Dollar strengthens broadly today on report that Stanford University John Taylor impressed President Donald Trump in his Fed chair interview. Taylor is famous for his so called Taylor rules and he is seen by some as a hawkish candidate as a Fed chair. However, it should be noted that Taylor recently said that rules shouldn’t be used as a "way to tie central bankers’ hands." Instead, "there are reasons to run policy with a strategy." . Meanwhile, chance of former Fed Governor Kevin Warsh is fading. Trump will interview current Fed chair Janet Yellen on Thursday. White House economic advisor Gary Cohn and Fed Governor Jerome Powell are among the candidates for the job.

UK CPI hit 4.5 year high, but other readings steady

Sterling didn’t get support from inflation data today even though headline CPI met expectations. Other inflation readings were generally steady. Headline CPI accelerated to 3.0% yoy in September, hitting five-and-a-half years high. Core CPI, on the other hand, was unchanged at 2.7% yoy. RPI was also unchanged at 3.0% yoy, below expectation of 4.0% yoy. RPI input was unchanged at 8.4% yoy, PPI output dropped to 3.3% yoy, PPI output core was unchanged at 2.5% yoy.

BoE Governor Mark Carney said to lawmakers that "inflation rising potentially above the 3 percent level in coming months is something that we have anticipated." And, as a result "we faced a trade-off, and we still face a trade-off, between having inflation above target and the need to support, or the desirability of supporting, jobs and activity." Meanwhile, Carney reminded the lawmakers that after Brexit referendum last week, BoE officials "expected Sterling to fall sharply. It did". And "the sole reason that inflation has gone up as much as it has is the depreciation of Sterling."

ZEW: Accelerating inflation points to change in ECB policy

German ZEW economic sentiment rose 0.6 pts to 17.6 in October, missing expectation of 20.0. That’s also well below long-term average of 23.8. Current situation gauge dropped 0.9 to 87.0, also missed expectation of 88.5. Meanwhile, Eurozone ZEW economic sentiment tumbled sharply to 26.7, down from 31.7, well off expectation of 34.2. Nonetheless, ZEW President Achim Wambach said that "the improved outlook for the coming six months is not least the result of the surprisingly positive growth figures seen in the previous months. In August, figures for both production and incoming orders were significantly better than expected." Also, "the fact that the inflation rate is rising again, and expected to climb further, equally points towards a positive economic development in Germany, making a change in the ECB’s monetary policy more likely."

RBA minutes give no sign of tightening soon

The RBA minutes for the October meeting reaffirmed the market that the central bank is in no hurry to increase interest rates. Policymakers stressed that rate hikes, or other kinds of monetary policy normalization, in other major economies do not necessarily imply that the RBA would follow suit anytime soon. The RBA remained upbeat in the domestic economic outlook, staying confident in the employment market conditions. Yet, it was still weary of subdued inflation. As usual, the central bank continued to warn of the strength in Australian dollar. More in RBA Shrugged Off Global Normalization Trend, Maintaining Neutral Stance

NZ CPI beat expectations, but no change to RBNZ’s stance

New Zealand CPI rose 0.5% qoq 1.9% yoy in Q3, up from prior 0.0% qoq 1.7% yoy, and beat expectation of 0.4% qoq 1.8% yoy. It’s also well above RBNZ’s own projection of 1.6% yoy. Still, it’s believed that RBNZ won’t change it’s neutral stance on monetary policy. So far, there is little signs of overheating in the economy that points to higher inflation ahead. Instead, the economy could be entering a slowing phase.

Former Japan EM Takenaka: Abe win will push the tide towards Kuroda

In Japan, former Economy Minister Heizo Takenaka hailed that BoJ Governor Haruhiko Kuroda has done an "excellent job" and "should continue" after his term expires next year. He pointed out that after Kuroda’s massive stimulus policy, prices have stopped falling, and the economy is in better shape. And, according to Takenaka, a win for Prime Minister Shinzo Abe in the October 22 election will "of course push the tide" towards another term for Kuroda. He noted that "there is a sufficient amount of trust between the government and the BoJ for that to happen". Also, renewing Kuroda’s term will raise expectations for appropriate policies but "a shift in personnel can change expectations at once".

GBP/USD Mid-Day Outlook

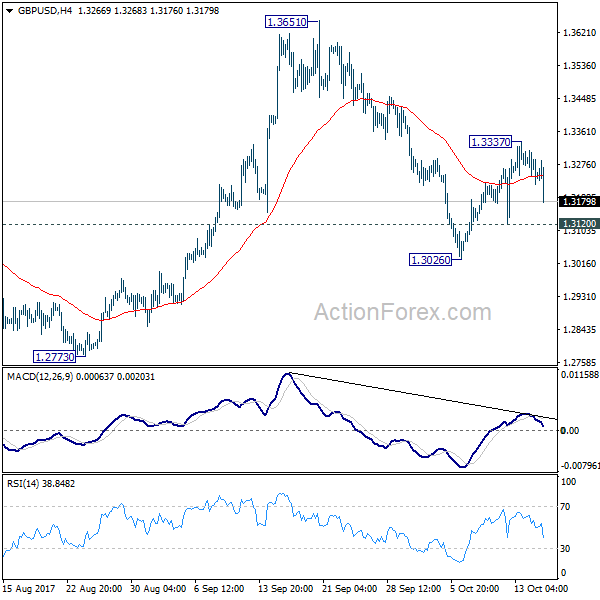

Daily Pivots: (S1) 1.3212; (P) 1.3261; (R1) 1.3299; More….

Intraday bias in GBP/USD remains neutral for the moment. On the downside, break of 1.3026 minor support will indicate that recovery is completed at 1.3337. And fall from 1.3651 is resuming for 1.2773 support. That will revive that case that medium term rise from 1.1946 has completed at 1.3651. Meanwhile, above 1.3337 will bring retest of 1.3651 high instead.

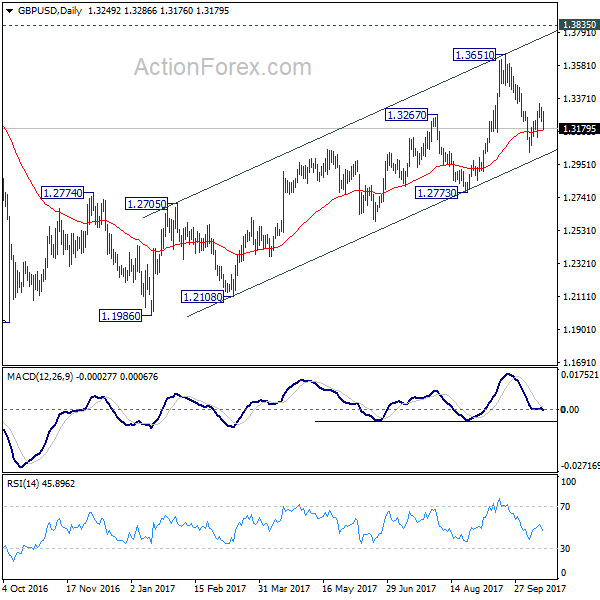

In the bigger picture, while the medium term rebound from 1.1946 was strong, GBP/USD hit strong resistance from the long term falling trend line. Outlook is turned a bit mixed and we’ll turn neutral first. On the downside, decisive break of 1.2773 key support will argue that rebound from 1.1946 has completed. The corrective structure of rise from 1.1946 to 1.3651 will in turn suggest that long term down trend is now completed. Break of 1.1946 low should then be seen. On the upside, break of 1.3835 support turned resistance will revive the case of trend reversal and target 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 0.50% | 0.40% | 0.00% | |

| 00:30 | AUD | RBA Meeting Minutes Oct | ||||

| 08:30 | GBP | CPI M/M Sep | 0.30% | 0.30% | 0.60% | |

| 08:30 | GBP | CPI Y/Y Sep | 3.00% | 3.00% | 2.90% | |

| 08:30 | GBP | Core CPI Y/Y Sep | 2.70% | 2.70% | 2.70% | |

| 08:30 | GBP | RPI M/M Sep | 0.10% | 0.30% | 0.70% | |

| 08:30 | GBP | RPI Y/Y Sep | 3.90% | 4.00% | 3.90% | |

| 08:30 | GBP | PPI Input M/M Sep | 0.40% | 1.20% | 1.60% | 2.30% |

| 08:30 | GBP | PPI Input Y/Y Sep | 8.40% | 8.20% | 7.60% | 8.40% |

| 08:30 | GBP | PPI Output M/M Sep | 0.20% | 0.20% | 0.40% | |

| 08:30 | GBP | PPI Output Y/Y Sep | 3.30% | 3.30% | 3.40% | |

| 08:30 | GBP | PPI Output Core M/M Sep | 0.00% | 0.10% | 0.20% | |

| 08:30 | GBP | PPI Output Core Y/Y Sep | 2.50% | 2.60% | 2.50% | |

| 08:30 | GBP | House Price Index Y/Y Aug | 5.00% | 5.40% | 5.10% | 4.50% |

| 09:00 | EUR | Eurozone CPI M/M Sep | 0.40% | 0.40% | 0.30% | |

| 09:00 | EUR | Eurozone CPI Y/Y Sep F | 1.50% | 1.50% | 1.50% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y Sep F | 1.10% | 1.10% | 1.10% | |

| 09:00 | EUR | German ZEW (Economic Sentiment) Oct | 17.6 | 20 | 17 | |

| 09:00 | EUR | German ZEW (Current Situation) Oct | 87 | 88.5 | 87.9 | |

| 09:00 | EUR | Eurozone ZEW (Economic Sentiment) Oct | 26.7 | 34.2 | 31.7 | |

| 12:30 | USD | Import Price Index M/M Sep | 0.70% | 0.60% | 0.60% | |

| 13:15 | USD | Industrial Production Sep | 0.20% | -0.90% | ||

| 13:15 | USD | Capacity Utilization Sep | 76.20% | 76.10% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 64 | 64 | ||

| 20:00 | USD | Net Long-term TIC Flows (USD) Aug | 14.3B | 1.3B |