Dollar is trading in mixed manner as focuses turns to FOMC rate hike today. The recovery attempt in the greenback this week was rather disappointing. In particular, it has conceded much ground against commodity currencies and Swiss Franc. Overall, risk sentiment will likely continue to dictate the moves in the forex markets. Judging from the resilience in US stocks, risk is probably more on the downside for Dollar.

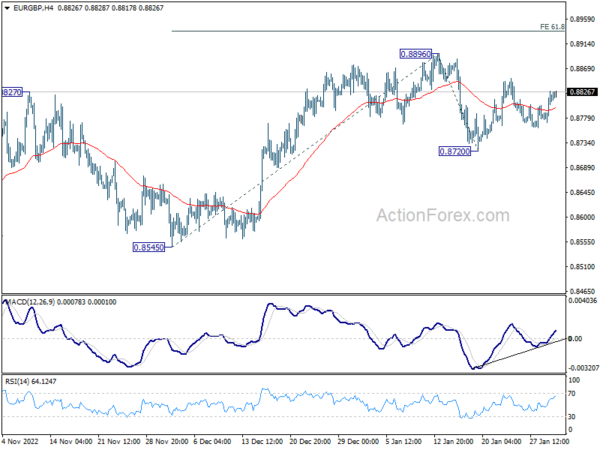

Technically, while much focuses will be on Dollar pairs today, some attention could be back on any moves in EUR/GBP ahead of tomorrow’s ECB and BoE rate decisions. The cross is staying in consolidation pattern from 0.8896. For now, rise from 0.8545 is in favor to continue. Firm break of 0.8896 will target 61.8% projection of 0.8545 to 0.8896 from 0.8720 at 0.8937. Let’s see if it will jump the gun.

In Asia, Nikkei rose 0.07%. Hong Kong HSI is up 0.71%. China Shanghai SSE is up 0.90%. Singapore Strait Times is up 0.23%. Japan 10-year JGB yield is down -0.0216 at 0.477.

Risk sentiment resilient ahead of FOMC rate hike, some previews

Fed is widely expected to continue to slow down its tightening pace today, and raise interest rate by 25bps to 4.50-4.75%. The accompanying statement should clearly indicate that the work is not done yet on fighting inflation. Such message should be echoed by Fed Chair Jerome Powell in the post-meeting press conference.

Fed fund futures are now pricing in another 25bps rate hike to 4.75-5.00% in March. But the main questions are, firstly, whether rate will peak above or below 5% level, and secondly, for how long it will stay there. No concrete answer would be provided at least until new economic projections to be published in March.

Here are some suggested readings on FOMC:

- Will the FOMC Surprise the Markets?

- Fed Expected to Hike, But Then What?

- Fed Meeting Preview: The Magic Show of Interest Rates, Inflation, and Growth

- Is the U.S. Fed Nearing the End of its Record Hiking Cycle?

- Will the Fed Add a Hawkish Flavor to a Smaller Hike?

- Fed Preview: What It Takes for the Fed to Cut Rates

- January Flashlight for the FOMC Blackout Period

Overall risk sentiment has been resilient going into FOMC announcement. For now, further rise is in favor in S&P 500 as long as 55 day EMA (now at 3934.97) holds. Decisive break of 41.00.51 resistance will confirm resumption of whole rebound from 3491.58 low. Further break of 61.8% projection of 3491.58 to 4100.51 from 3764.49 could prompt upside acceleration to 100% projection of 3491.58 to 4100.51 from 3764.49 at 4373.42, even as a bear market rally. If that happens, risk-on sentiment would continue to cap any rebound attempt of Dollar.

China Caixin PMI manufacturing ticked up to 49.2, optimism improving

China Caixin PMI Manufacturing ticked up from 49.0 to 49.2 in January. Caixin noted there were softer falls in output and new orders. Supply chain pressures eased. Confidence around the outlook hit the highest level since April 2021.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, the pandemic continued to take a toll on the economy in January. Supply and demand weakened, overseas demand was sluggish, employment declined, and logistics hadn’t fully recovered, while the quantity of purchases shrank, inventories dropped, and manufacturers faced growing pressure on profitability. But optimism in the sector continued to improve as businesses expected a post-Covid economic recovery.”

Japan PMI manufacturing finalized at 48.9 in Jan, but some positive signals

Japan PMI Manufacturing was finalized at 48.9 in January, unchanged from January’s 48.9. S&P Global also noted that reductions in output and new orders were slowest since last October. Supply chain disruptions were least widespread for nearly two years. Prices charged inflation cooled to its lowest for 16 months.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “Subdued global economic conditions continued to hold back customer demand across the Japanese manufacturing sector in January, but there were a number of positive signals from the latest PMI survey. The rates of decline for output and new orders were the smallest since last October, whilst marginal employment growth was maintained as manufacturers sought to boost capacity in line with long-term investment plans.”

NZ employment rose 0.2% in Q4, unemployment rate rose to 3.4%

New Zealand employment rose 0.2% in Q4, below expectation of 0.3%. Employment rate was unchanged at 69.3%. Unemployment rate rose from 3.3% to 3.4%, above expectation of 3.3%. Participation rate was unchanged at 71.7%. Labor cost index rose 1.1% qoq, below expectation of 1.3% qoq.

“The unemployment rate, as measured by the Household Labour Force Survey (HLFS), has remained at or near historic lows since the September 2021 quarter,” work and wellbeing statistics senior manager Becky Collett said.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9112; (P) 0.9200; (R1) 0.9249; More…

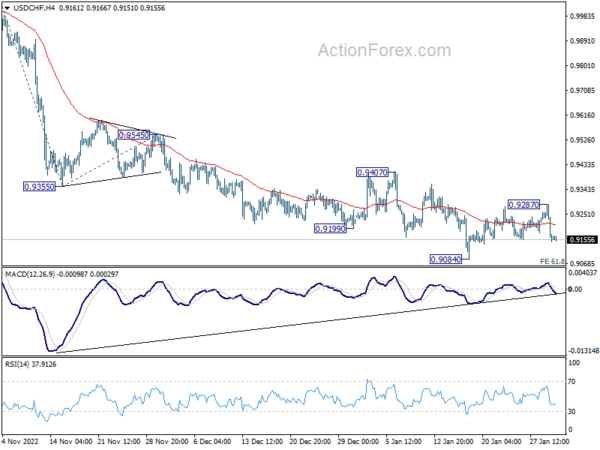

USD/CHF dropped notably after recovering to 0.9287, but stays above 0.9084 low. Intraday bias remains neutral for the moment. For now, outlook stays mildly bearish despite loss of downside momentum. On the downside, sustained break of 61.8% projection of 1.0146 to 0.9355 from 0.9545 at 0.9056 will pave the way to 100% projection at 0.8754, which is close to 0.8756 long term support. Nevertheless, on the upside, break of 0.9287 should confirm short term bottoming and turn bias back to the upside for 0.9407 resistance.

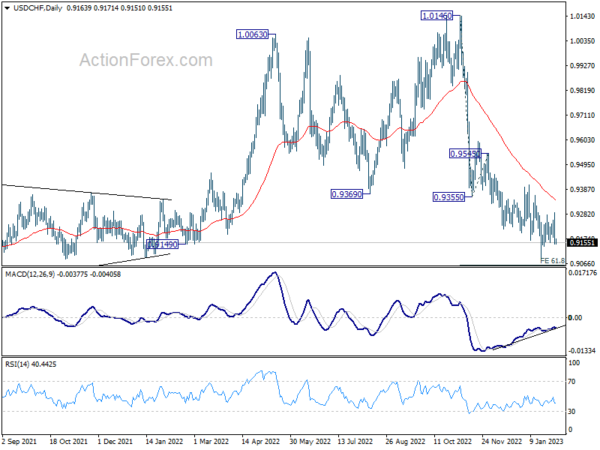

In the bigger picture, rise from 0.8756 (2021 low) has completed at 1.0146, well ahead of 1.0342 long term resistance (2016 high). Based on current downside momentum, fall from 1.0146 should be a medium term down trend itself. Next target is a test on 0.8756 low. Strong support should be seen there to bring rebound. Still, further decline will now be expected as long as 0.9407 resistance holds, in any case.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q4 | 0.20% | 0.30% | 1.30% | |

| 21:45 | NZD | Unemployment Rate Q4 | 3.40% | 3.30% | 3.30% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q4 | 1.10% | 1.30% | 1.10% | |

| 00:30 | JPY | Manufacturing PMI Jan F | 48.9 | 48.9 | 48.9 | |

| 01:45 | CNY | Caixin Manufacturing PMI Jan | 49.2 | 49.2 | 49 | |

| 08:30 | CHF | Manufacturing PMI Jan | 54.3 | 54.1 | ||

| 08:45 | EUR | Italy Manufacturing PMI Jan | 49.6 | 48.5 | ||

| 08:50 | EUR | France Manufacturing PMI Jan F | 50.8 | 50.8 | ||

| 08:55 | EUR | Germany Manufacturing PMI Jan F | 47 | 47 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Jan F | 48.8 | 48.8 | ||

| 09:30 | GBP | Manufacturing PMI Jan F | 46.7 | 46.7 | ||

| 10:00 | EUR | Eurozone CPI Y/Y Jan P | 9.00% | 9.20% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Jan P | 5.10% | 5.20% | ||

| 13:15 | USD | ADP Employment Change Jan | 168K | 235K | ||

| 14:30 | CAD | Manufacturing PMI Jan | 49.2 | |||

| 14:45 | USD | Manufacturing PMI Jan F | 46.8 | 46.8 | ||

| 15:00 | USD | ISM Manufacturing PMI Jan | 48.7 | 48.4 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Jan | 41.9 | 39.4 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Jan | 51.4 | |||

| 15:00 | USD | Construction Spending M/M Dec | 0.00% | 0.20% | ||

| 15:30 | USD | Crude Oil Inventories | 0.5M | |||

| 19:00 | USD | Fed Rate Decision | 4.75% | 4.50% | ||

| 19:30 | USD | FOMC Press Conference |