Dollar surged overnight trade and maintained its momentum into today’s Asian trading session. This robust performance followed the release of FOMC minutes, which depicted a high degree of uncertainty regarding the future trajectory of monetary policy. Despite this ambiguity, a pause in the tightening cycle by June does not necessarily signal its end, and any rate cuts appear to be a distant prospect.

Trailing behind the greenback, Euro ranks as the second strongest currency for the week so far, followed closely by Swiss Franc. Conversely, New Zealand Dollar is the worst performer, followed by Australian Dollar and Japanese Yen. Canadian dollar and British Pound are mixed in the current trading environment.

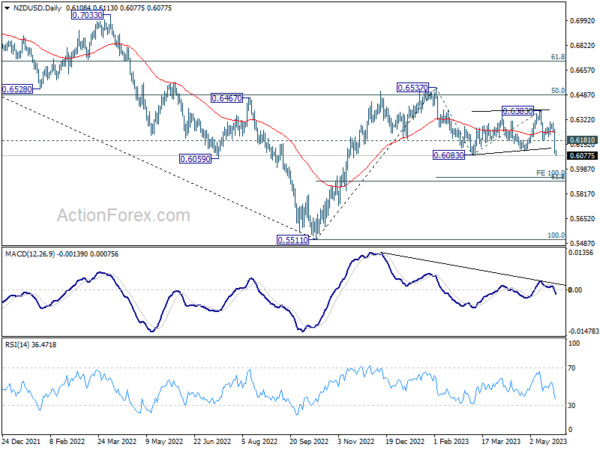

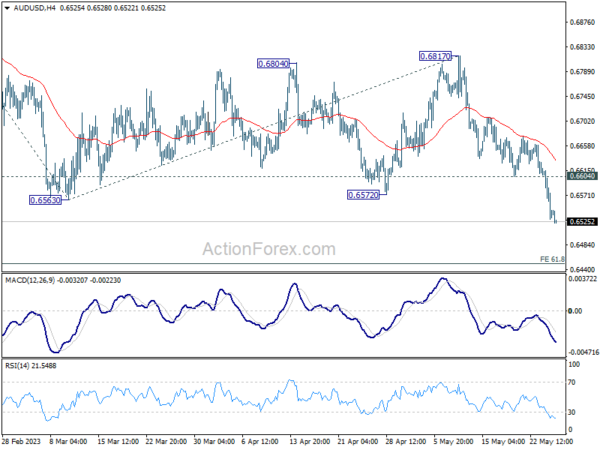

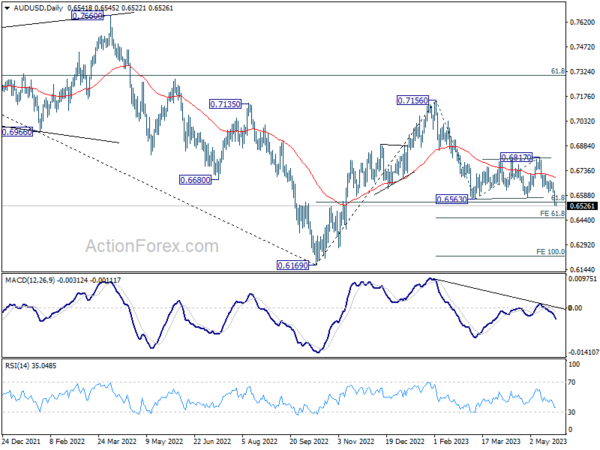

As a follow-up on NZD/USD, the selloff accelerated as expected after breaking 0.6181 support. Now that 0.6181 support is also broken, the whole decline from 0.6537 should be resuming. Near term outlook will stay bearish as long as 0.6181 support turned resistance holds. Next target is 100% projection of 0.6537 to 0.6083 from 0.6383 at 0.5929. It should be noted that AUD/USD also broke 0.6563 support to resume the whole fall from 0.7156. So, both would likely resume pressured against the greenback for the near term at least.

In Asia, at the time of writing, Nikkei is up 0.22%. Hong Kong HSI is down -2.06%. China Shanghai SSE is down -0.37%. Singapore Strait Times is down -0.18%. Japan 10-year JGB yield is up 0.0198 at 0.428. Overnight, DOW dropped -0.77%. S&P 500 dropped -0.73%. NASDAQ dropped -0.61%. 10-year yield rose 0.021 to 3.719.

FOMC minutes reveal uncertainty over future policy tightening

According to minutes from May 2-3 meeting of FOMC, there’s a cloud of uncertainty over the prospect of future policy tightening. The committee’s participants “generally agreed” that the cumulative effects of monetary policy tightening and the possible impact of further tightening on the economy render the extent of future target range increases “less certain”.

The minutes report, “Participants generally expressed uncertainty about how much more policy tightening may be appropriate.” This theme of uncertainty was echoed throughout the document, with the committee members emphasizing the need to “‘retain optionality” after the meeting.

Moreover, the minutes reveal, “Several participants noted that if the economy evolved along the lines of their current outlooks, then further policy firming after this meeting may not be necessary.” This implies that should economic conditions continue on their current trajectory, additional policy tightening may not be required, underscoring the tentative stance adopted by the FOMC.

Fed Waller: Hike or pause in June, but no stop

Fed Governor Christopher Waller said in a speech that the upcoming data over the next few months is unlikely to clearly indicate that the terminal rate has been reached.

Waller stated, “I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2 percent objective.”

He went on to say that the decision about whether to raise rates or hold off in the upcoming June meeting would be contingent on the data collected over the next three weeks.

Waller noted, “We will get additional labor market data, with some information about wages, and additional inflation numbers in the next few weeks that will continue to shape my view on where we stand relative to the FOMC’s dual mandate.”

Fed Bostic foresees no rate cut until well into 2024

Atlanta Fed President Raphael Bostic recently made some forward-looking remarks on monetary policy in an interview with MarketPlace, stating that the likelihood of a rate cut before 2024 is low given the current inflation levels.

He noted, “My best case is that we won’t be thinking about a cut until well into 2024. And, you know, inflation is just double what our target is by just about every measure.”

“I don’t see scenarios where the economy is going to evolve in a way such that inflation gets close enough to our target where we might contemplate any kind of cut,” he added.

RBNZ Orr sees potential for rate cut after early next year

In his address to the parliament’s finance and expenditure committee, RBNZ Governor Adrian Orr noted that the country’s interest rates are already significantly above neutral, thereby suppressing spending and investment.

“They (interest rates) are well above what we would consider neutral, are constraining spending and investment,” Orr said. He further stated, “The committee is confident monetary policy is restrictive and doing its job.”

Orr characterized yesterday’s 25bps rate hike as “an extra bit of insurance.” The RBNZ committee voted five to two in favor of raising the OCR with two dissenting votes advocating for holding. Orr was quick to downplay any notion of discord within the committee. “On the division in the committee, the voting, there is no division. It’s a committee decision,” he told the parliamentary committee.

Looking forward, Orr hinted that the RBNZ might start easing interest rates in early next year. “The committee expects the OCR to remain steady until early next year. At that point, we may be able to start easing interest rates,” he noted.

Looking ahead

Germany Gfk consumer confidence and Q1 GDP final will be released in European session. US will release jobless claims GDP revision and pending home sales later in the day.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6510; (P) 0.6564; (R1) 0.6597; More…

AUD/USD’s break of 0.6563 support confirms resumption of whole decline from 0.7156. Intraday bias stays on the downside for 61.8% projection of 0.7156 to 0.6563 from 0.6817 at 0.6451. Firm break there will target 100% projection at 0.6224. On the upside, above 0.6604 resistance will turn intraday bias neutral first.

In the bigger picture, rejection by 55 W EMA (now at 0.6822) keeps medium term outlook bearish. Firm break of 61.8% retracement of 0.6169 to 0.7156 at 0.6546 now suggests that whole rebound from 0.6169 has completed at 0.7156 already. Larger down trend from 0.8006 (2021 high) might be ready to resume through 0.6169 low. This will now remain the favored case as long as 0.6817 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany Gfk Consumer Confidence Jun | -24.5 | -25.7 | ||

| 06:00 | EUR | Germany GDP Q/Q Q1 F | 0.00% | 0.00% | ||

| 12:30 | USD | Initial Jobless Claims (May 19) | 253K | 242K | ||

| 12:30 | USD | GDP Price Index Q1 P | 4% | 4% | ||

| 12:30 | USD | GDP Annualized Q1 P | 1.10% | 1.10% | ||

| 14:00 | USD | Pending Home Sales M/M Apr | 1.20% | -5.20% | ||

| 14:30 | USD | Natural Gas Storage | 100B | 99B |