The forex markets open the week rather steadily. Sterling is trying to extend last week’s late rally but is held below Friday’s high for the moment. It will be a big week for the Pound with inflation, employment and sales data featured. Meanwhile, UK Prime Minister Theresa May is trying her last effort to break that deadlock in Brexit negotiation ahead of the crucial EU summit on October 19. Dollar, on the other hand, is mildly firmer, recovering some of the post CPI loss.

Fed Yellen, ECB Constancio, BoJ Kuroda and PBoC Zhou spoke

Fed Chair Janet Yellen sounded quite upbeat on the economy when she delivered a speech at G30 international banking panel that include BoJ Governor Haruhiko Kuroda, PBoC Governor and ECB Vice President Vitor Constancio. Yellen noted that "economic activity in the United States has been growing moderately so far this year, and the labor market has continued to strengthen." Impact of the hurricanes were "quite noticeable in the short term". But she emphasized that "history suggests that the longer-term effects will be modest and that aggregate economic activity will recover quickly."

Meanwhile, "risks to global growth have receded somewhat". And she expects " growth to continue to improve over the near term." And, wage gains "appear moderate" which is "broadly consistent with a tightening labor market". She noted that the "biggest surprise" has been this year’s low inflation "which could reflect something more persistent than is reflected in our baseline projections." Nonetheless, she expects "ongoing strength of the economy will warrant gradual increases in that rate to sustain a healthy labor market and stabilize inflation around our 2 percent longer-run objective."

ECB Vice President Vitor Constancio said policymakers "remain confidence that the continued closing of the output gap will lead inflation to return to our medium-term objective". However, "this return remains conditional on a very substantial degree of monetary accommodation. He also pointed out that "the apparent disconnect between strong economic activity, on the one hand, and low inflation and wages on the other is one of the stand-out characteristics of the ongoing recovery".

BoJ Governor Haruhiko Kuroda maintained that BoJ will "consistently pursue aggressive monetary easing with a view to achieving the price stability target at the earliest possible time." But he also noted that "achieving the 2% target is still a long way off." Nevertheless, he noted that business have started to adopt labor saving productivity improvements recently, and that would eventually lead to rising labor costs. Then, "once price increases become widespread, medium- to long-term inflation expectations for firms and households are expected to rise gradually and actual inflation will increase toward 2%."

PBoC Governor Zhou Xiaochuan said that while China’s growth has "slowed over the past few years", it has "rebounded this year". GDP growth hit 6.9% in the first half and "may achieve 7% in the second half". But he also pointed out that "the main problem is that the corporate debt is too high". And he urged to "pay further effort to deleveraging and strengthen policy for financial stability".

Updates on Geopolitical risks, US-North Korea, Brexit, Catalonia

Regarding geopolitical risks, US Secretary of State Rex Tillerson said in an interview that President Donald Trump wants him to continue diplomacy with North Korea "until the first bomb drops". But that was in contrast to what Trump has been tweeting as he noted that "only one thing will work" after decades of failure of diplomacy. Also, it’s reported that there is a rift as Tillerson called Trump a "moron". Trump responded by asking to compare IQ tests. Tillerson refused to comment on it during the interview. Separately, National Security adviser H.R. McMaster said that Trump is "willing to do anything necessary" to preview North Korea from threatening the US with nuclear weapons. And McMaster added that "what Kim Jong Un should recognize is that if he thinks the development of this nuclear capability is keeping him safer, it’s actually the opposite. It’s having the opposite effect,"

UK Prime Minster Theresa May will have a dinner with EU leaders in Brussels today, trying to rescue the Brexit negotiations. It came days after EU officials said the talks were deadlocked, as conclusion to the fifth round. It’s believed that May would try to persuade the EU counter parts to start the talks on post-Brexit trade agreements. But so far, nothing is know about what May could offer in return. And it’s clear that the EU side sees there isn’t "sufficient progress" to move on, with key issues like the divorce bill unresolved.

Catalan President Carles Puigdemont was requested by Spanish Prime Minister Mariano Rajoy to say clearly whether he is declaring independence. That came after Puigdemont suspended the declaration last week and opened the door for talks. But Rajoy was clear that he won’t negotiate until the unilateral declaration of independence is withdrawn. Puigdemont is given a deadline of 10am today to clarify his stance. If Puigdemont confirms the declaration, it’s very likely that Rajoy will trigger an Article 155 to take control of the Catalan administration and call for regional elections. If Puigdemont withdraws the declaration, separatists will likely start unravel. And Puigdemont would have no choice but call early regional elections to settle the issue in order manner. That is, one way or the other, a regional election could be the eventual outcome.

Looking ahead

It will be an important week on UK economic data with CPI, retail sales and job data featured. In particular CPI is expected to finally hit 3% level, meeting BoE’s forecast. And that should clear the way for BoE to hike interest rate at November meeting. Meanwhile, Aussie and Kiwi were strong last week thanks to China data. They will be facing another batch of Chinese growth data this week. Plus, New Zealand will release CPI, Australia will release employment and RBA minutes. Here are some highlights for the week ahead:

- Monday: Eurozone trade balance; Canada foreign securities purchase; US Empire state manufacturing index

- Tuesday: New Zealand CPI; RBA minutes; UK CPI, PPI; German ZEW, Eurozone CPI final; US industrial production, NAHB housing index

- Wednesday: UK employment; Canada manufacturing sales; US housing starts and building permits, Fed’s Beige Book

- Thursday: Japan trade balance; Australia employment; China GDP, industrial production, retail sales; Swiss trade balance; UK retail sales; US jobless claims, Philly Fed survey

- Friday: German PPI, Eurozone currency account; UK public sector net borrowing; Canada CPI, retail sales; US existing home sales

EUR/GBP Daily Outlook

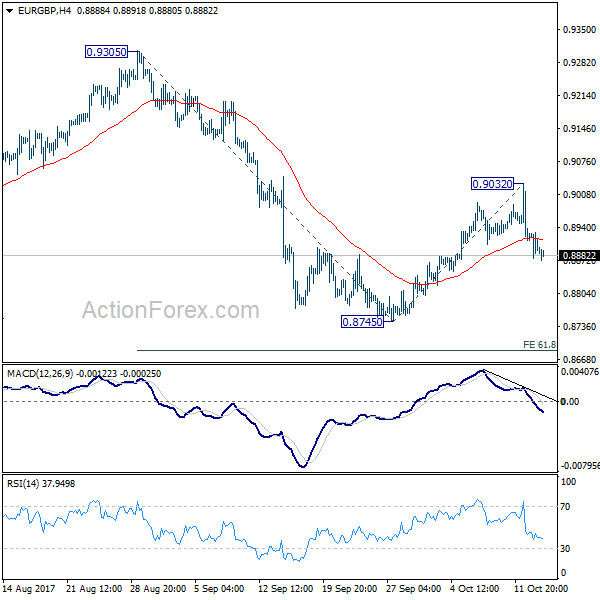

Daily Pivots: (S1) 0.8869; (P) 0.8899; (R1) 0.8924; More…

Intraday bias in EUR/GBP remains on the downside for the moment. As noted before, recovery from 0.8745 is completed at 0.9032. Deeper fall would be seen to retest 0.8745 first. Break will resume whole decline from 0.9305 and target 61.8% projection of 0.9305 to 0.8745 from 0.9032 at 0.8686. On the upside, break of 0.9032 is needed to confirm resumption of the rebound. Otherwise, risk will stay on the downside in near term.

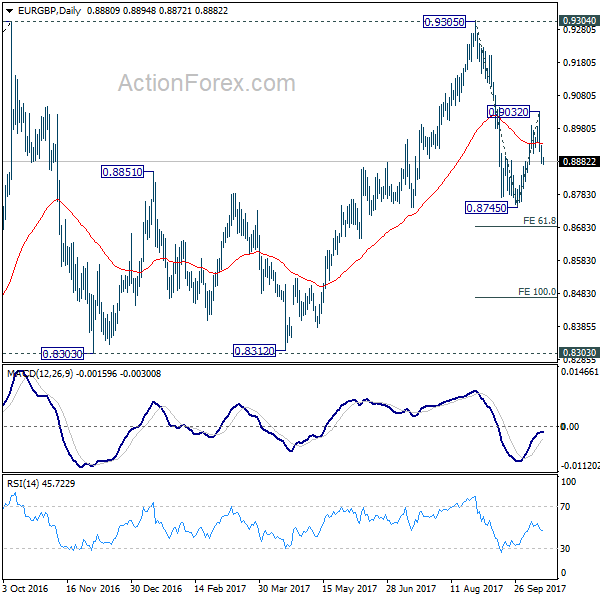

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of another fall. And in that case, EUR/GBP could have a retest on 0.8303. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Oct | 1.10% | -1.20% | ||

| 01:30 | CNY | CPI Y/Y Sep | 1.60% | 1.60% | 1.80% | |

| 01:30 | CNY | PPI Y/Y Sep | 6.90% | 6.40% | 6.30% | |

| 04:30 | JPY | Industrial Production M/M Aug F | 2.10% | 2.10% | ||

| 06:00 | EUR | German WPI M/M Sep | 0.40% | 0.30% | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Aug | 20.2B | 18.6B | ||

| 12:30 | CAD | International Securities Transactions (CAD) Aug | 23.95B | |||

| 12:30 | USD | Empire State Manufacturing Index Oct | 20.7 | 24.4 | ||

| 14:30 | CAD | BOC Business Outlook Survey |