Dollar trades mildly higher this week even though momentum is relatively week. US equities extended the record runs, with DOW, S&P 500 and NASDAQ closing at new records overnight. Treasury yields also recovered mildly. But there is little support to the greenback yet. The forex markets are generally mixed in consolidative mode, except that some extra weakness is seen in Euro, due to political jitters. Meanwhile, Australia Dollar is trading a touch softer after RBA minutes. Sterling, on the other hand, is firm as markets await inflation data from UK.

RBA minutes give no sign of tightening soon

The minutes of RBA’s October meeting showed that "the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time." The central bank acknowledged that "strengthening in global economic conditions had reduced some near-term risks to financial stability arising from rare or extreme events." But, it warned that "low interest rates and low financial market volatility had promoted financial risk-taking." Overall, there is practically no sign from RBA that indicates a rate hike soon. And considering sluggish wage growth that suggests plenty of spare capacity, RBA is no where near tightening. There are talks that RBA could stand pat throughout 2018.

NZ CPI beat expectations, but no change to RBNZ’s stance

New Zealand CPI rose 0.5% qoq 1.9% yoy in Q3, up from prior 0.0% qoq 1.7% yoy, and beat expectation of 0.4% qoq 1.8% yoy. It’s also well above RBNZ’s own projection of 1.6% yoy. Still, it’s believed that RBNZ won’t change it’s neutral stance on monetary policy. So far, there is little signs of overheating in the economy that points to higher inflation ahead. Instead, the economy could be entering a slowing phase.

Former EM Takenaka: Abe win will push the tide towards Kuroda

In Japan, former Economy Minister Heizo Takenaka hailed that BoJ Governor Haruhiko Kuroda has done an "excellent job" and "should continue" after his term expires next year. He pointed out that after Kuroda’s massive stimulus policy, prices have stopped falling, and the economy is in better shape. And, according to Takenaka, a win for Prime Minister Shinzo Abe in the October 22 election will "of course push the tide" towards another term for Kuroda. He noted that "there is a sufficient amount of trust between the government and the BoJ for that to happen". Also, renewing Kuroda’s term will raise expectations for appropriate policies but "a shift in personnel can change expectations at once".

May and Juncker agreed to accelerate Brexit negotiation

UK Prime Minister Theresa May and European Commission President Jean-Claude Juncker had a "constructive and friendly" dinner in Brussels yesterday. Coming out of the meeting, they said there was a "broad, constructive exchange on current European and global challenges". And in a joint statement regarding Brexit, they "reviewed the progress made in the Article 50 negotiations so far and agreed that these efforts should accelerate over the months to come." Separately, it’s reported that despite brief objections by France and Germany, a revised draft circulated by European Council President Donald Tusk retains the option open for Brexit negotiations to move on to trade as soon as after December EU summit.

Looking ahead

UK inflation data will be the main focus of the day. CPI is expected to finally hit 3% mark in September, solidifying the case for a BoE rate hike in November. But it should be noted that, that rate hike would only bring interest rate back to pre-Brexit referendum level. And based on the current uncertainty around Brexit negotiations, there is little chance for BoE to start a tightening cycle. RPI and PPI will also be released from UK.

Elsewhere, German ZEW economy sentiment and Eurozone CPI final will be featured in European session. US will release import price index, industrial production and NAHB housing index later in the day.

AUD/USD Daily Outlook

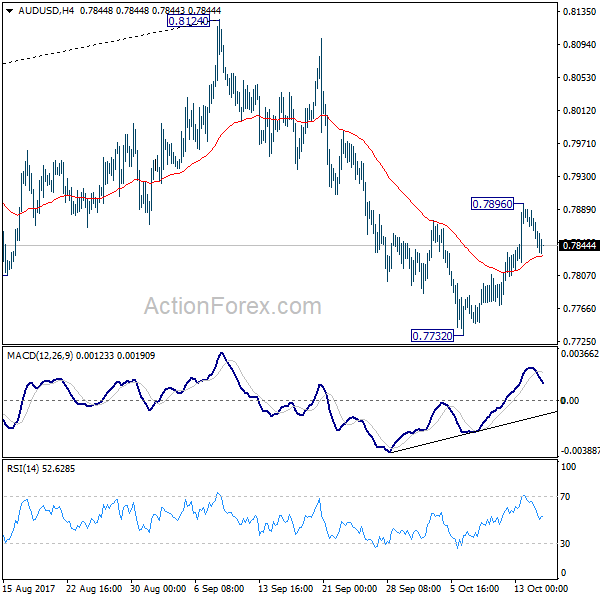

Daily Pivots: (S1) 0.7833; (P) 0.7861; (R1) 0.7879; More…

AUD/USD lost momentum after hitting 0.7896 and retreated. A temporary top was formed and intraday bias is turned neutral first. Another rise is mildly in favor for the moment. Break of 0.7896 will target a test on 0.8124 high. But we’d be cautious on strong resistance from there to limit upside and bring another fall to extend the corrective pattern. On the downside, break of 0.7732 will resume the decline from 0.8124 and target medium term fibonacci level at 0.7628 first.

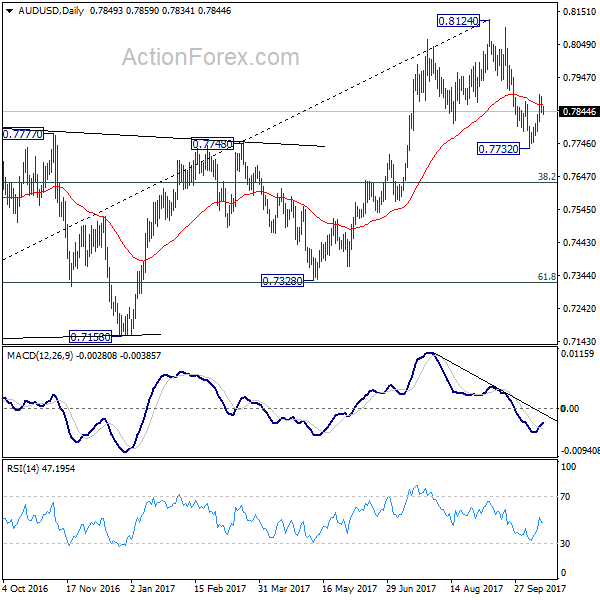

In the bigger picture, rise from 0.6826 medium term bottom is seen as corrective pattern. Current development suggests that it might be completed with three waves up to 0.8124 already. Break of 38.2% retracement of 0.6826 to 0.8124 at 0.7628 will firm this bearish case. And, decisive break of 0.7328 key cluster support (61.8% retracement at 0.7322) will confirm and bring retest of 0.6826 low. In case rise from 0.6826 resumes and extends, strong resistance should be seen at 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 0.50% | 0.40% | 0.00% | |

| 0:30 | AUD | RBA Meeting Minutes Oct | ||||

| 8:30 | GBP | CPI M/M Sep | 0.30% | 0.60% | ||

| 8:30 | GBP | CPI Y/Y Sep | 3.00% | 2.90% | ||

| 8:30 | GBP | Core CPI Y/Y Sep | 2.70% | 2.70% | ||

| 8:30 | GBP | RPI M/M Sep | 0.30% | 0.70% | ||

| 8:30 | GBP | RPI Y/Y Sep | 4.00% | 3.90% | ||

| 8:30 | GBP | PPI Input M/M Sep | 1.20% | 1.60% | ||

| 8:30 | GBP | PPI Input Y/Y Sep | 8.20% | 7.60% | ||

| 8:30 | GBP | PPI Output M/M Sep | 0.20% | 0.40% | ||

| 8:30 | GBP | PPI Output Y/Y Sep | 3.30% | 3.40% | ||

| 8:30 | GBP | PPI Output Core M/M Sep | 0.10% | 0.20% | ||

| 8:30 | GBP | PPI Output Core Y/Y Sep | 2.60% | 2.50% | ||

| 8:30 | GBP | House Price Index Y/Y Aug | 5.40% | 5.10% | ||

| 9:00 | EUR | Eurozone CPI M/M Sep | 0.40% | 0.30% | ||

| 9:00 | EUR | Eurozone CPI Y/Y Sep F | 1.50% | 1.50% | ||

| 9:00 | EUR | Eurozone CPI – Core Y/Y Sep F | 1.10% | 1.10% | ||

| 9:00 | EUR | German ZEW (Economic Sentiment) Oct | 20 | 17 | ||

| 9:00 | EUR | German ZEW (Current Situation) Oct | 88.5 | 87.9 | ||

| 9:00 | EUR | Eurozone ZEW (Economic Sentiment) Oct | 34.2 | 31.7 | ||

| 12:30 | USD | Import Price Index M/M Sep | 0.60% | 0.60% | ||

| 13:15 | USD | Industrial Production Sep | 0.20% | -0.90% | ||

| 13:15 | USD | Capacity Utilization Sep | 76.20% | 76.10% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 64 | 64 | ||

| 20:00 | USD | Net Long-term TIC Flows (USD) Aug | 14.3B | 1.3B |