In the quiet Asian session, Canadian Dollar continues to outperform, while positive risk sentiment is providing a slight boost to Australian Dollar, though not New Zealand Dollar. Euro is drawing support from hawkish remarks by ECB officials but lacks strong follow-through buying. Yen, Swiss Franc, and Dollar remain the weaker currencies this week, reflecting overall market sentiment. Trading may stay subdued until tomorrow’s Eurozone and US inflation data release or could be even be on hold until next week’s wave of April economic indicators.

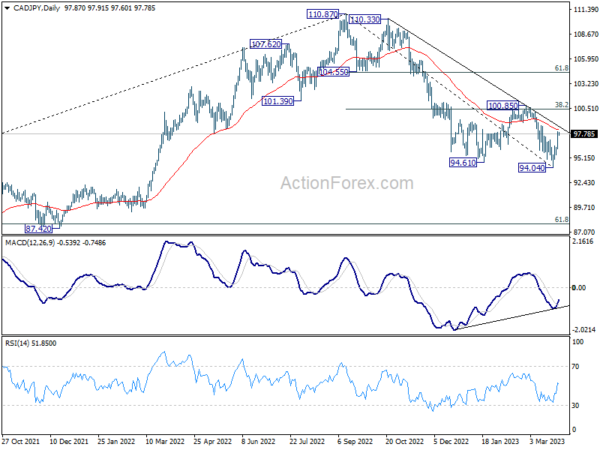

From a technical perspective, CAD/JPY seems to have completed its five-wave impulse from 110.87 to 94.04, as evidenced by bullish convergence in daily MACD. A further rebound towards the 55 day EMA (now at 98.22) and above is expected. The crucial test lies in the 100.85 cluster resistance (38.2% retracement of 110.87 to 94.04 at 100.46). Rejection by this resistance zone will keep outlook bearish for another decline through 94.04 at a later stage.

In Asia, at the time of writing, Nikkei is down -0.54%. Hong Kong HSI is up 0.43%. China Shanghai SSE is up 0.48%. Singapore Strait Times is down -0.25%. Japan 10-year JGB yield is up 0.0145 at 0.321. Overnight, DOW rose 1.00%. S&P 500 rose 1.42%. NASDAQ rose 1.79%. 10-year yield rose 0.002 to 3.566.

ECB Schnabel: Influence of energy price spike may not drop out as quickly as it moves in

ECB Executive Board member Isabel Schnabel commented yesterday on the challenges of underlying inflation in the Eurozone, noting that it has proven “sticky” and may not be significantly impacted by the recent fall in energy costs. Schnabel stated that the influence of the energy price spike “may not drop out as quickly as it moves in” and added that “it’s not even clear whether it’s going to be completely symmetric in the sense that everything is even going to drop out at all.”

Regarding monetary policy, Schnabel acknowledged that the ECB possesses “a bit of flexibility” and emphasized that the central bank’s target is defined over the medium term, which prevents the need to “cause unnecessary pain.”

As for the recent crisis, Schnabel observed that there has been a shift from overnight deposits to time deposits, but no general deposit outflow from banks, suggesting the banking sector remains relatively resilient. She also noted that the crisis could have a disinflationary effect that the ECB must consider, but the magnitude of that effect remains uncertain at this time.

BoE Mann: Rising core goods and services prices make our job difficult

BoE MPC member Catherine Mann, known for her hawkish stance, highlighted yesterday the difficulties in tackling inflation as core goods and services prices continue to trend upward. Despite falling gas prices, which Mann believes will be crucial in driving headline inflation down, she acknowledged the challenges that persist in managing inflation.

Mann said, “Gas prices in particular are on the down slope, and that type of dynamic is going to be very important in driving headline inflation down.” However, she also admitted that “core goods and services are trending up… It is going to make it very difficult to do our job.”

Although Mann has previously advocated for more aggressive tightening, she adjusted her vote to a 25 basis point increase during last week’s meeting, reflecting the complexities in navigating the current inflationary environment.

BoC Gravelle emphasizes agility amid uncertain times; monitors global banking stress

BoC Deputy Governor Toni Gravelle, in a speech yesterday, stressed the need for flexibility in response to the uncertain economic environment. He pointed out that, within the past month, headline inflation has dropped, and global markets have seen reduced risk appetite, partially due to the increased stress in global banking systems.

Gravelle noted that, despite these challenges, Canada’s labor market remains tight, which is pushing many services prices upward. He said, “We continue to expect consumer price index (CPI) inflation to come down in the months ahead, but we will need to see further slowing in core inflation to get CPI inflation back to the 2% target.”

As the BoC prepares for the April Monetary Policy Report, Gravelle explained that the central bank is closely monitoring global banking stresses, and will assess the macroeconomic impacts of this evolving situation. He emphasized that the bank will be “looking specifically at potential spillovers into the real economy to the extent that financial conditions tighten and there are broader confidence effects.”

NZ ANZ business confidence dipped to -43.4, slowdown aligns with RBNZ’s intentions

New Zealand ANZ Business Confidence index in March experienced a slight dip, moving from -43.3 to -43.4, while the Own Activity Outlook improved marginally, rising from -9.2 to -8.5. However, export intentions, investment intentions, employment intentions, and pricing intentions all experienced declines. Cost expectations also fell from 88.3 to 86.4, but profit expectations rose from -37.7 to -33.9. Inflation expectations dropped from 5.94 to 5.82. According to ANZ, firms are cautious but persevering, with indicators suggesting a soft landing.

Although the activity indicators are subdued, the labor market tightness is gradually shifting, and inflation and cost indicators are easing slowly. Nevertheless, the challenging environment is putting pressure on expected profitability as firms navigate high cost inflation and uncertain future demand. ANZ noted that the winter season might reveal more challenges as tourist numbers decline, but for now, the slowdown appears to align with RBNZ’s intentions.

Looking ahead

Germany CPI flash is a focus in European session while Eurozone economic sentiment and ECB monthly bulletin will be released. Later in the day, US will publish Q4 GDP final and jobless claims.

USD/CAD Daily Outlook

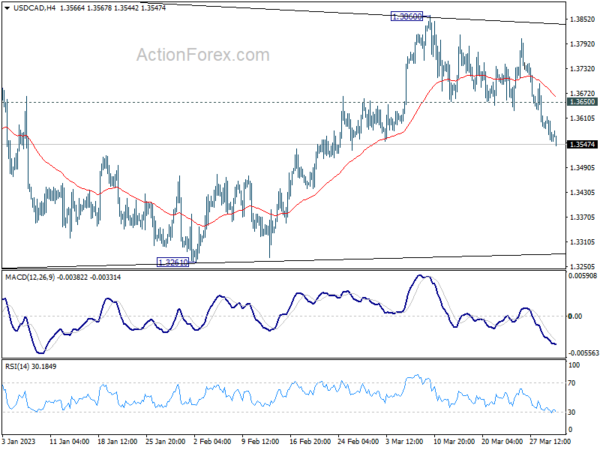

Daily Pivots: (S1) 1.3562; (P) 1.3628; (R1) 1.3665; More….

Intraday bias in USD/CAD remains on the downside for the moment, and further fall is expected as long as 1.3650 support turned resistance holds. Currently decline from 1.3860 could be seen as the third leg of the corrective pattern from 1.3976, and would target 1.3224. But strong support should be seen around there to bring rebound.

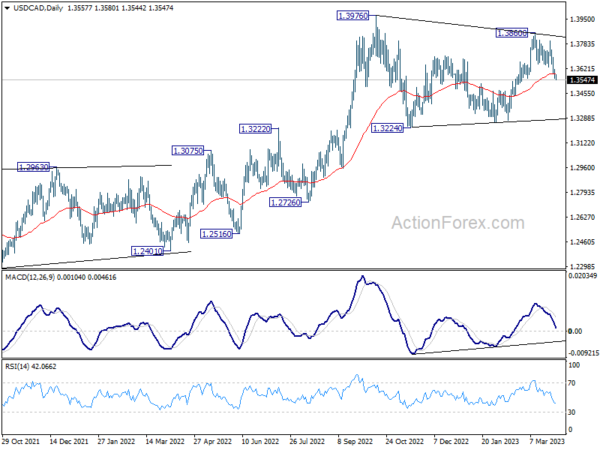

In the bigger picture, the up trend from 1.2005 (2021 low) is still in progress. Break of 1.3976 will confirm resumption and target 61.8% projection of 1.2401 to 1.3976 from 1.3261 at 1.4234. Firm break there will pave the way to long term resistance zone at 1.4667/89 (2016, 2020 highs). On the downside, sustained break of 55 week EMA (now at 1.3283) is needed to confirm medium term topping. Otherwise, outlook will remain bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | NZD | ANZ Business Confidence Mar | -43.4 | -43.3 | ||

| 08:00 | EUR | Italy Unemployment Feb | 8.00% | 7.90% | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Economic Sentiment Mar | 99.7 | 99.7 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Mar | 0.9 | 0.5 | ||

| 09:00 | EUR | Eurozone Services Sentiment Mar | 10.1 | 9.5 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Mar F | -19.2 | -19.2 | ||

| 12:00 | EUR | Germany CPI M/M Mar P | 0.40% | 0.80% | ||

| 12:00 | EUR | Germany CPI Y/Y Mar P | 8.90% | 8.70% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 24) | 195K | 191K | ||

| 12:30 | USD | GDP Price Index Q4 F | 3.90% | 3.90% | ||

| 12:30 | USD | GDP Annualized Q4 F | 2.70% | 2.70% | ||

| 14:30 | USD | Natural Gas Storage | -55B | -72B |