Australian Dollar took a dive in today’s Asian trading session, reeling from a sharp decline in consumer sentiment and a slew of weaker-than-anticipated economic data from China. Despite the headwinds facing Aussie, New Zealand Dollar held its ground, buoyed by Westpac’s predictions of continued monetary tightening by RBNZ from the present 5.25% to 6.00% in the coming months.

Meanwhile, Canadian Dollar, like its Australian counterpart, is on a downward trajectory as the second weakest performer of the day so far. Dollar trails close behind, undermined by uncertainty surrounding debt ceiling negotiations. Conversely, Japanese Yen is riding high, closely following Kiwi as the day’s second strongest currency, with Euro and Swiss Franc not far behind. British Pound is demonstrating mixed performance as it anticipates job data from the UK.

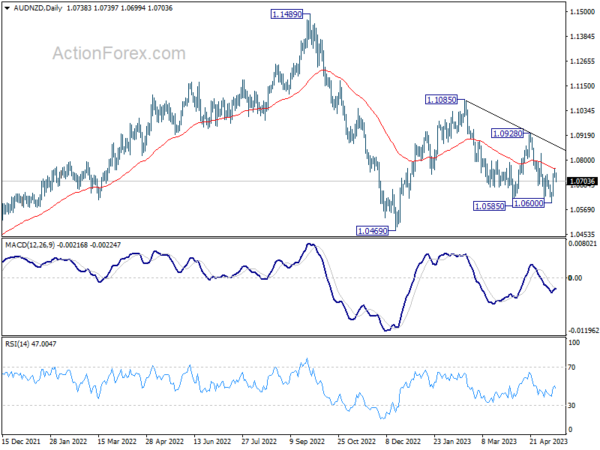

Technically, AUD/NZD’s recovery from 1.0600 might have hit a ceiling at 55 D EMA. Risk is mildly back on the downside for now. Firm break of 1.0600 support should resume the decline from 1.1085 through 1.0585 towards 1.0469 low. Nevertheless, another rise would likely push AUD/NZD through 55 D MA (now at 1.0760) to 1.0928 resistance instead.

Overnight, DOW rose 0.14%. S&P 500 rose 0.30%. NASDAQ rose 0.66%. In Asia, at the time of writing, Nikkei is up 0.84%, continuing its march to 30k handle. Hong Kong HSI is up 0.39%. China Shanghai SSE is up 0.01%. Singapore Strait Times is down -0.05%.

Fed’s Barkin questions “whether we need to do more”

Richmond Fed President Thomas said yesterday that he is unconvinced that inflation will taper off rapidly with only a marginal economic slowdown. Barkin stated, “You could tell yourself a story where inflation comes down relatively quickly … with only a modest economic slowdown.”

He quickly added, “But I’m not yet convinced … I do wonder whether we’re not going to need more impact on demand to bring inflation down to where we need to go.”

Barkin stayed open-minded about Fed’s policy direction at the upcoming June 13-14 meeting. Despite having raised the policy rate by 5 percentage points since March 2022, Barkin isn’t ruling out the possibility of another hike.

In terms of the labor market, Barkin noted the shift from what he described as “red hot” to merely “hot.” He asserted, “On the unemployment side, I think you could fairly say it’s moved from red hot to hot, right? There’s nothing about 3.4% unemployment that feels … cool.”

Despite the gradual effects of rate hikes beginning to show, Barkin emphasized that the job market remains robust and inflation persistent. He admitted, “I’m still seeing data that suggests a hot job market and enduring inflation,” leading him to believe inflation could persist longer than market measures suggest. Therefore, he concluded, “I’m still looking to ask myself the question whether we need to do more.”

Separately, Minneapolis Fed President Neel Kashkari said the central bank probably has “more work to do on our end, to try to bring inflation back down,” adding that “we should not be fooled by a few months of positive data.”

BoE Pill: Self-sustaining, second-round-effect momentum could keep inflation high

BoE Chief Economist, Huw Pill, voiced his concern about the enduring momentum of inflation in the UK during an online event yesterday. Pill warned of the risk of a self-sustaining inflation cycle, where despite the dissipation of key short-term inflation drivers like rising energy and food costs, businesses and workers would continue to seek substantial price and wage increases.

He said, “The risk is … that self-sustaining, second-round-effect momentum within the UK economy keeps inflation running at above-target levels.”

This trend could still align with a significant drop in headline inflation, Pill noted, but he expressed concern that headline inflation could stagnate at around 4% or 5% over the next two to three years.

“That’s still compatible with quite a big fall in headline inflation, but maybe headline inflation – other things equal – getting stuck at that 4%, 5% level over the next two or three years,” he clarified.

Meanwhile, Pill also highlighted the potential of AI to increase productivity and, subsequently, living standards. He emphasized, “Using AI to make ourselves more productive is one example of how we can do that to boost living standards. This is a win-win if we all get better off because we’re all more productive.”

RBA Minutes: Further hikes may still be required

Minutes of RBA’s May meeting revealed a detailed discussion where Board members weighed the pros and cons of keeping cash rate unchanged or increasing it by 25 basis points. Despite the fine balance of arguments, the Board saw it fit to raise the interest rates by 25bps to 3.85%, due to upside risks in inflation and tight labour market.

Data available in the month leading up to the meeting confirmed significant inflationary pressures and highlighted upside risks to the inflation outlook. The Board was concerned that if these risks materialised, it would “further delay the return of inflation to target levels” and potentially trigger a “damaging shift in inflation expectations”.

While acknowledging considerable uncertainties surrounding the economic outlook, particularly with respect to household consumption, the Board’s strong commitment to price stability and the necessity of anchoring inflation expectations tipped the scales in favour of a rate hike.

Looking forward, the Board indicated that “further increases in interest rates may still be required”, depending on the evolution of the economy and inflation.

Australian consumer sentiment plunges in May following unexpected RBA rate hike

Australia Westpac Consumer Sentiment Index dropping sharpy by -7.9% from 85.8 to 79.0 in May. This decline brings the index close to the grim levels observed in March, which were the lowest since COVID-19 outbreak in 2020 and, prior to that, since the severe recession of early 1990s.

The unexpected decision by RBA to raise the cash rate by an additional 0.25% in May, as well as the Federal Budget, were cited by Westpac as the two main factors impacting consumer sentiment over the last month.

Westpac stated, “Interest rates were again a key driver of the May survey. The RBA raised the official cash rate by a further 0.25% at its May meeting in the week before the survey. The move came as a major surprise to markets and most commentators, clearly stoking consumer fears of more increases to come.”

Looking ahead, Westpac predicts that RBA will likely pause in June, awaiting further data on inflation and the state of the economy. While the bank’s central view anticipates the current cash rate will remain at its peak due to economic weakness and clear progress toward the Board’s inflation target, it acknowledges that the risks are still “evenly balanced”.

China’s industrial production, retail sales miss expectations; youth unemployment hits record high

China’s industrial production growth fell short of expectations in April, with a year-on-year increase of 5.6% yoy, significantly under expectation of 10.1% growth. Despite missing the mark, the growth rate outpaced March’s 3.9% yoy rise and marked the fastest expansion since September 2022.

Retail sales also grew less than expected, posting 18.4% yoy rise, which fell short of anticipated 20.1% yoy growth. The figure was largely inflated due to a low comparison base, as retail sales plummeted by -11.1% yoy in April of the previous year due to severe lockdowns. On a monthly basis, retail sales contracted by -7.8% mom from March.

Fixed asset investment growth also came in below expectations 4.7% ytd yoy growth, underperforming expectation of 5.2%.

Urban jobless rate ticked down from 5.3% to 5.2%. However, unemployment among 16-24 age group spiked to a record high of 20.4%, up from 19.6% in the previous month. This exceeded the previous record of 19.9% set in July 2022.

The National Bureau of Statistics (NBS) stated, “In general, in April, the national economy continued to recover, and positive factors accumulated and increased. But we must also see that the international environment is still complex and severe, domestic demand is still insufficient, and the endogenous driving force for economic recovery is not yet strong.”

Looking ahead

UK emplyment and Germany ZEW economic sentiment are the main focus in European session. Eurozonne will also release Q1 GDP revision and trade balance. Later in the day, Canada CPi will take center stage with US retail sales.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6658; (P) 0.6684; (R1) 0.6725; More…

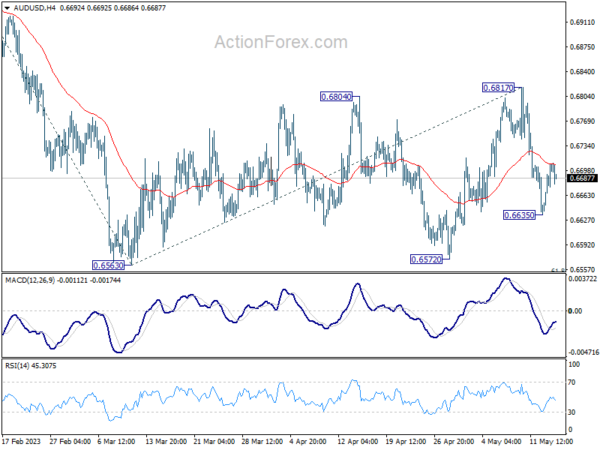

Intraday bias in AUD/USD is turned neutral first with current recovery. But risk will stay on the downside as long as 0.6817 resistance holds. Consolidation pattern from 0.6563 could have completed with three waves to 0.6817. Below 0.6635 will bring retest of 0.6563 low first. Decisive break there will resume larger decline from 0.7156 to 61.8% projection of 0.7156 to 0.6563 from 0.6817 at 0.6451.

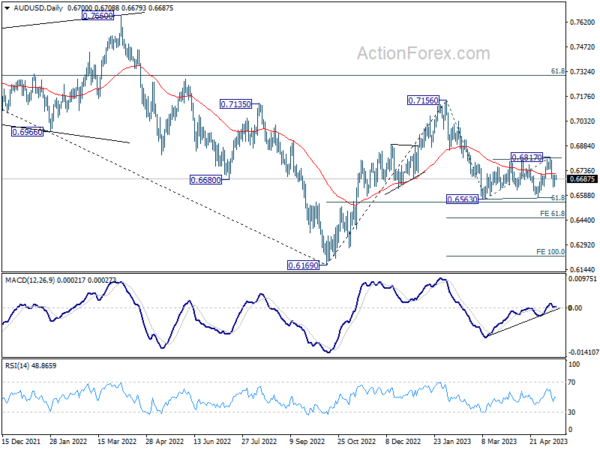

In the bigger picture, the failure to break through 55 W EMA (now at 0.6822) keeps medium term outlook bearish. Firm break of 61.8% retracement of 0.6169 to 0.7156 at 0.6546 will raise the chance of long term down trend resumption through 0.6169 low. This will now be the favored case as long as 0.6817 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 02:00 | CNY | Industrial Production Y/Y Apr | 5.60% | 10.10% | 3.90% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Apr | 4.70% | 5.20% | 5.10% | |

| 02:00 | CNY | Retail Sales Y/Y Apr | 18.40% | 20.10% | 10.60% | |

| 06:00 | GBP | Claimant Count Change Apr | 31.2K | 28.2K | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Mar | 3.80% | 3.80% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Mar | 5.10% | 5.90% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Mar | 6.80% | 6.60% | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Mar | 5.6B | -0.1B | ||

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.10% | 0.10% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment May | -5 | 4.1 | ||

| 09:00 | EUR | Germany ZEW Current Situation May | -35.3 | -32.5 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment May | 2.3 | 6.4 | ||

| 09:00 | EUR | Eurozone Employment Change Q/Q Q1 P | 0.30% | 0.30% | ||

| 12:30 | CAD | Manufacturing Sales M/M Mar | 0.70% | -3.60% | ||

| 12:30 | CAD | CPI M/M Apr | 0.50% | 0.50% | ||

| 12:30 | CAD | CPI Y/Y Apr | 4.10% | 4.30% | ||

| 12:30 | CAD | CPI Median Y/Y Apr | 4.30% | 4.60% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Apr | 4.10% | 4.40% | ||

| 12:30 | CAD | CPI Common Y/Y Apr | 5.50% | 5.90% | ||

| 12:30 | USD | Retail Sales M/M Apr | 0.80% | -0.60% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Apr | 0.50% | -0.40% | ||

| 13:15 | USD | Industrial Production M/M Apr | 0.00% | 0.40% | ||

| 13:15 | USD | Capacity Utilization Apr | 79.70% | 79.80% | ||

| 14:00 | USD | Business Inventories Mar | 0.10% | 0.20% | ||

| 14:00 | USD | NAHB Housing Market Index May | 45 | 45 |