European majors are taking center stage today as markets reopen after holidays. Although not spectacular, Eurozone data revealed improvements in investor confidence, which has bolstered overall market sentiment. Major European indexes and benchmark treasury yields are trading slightly higher. In contrast, commodity currencies and Dollar are trading on the softer side, while Yen is mixed for the day but remains the week’s worst performer. It’s important to note that volatility has been relatively low so far. Traders may remain cautious until tomorrow’s US CPI release and Bank of Canada rate decisions.

Meanwhile, the development in CHF/JPY is worth mentioning. The cross has entirely reversed the setback from the Credit Suisse turmoil in March, and it now appears ready to resume the rebound from 137.40. Technically, the corrective fall from 151.43 should have already completed at 137.40. A break of 147.68 should prompt a retest of the 151.43 high, a decisive break there would resume the larger uptrend. However, rejection by 151.43 could extend the corrective pattern from 151.43 with another falling leg, before an eventual upside breakout.

In Europe, at the time of writing, FTSE is up 0.24%. DAX is up 0.35%. CAC is up 0.81%. Germany 10-year yield is up 0.089 at 2.275. Earlier in Asia, Nikkei rose 1.05%. Hong Kong HSI rose 0.76%. China Shanghai SSE dropped -0.05%. Singapore Strait Times rose 0.10%. Japan 10-year JGB yield dropped -0.0142 to 0.454.

Bitcoin breaks out surpassing 30k, NASDAQ to follow?

Bitcoin has finally broken through its recent range to the upside, surpassing 30k level for the first time since June 2022. While some observers may attribute the rally since mid-March to safe-haven flows amid banking turmoil, it seems more likely that Bitcoin is moving in tandem with tech stocks, in anticipation of Fed nearing a pause in tightening.

With 100% projection of 15452 to 25242 from 19552 at 29342 now surpassed, the next target is 161.8% projection at 35392. Even if a retreat occurs, outlook will remain bullish as long as 27,808 support holds.

Focus now shifts to the upside momentum of the current move and the reaction to the 35392 projection target. This level is close to the 38.2% projection of 68986 to 15452 at 35901.

Strong upside momentum and a decisive break of the 35k/36k zone would suggest that the rise from 15452 is a of a medium-term impulsive up trend, potentially leading to further gains. Conversely, weak momentum and rejection by the 35k/36k zone would indicate that rebound from 15452 remains just a corrective move.

Another question arising is whether NASDAQ can follow suit and decisively break through 38.2% retracement of 16,212.22 to 10,088.82 at 12,427.95, confirming the underlying bullish momentum in tech-related sectors.

Eurozone Sentix Investor Confidence rose to -8.7, negative momentum weakening

Eurozone Sentix Investor Confidence increased from -11.1 to -8.7 in April, surpassing the expected -14.0. The Current Situation index experienced its sixth consecutive rise, moving from -9.3 to -4.3, reaching its highest level since March 2022. The Expectations index, however, remained unchanged at -13.0.

Sentix commented on the data, stating, “There is no doubt that the Eurozone economy has come through the winter months better than many feared in the autumn.” However, when considering the future, investors are less optimistic, citing “still considerable uncertainty about the further course of the Ukraine war, concerns about a lasting burden on the energy-intensive industrial sector, and – new – question marks about the state of the US economy.”

Despite these concerns, the Sentix Theme Barometer indicates that negative expectations regarding inflation and central bank policy have noticeably decreased. While not an all-clear signal, the negative momentum seems to be weakening.

Eurozone retail sales down -0.8% mom in Feb, EU down -0.9% mom

Eurozone retail sales volume dropped -0.8% mom in February, matched expectations. Volume of retail trade decreased by -1.8% for automotive fuels, by -0.7% for non-food products and by -0.6% for food, drinks and tobacco.

EU retail sales declined -0.9% mom. Among Member States for which data are available, the largest monthly decreases in the total retail trade volume were registered in Slovenia (-10.5%), Hungary and Poland (both -2.0%) and Sweden (-1.6%). The highest increases were observed in Cyprus (+1.6%), Luxembourg (+0.8%) and Belgium (+0.7%).

Australia consumer sentiment jumped 9.4% on RBA pause

Australia Westpac Melbourne Institute Consumer Sentiment Index witnessed a significant 9.4% increase in April, jumping from 78.4 in March to 85.8. This remarkable recovery can be largely attributed to RBA’s decision to pause rate hikes during its April meeting, breaking a sequence of ten consecutive meetings with cash rate increases.

However, confidence remains weak, sitting -10.4% lower than April of the previous year, before the tightening cycle began. Respondents continue to exercise caution, with 34.11% still expecting the Standard Variable Rate to rise by more than 1% over the year, although this figure is down from 44.55%.

Regarding the RBA’s meeting on May 2, Westpac noted that the central bank would benefit from a clean read on underlying inflation from the March quarter Inflation Report, set to be released on April 26, as well as staff’s refreshed economic forecasts. Westpac anticipates that a final 0.25% increase in the cash rate during the May Board meeting would be the best policy approach, rather than waiting for additional information and risking higher rates later in the cycle.

Australian NAB business confidence improved, conditions remain resilient

Australia NAB Business Confidence improved from -4 to -1 in March, while Business Conditions dropped slightly from 17 to 16. Delving into some details, trading conditions rose from 25 to 26, profitability conditions dipped from 14 to 13, and employment conditions fell from 12 to 10.

NAB Chief Economist Alan Oster commented, “Business conditions have been resilient, slowly edging lower over the past few months but remaining well above their long-run average.” He added that “trading conditions are particularly elevated, indicating that businesses continue to experience strong demand, and conditions are generally strong across states and sectors.”

On the topic of confidence, Oster stated, “Confidence appears to have stabilized, but it remains below average at -1 index point.” He noted that confidence was particularly poor in retail and wholesale sectors, likely due to firms being concerned about the sustainability of consumer spending.

In summary, the survey suggests the Australian economy is still holding up, with some easing in inflation. However, Oster emphasized that “there is still a long way to go to bring inflation back down to the RBA’s target band and growth could be more volatile from there.”

China CPI slows to 18-month low, PPI sees steepest decline since June 2022

China’s CPI slowed from 1.0% yoy to 0.7% yoy in March, falling below the expected 1.0% yoy and marking the lowest level in 18 months since September 2021. Excluding food and energy, CPI increased from 0.6% to 0.7% yoy. Food prices rose by 2.4% yoy compared to a year ago, down from 2.6% yoy in February. Notably, pork prices surged by 9.6% yoy, up from a rise of 3.9% yoy in February.

Dong Lijuan, an NBS statistician, attributed the easing consumer inflation in March to “continued resumption of production and life as well as sufficient market supplies.” He also mentioned that the fall in factory-gate prices was affected by a high comparison base in the previous year.

Meanwhile, PPI dropped from -1.4% yoy to -2.5% yoy, matching expectations and marking the steepest decline since June 2022. Dong Lijuan, senior NBS statistician, explained that “production and life continued to recover with sufficient supplies in March.”

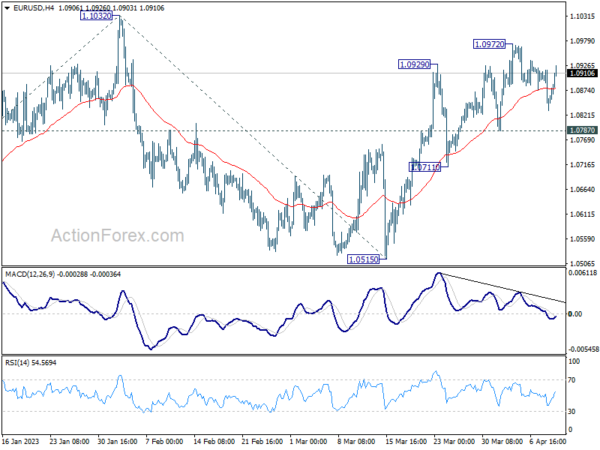

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0823; (P) 1.0870; (R1) 1.0908; More…

EUR/USD recovers today but stays inside range below 1.0972. Intraday bias remains neutral for the moment. With 1.0787 support intact, further rally is expected. On the upside, above 1.0972 will resume the rally from 1.0515 to retest 01.1032 high. Firm break there will resume larger up trend from 0.9534. However, break of 1.0787 will turn bias back to the downside for 1.0711 support instead.

In the bigger picture, rise from 0.9534 (2022 low) is in progress with 38.2% retracement of 0.9534 to 1.1032 at 1.0460 intact. The strong support from 55 week EMA (now at 1.0625) was also a medium term bullish sign. Next target is 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Consumer Confidence Apr | 9.40% | 0.00% | ||

| 01:30 | AUD | NAB Business Conditions Mar | 16 | 17 | ||

| 01:30 | AUD | NAB Business Confidence Mar | -1 | -4 | ||

| 01:30 | CNY | CPI Y/Y Mar | 0.70% | 1.00% | 1.00% | |

| 01:30 | CNY | PPI Y/Y Mar | -2.50% | -2.50% | -1.40% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Mar P | -15.20% | -10.70% | ||

| 08:30 | EUR | Sentix Investor Confidence Apr | -8.7 | -14 | -11.1 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Mar | -0.80% | -0.80% | 0.30% | 0.80% |

| 10:00 | USD | NFIB Business Optimism Index Mar | 90.1 | 89.6 | 90.9 |