Sterling is performing strongly after the release of stronger than expected UK CPI data, indicating a rise in inflation rather than a slow-down in February. As a result, it is highly likely that the BoE will hike interest rates by another 25bps during their meeting tomorrow. However, there is now speculation on whether there will be a pause in May, making tomorrow’s vote split more important than ever.

Dollar, on the other hand, is softer in comparison to most currencies, with the exception of Yen, as investors await the FOMC rate decision. The consensus is that there will be a 25bps rate hike, but what comes next is highly uncertain. Due to recent market turmoil, Fed may also delay the publication of new economic projections, leaving investors unsure of what to expect.

Elsewhere in the forex markets, Yen is the worst performer of the day due to rising US and European benchmark treasury yields, while Swiss Franc is the second worst. On the other hand, Euro, Aussie and Kiwi have been on the firmer side.

Technically, one major focus today is the stock markets’ reaction to Fed. NASDAQ’s break of 11827.92 resistance yesterday was a near term bullish signal, affirming the view the corrective pull back from 12269.55 has completed at 10982.80 already. That is, rise from 10207.47 should be resuming. Another day of rally and close above 11827.92 will likely set the base for at least a take on 12269.55 soon.

In Europe, at the time of writing, FTSE is up 0.11%. DAX is up 0.51%. CAC is up 0.35%. Germany 10-year yield is up 0.096 at 2.392. Earlier in Asia, Nikkei rose 1.93%. Hong Kong HSI rose 1.73%. China Shanghai SSE rose 0.31%. Singapore Strait Times rose 1.48%. Japan 10-year JGB yield rose 0.0879 to 0.334.

Some suggested readings on Fed:

- Fed expected to hike 25bps, divided opinion on future path

- Suderman Says: To Raise Rates or Not, Fed Walks a Tightrope

- Fed Faces Dilemma, Hit Pause or Keep Raising Rates?

- Fed Meeting Preview: Dollar Index at 1-month Low ahead of Tight Decision

- Fed to Go Ahead with 25 bp Hike; Canadian CPI Growth to Slow

- Fed Preview – Rate Hikes Continue Despite the Volatility

- March Flashlight for the FOMC Blackout Period: The Flashlight Needs Fresh Batteriess Too Dovish?”>

ECB President Lagarde Stresses Robust Strategy Amid High Inflation and Market Uncertainty

In a speech today, ECB President Christine Lagarde highlighted the challenges posed by persistent high inflation and increasing uncertainty. She noted, “Since July last year we have raised interest rates by 350 basis points. However, inflation is still high, and uncertainty around its path ahead has increased. This makes a robust strategy going forward essential.”

Lagarde outlined a three-pronged strategy to tackle these issues:

- Data-dependent rate path: Emphasizing the importance of data dependency in times of high uncertainty, Lagarde stated, “This means, ex ante, that we are neither committed to raise further nor are we finished with hiking rates.”

- Liquidity support amidst market volatility: Acknowledging recent financial market turbulence, she assured, “We are ready to act and provide liquidity support to the financial system if needed.” Lagarde emphasized the ECB’s proven ability to “set the appropriate policy stance to control inflation and at the same time use other instruments to address risks to monetary policy transmission.”

- Clear reaction function: The third element focuses on continuous monitoring of three key inputs – inflation outlook, underlying inflation, and policy transmission. Lagarde explained, “The future calibration of the rate path will be determined by – and will require continuous monitoring of – these three key inputs.”

Bundesbank Nagel insists fight against inflation continues

In an Financial Times interview, Bundesbank President Joachim Nagel expressed that the fight against inflation is far from over, despite the ECB’s efforts to curb it. He stated, “Our fight against inflation is not over. There’s certainly no mistaking that price pressures are strong and broad-based across the economy.”

Nagel emphasized the need for persistence in combating inflation, suggesting that “If we are to tame this stubborn inflation, we will have to be even more stubborn.”

He also highlighted the progress made by ECB, mentioning that they are “approaching restrictive territory.” However, he warned against the potential pitfalls of stopping rate hikes too soon and succumbing to calls for rate cuts. According to Nagel, doing so would risk a repeat of the 1970s, when “inflation flared up again” following the oil supply shocks.

As for concerns surrounding the recent banking crisis, Nagel dismissed comparisons to the 2008 financial crisis. He confidently asserted, “We are not facing a repeat of the financial crisis we saw in 2008. We can manage this with the Eurozone’s “resilient” banking system.

UK CPI rose back to 10.4% yoy in Feb, core CPI up to 6.2% yoy

UK CPI accelerated from 10.1% yoy to 10.4% yoy in February, well above expectation of slowing to 9.8% yoy. The reading was still below recent peak of 11.1% yoy in October 2022, the highest since 1981. CPI excluding food, energy, alcohol and tobacco (core CPI) jumped from 5.8% yoy to 6.2% yoy, above expectation of 5.7% yoy. On a monthly basis, CPI rose 1.1% mom, more than reversing January’s -0.6% mom decline, above expectation of 0.6% mom.

Also released, RPI came in at 1.2% mom, 13.8% yoy, above expectation of 0.8% mom, 13.2% yoy. PPI input was at -0.1% mom, 12.1% yoy, versus expectation of 0.8% mom, 12.5% yoy. PPI core output was at -0.2% mom, 10.4% yoy, versus expectation of 0.4% mom, 9.9% yoy.

Australia Westpac leading index remains negative, indicating further slowdown

Australia’s Westpac Leading Index rose slightly from -1.04% to -0.94% in February, but it still marks the seventh consecutive month of negative growth rate, pointing to below-trend growth over the next 3-9 months. This is in line with Westpac’s forecast that growth in the Australian economy will be only 1% in 2023.

The slowdown reflects the lagged effects of rising interest rates, a deep shock to real wages, a bottoming out of the savings rate, and falling house prices. Westpac also expects the weakness to extend into 2024, with more negative readings likely.

RBA indicated in its March minutes that the board intends to consider a pause at its April meeting. However, Westpac does not expect that a decision to pause in April will mark the end of the cycle. It expects new information for the May meeting to indicate the need for a further response from the board, with a final 0.25% increase in the cash rate in May marking the end of the tightening cycle.

NZ consumer confidence rose slightly to 77.7, but well below long-term average

New Zealand’s Westpac McDermott Miller Consumer Confidence Index rose slightly by 2.1 points to 77.7 in March, but still remains well below the long-term average of 108.8. The President Conditions Index and the Expected Conditions Index also increased, but are still far below their long-term averages of 106.1 and 100.6, respectively.

Despite the slight uptick in confidence, Westpac notes that households across the country continue to grapple with the increasing costs of living, higher mortgage rates, and a downturn in the housing market. The Expected financial situation has improved, but remains negative at -3.8, while the 1-year economic outlook has only slightly improved to -41.1, and the 5-year economic outlook has dropped to -10.8.

The mounting financial pressures are already affecting household spending, and as they become more pronounced, Westpac expects to see an increasing number of households winding back their spending over the next year. This weakness in consumer confidence could have significant implications for the overall economy, as household spending is a major driver of economic growth.

GBP/USD Mid-Day Outlook

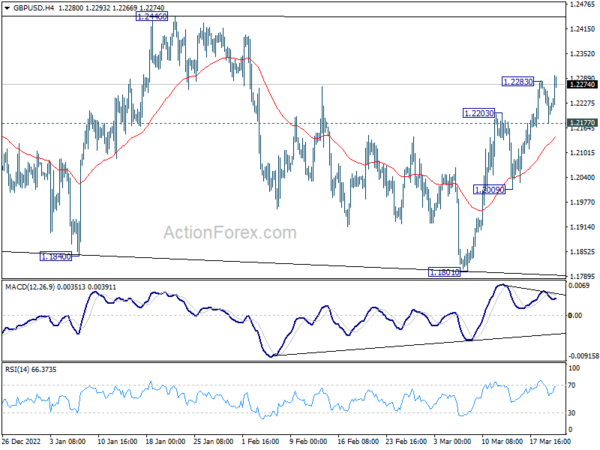

Daily Pivots: (S1) 1.2170; (P) 1.2226; (R1) 1.2274; More…

GBP/USD’s rally from 1.1801 resumed after brief retreat and intraday bias is back on the upside. Further rally should be seen to 2.2445/6 resistance zone. Decisive break there will resume larger rise from 1.0351, and target 1.2759 fibonacci level. However, break of 1.2177 minor support will now argue that corrective pattern from 1.2445 is extending with another falling leg, and turn bias to the downside.

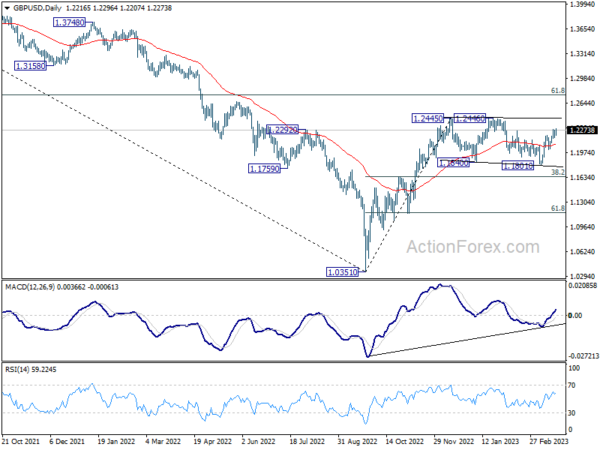

In the bigger picture, price action from 1.2445 are seen as a corrective pattern to rise from 1.0351 medium term bottom (2022 low). Resumption is expected as a later stage and firm break of 1.2446 will target 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. This will remain the favored case as long as 38.2% retracement of 1.0351 to 1.2445 at 1.1645 holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Feb | -0.10% | -0.10% | ||

| 07:00 | GBP | CPI M/M Feb | 1.10% | 0.60% | -0.60% | |

| 07:00 | GBP | CPI Y/Y Feb | 10.40% | 9.80% | 10.10% | |

| 07:00 | GBP | Core CPI Y/Y Feb | 6.20% | 5.70% | 5.80% | |

| 07:00 | GBP | RPI M/M Feb | 1.20% | 0.80% | 0.00% | |

| 07:00 | GBP | RPI Y/Y Feb | 13.80% | 13.20% | 13.40% | |

| 07:00 | GBP | PPI Input M/M Feb | -0.10% | 0.70% | -0.10% | 0.40% |

| 07:00 | GBP | PPI Input Y/Y Feb | 12.70% | 10.80% | 14.10% | 13.50% |

| 07:00 | GBP | PPI Output M/M Feb | -0.20% | 0.80% | 0.50% | |

| 07:00 | GBP | PPI Output Y/Y Feb | 12.10% | 12.50% | 13.50% | |

| 07:00 | GBP | PPI Core Output M/M Feb | -0.20% | 0.40% | 0.60% | 0.70% |

| 07:00 | GBP | PPI Core Output Y/Y Feb | 10.40% | 9.90% | 11.10% | 11.20% |

| 09:00 | EUR | Eurozone Current Account (EUR) Jan | 17.0B | 16.5B | 15.9B | |

| 12:30 | CAD | New Housing Price Index M/M Feb | -0.20% | -0.10% | -0.20% | |

| 14:30 | USD | Crude Oil Inventories | -1.7M | 1.6M | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.00% | 4.75% | ||

| 18:30 | USD | FOMC Press Conference |