Risk aversion is the theme of the day as protests in China spread to multiple cities. There might be talks that pressure is mounting on the government to exit zero-Covid policy early. Investors are clearly more pessimistic on guard of escalations, which could further disrupt the economy. Australian Dollar continues to lead commodity currencies as the worst performing ones. Dollar, Yen and Swiss Franc are firm. But Euro outshines on divergence of benchmark yields with the US and the UK.

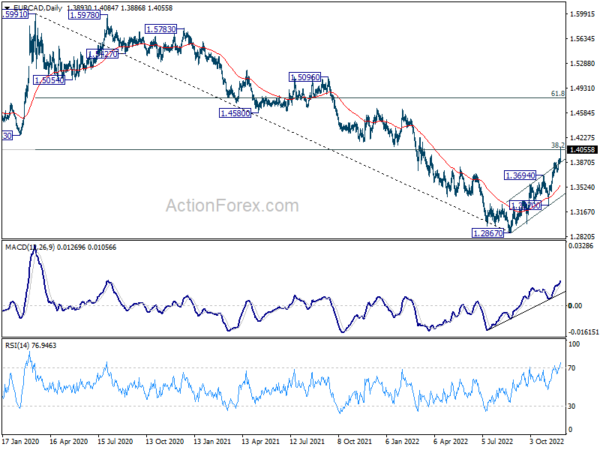

Technically, EUR/CAD accelerates to as high as 1.4084 today and it’s now pressing an important fibonacci level at 38.2% retracement of 1.5991 (2020 high) to 1.2867 at 1.4060. Sustained break there will add the chance of medium term bullish reversal, and target 61.8% retracement at 1.4798. In any case, near term outlook will stay bullish as long as 1.3694 resistance turned support holds. Also, if happens, further rally in EUR/CAD could help EUR/USD break through corresponding level at 1.0609.

In Europe, at the time of writing, FTSE is down -0.53%. DAX is down -0.97%. CAC is down -0.96%. Germany 10-year yield is up 0.0083 at 1.985. Earlier in Asia, Nikkei dropped -0.42%. Hong Kong HSI dropped -1.57%. China Shanghai SSE dropped -0.75%. Singapore Strait Times dropped -0.14%. Japan 10-year JGB yield dropped -0.0022 to 0.258.

ECB Knot: Risk of doing too little clearly more pronounced

ECB Governing Council member Klaas Knot said, “My worry is still inflation, inflation, inflation… As long as the risks to our inflation outlook are so clearly tilted to the upside, I think the risk of us doing too little is clearly more pronounced than us doing too much… We should not give up too early and not cry victory too early.”

Knot also said a recession is “not a foregone conclusion”. “If you look at Germany, where actually the economy is doing better than then was feared, it’s not a foregone conclusion that we will get a recession”, he said. “We will get weaker growth, that’s for sure. But we also need weaker growth to bring inflation back to target.”

Australia retail sales fell -0.2% mom in Oct, first decline this year

Australia retail sales turnover dropped -0.2% mom to AUD 35.02B in October, much worse than expectation of 0.5% mom rise. That’s also the first monthly decline in 2022.

Ben Dorber, ABS head of retail statistics said: “The October fall in retail turnover ends a run of nine straight monthly rises and suggests increased cost of living pressures including interest rate rises have started to weigh on consumer spending.”

“Turnover fell in all industries in October except for food retailing, which rose 0.4 per cent boosted by flood-related spending in parts of Australia and continued high food prices.”

RBA Lowe: Best outcome is for wages to pick up but not too much further

RBA Governor Philip Lowe told a parliamentary committee that the central bank is keeping an eye on electricity prices and housing. “If we can address those two issues then that will make a substantial contribution in bringing inflation back down over the next couple of years,” he said.

Also, he added that a massive spike in wages would make it harder to bring inflation down. “If wage growth was 7 or 8 per cent then inflation would be 6 or 7 per cent … we were in this world in the 1970s and it worked out very badly,” Lowe said. “The best outcome for the country is for wages to pick up but to not go too much further.”

RBNZ Silk: The persistence factor of inflation was most surprising

RBNZ Assistant Governor Karen Silk said in an interview, “What we have seen is actual inflation continue to surprise on the upside, but more importantly inflation expectations have moved higher as well… And it’s the persistence factor that has probably been the most surprising.”

On tightening, “obviously we started way earlier than other central banks, so other central banks had to move an awful lot faster basically to play catch up,” she said. “So no, I don’t believe that the MPC has dilly-dallied around on this at all.”

“If the information shows that we’ve reached that peak (5.5% interest rate) and we see that turn and we’re starting to see real impacts on inflation and inflation expectations, then that does offer us the opportunity to revisit,” she said.

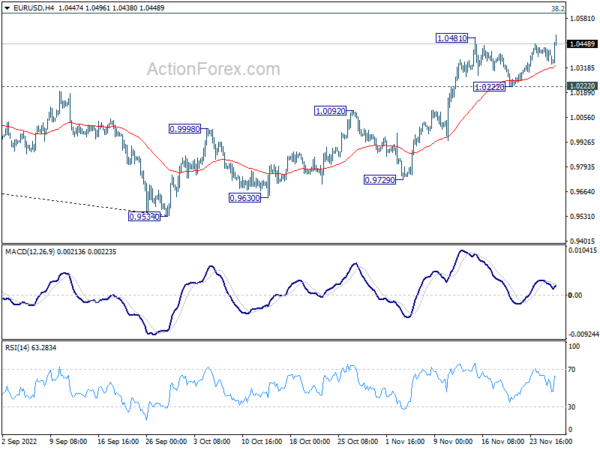

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0359; (P) 1.0394; (R1) 1.0433; More…

EUR/USD’s breach of 1.0481 resistance indicates resumption of rise from 0.9534. Intraday bias is back on the upside. Further rally should be seen to 1.0609 fibonacci level. For now, outlook will remain bullish as long as 1.0222 support holds, in case of retreat.

In the bigger picture, a medium term bottom was in place at 0.9534, on bullish convergence condition in daily MACD. Even as a corrective rise, rally from 0.9534 should target 38.2% retracement of 1.2348 (2021 high) to 0.9534 at 1.0609. Sustained trading above 55 week EMA (now at 1.0566) will raise the chance of trend reversal and target 61.8% retracement at 1.1273. This will now remain the favored case as long as 1.0092 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Oct | -0.20% | 0.50% | 0.60% | |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Oct | 5.10% | 6.50% | 6.30% | |

| 13:30 | CAD | Current Account (CAD) Q3 | -11.1B | -4.0B | 2.7B |