Disappointing US private job data doesn’t trigger significant fresh selling in Dollar, but it’s still maintaining its position as the week’s weakest performer so far. Countervailing forces from declining US and European benchmark treasury yields are keeping the greenback’s losses against Euro and Sterling in check. However, Swiss Franc and Yen seem to be making headway in broad rallies.

Australian Dollar is currently the day’s weakest performer, as post-RBA selloff gains momentum. Meanwhile, New Zealand Dollar is holding onto its gains after a larger-than-expected RBNZ rate hike during the Asian session, although no clear follow-through buying has emerged.

From a technical standpoint, AUD/JPY’s rebound from 86.04 is likely complete at 90.15, following a rejection by the 55 day EMA. Deeper decline is now anticipated towards 86.04 and below, resuming the overall downtrend from 99.32. The key level to watch ahead is 61.8% projection of 99.32 to 87.00 from 93.02 at 85.40. Firm break below this level could trigger a more rapid decline to the 100% projection at 80.70, potentially within Q2.

In Europe, at the time of writing, FTSE is up 0.28%. DAX is down -0.51%. CAC is down -0.25%. Germany 10-year yield is down -0.019 at 2.234. Earlier in Asia, Nikkei dropped -1.68%. Japan 10-year JGB yield rose 0.0532 to 0.469. Singapore Strait Times rose 0.23%. Hong Kong and China were on holiday.

US ADP employment rose only 145k, signals economy is slowing

US ADP private sector employment increased by 145k jobs in March, well below expectation of 200k. By industry sector, goods-producing jobs increased 70k while service-providing jobs increased 75k. By establishment size, small company jobs rose 101k, medium companies rose 33k, and large companies rose 10k.

“Our March payroll data is one of several signals that the economy is slowing,” said Nela Richardson, chief economist, ADP. “Employers are pulling back from a year of strong hiring and pay growth, after a three-month plateau, is inching down.”

UK PMI services finalized at 52.9, composite at 52.2

UK PMI Services was finalized at 52.9 in March, down from February’s 53.5. PMI Composite was finalized at 52.2, down from prior month’s 53.1.

Tim Moore, Economics Director at S&P Global Market Intelligence, noted that the UK service sector returned to growth in Q1 2023 due to improved business and consumer confidence, as well as a sustained rebound in new orders. Export sales also boosted the service economy, with the fastest rise in new orders from abroad in over eight years.

Overall business expenses increased at the slowest pace since May 2021, as lower transport bills and falling commodity prices offset rising staff costs. Moore highlighted that prices charged by service sector businesses increased at the weakest rate in 19 months, signaling that competitive pressures and improved supply conditions would likely reduce consumer price inflation in the coming months.

Eurozone PMI composite finalized at 10-month high, but growth varies across countries

Eurozone PMI Services was finalized at 55.0 in March, up from February’s 52.7. PMI Composite was finalized at 53.7, up from prior month’s 52.0. Both indexes were at their 10-month highs.

Looking at PMI Composite of some member states, improvements were seen in Spain (58.2, 16-month high), Italy (55.2, 16-month high), France (52.7, 10-month high), and Germany (52.6, 10-month high). Ireland dropped to 52.8, 2-month low.

Joe Hayes, Senior Economist at S&P Global Market Intelligence said eurozone economy is rebounding from the slowdown seen in late 2022, and for now, appears to be clear of a recession.

He noted that March’s economic activity increase was driven by strong growth in the service sector, but highlighted that growth varies across countries, with significant contributions from Spain and Italy. However, modest activity levels in Germany and France suggest a more conservative outlook for the eurozone’s overall economic health.

Hayes also mentioned that the case for further interest rate hikes remains strong, as inflation rates, though cooling from their peaks, continue to run high, especially in the service sector.

RBNZ hikes 50bps after considering a 25bps move too

In an unexpected move, RBNZ raised the Official Cash Rate by 50bps to 5.25%, doubling the anticipated 25bps hike. This bold step reflects the central bank’s concerns about persistently high inflation and employment levels.

The RBNZ statement highlighted that “inflation is still too high and persistent, and employment is beyond its maximum sustainable level.” Despite lower-than-expected economic activity in the December quarter, demand continues to outstrip supply, exerting further pressure on annual inflation.

The statement also noted that severe weather events in the North Island have contributed to higher prices for some goods and services. This increased near-term CPI inflation poses a risk of inflation expectations remaining above the target range.

In the meeting minutes, the Committee emphasized the need to continue raising the OCR to bring inflation back to the 1-3% target and fulfill their remit. They discussed both 25 and 50 basis point increases, ultimately opting for the more aggressive 50 basis point hike. This decision aims to maintain current lending rates for businesses and households while supporting an increase in retail deposit rates, countering the downward pressure on lending rates caused by falling wholesale interest rates since the February Statement.

RBA Lowe: To hold doesn’t imply tightening is over

RBA Governor Philip Lowe, in a speech today, clarified that the decision to keep interest rates unchanged yesterday does not mark the end of tightening measures.

“The decision to hold rates steady this month does not imply that interest rate increases are over. Indeed, the Board expects that some further tightening of monetary policy may well be needed to return inflation to target within a reasonable timeframe,” he said.

Acknowledging that monetary policy is now in restrictive territory, Lowe said it was time to hold interest rates steady and gather more information. He also mentioned that RBA will review its monetary policy stance at the next meeting, taking into account updated forecasts and scenarios.

USD/CHF Mid-Day Outlook

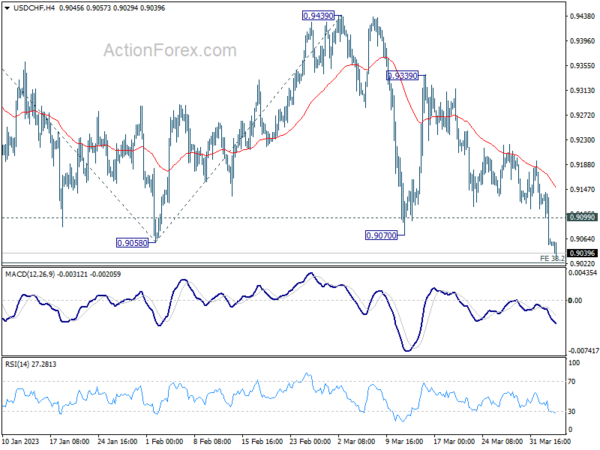

Daily Pivots: (S1) 0.9031; (P) 0.9087; (R1) 0.9118; More…

Intraday bias in USD/CHF stays on the downside for 38.2% projection of 1.0146 to 0.9058 from 0.9439 at 0.9023. Decisive break there will extend the down trend from 1.0146 to 61.8% projection at 0.8767.On the upside, above 0.9099 minor resistance will delay the bearish case and turn intraday bias neutral again.

In the bigger picture, outlook will stay bearish as long as 0.9439 resistance holds, and fall from 1.1046 (2022 high) is still in progress. Prior rejection by 55 week EMA was a medium term bearish sign. Sustained of 0.9058 will resume such decline towards 0.8756 support (2021 low). But overall, this fall is still as a leg in the long term range pattern from 1.0342 (2016 high). So, downside should be contained by 0.8756 to bring reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | NZD | RBNZ Interest Rate Decision | 5.25% | 5.00% | 4.75% | |

| 06:00 | EUR | Germany Factory Orders M/M Feb | 4.80% | 0.40% | 1.00% | 0.50% |

| 06:45 | EUR | France Industrial Output M/M Feb | 1.20% | 0.60% | -1.90% | -1.40% |

| 07:45 | EUR | Italy Services PMI Mar | 55.7 | 53 | 51.6 | |

| 07:50 | EUR | France Services PMI Mar F | 53.9 | 55.5 | 55.5 | |

| 07:55 | EUR | Germany Services PMI Mar F | 53.7 | 53.9 | 53.9 | |

| 08:00 | EUR | Eurozone Services PMI Mar F | 55 | 55.6 | 55.6 | |

| 08:30 | GBP | Services PMI Mar F | 52.9 | 52.8 | 52.8 | |

| 09:00 | EUR | Italy Retail Sales M/M Feb | -0.10% | 0.50% | 1.70% | |

| 12:15 | USD | ADP Employment Change Mar | 145K | 200K | 242K | 261K |

| 12:30 | CAD | Trade Balance (CAD) Feb | 0.4B | 2.2B | 1.9B | 1.2B |

| 12:30 | USD | Trade Balance (USD) Feb | -70.5B | -68.5B | -68.3B | -68.7B |

| 13:45 | USD | Services PMI Mar F | 53.8 | 53.8 | ||

| 14:00 | USD | ISM Services PMI Mar | 54.5 | 55.1 | ||

| 14:30 | USD | Crude Oil Inventories | -1.6M | -7.5M |