Japanese yen made a modest recovery today, bolstered by yet another month of robust consumer inflation data. However, this uptick in the currency was held back by strong risk-on sentiment prevalent in Japan, with Nikkei surging to a 33-year high. BoJ’s continued commitment to its ultra-loose monetary policy also put a damper on Yen’s rise, securing its position as the weakest performer for the week – and by a significant margin at that.

With the week drawing to a close, Euro and Swiss franc are trailing closely behind the Yen as underperformers, followed by Sterling. New Zealand Dollar stands as the week’s strongest, receiving a slight boost from promising trade data released today. Canadian dollar, buoyed by earlier in the week’s CPI data, anticipates the next move from retail sales figures due later today. Dollar maintains a firm stance, albeit lagging behind Kiwi and Loonie.

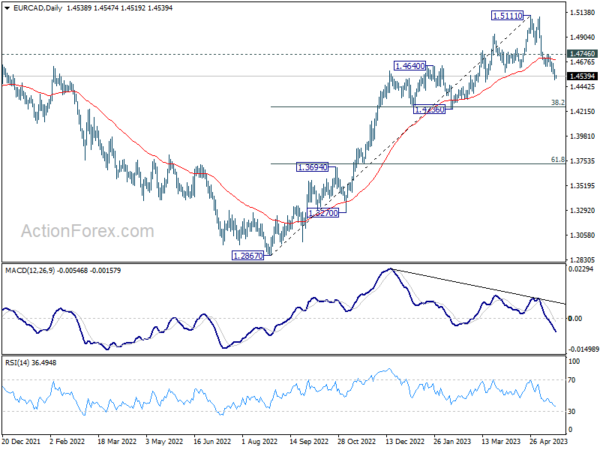

From a technical standpoint, EUR/CAD pair has seen its fall from 1.5111 intensify this week. Given bearish divergence in D MACD, the decline could be viewed as a correction to the overall uptrend from 1.2867. As long as 1.4746 resistance level holds, deeper fall towards 1.4236 cluster support (38.2% retracement of 1.2867 to 1.5111 at 1.4254) is expected. Notably, strong support could emerge here to trigger a rebound, at least on the initial attempt.

In Asia, Nikkei rose 0.77% to 30808.35. Japan 10-year JGB yield rose 0.0177 to 0.403. Hong Kong HSI is currently down -1.28%. China Shanghai SSE is down -0.47%. Singapore Strait Times is up 0.55%. Overnight, DOW rose 0.34%. S&P 500 rose 0.94%. NASDAQ rose 1.51%. 10-year yield rose 0.067 to 3.648.

Japan CPI core rose back to 3.5% in April, core-core hit 42-yr high

April saw Japanese consumer prices accelerating, with CPI accelerated from 3.2% yoy to 3.5% yoy. That put a halt to the slowdown of headline inflation from 4.3% in January.

Even more significantly, core CPI (which excludes fresh food) rose from 3.1% yoy to 3.4%. This metric has been above BoJ’s 2% target for an uninterrupted 13 months, signifying persistent inflationary pressure.

In the realm of core-core CPI, which excludes both fresh food and energy, the increase is even starker, rising from 3.8% yoy to 4.1%. This figure is the highest it has been since September 1981, marking a nearly 42-year peak.

Looking at some details, services inflation increased from 1.5% yoy to 1.7%, the highest in 28 years since 1995 (excluding the impact of sales tax hikes). Durable goods prices soared 9.8% yoy, and food prices accelerated from 8.2% yoy to 9.0%, hitting the highest level in almost 47 years since 1976. Energy prices, however, bucked the trend with a yoy decrease of -4.4% yoy.

Despite these inflationary pressures, there is no clear indication that BoJ is preparing to exit its ultra-loose monetary policy. The bank projected CPI to average 1.8% and core CPI at 2.5% for the current fiscal year, but given the current data, it is likely that these projections will be revised upward in the next release.

New Zealand exports rise 10% yoy with China leading, EU tops 12% imports growth

New Zealand’s trade balance in April reported a surplus of NZD 427m, defying expected deficit of NZD -1310m. Both imports and exports experienced significant year-on-year growth, with exports rising 10% yoy (NZD 641m) to NZD 6.8B and imports increasing 12% yoy (NZD 683m) to NZD 6.4B.

In the export sector, notable growth was observed in shipments to China, Australia, and the US. Specifically, total exports to China rose by NZD 259m (16% yoy), to Australia by NZD 67m (10% yoy), and to the US by NZD 109m (17% yoy). However, exports experienced a slight downturn to the EU, falling by NZD -2.2m (-0.4% yoy), and a more substantial drop to Japan, decreasing by NZD -53m (-12% yoy).

On the import side, the European Union led the surge with total imports up by NZD 108m (13% yoy). Imports from the US also experienced growth, with an increase of NZD 46m (7.6% yoy). Conversely, imports from China, Australia, and South Korea all fell, with decreases of NZD -29m (-2.4% yoy), NZD -37m (-5.1% yoy), and NZD -28m (-8.3% yoy) respectively.

Looking ahead

ECB will publish monthly economic bulletin today. Canada will release retail sales.

USD/JPY Daily Outlook

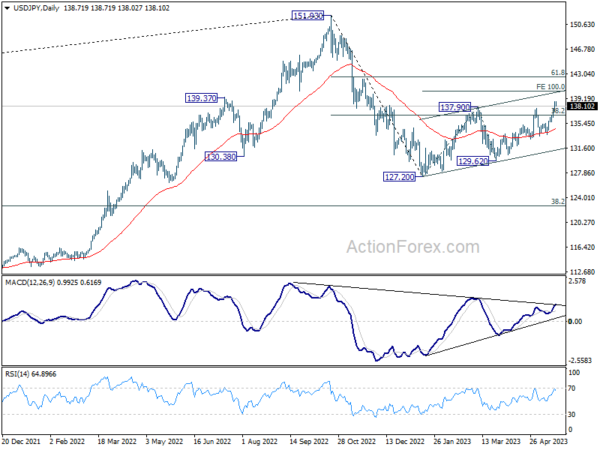

Daily Pivots: (S1) 137.75; (P) 138.25; (R1) 139.21; More…

Intraday bias in USD/JPY remains on the upside for now, despite current slight retreat. Current rise is part of the whole rally from 127.20. Next target is 100% projection of 127.20 to 137.90 from 129.62 at 140.32. Break there will target 142.48 fibonacci level. On the downside, below 137.27 minor support will turn intraday bias neutral first.

In the bigger picture, price actions from 151.93 high are currently seen as a corrective pattern to the long term up trend. The first leg should have completed at 127.20. Rebound from there is seen as the second leg. Sustained break of 38.2% retracement of 151.93 to 127.20 at 136.34 will bring stronger rise to 61.8% retracement at 142.48. Meanwhile, break of 129.62 will argue that the third leg is starting through 127.20 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Apr | 427M | -1310M | -1273M | -1586M |

| 23:01 | GBP | GfK Consumer Confidence May | -27 | -30 | ||

| 23:30 | JPY | National CPI Y/Y Apr | 3.50% | 3.20% | ||

| 23:30 | JPY | National CPI Core Y/Y Apr | 3.40% | 3.40% | 3.10% | |

| 23:30 | JPY | National CPI Core-core Y/Y Apr | 4.10% | 3.80% | ||

| 04:30 | JPY | Tertiary Industry Index M/M Mar | -1.70% | -0.10% | 0.70% | 1.70% |

| 06:00 | EUR | Germany PPI M/M Apr | 0.30% | -0.50% | -2.60% | -1.40% |

| 06:00 | EUR | Germany PPI Y/Y Apr | 4.10% | 4.00% | 7.50% | 6.70% |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | CAD | Retail Sales M/M Mar | -1.30% | -0.20% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Mar | -0.80% | -0.70% |