Australian Dollar is gaining ground today, supported by RBA minutes that revealed a rate hike was discussed during the April meeting. Encouragingly, stronger than expected Chinese GDP data is also contributing to the Aussie’s rise. Meanwhile, Dollar’s momentum has waned after yesterday’s rally, and Yen remains under broad pressure. Sterling and Canadian Dollar are currently mixed, as traders await the release of key UK employment and Canadian CPI data.

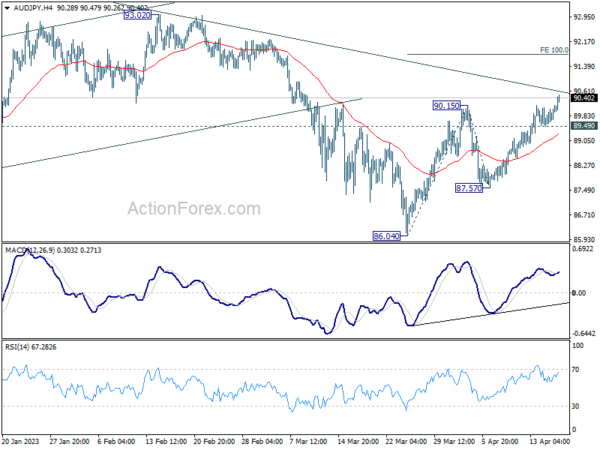

Technically, the break of 90.15 resistance in AUD/JPY confirms resumption of the overall rebound from 86.40. As long as the 89.49 minor support holds, further gains are expected. The immediate focus is on the trendline resistance at 90.61, and a firm break there could lead to a more substantial rally towards the 100% projection of 86.04 to 90.15 from 87.57 at 91.68.

In Asia, at the time of writing, Nikkei is up 0.46%. Hong Kong HSI is down -0.73%. China Shanghai SSE is up 0.11%. Singapore Strait Times is down-0.48%. Japan 10-year JGB yield is down -0.0052 at 0.477. Overnight, DOW rose 0.30%. SD&P 500 rose 0.33%. NASDAQ rose 0.28%. 10-yaer yield rose 0.069 to 3.591.

RBA minutes reveal considerations of rate hike and pause

The minutes from the RBA April 4 monetary policy meeting revealed that the Board weighed the options of a 25bps rate hike and a pause. On balance, there was a “a stronger case to pause at this meeting and reassess the need for further tightening at future meetings”, after having “additional data and an updated set of forecasts”. But members emphasized the to communicate clearly that “monetary policy may need to be tightened at subsequent meetings”. RBA kept cash rate target unchanged at 3.6% at that meeting.

The case for a 25bps hike was primarily driven by concerns over high inflation and a tight labor market. The potential persistence of high inflation and two additional factors—upgraded near-term population growth projections and the risk of larger wage increases in parts of the economy—also supported further tightening.

On the other hand, the case for a pause stemmed from the already restrictive monetary policy following significant tightening in a short period, with the full effects on the economy yet to be observed. Tighter monetary policy had contributed to a housing market slowdown, decelerated consumption growth, and financial pressure on some households with housing loans. The value of pausing lay in the opportunity to gather additional data on various economic indicators and to receive updated forecasts from the staff, which would be invaluable in reassessing the economic outlook and determining the extent of further tightening needed.

China’s Q1 GDP growth surpasses expectations, retail sales bounce

China’s Q4 GDP growth outperformed expectations at 4.5% yoy, up from 2.9% in Q4, and beat expectation of 4.0% yoy. Retail sales in March saw a 10.6% yoy increase, the largest since June 2021. Despite the positive figures, industrial production rose by only 3.9% yoy in March, missing the anticipated 4.7%. Additionally, fixed asset investment saw a 5.1% ytd yoy growth in March, falling short of the expected 5.8%.

The National Bureau of Statistics (NBS) report on Tuesday cited challenges faced by China in the first quarter, including a “grave and complex international environment” and domestic tasks for reform, development, and stability.

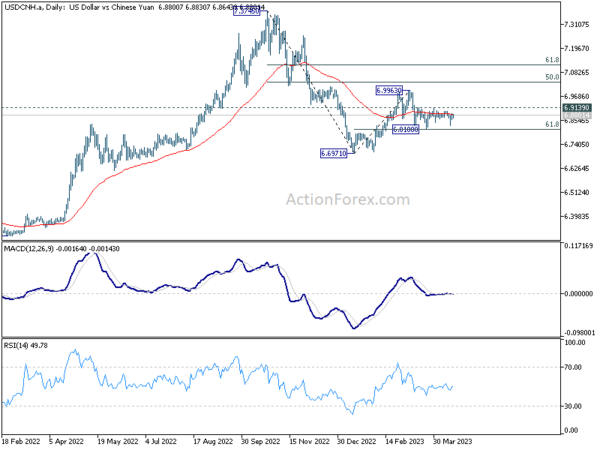

USD/CNH has remained in a sideways pattern since dropping to 6.8100 in late March. 61.8% retracement of 6.6971 to 6.9963 at 6.8114 offered some support, halting the decline from 6.9963. However, a break of 6.9139 resistance is needed to confirm completion of the pullback. Without this confirmation, another fall is in favor, and a break of 6.8100 could lead to retesting 6.6971 low from January.

UK job data and Canada CPI in focus, GBP/CAD pressing 55 D EMA

UK employment and Canada CPI data are the major focuses for today. BoE is clearly looking into economic data to assess how persistent inflation pressure remains. Another 25bps hike in May is still likely but that would depend on today’s job data, in particular on wages growth, as well as tomorrow’s CPI report.

Meanwhile, BoC is clear that an accumulation of evidence is needed before consideration of resumption of tightening. Today’s CPI data might not be a determining factor on any near term move in BoC’s policy. Yet, they still crucial for BoC to decide whether another hike is needed later in the year.

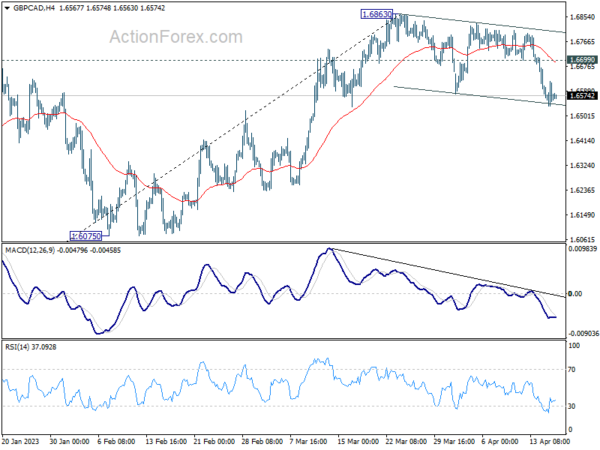

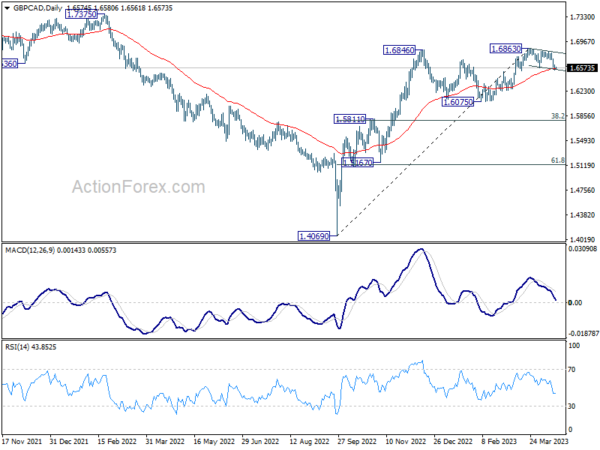

Technically, GBP/CAD’s pull back from 1.6863 short term top extended lower this week. It’s now pressure 55 D EMA (now at 1.6659). Strong rebound from current level will retain the case that it’s merely in a near term correction. That is, another rise through 1.6863 should be seen sooner rather than later.

However, sustained break of the EMA will argue that GBP/CAD is already in correction to whole up trend from 1.4069. That would open up deeper fall through 1.6075 support, possibly to 1.5811 cluster support (38.2% retracement of 1.5069 to 1.6863 at 1.5796) before forming a base.

Looking ahead

UK employment, Germany ZEW economic sentiment are the main focus in European session. Canada CPI will take center stage later in the day, and US building permits and housing starts will be featured too.

AUD/USD Daily Report

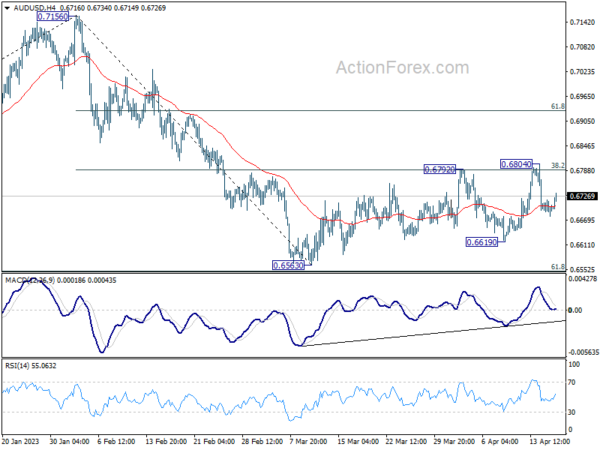

Daily Pivots: (S1) 0.6682; (P) 0.6701; (R1) 0.6720; More…

AUD/USD recovers mildly today but stays inside range of 0.6619/6804. Intraday bias remains neutral for the moment. On the downside, break of 0.6619 will indicate that decline from 0.7156 is resuming through 0.6563 low. Nevertheless, sustained break of 0.6804 will bring stronger rally back to 61.8% retracement of 0.7156 to 0.6563 at 0.6929.

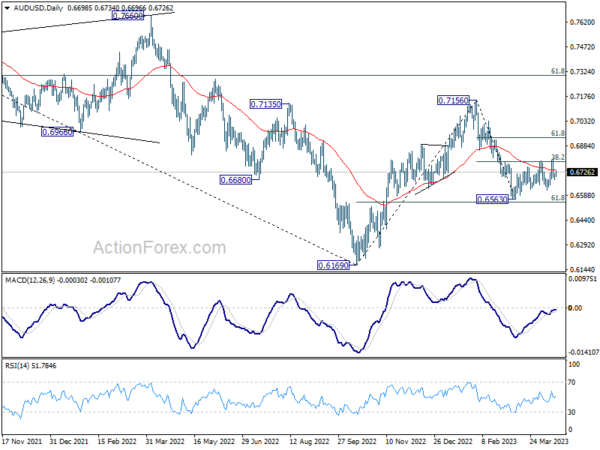

In the bigger picture, as long as 61.8% retracement of 0.6169 to 0.7156 at 0.6546 holds, the decline from 0.7156 is seen as a correction to rally from 0.6169 (2022 low) only. Another rise should still be seen through 0.7156 at a later stage. However, sustained break of 0.6546 will raise the chance of long term down trend resumption through 0.6169 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 02:00 | CNY | GDP Y/Y Q1 | 4.50% | 4.00% | 2.90% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Mar | 5.10% | 5.80% | 5.50% | |

| 02:00 | CNY | Industrial Production Y/Y Mar | 3.90% | 4.70% | 2.40% | |

| 02:00 | CNY | Retail Sales Y/Y Mar | 10.60% | 8.00% | 3.50% | |

| 06:00 | GBP | Claimant Count Change Mar | 28.2K | 10.2K | -11.2K | |

| 06:00 | GBP | ILO Unemployment Rate (3M) Feb | 3.80% | 3.70% | 3.70% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Feb | 6.60% | 6.20% | 6.50% | 6.60% |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Feb | 5.90% | 5.10% | 5.70% | 5.90% |

| 08:00 | EUR | Italy Trade Balance (EUR) Feb | -3.23B | -4.19B | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Apr | 15.1 | 13 | ||

| 09:00 | EUR | Germany ZEW Current Situation Apr | -40 | -46.5 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Apr | 11.2 | 10 | ||

| 12:30 | USD | Building Permits Mar | 1.46M | 1.52M | ||

| 12:30 | USD | Housing Starts Mar | 1.41M | 1.45M | ||

| 12:30 | CAD | CPI M/M Mar | 0.60% | 0.40% | ||

| 12:30 | CAD | CPI Y/Y Mar | 4.30% | 5.20% | ||

| 12:30 | CAD | CPI Median Y/Y Mar | 4.50% | 4.90% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Mar | 4.40% | 4.80% | ||

| 12:30 | CAD | CPI Common Y/Y Mar | 6.00% | 6.40% |