Markets are generally staying in consolidation mode in Asian session today. The retreat in Dollar this week is so far shallow, suggesting more upside is in favor. But the next move will still be dependent on overall risk sentiment. As for today, focuses will be on PMIs from Eurozone and UK, as well as Germany ZEW. Larger reactions could be found to Canada CPI and retail sales.

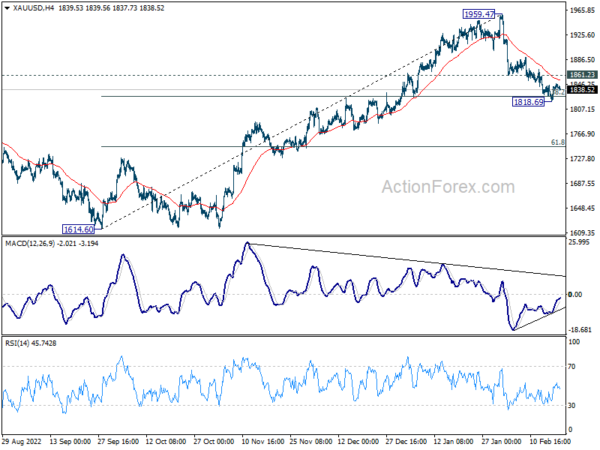

Technically, Gold’s pull back from 1959.47 halted after hitting 1818.69. Some support was seen from 38.2% retracement of 1614.60 to 1959.47 at 1827.72. Bullish convergence is also seen in 4 hour MACD. Break of 1861.23 resistance will argue that such correction has completed and bring stronger rebound back towards 1959.47 high. However, another fall below 1818.69 will now likely extend the correction to 61.8% retracement at 1746.34. The development will be used to confirm Dollar’s next move (in opposite direction).

In Asia, Nikkei closed down -0.21%. Hong Kong HSI is down -1.64%. China Shanghai SSE is down -0.08%. Singapore Strait Times is down -0.14%. Japan 10-year JGB yield is up 0.0028 at 0.508.

SNB Schlegel: Still willing to intervene in the currency markets

Vice Chairman Martin Schlegel said yesterday that SNB is “still willing” to be active in currency intervention. “If the Swiss franc depreciates we are ready to sell foreign exchange, if the Swiss franc appreciates strongly we are willing to buy foreign exchange,” he said.

He also noted that SNB had to “react forcefully” to fight inflation, which peaked at 3.5% last year. “The most important contribution we can do for society is to have stability-orientated policy and maintain price stability.”

RBA minutes: 25bps and 50bps hike considered at Feb meeting

Minutes of RBA’s February 7 meeting revealed that both the options of 25bps and 50bps hike were considered. But the case for a 25bps hike was stronger, with “the monthly meetings provided the Board with frequent opportunities to assess how these uncertainties were being resolved and to adjust policy if needed”.

The minutes also noted, “members agreed that further increases in interest rates are likely to be needed over the months ahead to ensure that inflation returns to target and that the current period of high inflation is only temporary.”

Australia PMI composite rose to 49.2, on the narrow path to achieve soft landing

Australia PMI Manufacturing ticked up from 50.0 to 50.1 in February. PMI Services rose from 48.6 to 49.2. PMI Composite also rose from 48.5 to 49.2.

Warren Hogan, Chief Economic Advisor at Judo Bank said: “Australian business activity improved in February 2023 with a second consecutive small rise in the flash composite output index to 49.2. The economy has slowed from the strong rates of growth in 2022 to be on a more sustainable footing in early 2023. We still appear to be on the narrow path to achieve a soft landing for the economy in 2023…

“At this stage the Judo Bank PMIs are pointing to a welcome slowdown in the economy that may help take upward pressure off interest rates. While this will do little to alter the RBA’s intentions to raise interest rates further over the months ahead, it does indicate that we may be close to the point where the RBA Board can pause the current tightening cycle.”

Japan PMI manufacturing dropped to 47.4, services rose to 53.6

Japan PMI Manufacturing dropped from 48.9 to 47.4 in February, below expectation of 49.3. It’s also the worst reading in over two-and-a-half years. Manufacturing Output dropped sharply from 47.2 to 44.9. PMI services, on the other hand, rose from 52.3 to 53.6. PMI Composite was unchanged at 50.7.

Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“The modest, stable growth signalled by the au Jibun Bank Flash Japan Composite PMI in February masked widely differing trends between the manufacturing and service sectors midway through the first quarter of the year.

“Service providers posted sharper rises in activity and new business as the latest wave of the COVID-19 pandemic faded, providing a boost to demand.

“The picture was much less positive in the manufacturing sector, however, where new orders and production dropped to the greatest extents in just over two-and-a-half years.”

Looking ahead

Swiss trade balance, Eurozone PMIs, UK PMIs, Germany ZEW economic sentiment will be released in European session. Later in the day, Canada CPI and retail sales will take center stage. US will release PMIs and existing home sales.

USD/CAD Daily Outlook

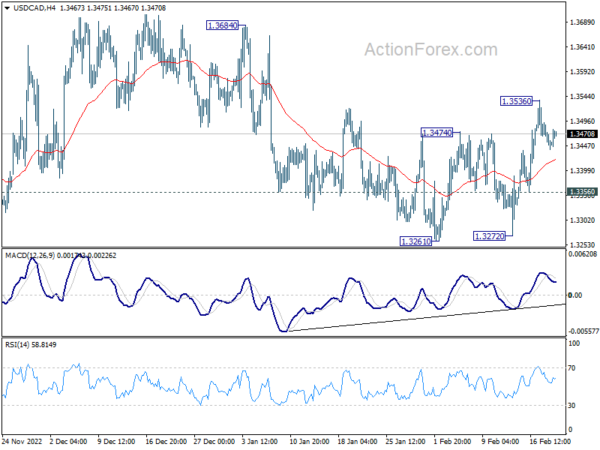

Daily Pivots: (S1) 1.3432; (P) 1.3464; (R1) 1.3485; More….

USD/CAD retreated after hitting 1.3536 and intraday bias is turned neutral first. Outlook is unchanged that corrective pattern from should have completed at 1.3261. Above 1.3536 will turn bias to the upside for 1.3684 resistance. Nevertheless, break of 1.3356 minor support will dampen this bullish case and bring retest of 1.3261 instead.

In the bigger picture, as long as 1.3222 cluster support (38.2% retracement of 1.2005 to 1.3976 at 1.3223) holds, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 high at a later stage. However, firm break of 1.3222/3 will indicate that the trend might have reversed. Deeper fall would be seen to next cluster support at 1.2726 (61.8% retracement at 1.2758).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q4 | 0.50% | 0.50% | 0.80% | |

| 21:45 | NZD | PPI Output Q/Q Q4 | 0.90% | 0.40% | 1.60% | |

| 22:00 | AUD | Manufacturing PMI Feb P | 50.1 | 50 | ||

| 22:00 | AUD | Services PMI Feb P | 49.2 | 48.6 | ||

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 00:30 | JPY | Manufacturing PMI Feb P | 47.4 | 49.3 | 48.9 | |

| 07:00 | CHF | Trade Balance (CHF) Jan | 3.75B | 2.83B | ||

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Jan | 2.3B | 26.6B | ||

| 08:15 | EUR | France Manufacturing PMI Feb P | 50.7 | 50.5 | ||

| 08:15 | EUR | France Services PMI Feb P | 50.0 | 49.4 | ||

| 08:30 | EUR | Germany Manufacturing PMI Feb P | 48.0 | 47.3 | ||

| 08:30 | EUR | Germany Services PMI Feb P | 51.0 | 50.7 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Feb P | 49.4 | 48.8 | ||

| 09:00 | EUR | Eurozone Services PMI Feb P | 51.0 | 50.8 | ||

| 09:30 | GBP | Manufacturing PMI Feb P | 47.5 | 47.0 | ||

| 09:30 | GBP | Services PMI Feb P | 49.4 | 48.7 | ||

| 10:00 | EUR | Germany ZEW Economic Sentiment Feb | 19 | 16.9 | ||

| 10:00 | EUR | Germany ZEW Current Situation Feb | -50 | -58.6 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Feb | 17.3 | 16.7 | ||

| 13:30 | CAD | Retail Sales M/M Dec | 0.50% | -0.10% | ||

| 13:30 | CAD | Retail Sales ex Autos M/M Dec | -0.10% | -0.60% | ||

| 13:30 | CAD | CPI M/M Jan | 0.20% | -0.60% | ||

| 13:30 | CAD | CPI Y/Y Jan | 5.70% | 6.30% | ||

| 13:30 | CAD | CPI Core M/M Jan | 0.30% | |||

| 13:30 | CAD | CPI Median Y/Y Jan | 4.90% | 5.00% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Jan | 5.20% | 5.30% | ||

| 13:30 | CAD | CPI Common Y/Y Jan | 6.50% | 6.60% | ||

| 14:45 | USD | Manufacturing PMI Feb P | 47.4 | 46.9 | ||

| 14:45 | USD | Services PMI Feb P | 47.3 | 46.8 | ||

| 15:00 | USD | Existing Home Sales Jan | 4.06M | 4.02M |