Dollar faces renewed selling pressure as Asian markets exhibit a positive tone, following the overnight rebound in US stocks. The question remains: is the banking crisis over? It seems likely, at least temporarily, as major banks rushed to support First Republic and the situation surrounding Credit Suisse stabilized. If Wall Street’s rebound continues to gain momentum, the greenback could face further downside risk today. However, given that FOMC rate decision is less than a week away, investors may opt to take profits and adopt a more cautious stance in the meantime.

Currently, Australian Dollar leads as the best performer for the week, closely followed by New Zealand Dollar. Both currencies appear to be gaining momentum. Despite struggling to extend earlier gains, Japanese Yen remains the third strongest currency. Swiss Franc, on the other hand, is the weakest performer, followed by Dollar. The post-ECB selloff in Euro didn’t last but it lacks momentum for rebound, and it’s now the third weakest. Both the British Pound and the Canadian Dollar are mixed for the week.

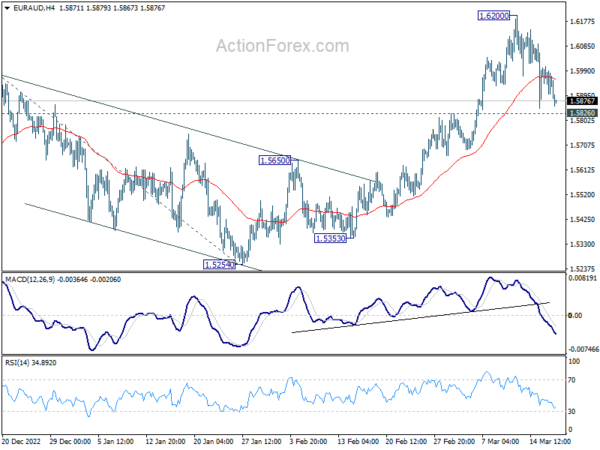

Technically, Aussie is worth a watch before the weekly. AUD/USD is now pressing 0.6715 resistance and firm break there will indicate short term bottoming at 0.6563. On the other hand, EUR/AUD is holding just slightly above 1.5826 support. Firm break of this support will indicate short term topping 1.6200. In this case, deeper decline would be seen back to 1.5650 resistance turned support and possibly below. Let’s see how Aussie goes.

In Asia, Nikkei rose 1.20%. Hong Kong HSI is up 1.12%. China Shanghai SSE is up 0.58%. Singapore Strait Times is up 0.67%. Japan 10-year JGB yield is down -0.0062 at 0.291. Overnight, DOW rose 1.17%. S&P 500 rose 1.76%. NASDAQ rose 2.48%. 10-year yield rose 0.093 to 3.585.

NASDAQ displays bullish sign after major banks rescue First Republic

US stocks experienced a notable rebound overnight as major banks stepped in to rescue the beleaguered First Republic Bank, preventing the potential contagion from evolving into a full-blown banking crisis.

Bank of America, Goldman Sachs, JP Morgan, and others have collectively agreed to deposit USD 30B in First Republic, which has faced a mass withdrawal of customer funds in the wake of Silicon Valley Bank’s collapse and concerns that First Republic could be next.

In a joint statement on Thursday, the banks expressed their confidence in the US banking system, stating, “Together, we are deploying our financial strength and liquidity into the larger system, where it is needed the most.”

Among the major US stock indexes, NASDAQ led the way with an impressive 2.48% rally. From a technical perspective, there are indications of bullish momentum, as the index closed above the near-term trend line resistance. This development suggests that the corrective pullback from 12269.55 may have concluded at 10982.80 already.

In the coming days, reaction to the 11827.92 resistance level should be closely monitored. A firm break above this threshold would solidify the bullish case, potentially leading to a resumption of the rally from 10207.47 through the 12269.55 resistance level.

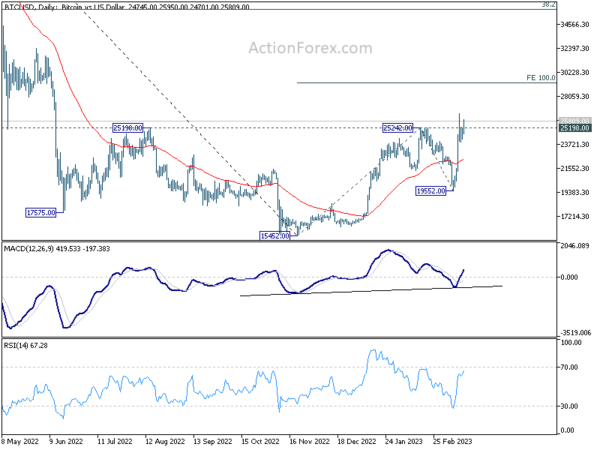

Bitcoin broke key resistance, safe-haven asset or tech sector barometer?

Bitcoin has showcased remarkable resilience amid recent turmoil in financial markets, prompting discussions about its potential status as a safe-haven asset. The leading cryptocurrency has outperformed traditional safe havens such as gold this week, further fueling this debate.

Interestingly, Bitcoin has displayed a correlation with the NASDAQ index, suggesting that it may serve as a leading indicator or confirmation signal for risk appetite, particularly in the technology sector. It’s could still be more of a tech sector barometer.

In either case, the breakthrough of 25242 resistance indicates that rally from 15452 is resuming. More significantly, the break above the 55 week EMA and 25198 structural resistance suggests that Bitcoin is now in the midst of correcting the entire downtrend from its 2021 record high of 68986, as a medium term move.

In the short term, further gains are expected, with a target of 100% projection of 15452 to 25242 from 19552 at 29342. The market’s reaction at this level will provide insight into the potential trajectory of the medium-term rise from 15452.

Additionally, the momentum of Bitcoin’s ascent could be an important factor in determining the likelihood of NASDAQ breaking through the 12269.55 resistance level.

As market participants keep a close eye on these developments, Bitcoin’s performance may hold broader implications for the technology sector and the overall market sentiment.

Looking ahead

Italy trade balance and Eurozone CPI final will be released in European session. Later in the day, Canada will release IPPI and RMPI. US will release industrial production and U of Michigan consumer sentiment.

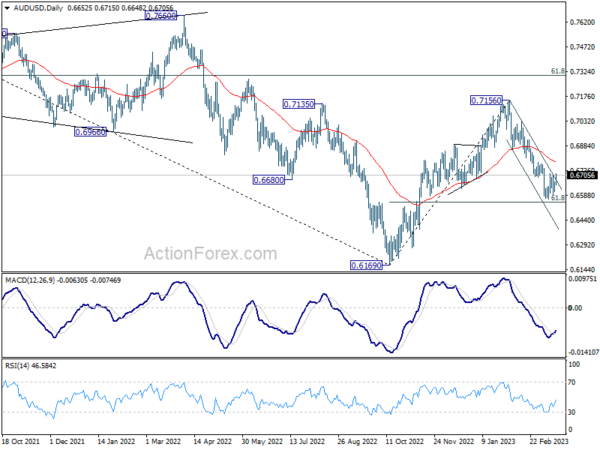

AUD/USD Daily Report

Daily Pivots: (S1) 0.6623; (P) 0.6645; (R1) 0.6680; More…

Intraday bias in AUD/USD stays neutral first with focus on 0.6715 resistance. Decisive break there will confirm short term bottoming at 0.6563, just ahead of 0.6546 fibonacci level. Intraday bias will be back on the upside for 55 day EMA (now at 0.6784). Sustained break there will pave the way back to retest 0.7156 high. On the downside, however, sustained break of 0.6546 will carry larger bearish implication and target 0.6169 low.

In the bigger picture, rise from 0.6169 (2022 low) has completed at 0.7156, after rejection by 55 month EMA (now at 0.7158). Deeper decline would then be see back to 61.8% retracement of 0.6169 to 0.7156 at 0.6546, even as a corrective fall. Sustained break there will raise the chance of long term down trend resumption through 0.6169 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M Jan | 0.90% | 0.30% | -0.40% | |

| 09:00 | EUR | Italy Trade Balance (EUR) Jan | 1.50B | 1.07B | ||

| 09:30 | GBP | Consumer Inflation Expectations | 4.80% | |||

| 10:00 | EUR | Eurozone CPI Y/Y Feb F | 8.60% | 8.60% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb F | 5.60% | 5.60% | ||

| 12:30 | CAD | Industrial Product Price M/M Feb | -0.30% | 0.40% | ||

| 12:30 | CAD | Raw Material Price Index Feb | -0.20% | -0.10% | ||

| 13:15 | USD | Industrial Production M/M Feb | 0.60% | 0.00% | ||

| 13:15 | USD | Capacity Utilization Feb | 78.50% | 78.30% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Mar P | 67 | 67 |