next get-together." And, "I have said we are ready to accelerate the rhythm, but to accelerate you need two." However, UK’s Brexit Secretary David Davis said yesterday that "we are reaching the limits of what we can achieve without consideration of the future relationship." Davis’s comments suggests he is unwilling to revolve the key issues of the "past" like the divorce bill, before talking about the "future" trade agreements.

Loonie rebounds as NAFTA negotiations extend

Canadian Dollar rebounded overnight on news regarding North American Free Trade Agreement negotiation. The fourth round of NAFTA negotiation concluded yesterday. U.S. Trade Representative Robert Lighthizer, Mexican Economy Minister Ildefonso Guajardo and Canadian Foreign Minister Chrystia Freeland jointly postponed the target from December to March 2018. The time between negotiating rounds were also extended to give everyone more room to study the proposals. This is seen as a sign of willingness to resolve the differences between the parties. While it’s unlikely, there were some speculations that NAFTA could be ripped to zero as the worst case scenario.

On the data front

Australia Westpac leading index rose 0.1% mom in September. UK employment data will be the key focus in European session. Later in the day, Canada will release manufacturing shipments. US will release housing starts and building permits. Fed will also release Beige Book economic reports.

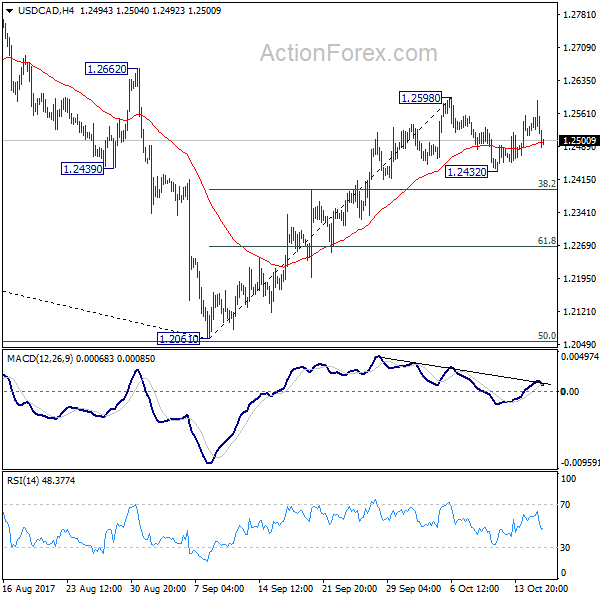

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2491; (P) 1.2541; (R1) 1.2569; More….

USD/CAD’s rebound was limited below 1.2598 and weakened again. Intraday bias is turned neutral first. Consolidation from 1.2598 is still in progress. In case of deeper fall, we’d now expect downside to be contained by 38.2% retracement of 1.2061 to 1.2598 at 1.2393 to bring rally resumption. On the upside, break of 1.2598 will extend the rebound from 1.2061 to 1.2777 resistance next.

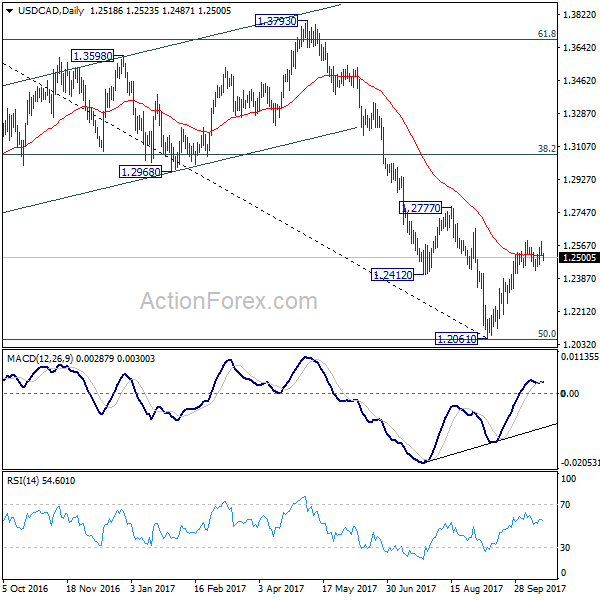

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4869 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Break of 1.2777 will further affirm this bullish case. That is, larger up trend from 0.9406 is not completed. And in that case, USD/CAD should target 1.3793 resistance next. However, on the other hand, firm break of 1.2048 will indicate that fall from 1.4689 is at least a medium term down trend and should target 61.8% retracement at 1.1424 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Sep | 0.10% | -0.08% | ||

| 08:30 | GBP | Jobless Claims Change Sep | 3.2K | -2.8K | ||

| 08:30 | GBP | Claimant Count Rate Sep | 2.30% | |||

| 08:30 | GBP | ILO Unemployment Rate 3M Aug | 4.30% | 4.30% | ||

| 08:30 | GBP | Average Weekly Earnings 3M/Y Aug | 2.10% | 2.10% | ||

| 12:30 | CAD | Manufacturing Shipments M/M Aug | -0.30% | -2.60% | ||

| 12:30 | USD | Housing Starts Sep | 1.18M | 1.18M | ||

| 12:30 | USD | Building Permits Sep | 1.25M | 1.27M | ||

| 14:30 | USD | Crude Oil Inventories | -2.7M | |||

| 18:00 | USD | Federal Reserve Beige Book |