Yen is extending this week’s rebound in Asian session, with help from extended decline in US and European benchmark yields. Investors were showing signs of worries of a sharper slowdown in US economy after much weaker than expected economic data. Dollar is recovering on mild risk aversion too, but remains the worst performer of the week. The US markets will be keenly awaiting tomorrow’s non-farm payroll data to adjust their forecasts on the economy, Fed’s rate path, and next moves in the markets.

But for today, Canadian employment data will be a focus first. The lift from oil prices this week has so far faded, with WTI crude oil still struggling around 80 handle. As for BoC monetary policies, there is little reason for a piece of data to take the central out of the pause in tightening. Nevertheless, there are still speculations of at least one more hike by BoC this year, which will be heavily data-dependent.

AUD/CAD would be a pair to watch today. Aussie is among the worst performer for the week after RBA’s rate pause. Strong job data from Canada could push AUD/CAD through 0.8984 support. The down trend from 0.9545 would then resume and target 61.8% projection of 0.9545 to 0.9043 from 0.9229 at 0.8919. Overall, outlook will stay bearish as long as 0.9127 resistance holds, in case of a rebound.

In Asia, at the time of writing, Nikkei is down -1.35%. Hong Kong HSI is down -0.38%. China Shanghai SSE is down -0.01%. Singapore Strait Times is down -0.66%. Japan 10-year JGB yield is down -0.0053 at 0.464. Overnight, DOW rose 0.24%. S&P 500 dropped -0.25%. NASDAQ dropped -1.07%. 10-year yield dropped -0.050 to 3.287.

US 10-year yield plunges to 7-month low on worries of sharper slowdown

Following weaker-than-expected private job data and services PMI, US 10-year yield dropped to its lowest level in seven months overnight. Despite these signs of a potential cooling in the economy, which could prompt the Fed to ease up on tightening measures, major stock indexes closed mixed, suggesting that investors may be more concerned about a sharper slowdown on the horizon.

Technically, 10-year yield is approaching a critical support level at 55 week EMA (now at 3.237). A rebound around the EMA, followed by a break of 3.61 resistance, would initially signal a short-term bottoming. More importantly, this would argue that price fluctuations from 4.333 are merely a medium-term corrective pattern.

However, firm break of the 55 week EMA could indicate that 10-year yield is already correcting the whole uptrend that began at 0.398 (2020 low). In this scenario, a deeper decline through the 3% handle to 38.2% retracement of 0.398 to 4.333 at 2.829 could occur before finding sufficient support for a sustainable bounce.

China Caixin PMI services rose to 57.8, highest since Nov 2020

China’s Caixin PMI Services index exceeded expectations in March, rising from 55.0 to 57.8, marking the highest level since November 2020. The data revealed sharp increases in activity, sales, and employment, with the services sector showing stronger expansion compared to the manufacturing sector. Business confidence remained historically strong, while input price inflation reached a seven-month high. The PMI Composite also experienced a slight increase from 54.2 to 54.5, reaching its highest point since June 2022.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Production, demand and employment all grew, with the services sector showing a stronger expansion, whereas manufacturing activity turned comparatively sluggish. Input costs and prices charged remained stable, and businesses were highly optimistic.”

Looking ahead

Swiss unemployment rate and foreign currency reserves, Germany industrial production and UK PMI construction will be released in European session. Later in the day, Canada employment will take center stage, while US will release Challenger job cuts and jobless claims.

USD/JPY Daily Outlook

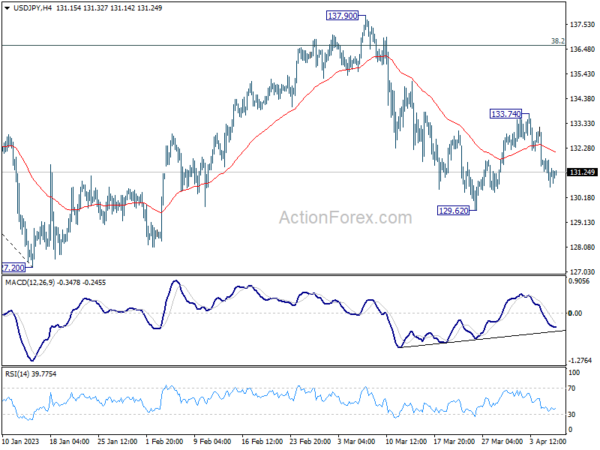

Daily Pivots: (S1) 130.70; (P) 131.27; (R1) 131.91; More…

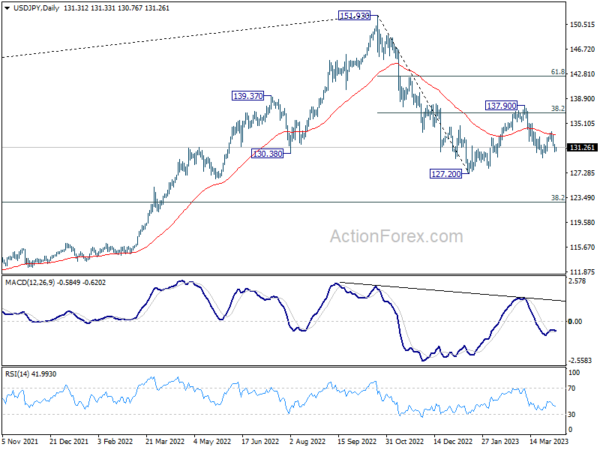

Intraday bias in USD/JPY remains on the downside for 129.62 support. Break there will resume the whole decline form1 37.90 to retest 127.20 low. On the upside, however, above 133.74 resistance will turn bias back to the upside for another rise. Overall, eventual downside break out is expected as long as 137.90 resistance holds.

In the bigger picture, corrective pattern from 127.20 might be extending. But after all, down trend from 151.93 is expected to resume at a later stage. Break of 127.20 will resume this down trend and target 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61. This will now be the favored case as long as 137.90 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) Feb | 13.87B | 11.12B | 11.69B | 11.27B |

| 01:45 | CNY | Caixin Services PMI Mar | 57.8 | 55 | 55 | |

| 05:45 | CHF | Unemployment Rate Mar | 1.90% | 1.90% | 1.90% | |

| 06:00 | EUR | Germany Industrial Production Feb | -0.40% | 3.50% | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) Mar | 771B | |||

| 08:30 | GBP | Construction PMI Mar | 53.6 | 54.6 | ||

| 11:30 | USD | Challenger Job Cuts Mar | 410.10% | |||

| 12:30 | USD | Initial Jobless Claims (Mar 31) | 200K | 198K | ||

| 12:30 | CAD | Net Change in Employment Mar | 10.2K | 21.8K | ||

| 12:30 | CAD | Unemployment Rate Mar | 5.10% | 5.00% | ||

| 14:00 | CAD | Ivey PMI Mar | 52 | 51.6 | ||

| 14:30 | USD | Natural Gas Storage | -20B | -47B |