Dollar remains somewhat soft in the Asian trading session, though it hasn’t seen any follow-through selling. Hawkish FOMC minutes have partially offset the impact of consumer inflation data on the currency. The broader financial markets also lack a clear direction, as US stock indexes closed lower after initial rally. Benchmark treasury yields mostly reversed their initial losses, while gold remains above 2000 level but struggles to break through recent high. Market participants will look for further guidance from upcoming data to adjust their expectations of Fed rate path, as Fed fund futures continue to suggest a near 70% chance of another 25 basis point hike in May.

In the currency markets, Australian Dollar is slightly buoyed by stronger-than-expected job data, while Canadian Dollar appears unfazed by BoC’s decision to keep interest rates unchanged. Japanese Ten, Swiss Franc, and Euro are today’s weaker currencies so far, but most major pairs and crosses are currently confined within yesterday’s trading range. For the week, Yen is the worst performer, followed by New Zealand Dollar and US Dollar, while Swiss franc leads, followed by the Euro and Canadian dollar.

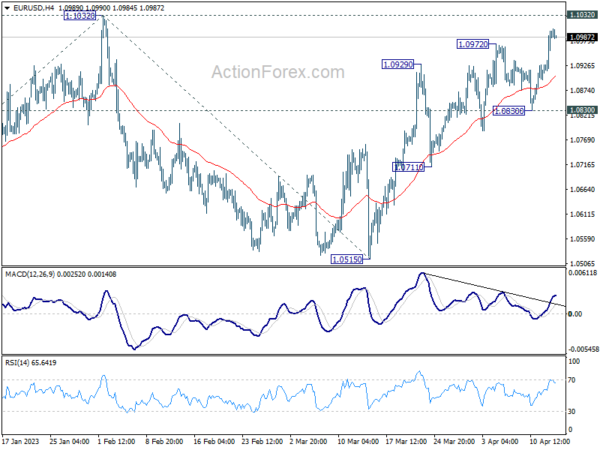

Technically, a key focus remains on the EUR/USD pair’s reaction to the 1.1032 resistance level. The currency pair is building upside momentum, as evidenced by the 4H MACD. However, it remains uncertain if this momentum is enough to break through the resistance and resume the larger uptrend from 2022 low at 0.9534. A rejection by 1.1032 followed by break of 1.0830 would signal that the correction pattern from 1.1032 is set to extend with another falling leg, back towards the 1.0515 support level, before eventually staging an upside breakout.

In Asia, at the time of writing, Nikkei is up 0.22%. Hong Kong HSI is down -0.46%. China Shanghai SSE is up 0.02%. Singapore Strait Times is up 0.02%. Japan 10-year JGB yield is up 0.0011 at 0.467. Overnight, DOW dropped -0.11%. S&P 500 dropped -0.41%. NASDAQ dropped -0.85%. 10-year yield dropped -0.013 to 3.421.

FOMC minutes reveal larger rate hike considered, banking developments held back aggressive action

FOMC minutes from the March 21-22 meeting revealed that committee members acknowledged inflation remaining significantly above the 2% target and a tight labor market, suggesting that “additional policy firming may be appropriate.” Some participants even considered a 50 basis point increase in the target range, but due to potential banking-sector developments impacting financial conditions and economic activity, they opted for a smaller increment.

The minutes note that several participants contemplated keeping the target range steady to allow more time to assess the economic effects of recent banking-sector developments and the cumulative tightening of monetary policy. However, due to Fed’s actions in coordination with other government agencies, which helped stabilize the banking sector, they deemed a 25 basis point increase appropriate in order to address elevated inflation and stay committed to the 2% longer-run goal.

The Committee agreed to consider recent banking developments in future monetary policy decisions, focusing on how they may affect employment, inflation, and the risks surrounding the outlook.

BoJ Ueda emphasizes divergent inflation path in Japan, pledges continued monetary easing

In the G7 central bank chief briefing in Japan, BoJ Governor Kazuo Ueda underscored the unique inflation situation in Japan compared to other countries. While elevated inflation rates are affecting many countries, Japan’s price gains are expected to slow down to below 2%, prompting the BoJ to continue its monetary easing policies.

Ueda acknowledged the possibility of Japan falling behind the curve in addressing the risk of high inflation. However, he emphasized the importance of being more focused on the risk of inflation falling short of the 2% target. He stated, “As we guide monetary policy, it is appropriate to pay more attention to the risk of inflation undershooting 2 percent and thus moving away from the goal.”

Ueda is set to have his first policy meeting on April 27-28, where he will likely further discuss Japan’s distinct inflation trajectory and the country’s monetary policy approach.

Australian employment grew solidly by 53k, bolstering case for more RBA tightening

Australian labor market continued to show strength in March, with employment growth significantly outperforming expectations. The strong employment data shows very few signs of weakness in the labor market, suggesting that RBA may need to resume tightening in May.

According to the today’s data, employment increased by 53k in seasonally adjusted terms, well above expectation of 20k gain. Full-time jobs saw an increase of 72.2k, while part-time employment declined by -19.2k.

Despite expectations of a rise to 3.6%, unemployment rate remained unchanged at 3.5%. Additionally, the participation rate held steady at 66.7%, and monthly hours worked decreased by -0.2%. Lauren Ford, the ABS head of labor statistics, highlighted that the unemployment rate stayed at a near 50-year low of 3.5%.

Ford also noted that the employment-to-population ratio increased by 0.1 percentage point to 64.4%, with the participation rate remaining at 66.7%. Both indicators were close to their historical highs in November 2022, reflecting a tight labor market that has made it challenging for employers to fill the high number of job vacancies.

Looking ahead

UK GDP is the main feature in European session while production and trade balance will be released too. Eurozone too publish industrial production. Later in the day, US will release PPI and jobless claims.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6653; (P) 0.6688; (R1) 0.6728; More…

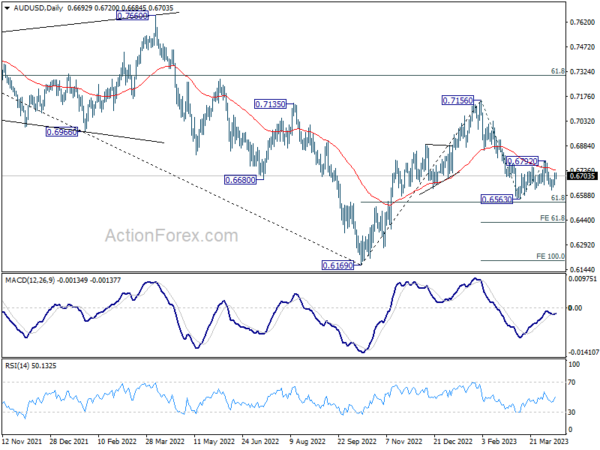

AUD/USD’s recovery from 0.6619 continues today but stays well below 0.6792 resistance. Intraday bias remains neutral for the moment. Risk stays on the downside with 0.6792 resistance intact. Below 0.6619 will bring retest of 0.6563 low first. sustained break of 0.6563 support will resume the decline from 0.7156 to 61.8% projection of 0.7156 to 0.6563 from 0.6792 at 0.6426.

In the bigger picture, as long as 61.8% retracement of 0.6169 to 0.7156 at 0.6546 holds, the decline from 0.7156 is seen as a correction to rally from 0.6169 (2022 low) only. Another rise should still be seen through 0.7156 at a later stage. However, sustained break of 0.6546 will raise the chance of long term down trend resumption through 0.6169 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Mar | 2.60% | 2.50% | 2.60% | |

| 01:30 | AUD | Employment Change Mar | 53.0K | 20.0K | 64.6K | 63.6K |

| 01:30 | AUD | Unemployment Rate Mar | 3.50% | 3.60% | 3.50% | |

| 03:00 | CNY | Trade Balance (USD) Mar | 88.2B | 40.0B | 116.9B | |

| 03:00 | CNY | Exports Y/Y Mar | 14.80% | 3.10% | -6.80% | |

| 03:00 | CNY | Imports Y/Y Mar | -1.40% | 3.90% | -10.20% | |

| 06:00 | EUR | Germany CPI M/M Mar F | 0.80% | 0.80% | ||

| 06:00 | EUR | Germany CPI Y/Y Mar F | 7.40% | 7.40% | ||

| 06:00 | GBP | GDP M/M Feb | 0.10% | 0.30% | ||

| 06:00 | GBP | Index of Services 3M/3M Feb | -0.20% | 0.00% | ||

| 06:00 | GBP | Industrial Production M/M Feb | 0.30% | -0.30% | ||

| 06:00 | GBP | Industrial Production Y/Y Feb | -3.70% | -4.30% | ||

| 06:00 | GBP | Manufacturing Production M/M Feb | 0.30% | -0.40% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Feb | -4.70% | -5.20% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Feb | -17.0B | -17.9B | ||

| 08:00 | EUR | Italy Industrial Output M/M Feb | 0.50% | -0.70% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Feb | 1.00% | 0.70% | ||

| 11:00 | GBP | NIESR GDP Estimate (3M) Mar | -0.10% | -0.10% | ||

| 12:30 | USD | PPI M/M Mar | 0.10% | -0.10% | ||

| 12:30 | USD | PPI Y/Y Mar | 3.10% | 4.60% | ||

| 12:30 | USD | PPI Core M/M Mar | 0.20% | 0.00% | ||

| 12:30 | USD | PPI Core Y/Y Mar | 3.30% | 4.40% | ||

| 12:30 | USD | Initial Jobless Claims (Apr 7) | 235K | 228K | ||

| 14:30 | USD | Natural Gas Storage | 25B | -23B |