Euro weakens mildly following the ECB’s decision to increase interest rates by 50bps, in line with their previously stated intentions. However, the absence of any reference to future rate hikes in the accompanying statement hints at the possibility of a pause in upcoming monetary policy meetings. Concurrently, Yen is resuming its recent rally in early US trading as the US 10-year yield drops back to 3.4% level. Despite positive job data, Dollar remains mixed and continues to trade within a familiar range against commodity currencies.

Meanwhile, it is worth noting that due to the ongoing banking crisis, market expectations now point towards a final 25 basis point rate hike from the Federal Reserve next week. In fact, Fed fund futures currently suggest a greater than 70% probability of a rate cut in June, returning to a range of 4.50-4.75%. By year-end, there is a 70% chance that the federal funds rate will revert to a range of 3.75-4.00%.

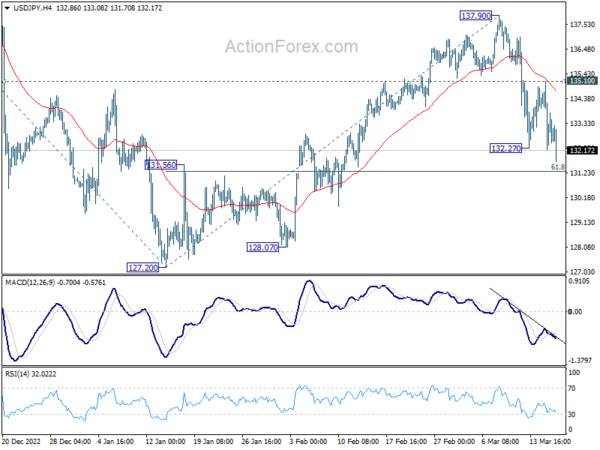

Technically, USD/JPY’s fall from 137.90 resumes by breaking through 132.27 support today. Immediate focus is now on 61.8% retracement of 127.20 to 137.90 at 131.28. Sustained break there will pave the way to retest 127.20 low. For now, risk will stay on the downside as long as 135.10 resistance holds, in case of recovery.

In Europe, at the time of writing, FTSE is up 0.21%. DAX is up 0.33%. CAC is up 0.60%. Germany 10-year yield is up 0.055 at 2.180. Earlier in Asia, Nikkei dropped -0.80%. Hong Kong HSI dropped -1.72%. China Shanghai SSE dropped -1.12%. Singapore Strait times dropped -0.55%. Japan 10-year JGB yield dropped -0.0193 to 0.297.

ECB hikes 50bps, next move data-dependent

ECB raises the three key interest rates by 50bps today. After that, the main refinancing, marginal lending facility and deposit facility rates will be 3.50%, 3.75%, and 3.00% respectively.

There was no reference to further tightening in upcoming meetings. Instead the governing council will continue with a “data-dependent approach”, with decisions determined by inflation outlook, dynamics of underlying inflation, and strength of monetary policy transmission.

In the new economic projections, headline inflation forecast was revised down across the horizon. But core inflation forecast was revised up in 2023. GDP growth forecast is also revised up in 2023.

- Headline inflation is forecast to average 5.3% in 2023, 2.9% in 2024, and 2.1% in 2025. The estimate was downgraded from December’s 6.3% in 2023, 3.4% in 2024, and 2.3% in 2025.

- Core inflation is projected to average 4.6% in 2023, 2.5% in 2025, and 2.2% in 2025. Comparing to December projections of 4.2% in 2023, 2.8% in 2024, and 2.4% in 2025.

- GDP growth is forecast to average at 1.0% in 2023, 1.6% in 2024, and 1.6% in 2025, comparing to December’s forecast of 0.5% in 2023, 1.9% in 2024, and 1.8% in 2025.

But the central noted that the macroeconomic projections were finalized before recent emergence of financial market tensions. Hence, there is additional uncertainty around the above baseline assessments.

US initial jobless claims dropped to 192k

US initial jobless claims dropped -20k to 192k in the week ending March 11, below expectation of 205k. Four-week moving average of initial claims dropped -750 to 196.5k. Continuing claims dropped -29k to 1684k in the week ending March 4. Four-week moving average of continuing claims dropped -1750 to 1676.5k.

Also from the US, Philly Fed manufacturing survey rose from -24.3 to -23.2 in March, but missed expectation of -16.

Swiss SECO: Growth below average this year, but no recession

Swiss economic growth projections for 2023 and 2024 have been revised by the State Secretariat for Economic Affairs (SECO), as recent forecasts indicate mixed outcomes for the nation.

The Swiss economy, adjusted for sporting events, is now anticipated to grow by 1.1% in 2023, a slight increase from December’s 1.0% forecast. However, the outlook for 2024 has been lowered, with an expected growth rate of 1.5% compared to the previous 1.6% projection. While 2023’s growth rate remains below average, it is not expected to plunge the economy into a recession.

Meanwhile, inflation is forecast to decelerate from 2.8% in 2022 to 2.4% in 2023, a revision from the initial 2.2% estimate, before settling at 1.5% in 2024, in line with prior expectations.

Early indicators for the first quarter of 2023 suggest a robust performance for the Swiss economy. Private consumption is projected to experience modest growth in the coming quarters, supported by a strong labor market and nominal wage increases. However, investment growth is likely to remain below average under current conditions.

SECO predicts that the European energy situation will stabilize further by the end of 2024, contributing to a gradual decline in global inflation rates. This should lead to a recovery in international demand. Nevertheless, the Swiss economy may outperform these projections if the energy landscape and inflation rates prove to be more favorable than anticipated, potentially resulting in stronger demand both domestically and globally.

Japan posted record February trade deficit

In February, Japan exports rose 6.5% yoy to JPY 7655B, below expectation of 7.1% yoy. Imports rose 8.3% yoy to JPY 8552B, below expectation of 12.2% yoy. Consequently, the country experienced its largest February trade deficit to date at JPY -897.7B.

The breakdown of trade relations painted an interesting picture, with the US and China displaying contrasting trends. Exports to the US surged by 14.9% yoy, while imports increased by 6.6%, resulting in a favorable surplus of JPY 530.5B. However, trade with China proved more challenging, as exports dipped by -10.9% yoy and imports saw a marginal decrease of 0.6% yoy, culminating in a deficit of JPY -209.8B.

On a more positive note, seasonally adjusted figures highlighted a 4.4%mom rise in exports to JPY 8146B, accompanied by a 3.0% mom drop in imports to JPY 9336B. As a result, trade deficit narrowed to JPY -1191B, outperforming the expected JPY -1460B.

Australia employment grew 64.6k in Feb, unemployment rate dropped to 3.5%

Australia employment grew 64.6k in February, well above expectation of 48.5k. Full-time employment rose 74.9k. Part-time employment decreased -10.3k.

Unemployment rate dropped from 3.7% to 3.5%, below expectation of 3.6%. Participation rate rose 0.1% to 66.6%. Monthly hours worked rose 3.9% mom.

Bjorn Jarvis, ABS head of labour statistics said: “with employment increasing by around 65,000 people, and the number of unemployed decreasing by 17,000 people, the unemployment rate fell to 3.5 per cent. This was back to the level we saw in December.

“The February increase in employment follows consecutive falls in December and January. In January, this reflected a larger than usual number of people waiting to start a new job, the majority of whom returned to or commenced their jobs in February.

NZ GDP contracted -0.6% qoq in Q4, RBNZ may slow tightening

New Zealand’s Q4 GDP contracted by -0.6% qoq, missing the expected contraction of 0.2% qoq. The primary industries fell by 1.3%, service industries were down by 0.1%, and goods-producing industries were down by 0.3%.

Although the Finance Minister Grant Robertson acknowledged that the GDP could fluctuate as the country continues to recover from COVID, he also highlighted that the economy is nearly 6.7% larger than pre-pandemic levels, outpacing other countries.

Despite this, the GDP figure is significantly below RBNZ’s forecast of 0.7% growth, suggesting that the central bank may not need to be as aggressive with its tightening in the future. As a result, economists are now predicting that the RBNZ will opt for a more modest 25bps rate hike in April instead of the previously expected 50bps

EUR/USD Mid-Day Outlook

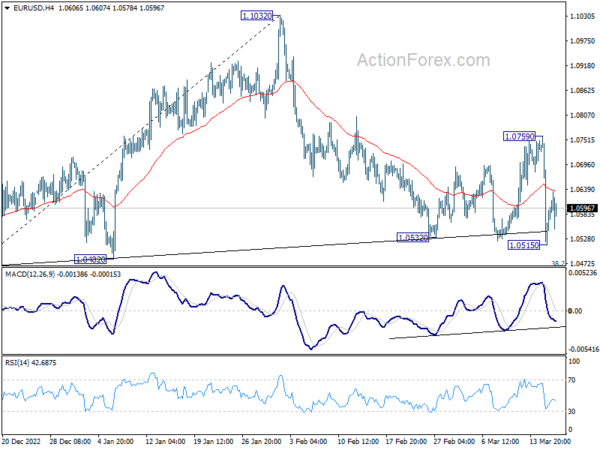

Daily Pivots: (S1) 1.0475; (P) 1.0618; (R1) 1.0718; More…

EUR/USD dips mildly after failing to break through 4 hour 55 EMA and intraday bias stays neutral first. Focus remains on support zone between 38.2% retracement of 0.9534 to 1.1032 at 1.0258 and 1.0482. Strong support from there, followed by rebound through 1.0759 resistance, will retain near term bullishness. However, sustained break of 1.0258 will complete a head and shoulder top (ls: 1.0733, h: 1.1032, rs: 1.0759). Outlook will be turned bearish fro 61.8% retracement at 1.0106.

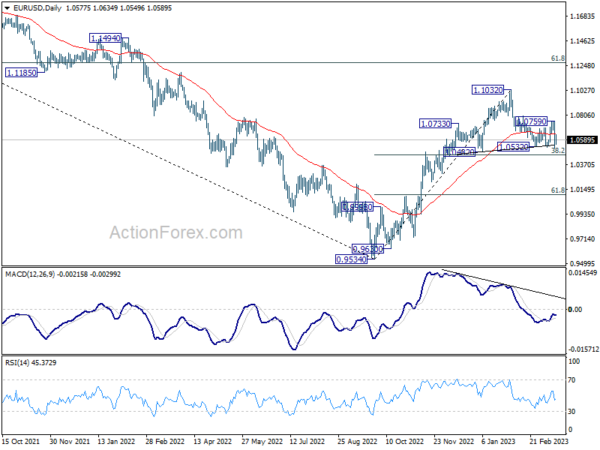

In the bigger picture, as long as 1.0482 support holds, rise from 0.9534 (2022 low) should continue to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. However, sustained break of 1.0482 will bring deeper fall to 61.8% retracement of 0.9534 to 1.1032 at 1.0106, with risk of breaking through 0.9534 eventually.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q4 | -0.60% | -0.20% | 2.00% | 1.70% |

| 23:50 | JPY | Trade Balance (JPY) Feb | -1.19T | -1.46T | -1.82T | |

| 23:50 | JPY | Machinery Orders M/M Jan | 9.50% | 1.80% | 1.60% | |

| 00:00 | AUD | Consumer Inflation Expectations Mar | 5.00% | 5.10% | ||

| 00:30 | AUD | Employment Change Feb | 64.6K | 48.5K | -11.5K | -10.9K |

| 00:30 | AUD | Unemployment Rate Feb | 3.50% | 3.60% | 3.70% | |

| 04:30 | JPY | Industrial Production M/M Jan F | -5.30% | -4.60% | -4.60% | |

| 08:00 | CHF | SECO Economic Forecasts | ||||

| 12:30 | CAD | Wholesale Sales M/M Jan | 2.40% | 0.10% | -0.80% | -0.70% |

| 12:30 | USD | Initial Jobless Claims (Mar 10) | 192K | 205K | 211K | 212K |

| 12:30 | USD | Housing Starts Feb | 1.45M | 1.32M | 1.31M | 1.321M |

| 12:30 | USD | Building Permits Feb | 1.524M | 1.35M | 1.34M | 1.339M |

| 12:30 | USD | Import Price Index M/M Feb | -0.10% | -0.20% | -0.20% | -0.40% |

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Mar | -23.2 | -16 | -24.3 | |

| 13:15 | EUR | ECB Main Refinancing Rate | 3.50% | 3.50% | 3.00% | |

| 13:45 | EUR | ECB Press Conference | ||||

| 14:30 | USD | Natural Gas Storage | -62B | -84B |