Dollar trades broadly lower overnight and remains soft in Asian session. Despite risk-off sentiment in the US, the greenback failed to find support, as market participants bet on an earlier Fed rate cut due to ongoing bank concerns. Meanwhile, Euro is also facing pressure due to falling treasury yields, with yesterday’s ECB rate hike now in the rearview mirror.

In contrast, Australian Dollar emerged as one of the stronger currencies today, following RBA’s Statement on Monetary Policy, which suggested that further rate hikes could still be on the horizon. New Zealand Dollar is also showing strength, while Canadian Dollar lags far behind. Yen and Swiss Franc are firm but outpaced by Aussie. However, these two safe-haven currencies could potentially gain traction if risk aversion intensifies before the weekly close.

Technically, the case of near term bullish reversal in AUD/CAD is building up. Immediate focus is now on 0.9104 resistance. Strong rebound there will resume the rebound from 0.8941 short term bottom, to 38.2% retracement of 0.9545 to 0.8941 at 0.9172, or even further to 0.9229 resistance. Nevertheless, rejection by 0.9104, followed by break of 55 4H EMA (now at 0.9044) will retain near term bearishness for breaking through 0.8941 low at a later stage. Today’s Canadian job data could be a trigger for the next move.

In Asia, Japan is still on holiday. Hong Kong HSI is up 0.59% at the time of writing, China Shanghai SSE is down -0.67%. Singapore Strait Times is down -0.18%. Overnight, DOW dropped -0.86%. S&P 500 dropped -0.72%. NASDAQ dropped -0.49%. 10-year yield dropped -0.052 to 3.351.

BoC Macklem: Getting inflation down to 2% would be more difficult

BoC Governor Tiff Macklem has reiterated the central bank’s commitment to restore price stability, stating that it is prepared to raise rates further if inflation remains materially above the 2% target.

Macklem explained in a speech, “We expect [inflation] will hit 3% this summer, even as the economy continues to grow modestly.” Although encouraged by the progress, he noted that bringing inflation back down to the 2% target would be “more difficult”, with current projections pointing to the end of 2024.

The BoC Governor emphasized, “our job is not done until we restore price stability—in other words, until inflation is centered on our 2% target.”

He also acknowledged the biggest upside risk to their inflation forecast is the persistence of services price inflation, which requires the labor market to rebalance, corporate pricing behavior to normalize, and near-term inflation expectations to come down further in order to return to the 2% target.

RBA SoMP: Faster inflation slowdown in 2023, but not after

In the quarterly Statement on Monetary Policy, RBA reiterated that “some further tightening of monetary policy may be required” to ensure that inflation returns to target in a “reasonable timeframe”. But that will depend upon “how the economy and inflation evolve.”

The new economic projections show both headline and trimmed mean inflation slowing more rapidly in 2023. However, both measures are only expected to reach the top of target range by mid-2025. Additionally, the central bank downgraded its GDP growth forecasts for 2023 and predicts a higher unemployment rate. The evolving economic landscape will be key in determining the RBA’s future policy moves.

Year-average GDP growth forecast:

- 2023 at 1.75% (revised down from 2.25%).

- 2024 at 1.50% (unchanged).

Unemployment rate forecast:

- Dec 2023 at 4.00% (revised up from 3.75%).

- Dec 2024 at 4.50% (revised up from 4.25%).

Headline CPI forecast:

- Dec 2023 at 4.50% (revised down from 4.75%).

- Dec 2024 at 3.25% (unchanged).

- Jun 2025 at 3.00% (unchanged).

Trimmed mean CPI forecast:

- Dec 2023 at 4.00% (revised down from 4.25%).

- Dec 2024 at 3.00% (unchanged).

- Jun 2025 at 3.00% (unchanged).

China Caixin PMI services dropped to 56.4, remains to be seen if rebound sustainable

China’s Caixin PMI Services dropped to 56.4 in April, down from 57.8 in March and slightly below the expected 56.5. According to Caixin, the sector experienced slower yet still sharp increases in activity and new work, while input cost inflation accelerated to a one-year high. Employment growth slowed and backlogs continued to build, with the PMI Composite index falling from 54.5 to 53.6.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In April, the services sector kept up momentum, while manufacturing activity turned comparatively sluggish and became a drag on economic growth. It remains to be seen if the economic rebound is sustainable after a short-term release of pent-up demand, with a number of indicators flagging that the recovery has yet to find a stable footing.”

US non-farm payroll data in focus, reactions to be complex

Market attention today is on US non-farm payroll data, with headline job growth anticipated to slow to 181k in April. Unemployment rate is predicted to remain steady at 3.5%, while average hourly earnings are expected to maintain a 0.3% mom pace.

Recent related data releases include a sharp rise in ISM manufacturing employment from 46.9 to 50.2 in April and a slight drop in ISM services employment from 51.3 to 50.8. Additionally, ADP private jobs saw a robust growth of 296k. But four-week moving average of initial jobless claims rose significantly from 198k to 239k.

Reactions to today’s non-farm payroll data may be complex, as investors will likely want to see job market loosening up with a cooldown in wage growth. However, concerns surrounding banks and Dollar’s reaction to Fed expectations, risk sentiment, and treasury yields also need to be considered.

Following DOW’s strong break of 55 D EMA (now at 33351.09) and 33233.85 support overnight, rebound from 31429.82 appears to have completed at 34257.83. Whether the fall from there represents a correction to rise from 31429.82 or a falling leg of the pattern from 37412.28 remains to be seen. But a deeper fall is expected in the near term. First line of defense will be trend line support at around 32350. The second line is 31429.82. Nevertheless a close above 55 D EMA for the week would revive near term bullishness.

Elsewhere

Swiss unemployment rate and CPI, Germany factory orders, France industrial output, Eurozone retail sales, and UK PMI construction will be released in European session. Later in the day, in additional to US NFP, Canada will also release job data.

AUD/USD Daily Report

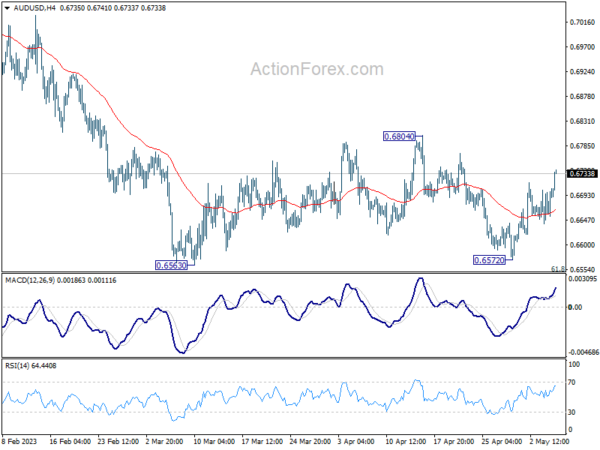

Daily Pivots: (S1) 0.6653; (P) 0.6680; (R1) 0.6719; More…

AUD/USD’s rebound from 0.6572 extends higher today but stays well below 0.6804 resistance. Intraday bias remains neutral at this point. Near term outlook also stays bearish as long as 0.6804 resistance holds, and down trend resumption through 0.6563 low is in favor at a later stage. Nevertheless, sustained break of 0.6804 should indicate completion of whole fall from 0.7156, and turn near term outlook bullish for retesting this high instead.

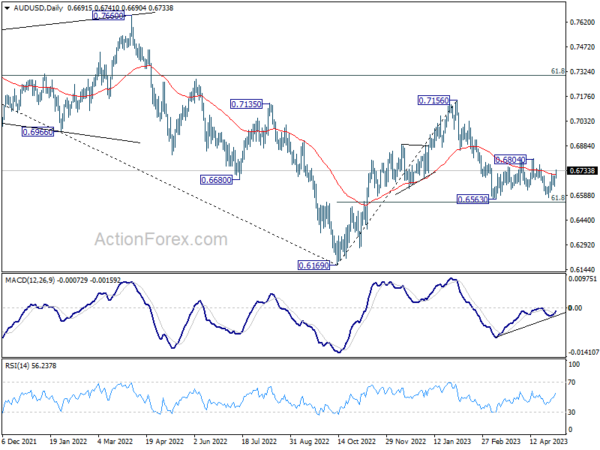

In the bigger picture, as long as 61.8% retracement of 0.6169 to 0.7156 at 0.6546 holds, the decline from 0.7156 is seen as a correction to rally from 0.6169 (2022 low) only. Another rise should still be seen through 0.7156 at a later stage. However, sustained break of 0.6546 will raise the chance of long term down trend resumption through 0.6169 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Monetary Policy Statement | ||||

| 01:45 | CNY | Caixin Services PMI Apr | 56.4 | 56.5 | 57.8 | |

| 05:45 | CHF | Unemployment Rate Apr | 1.90% | 1.90% | ||

| 06:00 | EUR | Germany Factory Orders M/M Mar | -2.00% | 4.80% | ||

| 06:30 | CHF | CPI M/M Apr | 0.20% | 0.20% | ||

| 06:30 | CHF | CPI Y/Y Apr | 2.80% | 2.90% | ||

| 06:45 | EUR | France Industrial Output M/M Mar | -0.30% | 1.20% | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) Apr | 743B | |||

| 08:00 | EUR | Italy Retail Sales M/M Mar | 0.00% | -0.10% | ||

| 08:30 | GBP | Construction PMI Apr | 51.1 | 50.7 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | -0.20% | -0.80% | ||

| 12:30 | USD | Nonfarm Payrolls Apr | 181K | 236K | ||

| 12:30 | USD | Unemployment Rate Apr | 3.50% | 3.50% | ||

| 12:30 | USD | Average Hourly Earnings M/M Apr | 0.30% | 0.30% | ||

| 12:30 | CAD | Net Change in Employment Apr | 21.6K | 34.7K | ||

| 12:30 | CAD | Unemployment Rate Apr | 5.10% | 5.00% |