Dollar continues to be the strongest one for the week and sees fresh buying in early US session. Republican House Speaker Kevin McCarthy noted the debt ceiling negotiations have made some progress. But that was largely ignored by stock investors, even through treasury yields are on the rise. As for today, Canadian Dollar and Swiss France are currently the next strongest, just because they’re facing less selling pressure. Kiwi, Aussie and Euro are the worst together with Euro.

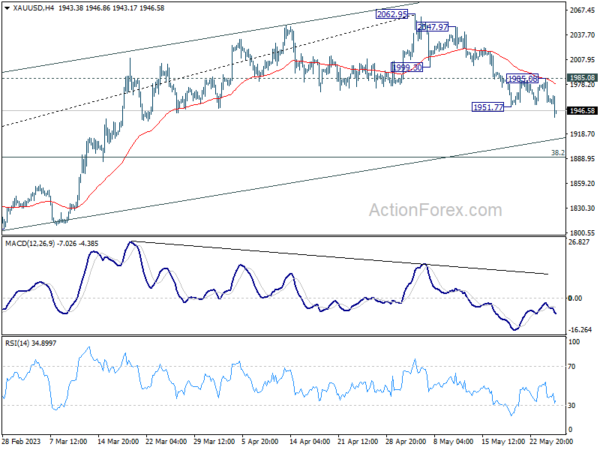

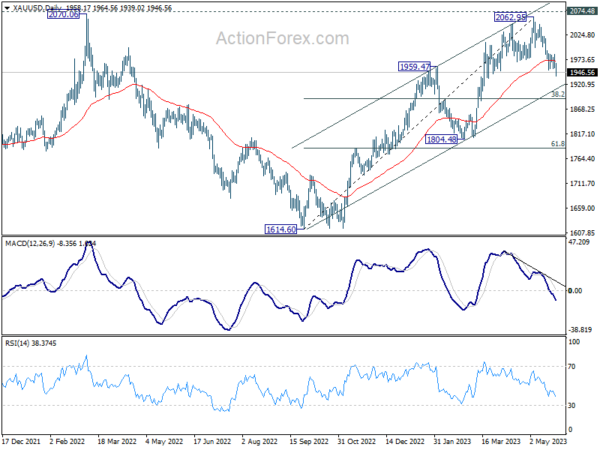

Technically, Gold’s decline from 2062.95 resumed by breaking through 1951.77 support today. Further fall is now expected as long as 1985.08 resistance holds. There might be some support between 38.2% retracement of 1614.60 to 2062.95 at 1891.68, and channel support at around 1913 to contain downside. That is, 1900 is a key hurdle for the down trend to overcome. However, firm break of this support zone could easily push gold towards 1800 handle.

In Europe, at the time of writing, FTSE is down -0.17%. DAX is up 0.05%. CAC is down -0.05%. Germany 10-year yield is up 0.007 at 2.480. Earlier in Asia, Nikkei rose 0.39%. Hong Kong HSI dropped -1.93%. China Shanghai SSE dropped -0.11%. Singapore Strait Times dropped -0.20%. Japan 10-year JGB yield rose 0.0215 to 0.430.

US initial jobless claims rose 2k to 229k

US initial jobless claims rose 4k to 229k in the week ending May 20, below expectation of 253k. Four-week moving average of initial claims was unchanged at 232k.

Continuing claims dropped -5k to 1794k in the week ending May 13. Four-week moving average of continuing claims dropped -12k to 1800k.

BoJ Ueda: No premature exit, but YCC tweak an option

BoJ Governor Kazuo Ueda stressed the importance of not prematurely tightening monetary policy to ensure that Japan can sustainably achieve its 2% inflation target. However, Ueda also suggested potential adjustments to the Yield Curve Control (YCC) if the policy’s benefits and costs shift.

As for Japan’s inflation forecast, Ueda expects consumer inflation to slow down as global fuel and raw material prices have begun to decline. Despite this projection, he did not entirely dismiss the possibility of needing to revise this outlook. “We can’t completely rule out the possibility that this projection could prove wrong,” Ueda said, adding, “If that’s the case and if we see the need to revise our forecast, we’d like to act swiftly.”

Ueda elaborated on possible modifications to the YCC policy. “If the BOJ were to modify YCC in the future, there are various ways of doing so,” he stated. One potential approach he mentioned was targeting bond yields in the five-year zone, rather than the current 10-year zone.

“But I won’t comment on whether we would definitely do so, how likely this could happen, or under what conditions the BOJ would see this option as desirable,” Ueda said.

ECB de Guindos: Will continue tightening path to overcome high inflation

ECB Vice President Luis de Guindos told lawmakers in Brussels today, “Our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our 2% medium-term target.” Then, interest rates will be “kept at those levels for as long as necessary,” he said.

“Within less than a year we have raised the key interest rate by 375 basis points so far, stopped net purchases of bonds, and will probably stop reinvesting via the APP program from July,” he said. “And the ECB Governing Council will continue on this monetary tightening path to overcome high inflation.”

“As the energy crisis fades, governments should roll back the related support measures promptly and in a concerted manner to avoid driving up medium-term inflationary pressures, which would call for a stronger monetary policy response,” de Guindos added.

Separately, Governing Council member, Bostjan Vasle, said “Further interest-rate increases will be needed.”

“But they’ll be smaller than they were in the past. We’re approaching the level of rates that’s restrictive enough to bring inflation back toward 2%. Fiscal — including wage policy — and monetary policies will have to be linked to a greater extent than in the past,” Vasle noted.

Germany Gfk consumer sentiment rose to -24.2, not showing a clear up trend

Germany Gfk consumer sentiment for June rose slightly from -25.8 to -24.2, above expectation of -24.5. In May, economic expectations dropped from 14.3 to 12.3. Income expectations rose from -10.7 to -8.2. Propensity to buy dropped from -13.1 to -16.1.

“Consumer sentiment is not showing a clear upward trend at present. As a result, the rise in consumer climate index has slowed again somewhat,” explains Rolf Bürkl, GfK consumer expert.

“A lower propensity to save has prevented the recovery in consumer sentiment from stagnating this month. However, it is still below the low level of spring 2020 during the first Covid-19 lockdown.”

RBNZ Orr sees potential for rate cut after early next year

In his address to the parliament’s finance and expenditure committee, RBNZ Governor Adrian Orr noted that the country’s interest rates are already significantly above neutral, thereby suppressing spending and investment.

“They (interest rates) are well above what we would consider neutral, are constraining spending and investment,” Orr said. He further stated, “The committee is confident monetary policy is restrictive and doing its job.”

Orr characterized yesterday’s 25bps rate hike as “an extra bit of insurance.” The RBNZ committee voted five to two in favor of raising the OCR with two dissenting votes advocating for holding. Orr was quick to downplay any notion of discord within the committee. “On the division in the committee, the voting, there is no division. It’s a committee decision,” he told the parliamentary committee.

Looking forward, Orr hinted that the RBNZ might start easing interest rates in early next year. “The committee expects the OCR to remain steady until early next year. At that point, we may be able to start easing interest rates,” he noted.

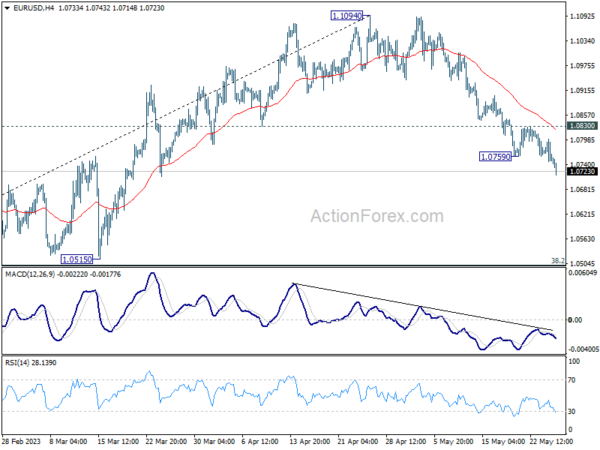

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0731; (P) 1.0766; (R1) 1.0784; More…

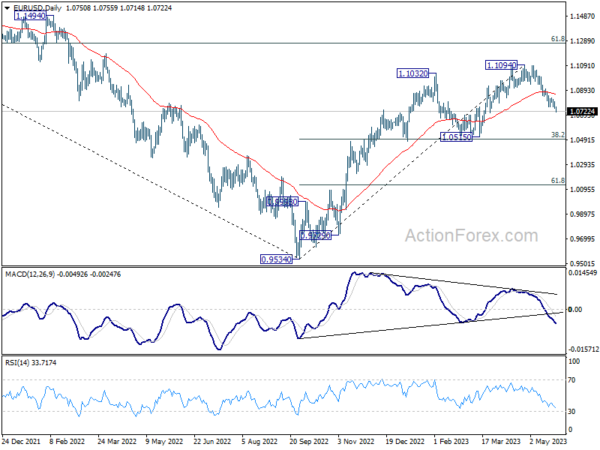

Intraday bias in EUR/USD is back on the downside as fall from 1.1094 resumes by breaking 1.0759. Current fall is seen as correcting whole up trend from 0.9534. Deeper decline should be seen to 1.0515 cluster support, 38.2% retracement of 0.9534 to 1.1094 at 1.0498. On the upside, above 1.0830 minor resistance will turn intraday bias neutral first.

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany Gfk Consumer Confidence Jun | -24.2 | -24.5 | -25.7 | -25.8 |

| 06:00 | EUR | Germany GDP Q/Q Q1 F | -0.30% | 0.00% | 0.00% | |

| 12:30 | USD | Initial Jobless Claims (May 19) | 229K | 253K | 242K | 225K |

| 12:30 | USD | GDP Price Index Q1 P | 4.20% | 4.00% | 4.00% | |

| 12:30 | USD | GDP Annualized Q1 P | 1.30% | 1.10% | 1.10% | |

| 14:00 | USD | Pending Home Sales M/M Apr | 1.20% | -5.20% | ||

| 14:30 | USD | Natural Gas Storage | 100B | 99B |