Dollar remains weak in early US session, despite strong ADP job data, seeing only modest gains the Australian and Canadian Dollars. However, the selloff remains contained, even against strong Yen and Swiss Franc. Traders are evidently holding their bets as they await FOMC rate decision. A 25bps hike to 5.00-5.25% is widely anticipated, and it is unlikely to surprise the market. The primary question is whether Chair Jerome Powell will explicitly indicate a pause following today’s move.

Throughout the week, New Zealand Dollar has emerged as the strongest performer, buoyed by robust job data released earlier in Asian session. Australian Dollar follows closely, although its momentum has waned. Swiss Franc and Yen trail behind, reflecting some underlying risk-off sentiment. Meanwhile, Canadian Dollar is the weakest performer, followed by Sterling and Dollar. Overall, most currency pairs and crosses are trading within last week’s range, with the exception of some Kiwi and Aussie pairs.

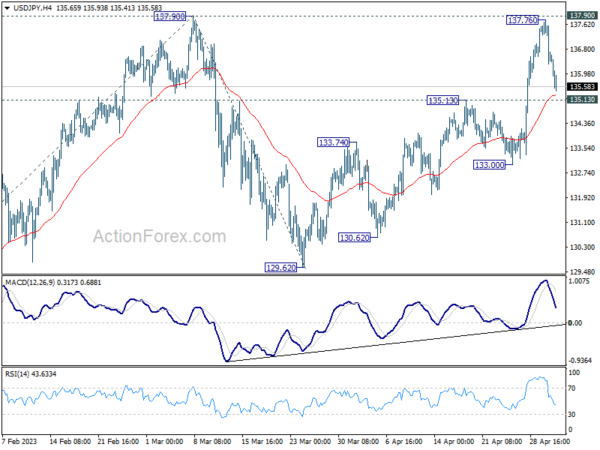

Technically, USD/JPY is quickly approaching 135.13 resistance turned support as the pull back from 137.76 extends. As long as this support holds, further rise is in favor through 137.90, sooner rather than later. However, firm break of 135.13 will argue that the pattern from 137.90 has started another falling leg, and risk deeper decline through 133.00 support towards 129.62.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is up 0.74%. CAC is up 0.56%. Germany 10-year yield is down -0.0059 at 2.256. Earlier in Asia, Hong Kong HSI dropped -1.18%. Singapore Strait times dropped -0.61%. Japan and China were on holiday.

US ADP jobs grew 296k in Apr, pay growth slowed

US ADP private employment grew 296k in April, well above expectation of 150k. By sector, goods-producing jobs rose 67k. Service-providing jobs rose 229. By establishment size, small companies added 121k jobs, medium companies added 122k, large companies added 47k.

Median change in annual pay of job-stayers rose 6.7% yoy, slowed slightly from 6.9% yoy. Median change in annual pay of job-changers rose 13.2% yoy, slowed notably from 14.2% yoy.

“The slowdown in pay growth gives the clearest signal of what’s going on in the labor market right now. Employers are hiring aggressively while holding pay gains in check as workers come off the sidelines. Our data also shows fewer people are switching jobs.” Nela Richardson, Chief Economist, ADP, said.

Eurozone unemployment rate hits record low at 6.5%

Eurozone unemployment rate dipped to a new record low in March, falling from 6.6% to 6.5%, below the expected 6.6%. Meanwhile, the EU unemployment rate remained steady at 6.0%.

Eurostat estimates that 12.96m individuals in EU, including 11.01m in Eurozone, were unemployed in the month. This marks a decrease of -155k in EU and -121k in Eurozone compared to February. Furthermore, compared to March 2022, unemployment fell by -353k in EU and -365k in the Eurozone.

New Zealand employment growth exceeds expectations; unemployment rate remains low

New Zealand employment data for Q1 showcased a 0.8% qoq increase, surpassing expectation of 0.4% qoq growth. Unemployment rate remained steady at 3.4%, defying expectations of rise to 3.5% and staying close to record low of 3.2% made in Q1 2022. Additionally, employment rate climbed from 69.3% to 69.5%, while labor force participation rate rose from 71.8% to 72.0%. Both employment and participation rates reached their highest levels since records began in 1986.

All sector wage inflation was at 1.0%, 4.3% yoy. “Annual wage cost inflation is at its highest level since the series began in 1992, up from 4.1 percent in the year to the December 2022 quarter,” business prices manager Bryan Downes said. “This aligns with other wage measures, like the unadjusted LCI and average hourly earnings, both of which also had the largest annual increases on record.”

New Zealand’s financial system well-positioned for higher interest rate environment

In May 2023 Financial Stability Report, RBNZ Governor Adrian Orr highlighted that the country’s financial system is well-placed to handle the higher interest rate environment and international financial disruptions. Global inflation continues to persist at levels significantly above central banks’ policy targets. Although central banks have recently slowed pace of tightening, the full impact of previous tightening measures remains to be seen.

Governor Orr explained that “to date there have been limited signs of distress in banks’ lending portfolios, with only a small share of borrowers falling behind on their payments.” This resilience, he said, reflects ongoing strength of the labor market and the ability of borrowers to adjust their spending or use previous savings and repayment buffers.

Australian retail sales exceed expectations, rising 0.4% mom in Mar

Australia’s retail sales turnover increased by 0.4% mom to AUD 35.3m in March, surpassing expectations of 0.2% mom. Year-on-year, sales turnover was up by 5.4% compared to the same month a year ago.

Ben Dorber, Australian Bureau of Statistics Head of Retail Statistics, noted that while retail sales recorded a third consecutive rise in March, pull-back in spending on discretionary goods has kept monthly turnover at a similar level to six months ago.

Dorber also noted the importance of analyzing quarterly retail sales volumes, set to be released next week, in order to understand the impact of consumer prices on recent turnover growth, particularly as CPI data showed high inflation levels despite slower growth in March quarter.

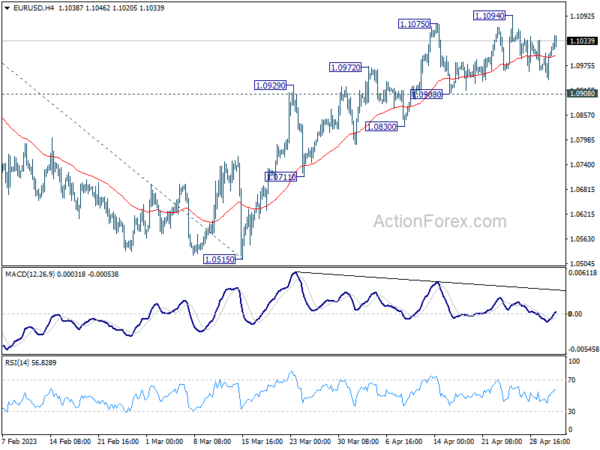

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0917; (P) 1.0958; (R1) 1.0983; More…

EUR/USD recovers mildly today but stays in range below 1.1094. Intraday bias remains neutral at this point. Further rally is expected as long as 1.0908 support holds. Break of 1.1094 will resume larger up trend to 1.1273 fibonacci level. Break there will target 61.8% projection of 0.9534 to 1.1032 from 1.0515 at 1.1441 However, considering bearish divergence condition in 4H MACD, break of 1.0908 support will indicate short term topping and turn bias back to the downside.

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Employment Change Q1 | 0.80% | 0.40% | 0.20% | |

| 22:45 | NZD | Unemployment Rate Q1 | 3.40% | 3.50% | 3.40% | |

| 22:45 | NZD | Labour Cost Index Q/Q Q1 | 0.90% | 1.10% | 1.10% | |

| 01:30 | AUD | Retail Sales M/M Mar | 0.40% | 0.20% | 0.20% | |

| 08:00 | EUR | Italy Unemployment Rate Mar | 7.80% | 8.10% | 8.00% | 7.90% |

| 09:00 | EUR | Eurozone Unemployment Rate Mar | 6.50% | 6.60% | 6.60% | |

| 12:15 | USD | ADP Employment Change Apr | 296K | 150K | 145K | |

| 13:45 | USD | Services PMI Apr F | 53.7 | 53.7 | ||

| 14:00 | USD | ISM Services PMI Apr | 53.1 | 51.2 | ||

| 14:30 | USD | Crude Oil Inventories | -0.5M | -5.1M | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.25% | 5.00% | ||

| 18:30 | USD | FOMC Press Conference |