Dollar’s decline continues in early trading, fueled by weaker-than-expected upstream inflation and job data, pushing the greenback to its lowest level against Euro this year. The Swiss Franc emerges as today’s biggest winner, bolstered by falling benchmark yields in Germany and the UK. Meanwhile, Euro benefits from hawkish remarks by ECB officials, while Australian dollar remains strong thanks to robust employment data.

Conversely, Sterling faces headwinds following unexpected stagnation in UK GDP for February and weak production data. Canadian Dollar is trimming recent gains, while Yen softens on expectations of prolonged monetary easing by BoJ and an uptick in risk appetite.

On the technical front, Gold has resumed its near-term rally, breaking through 2,032.05 and targeting resistance levels of 2,070.06 and record high of 2,074.84 set in 2020. A decisive break above these levels would confirm the resumption of the long-term uptrend. However, a drop below the 2,009.59 resistance-turned-support level would signal potential rejection by the 2,070.06/2,074.84 resistance zone and trigger a near-term pullback

In Europe, at the time of writing, FTSE is up 0.20%. DAX is up 0.02%. CAC is up 1.10%. Germany 10-year yield is down -0.009 at 2.358. Earlier in Asia, Nikkei rose 0.26%. Hong Kong HSI rose 0.17%. China Shanghai SSE dropped -0.27%. Singapore Strait Times rose 0.26%. Japan 10-year JGB yield dropped -0.0002 to 0.465.

US initial jobless claims rose to 239k, highest since Jan 2022

US initial jobless claims rose 11k to 239k in the week ending April 8, above expectation of 235k. That’s the highest level since January 15, 2022. Four-week moving average of continuing claims rose 2k to 240, highest since November 20, 2021.

Continuing claims dropped -13k to 1810k in the week ending April 1. Four-week moving average of continuing claims rose 9.5k to 1814k, highest since November 13, 2021.

US PPI at -0.5% mom, 2.7% yoy in Mar

US PPI for final demand dropped -0.5% mom in March, well below expectation of 0.1% mom. Two-thirds of the decline in the PPI for final demand can be attributed to a -1.0% mom decrease in prices for final demand goods. The PPI for final demand services also moved down -0.3% mom. Prices for final demand less foods, energy, and trade services edged up 0.1% mom.

For the 12 months period, PPI dropped from 4.6% yoy to 2.7% yoy, below expectation of 2.7% yoy. PPI less foods, energy, and trade services was up 3.6% yoy.

Bundesbank Nagel: Monetary-policy have to stubborn to fight against inflation

Bundesbank President Joachim Nagel, in an interview with CNBC on the sidelines of the IMF Spring Meetings, described euro-zone price gains as “a very stubborn phenomenon” and emphasized the need for persistent action against inflation. Nagel stated, “it’s definitely the case that we on the monetary-policy side have to be even more stubborn to fight against inflation.”

Nagel acknowledged the necessity to do more on the inflation front, explaining that while headline inflation might be heading in the right direction, core inflation remains at a very elevated level. He expects core inflation to come down before summer but warned that it would likely stay at high levels for the next few months, requiring continued vigilance in addressing the inflation issue.

Regarding the German economy, Nagel expressed confidence in its ability to adapt and overcome challenges, stating that “the energy crisis is more or less solved.” He added, “We had a really worried situation in the past, but this is now over, and the outlook is good.

UK economy stalls in Feb as GDP growth misses expectations

UK economy experienced a slowdown in February, with no monthly growth (0.0% mom) in GDP, falling short of the 0.1% mom growth expected by analysts. The disappointing result follows a 0.4% mom growth in January. The data reveals that services contracted by -0.1% mom after a 0.7% mom growth in January, while production fell by -0.2% mom following a -0.5% mom contraction in January. In contrast, construction sector saw growth of 2.4% mom, rebounding from a -1.7% mom contraction in January.

In the three months to February, GDP grew by a mere 0.1% when compared to the three months to November. During this period, services grew by 0.1%, production declined by -0.2%, and construction experienced growth of 0.9%. The lackluster performance raises concerns about the overall health of the UK economy.

Also published, industrial production came in at -0.2% mom, -3.1% yoy, versus expectation o f0.3% mom, -3.7% yoy. Manufacturing production was at 0.0%mom, -2.4% yoy, versus expectation of 0.3% mom, -4.7% yoy. Goods trade deficit narrowed slightly to GBP -17.5B, versus expectation of GBP -17.0B.

NIESR: UK GDP grew 0.1% in Q1, to expand 0.3% in Q2

NIESR estimated that UK GDP grew by 0.1% in Q1, an upgrade from prior forecasts -0.1% contraction. The early forecasts for Q2 sees quarterly growth rate picking up to 0.3%.

Paula Be jar a no Carbo Associate Economist, NIESR said: “The UK economic outlook for the first quarters of this year appears to be more resilient than previously thought, though broadly consistent with the longer-term trend of flatlining economic growth.”

Australian employment grew solidly by 53k, bolstering case for more RBA tightening

Australian labor market continued to show strength in March, with employment growth significantly outperforming expectations. The strong employment data shows very few signs of weakness in the labor market, suggesting that RBA may need to resume tightening in May.

According to the today’s data, employment increased by 53k in seasonally adjusted terms, well above expectation of 20k gain. Full-time jobs saw an increase of 72.2k, while part-time employment declined by -19.2k.

Despite expectations of a rise to 3.6%, unemployment rate remained unchanged at 3.5%. Additionally, the participation rate held steady at 66.7%, and monthly hours worked decreased by -0.2%. Lauren Ford, the ABS head of labor statistics, highlighted that the unemployment rate stayed at a near 50-year low of 3.5%.

Ford also noted that the employment-to-population ratio increased by 0.1 percentage point to 64.4%, with the participation rate remaining at 66.7%. Both indicators were close to their historical highs in November 2022, reflecting a tight labor market that has made it challenging for employers to fill the high number of job vacancies.

BoJ Ueda emphasizes divergent inflation path in Japan, pledges continued monetary easing

In the G7 central bank chief briefing in Japan, BoJ Governor Kazuo Ueda underscored the unique inflation situation in Japan compared to other countries. While elevated inflation rates are affecting many countries, Japan’s price gains are expected to slow down to below 2%, prompting the BoJ to continue its monetary easing policies.

Ueda acknowledged the possibility of Japan falling behind the curve in addressing the risk of high inflation. However, he emphasized the importance of being more focused on the risk of inflation falling short of the 2% target. He stated, “As we guide monetary policy, it is appropriate to pay more attention to the risk of inflation undershooting 2 percent and thus moving away from the goal.”

Ueda is set to have his first policy meeting on April 27-28, where he will likely further discuss Japan’s distinct inflation trajectory and the country’s monetary policy approach.

EUR/USD Mid-Day Outlook

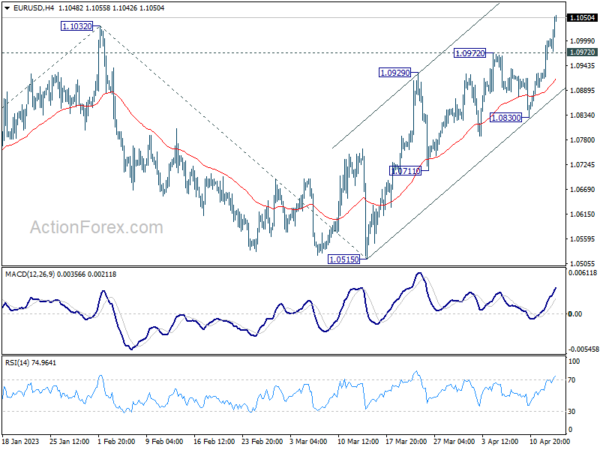

Daily Pivots: (S1) 1.0935; (P) 1.0968; (R1) 1.1024; More…

EUR/USD’s break of 1.1032 resistance indicate resumption of whole up trend from 0.9534. Intraday bias is stay on the upside for 1.1273 fibonacci level. Break there will target 61.8% projection of 0.9534 to 1.1032 from 1.0515 at 1.1441. On the downside,e below 1.0972 support will turn intraday bias neutral and bring consolidations first. But near term outlook will stay bullish as long as 1.0830 support holds.

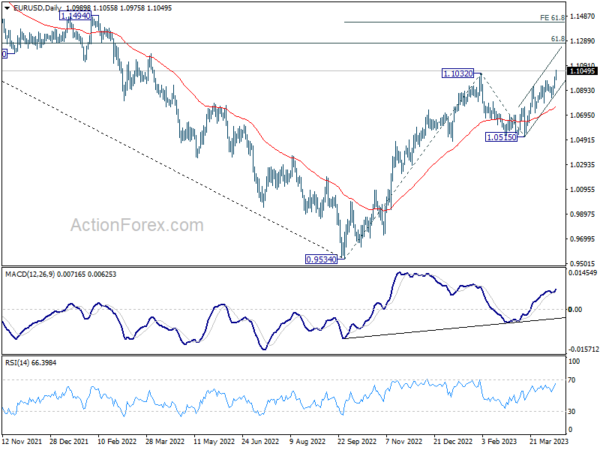

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Mar | 2.60% | 2.50% | 2.60% | |

| 01:30 | AUD | Employment Change Mar | 53.0K | 20.0K | 64.6K | 63.6K |

| 01:30 | AUD | Unemployment Rate Mar | 3.50% | 3.60% | 3.50% | |

| 03:00 | CNY | Trade Balance (USD) Mar | 88.2B | 40.0B | 116.9B | |

| 03:00 | CNY | Exports Y/Y Mar | 14.80% | 3.10% | -6.80% | |

| 03:00 | CNY | Imports Y/Y Mar | -1.40% | 3.90% | -10.20% | |

| 06:00 | EUR | Germany CPI M/M Mar F | 0.80% | 0.80% | 0.80% | |

| 06:00 | EUR | Germany CPI Y/Y Mar F | 7.40% | 7.40% | 7.40% | |

| 06:00 | GBP | GDP M/M Feb | 0.00% | 0.10% | 0.30% | 0.40% |

| 06:00 | GBP | Index of Services 3M/3M Feb | 0.10% | -0.20% | 0.00% | 0.10% |

| 06:00 | GBP | Industrial Production M/M Feb | -0.20% | 0.30% | -0.30% | -0.50% |

| 06:00 | GBP | Industrial Production Y/Y Feb | -3.10% | -3.70% | -4.30% | -3.20% |

| 06:00 | GBP | Manufacturing Production M/M Feb | 0.00% | 0.30% | -0.40% | -0.10% |

| 06:00 | GBP | Manufacturing Production Y/Y Feb | -2.40% | -4.70% | -5.20% | -2.80% |

| 06:00 | GBP | Goods Trade Balance (GBP) Feb | -17.5B | -17.0B | -17.9B | |

| 08:00 | EUR | Italy Industrial Output M/M Feb | -0.20% | 0.50% | -0.70% | -0.50% |

| 09:00 | EUR | Eurozone Industrial Production M/M Feb | 1.50% | 1.00% | 0.70% | 1.00% |

| 11:00 | GBP | NIESR GDP Estimate (3M) Mar | 0.10% | -0.10% | -0.10% | 0.10% |

| 12:30 | USD | PPI M/M Mar | -0.50% | 0.10% | -0.10% | 0.00% |

| 12:30 | USD | PPI Y/Y Mar | 2.70% | 3.10% | 4.60% | |

| 12:30 | USD | PPI Core M/M Mar | -0.10% | 0.20% | 0.00% | 0.20% |

| 12:30 | USD | PPI Core Y/Y Mar | 3.40% | 3.30% | 4.40% | |

| 12:30 | USD | Initial Jobless Claims (Apr 7) | 239K | 235K | 228K | |

| 14:30 | USD | Natural Gas Storage | 25B | -23B |