Euro retreats notably even after ECB hikes 50bps and expresses the intention to do the same in March. Sterling is also trading lower after BoE hikes by 50bps as expected. Yen is currently the stronger one with help from extended fall in US and European benchmark treasury yields. Dollar, on the other hand, has turned mixed as the post-FOMC sell-off cools. It now looks like that markets will turn cautious again, and await tomorrow’s US non-farm payroll job data.

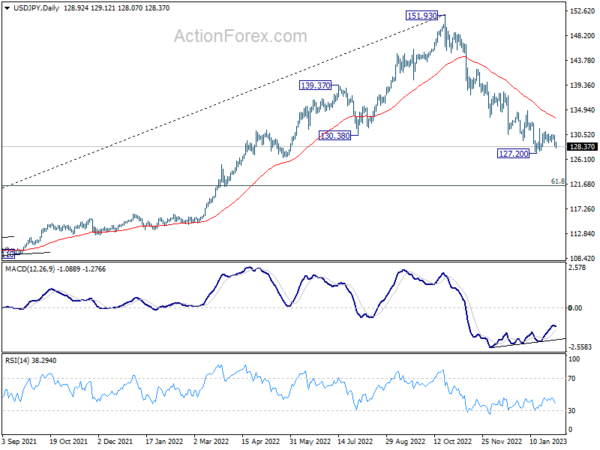

Technically, focuses would turn to Yen pairs before the weekend. USD/JPY’s price actions from 127.20 are more corrective looking than not, indicating that recent down trend from 151.93 is not over. Extended decline in US yields could drag USD/JPY through 127.20 towards 120 handle. Let’s see.

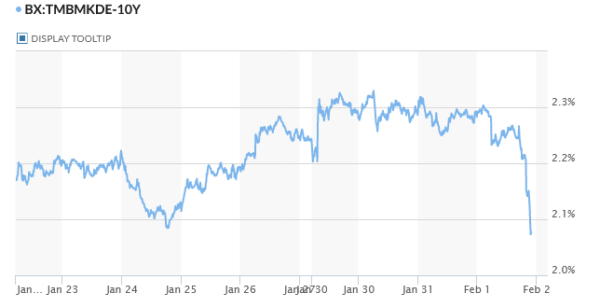

In Europe, at the time of writing, FTSE is up 0.90%. DAX is up 1.61%. CAC i up 0.73%. Germany 10-year yield is down -0.211 at 2.072. Earlier in Asia, Nikkei rose 0.20%. Hong Kong HSI dropped -0.52%. China Shanghai SSE rose 0.02%. Singapore Strait Times dropped -0.41%. Japan 10-year JGB yield rose 0.0176 to 0.500, pressing BoJ’s 0.5% cap.

US initial jobless claims dropped to 183k

US initial jobless claims dropped -3k to 183k in the week ending January 28, below expectation of 196. Four-week moving average of initial claims dropped -6k to 192k.

Continuing claims dropped -11k to 1655k in the week ending January 21. Four-week moving average of continuing claims dropped -11k to 1652k.

ECB hikes 50bps today, intends to hike another 50bps in March

ECB raises main refinancing rate by 50bps to 3.00% as widely expected. The marginal lending facility and deposit facility rates are raised by the same amount to 3.25% and 2.50% respectively.

In accompanying statement, ECB said it will “stay the course” with today’s hike. Also, it said the “Governing Council intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March.” Then, it will “evaluate the subsequent path of its monetary policy”.

“Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations,” ECBB added.

Also, the APP portfolio will “decline by €15 billion per month on average from the beginning of March until the end of June 2023”. PEPP principal payments from maturing securities will by reinvested until the end of 2024.

BoE hikes 50bps, known hawk consents, two doves dissent again

BoE raises Bank Rate by 50bps to 4.00% as widely expected. The decision was made by 7-2 votes. Swati Dhingra and Silvana Tenreyro voted for no change again, as in December. Known hawk Catherine Mann consented this time.

In the accompanying statement, BoE noted that “domestic inflationary pressures have been firmer than expected”. Still the bank expects that rate hike since December 2021 to have an “increasing impact on the economy in the coming quarters”.

In the new economic forecasts, annual CPI inflation is expected fall from current 10.5% to around 4% towards the end of the year. Also, conditioned on interest at around 4.50% in mid 2023 and falls back to 3.25% in three years time, CPI will decline to below 2% target in the medium term.

Also, the economy is expected to have a “much shallower” recession than prior expected. Calender -year GFP growth is expected to be at -0.50% in 2023 and -0.25% in 2024 only.

BoE Bailey: We have seen a turning of the corner, but it’s very early days

At the post meeting press conference, BoE Governor Andrew Bailey said, “since the November monetary policy report we’ve seen the first signs that inflation has turned the corner.”

“We have done a lot on rates already. The full effect of that is still to come through. But it’s too soon to declare victory just yet, inflationary pressures are still there,” he warned.

On BoE’s language, he said, “In the previous language we had a presumption that if the economy evolved as the forecast suggests – that’s in November – then we expect there to be further rates increase. We also had that word ‘forceful’ in there.

“And we have changed both of those points. And I think that reflects the fact that we’ve now got a combination of what I would call – we have we have seen a turning of the corner, but it’s very early days and the risks are very large and it’s really that that I think shapes where we where we go from here.”

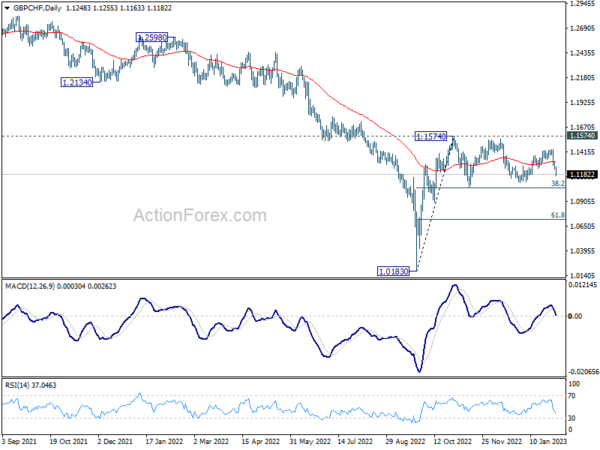

GBP/CHF accelerates lower as BoE close to end of tightening cycle

Sterling dives broadly after BoE rate decision. CPI is now projected to fall back to below 2% target in the medium term, based on conditioned forecasts with interest rate peaking at 4.50% in mid-2023. That is, with Bank Rate at 4.00% after today’s 50bps hike, BoE is now close to the end of the tightening cycle.

GBP/CHF ‘s fall from 1.1433 accelerates lower after the announcement. At this point, such decline is still viewed as the fifth leg of the triangle pattern from 1.1574, Hence, while breach of 1.1094 couldn’t be ruled out, strong support should be seen at 1.1045 cluster (38.2% retracement of 1.0183 to 1.1574 at 1.1043) to contain downside and bring rebound.

However, decisive break of 1.1043/5 will argue that price actions from 1.1574 are indeed a triple top reversal pattern. Deeper decline would then be seen to 61.8% retracement at 1.0714 and below.

EUR/JPY Mid-Day Outlook

Daily Pivots: (S1) 141.15; (P) 141.49; (R1) 142.07; More….

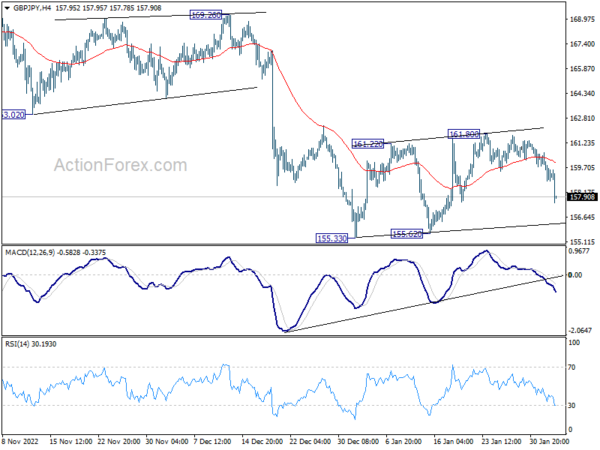

EUR/JPY drops sharply today but stays in range of 155.33/161.80. Intraday bias remains neutral first. On the downside, firm break of 155.33 will resume the whole decline from 148.38 to 135.40 fibonacci level next. On the upside, decisive break of 142.84 resistance will argue that the correction from 148.38 has completed. Stronger rally should then be seen back to 146.71 resistance.

In the bigger picture, as long as 55 week EMA (now at 138.81) holds, larger up trend from 114.42 (2020 low) is still in progress for 149.76 long term resistance. However, firm break of 55 week EMA will bring deeper fall to 38.2% retracement of 114.42 to 148.38 at 135.40. Sustained break there will raise the chance of trend reversal, and target 61.8% retracement at 127.39.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Dec | -7.20% | 7.00% | 6.70% | |

| 23:50 | JPY | Monetary Base Y/Y Jan | -3.80% | -3.20% | -6.10% | |

| 00:30 | AUD | Building Permits M/M Dec | 18.50% | 1.10% | -9.00% | |

| 07:00 | EUR | Germany Trade Balance (EUR) Dec | 10.0B | 8.8B | 10.8B | 10.9B |

| 08:00 | CHF | SECO Consumer Climate Q1 | -30 | -38 | -47 | |

| 12:00 | GBP | BoE Rate Decision | 4.00% | 4.00% | 3.50% | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 7–0–2 | 7–0–2 | 7–0–2 | |

| 12:30 | USD | Challenger Job Cuts Y/Y Jan | 440.00% | 129.10% | ||

| 13:15 | EUR | ECB Main Refinancing Rate | 3.00% | 3.00% | 2.50% | |

| 13:30 | USD | Initial Jobless Claims (Jan 27) | 183K | 196K | 186K | |

| 13:30 | USD | Nonfarm Productivity Q4 P | 3.00% | 2.50% | 0.80% | |

| 13:30 | USD | Unit Labor Costs Q4 P | 1.10% | 1.60% | 2.40% | |

| 13:30 | CAD | Building Permits M/M Dec | -7.30% | 1.50% | 14.10% | |

| 13:45 | EUR | ECB Press Conference | ||||

| 15:00 | USD | Factory Orders M/M Dec | 2.30% | -1.80% | ||

| 15:30 | USD | Natural Gas Storage | -146B | -91B |